Ka-ching! ATO tips in for Golden Mile’s innovation with handy nickel-cobalt project tax incentive

Mining

Mining

Special Report: Golden Mile Resources has just bagged itself a nice payday from the ATO for research and development funding related to its Quicksilver flagship nickel-cobalt project.

Breaking news: A bunch of people actually quite like the Australian Tax Office this morning.

This morning, critical metals and gold exploration junior Golden Mile Resources (ASX:G88) announced it’s just received $358,825 from the ATO from its 2023 AusIndustry Research and Development Tax Incentive.

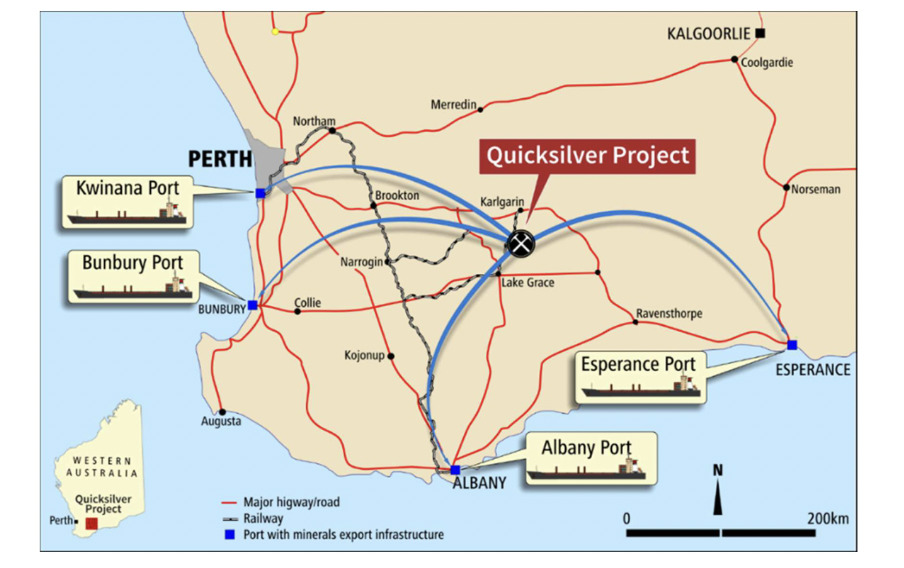

The cash incentive specifically relates to G88’s activities at its flagship, 100%-owned, Quicksilver nickel-cobalt project, which is near the town of Lake Grace.

The home of dual Brownlow Medallist Nat Fyfe, that’s about 300km south-east of Perth.

This comes at a great time for the company (when isn’t it a great time to bag $358k?) as it continues to chart a course for growth across its suite of current projects and potential further operations, with a low-cost, high-value ethos in mind.

Golden Mile has a number of irons in fires and boots on ground at critical metals and gold projects in WA’s Eastern Goldfields, Murchison, Pilbara and Southwest regions, with its Quicksilver Ni-Co project particularly eye-catching as it holds an impressive 26.3Mt resource.

The company is currently in the review stage on at least 21 projects – domestically and internationally. That review is due for completion in June and includes zeroing in on gold and copper assets.

Golden Mile’s Research and Development claim has been granted by the ATO specifically for the development of ‘Novel Laterite Nickel/Cobalt Process Technology’ at Quicksilver, where drilling by the company in 2017-2018 resulted in a maiden indicated and inferred Mineral Resource Estimate of 26.3Mt at 0.64% nickel and 0.04% cobalt for 168,500 tonnes of contained nickel, and 11,300 tonnes of contained cobalt.

Centred over a narrow greenstone belt, the project is not only prospective for nickel-cobalt, but also gold.

The new funding represents a significant tax-incentive lift on when the company last saw some decent inflows from the tax department. Golden Mile received $79,360 for its Research and Development incentive in 2022.

The company recently conducted a high-level geological review of the Quicksilver project that included data validation and reinterpretation, providing valuable insight into the potential controls on both the nickel and cobalt mineralisation including understanding of the formation of vermiculite mineralisation.

Vermiculite holds high importance at Quicksilver as it correlates with the highest-grade nickel domains within the deposit. It’s an important weathering and alteration product which acts as a “sponge” in the clay profile, absorbing nickel and other metals.

Hyperspectral data gathered by G88 has, says the company, ‘added significant value by quantifying the proportion of the vermiculite’.

That data supports the correlation between vermiculite and high-grade nickel mineralisation, allowing for more accurate targeting of the deposit’s high-grade vermiculite zones.

Upshot: this fresh knowledge ultimately ought to enhance the economic potential of the Quicksilver project.

A Stage 3 metallurgical testwork programme has also now been completed to a pre-feasibility standard at Quicksilver, which should, says the company, help accelerate the project through the study stages.

On that, Golden Mile’s MD Damon Dormer, noted:

“The major work streams of the Quicksilver Stage 3 metallurgical testwork program are complete with only minor works remaining.

“The flowsheet, based on the metallurgical testwork program, is nearing completion and will allow high-level processing capital and operating costs to be determined.”

This article was developed in collaboration with Golden Mile Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.