Jurisdiction spotlight: Who’s poised to ride the infrastructure coattails of BHP’s $1.7bn Nebo-Babel mine development?

Picture: Getty Images

As battery metal demand grows, big miners are increasingly looking to get more tonnes out of the ground – or pick up smaller players with potentially economic projects.

The idea is for these established producers to reduce costs through economies of scale, and buying ounces, often close to existing processing infrastructure, can be cheaper than finding and developing from the ground up.

M&A activity can also free up capital as shareholders in acquired targets reinvest down the value chain in the anticipation of repeating a speculative discovery to production cycle.

Betashares senior investment strategist Cameron Gleeson said back in July that big miners like BHP (ASX:BHP) and Rio Tinto (ASX:RIO) were “on the hunt for high quality assets to address their underexposure to copper and other energy transition metals.”

“While copper has been the first cab off the rank for both BHP and Rio Tinto, it’s our view they will perhaps start looking to build out exposure to other energy transition metals like nickel,” he said.

That could be why BHP has launched into one of the biggest investment splurges its once near-dead nickel division has seen in 50 years.

Last year the mining giant bolstered its ~80,000tpa capacity by purchasing OZ Minerals for a tidy $9.6bn.

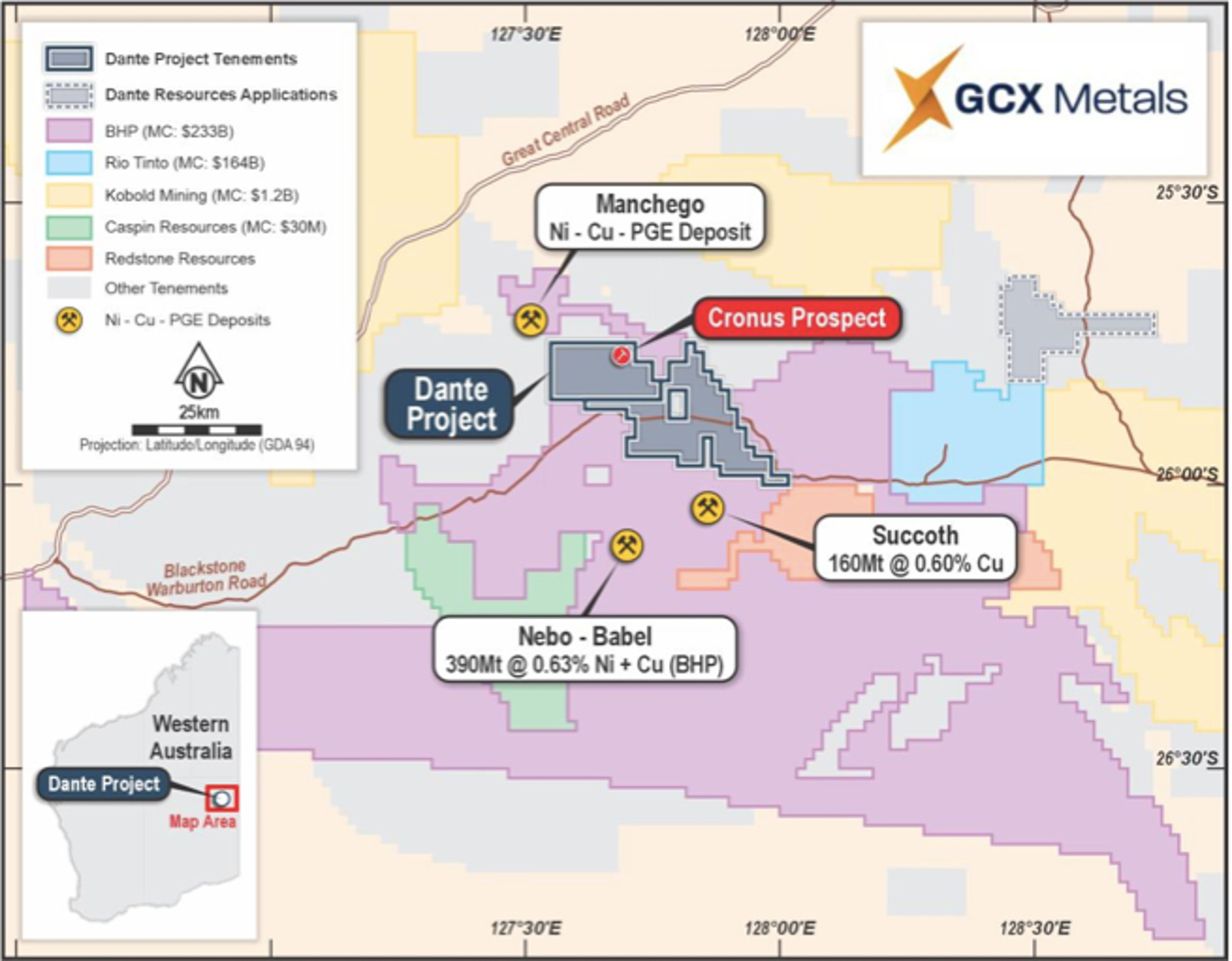

The deal included its $1.7b West Musgrave project – which comprises the Succoth copper deposit and the 390Mt Nebo-Babel nickel-copper-PGE mine, which is expected to deliver annual production of 28,000t of nickel and 35,000t of copper over a 24-year operating life.

Ironically, BHP actually owned the mine years ago.

It was discovered by Western Mining geos working in the region in the late 90s and early 2000s, and has the right iron and magnesium ratios to be processed at BHP’s Nickel West smelter in Kalgoorlie.

BHP sold the project for just $250,000 to Cassini Resources back in 2014 before the junior was consumed by JV partner OZ in 2020.

An emerging mining hub in West Musgrave

WA’s remote West Musgrave region is a major metallogenic province near the intersection of the borders between Western Australia, South Australia and the Northern Territory.

And it’s now emerging as a new mining hub, since OZ had already approved development of the West Musgrave project before it got picked up by BHP.

Currently Nebo-Babel is six months into a two-year build, with the project expected to deliver its first concentrate in the second half of 2025 at a lowest quartile operating C1 cost of US$0.50/lb nickel.

Along with the mine itself, the plan is to develop processing facilities, a borefield, temporary and permanent waste landforms, a tailings storage facility, accommodation, airstrip and power infrastructure.

More than 80% of the project’s power will be provided by renewables.

Having a big miner build all this infrastructure in the region is a boon for juniors, who could piggyback on bigger projects to de-risk their own.

Not to mention, having an asset in this emerging hub means projects that looked like dusters a few years ago could be of interest as big miners like BHP spread a larger pool of resources thinner in the hopes of making a big nickel or copper discovery.

It’s put juniors and their assets even more on the radar of the majors than at any point in recent memory.

Who’re the juniors with a play in the region?

GCX Metals (ASX:GCX)

The company recently picked up the Dante nickel-copper-PGE project, just 15km from Nebo-Babel.

It’s not a greenfields play, either. Dante comes with a treasure trove of historical datasets, which includes drilling that returned a thick 310.5m intercept of disseminated copper sulphides in the same rock types that host Nebo-Babel.

GCX have already delineated big, advanced targets including ~23km of outcropping mineralised strike grading an average of 1.1g/t PGE3, 1.13% V2O5, and 23.2% TiO2, with grades up to 3.4g/t PGE3 along with the 7km-long Cronus prospect.

And according to MD Thomas Line, BHP are flying 10 flights up to the West Musgrave every single week and are bringing in a huge amount of infrastructure – de-risking that area from an infrastructure and logistics perspective.

NICO Resources (ASX:NC1)

The company holds the Wingellina nickel-cobalt project, part of its Central Musgrave project, which was discovered back in the 1950s.

But the conditions for its development have never really come to pass until the recent run in nickel prices that prompted Metals X (ASX:MLX) to spin the deposit into its own vehicle in 2021.

A PFS study indicated it could have an initial 42-year mine life as a 40,000tpa nickel and a 3,000tpa cobalt producer.

The project is around 120km from Nebo Babel and the company says its set to benefit from infrastructure in the region including recent approvals for the Jamieson Road to BHP’s project.

A DFS for Wingellina is due this year.

Redstone Resources (ASX:RDS)

RDS has its own West Musgrave project close to both the Nebo-Babel and Succoth deposits and NC1’s Wingellina nickel-cobalt project.

The company says the project is highly prospective for nickel-copper-cobalt-PGEs, especially considering it’s just 40km from Nebo-Babel.

The focus is currently on drilling to grow the Tollu copper vein deposit, with assays this year returning 11m at 1.2% copper from the Chatsworth prospect.

These assays, along with previous intersections at Chatsworth dating back to 2017 have yet to be included in the resource for the project – meaning there’s some solid room to grow.

Redstone expects the initial resource at Tollu of 3.8 million tonnes at 1% copper, containing 38,000 tonnes of copper, and 0.01% cobalt, which equates to 535 tonnes of contained cobalt, the mineralised area, and the volume of hydrothermal mineralisation, to increase with further drilling.

Caspin Resources (ASX:CPN)

Caspin was spun out after parent company Cassini was bought by Oz Minerals for the advanced West Musgrave nickel-copper project in 2020, then Oz was bought by BHP last year.

One of its biggest holders is Chalice Gold Mines (ASX:CHN) at 9.2%.

CPN has the Mount Squires project, prospective for nickel, copper, gold and REE in the West Musgrave region – adjacent to the western border of BHP’s West Musgrave project.

It includes a 40+km structural corridor with significant gold mineralisation and a 17km strike extension of the West Musgrave nickel and copper corridor.

Significant gold and copper mineralisation has already been identified close to surface with limited drilling – plus the company made an accidental rare earths discovery this year at the Duchess copper-gold-molybdenum target.

The company flagged 46m at 7,102ppm TREO with a higher-grade zone of 22m at 12,545ppm (or 1.25%) TREO, with more assays pending.

Power Minerals (ASX:PNN)

PNN is another company with a project in the Musgrave region – on the South Australian side of the border but it still counts.

The junior has delineated copper, nickel and PGE targets at the highly prospective Mt Caroline intrusion at its Musgrave project, which PNN says presents “an exciting target model for future exploration programs” and drilling to test below the surface cover sequence for mineralisation.

Negotiations for an exploration deed with the traditional owners of the APY lands at the project are currently underway. comprising two Exploration Licences and eight exploration licence applications held, or under farm-in, by wholly-owned Power subsidiary NiCul Minerals.

The priority target at the project is the Pink Slipper geophysical anomaly, which is part of a farm-in and joint venture agreement with Rio Tinto Exploration, covering four ELAs.

GCX, NC1, RDS, CPN and PNN share prices today:

At Stockhead we tell it like it is. While GCX Metals and Power Minerals are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.