It’s not all about lithium in Canada: These are the ASX explorers getting their feet in other critical mineral doors

Pic: Getty Images

- The call to Canada is being heard by other ASX critical mineral explorers keen to take part in the world’s decarbonisation and electrification push

- Regions like Manitoba, home to the word’s fifth largest nickel mining camp, and Quebec, one of the world’s rare producers of niobium, are seeing increasing numbers of companies staking ground

- Here’s a who’s who of ASX explorers getting in on the action

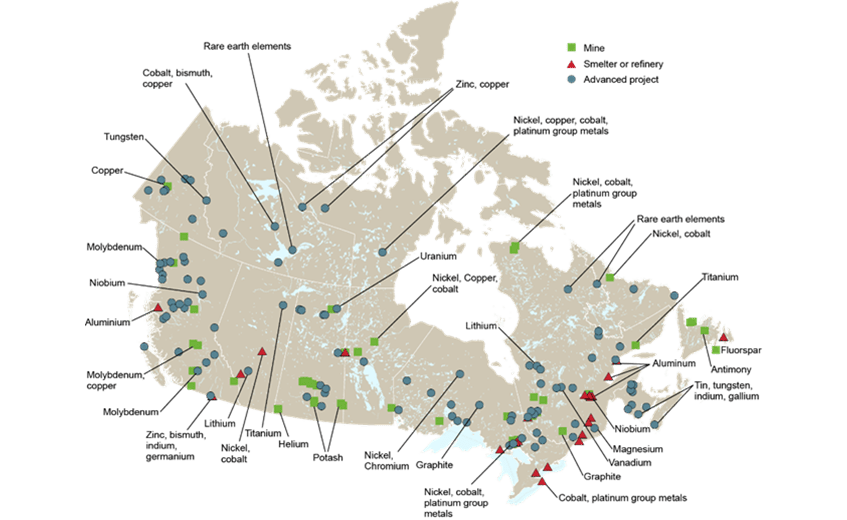

Canada’s James Bay region has received overwhelming attention for its lithium prospectivity in recent times, but the call to the ‘Great White North’ is also being heard by Australian mining companies searching for other critical minerals which fill the rest of the snowy country.

Quebec, Canada’s largest province by area and the second largest by population, has long been known for its rich mineral resources and also ranks as one of the world’s rare producers of niobium, titanium dioxide, cobalt, and platinum.

It’s also Canada’s biggest producer of iron concentrate and zinc and accounts for one-fifth of Canada’s mineral production.

As the developer and producer of about 30 commodities, Quebec holds the most diversified supply of minerals in the country, making it an ideal candidate for battery manufacturing.

The province has an abundance of green energy sources, with almost 99% of its energy being renewable and low cost, making Quebec’s mineral production some of the cleanest in the world with very low carbon intensity.

Canada’s regulatory regime supports exploration

While these benefits alone are enough to attract companies and potential investors, Canada’s Federal and Provincial governments are playing their part too by providing an effective regulatory regime which welcomes, encourages, and incentivises exploration and development.

As part of the country’s 2022 budget, Canada launched its Critical Mineral Exploration Tax Credit (CMETC) in a bid to beef up the country’s energy-transition supply chain and bolster the discoveries of critical minerals.

The CMETC offers a 30% tax credit to people investing in flow-through shares in mining companies’ exploration activities for specified critical minerals that are necessary to develop clean technologies.

Mining companies then pass on the tax benefits to investors through the country’s flow-through share system, which allows investors to claim tax deductions and credits related to domestic exploration spending.

MTM Critical Metals (ASX:MTM) managing director Lachlan Reynolds told Stockhead the Canadian Flow Through Scheme has been tailored for critical metals, providing ASX explorers with the opportunity to raise money for specialty metals and minerals with significant tax rebates attached to them.

“There is definitely an emphasis on providing explorers with incentives to go out and find new supplies of these commodities,” Reynolds said.

“There’s also been an interesting trend in the market where Australian companies seem to be able to raise capital to work in Canada more easily than the Canadians themselves.

“There has been a real surge of Australian companies going into Canada because they see the geological potential and the market is supporting them to do that.”

REE stocks in Quebec

MTM owns the Pomme project in Quebec, which is shaping up to be a “very large” +2km2 rare earths-niobium system, adjacent to the world-class 266Mt Montivel deposit owned by Geomega Resources.

Pomme is a carbonatite intrusion, a specified class of rare earth deposits which are higher grade and tend to be larger tonnage. A similar example is Lynas Corporation’s (ASX:LYN) Mount Weld deposit, one of the largest of its type on Earth, with total reserves estimated at 19.5Mt at a grade of 8.5%.

Carbonatite deposits have been the mainstay of rare earth production for many years, Reynolds says.

“They tend to be very large and much higher grade, like 10-20 times higher grade than the clay hosted deposits,” he adds.

“Their metallurgy is complex but relatively understood and can be mined in conventional ways with a classic open pit or underground mining.”

Drilling by previous explorers in 2012 returned thick mineralised intersections at Pomme, which indicate the potential for a compelling REE and niobium resource, including:

- 508.3m at 0.43% TREO, 413ppm Nb2O5 and 1.48% P2O5, from 73.7m depth; and

- 478.1m at 0.12% TREO, 340 ppm Nb2O5 and 2.14% P2O5, from 25.9m to end of hole.

MTM recently wrapped up maiden drilling at the site after having identified mineralisation throughout the Pomme carbonatite complex.

“Large areas still remain untested by the reconnaissance drilling so we’re keenly awaiting the results, which we are confident will indicate numerous zones of higher-grade rare earth and niobium mineralisation,” Reynolds explains.

“Our exploration strategy is to discover zones of about 1.5% or greater total rare earth oxide grade, similar to intercepts in the original drill hole that tested the carbonatite and the nearby Montviel deposit.”

Where else can you get your REE fix in Canada?

BINDI METALS (ASX:BIM)

Heading northwest into the neighbouring Ontario province is Bindi Metals with its newly acquired rare earths and niobium Schryburt Lake project, host to a 4.5km diameter pipe with historical drill assays up to 5.65% Rare Earth Oxides (REO) from very limited REE sampling that is open in all directions.

Niobium results up to 1.82% were also returned in outcrop and trench sampling at the site, where little-to-no exploration work has taken place since the 1970s.

This is why the explorer is so keen to kick off works, with even the Ontario Geological Survey flagging Schryburt Lake as a priority project for REE and niobium exploration.

Schryburt Lake, like MTM’s Pomme project, lies within the highly prospective Superior Province but what makes BIM’s project particularly exciting is its resemblance to the Niobec deposit – Canada’s biggest niobium mine and one of three global producers of niobium.

BIM’s recent detailed survey returned strong similarities to the lower resolution anomaly, which is associated with the 1Bt at 1.7% total rare earth oxide (TREO) and 700Mt at 0.4% niobium oxide Niobec deposit.

The new data has also defined a 1,000m by 800m thorium radiometric anomaly at Goldfinch, where rock chip sampling has returned up to 1.8% niobium and an average of 25% neodymium and praseodymium as well as up to 130ppm scandium oxide.

Bindi has secured a contractor for its upcoming drill program with permitting – including negotiations with First Nations groups – progressing well.

CAZALY RESOURCES (ASX:CAZ)

$15.80m market cap minnow Cazaly resides further west from BIM in Ontario, within earshot of the Ontario-Manitoba border.

The company secured an option agreement to acquire the Carb Lake REE project in April and completed the acquisition in June, following extensive due diligence whereby CZY gained access to historic diamond drill core.

The Carb Lake carbonatite complex has received very little modern exploration since circa 1967 when the project was drill tested for niobium.

A pXRF program was planned to test available drill core for rare earth elements and following completion of this initial drill core testing and acquisition of the geophysics, a field reconnaissance program will be refined.

REE stocks share prices today:

Nickel stocks in Canada

Canada’s pipeline of critical mineral projects also include nickel, a key component in lithium-ion batteries as the provider of higher energy density and storage, allowing vehicles to travel further.

The country has an estimated 2Mt of nickel reserves, representing 2% of the world’s reserves and ranking sixth for nickel production globally.

CORAZON MINING (ASX:CZN)

Corazon has been exploring for nickel at its historically significant Lynn Lake nickel-copper-cobalt project in Manitoba since 2010, located in the world-class Thompson nickel belt, a hot address for nickel exploration as host to more than 18 nickel deposits.

The Thompson nickel belt is the world’s fifth largest nickel mining camp with some 6bn pounds of nickel produced since 1961.

Corazon took the strategic step to consolidate the entire Lynn Lake nickel field in 2015, which marked the first time the mining centre had been controlled by one company since mine closure in 1976.

The company’s aim is to bring the project – which produced 206,200t of nickel and 107,600t over a period of 24 years up to 1976 — back into production.

It boasts a substantial (and growing) resource of 16.3Mt for 116,800t nickel, 54,300t copper, and 5300t cobalt.

LEEUWIN METALS (ASX:LM1)

Newly listed battery metals play, Leeuwin Metals owns the William Lake nickel sulphide project, which also resides in the Thompson nickel belt in Manitoba.

Recent drilling has identified a new high-grade zone, extending from known mineralisation over a 2km trend at the site, and returned a 6.5m intersection grading 2.56% nickel from 439.2m at the W56 prospect.

Coupled with historical drilling results, such as 21.9m at 1.02% nickel, Leeuwin reckons these new findings provide further evidence of a significant project.

“Not only do they demonstrate the high-grade mineralisation and confirm the scale from Leeuwin’s drilling, with two holes drilled 2km apart, it has revealed considerable exploration upside,” LM1 MD Christopher Piggot says.

Further assay results from the William Lake diamond drilling program are expected over the coming weeks.

PIVOTAL METALS (ASX:PVT)

Pivotal Metals holds the early stage Belleterre-Angliers Greenstone Belt (BAGB) project which has demonstrated near-surface grades of nickel, copper and PGMs.

A review of EM anomalies below 300m from recent VTEM surveys has identified 20 high priority targets never explored, which will be the focus of a survey program scheduled for later in 2023.

Its portfolio also includes the advanced Horden Lake project, home to a 27.8Mt at 1.49% copper equivalent resource.

A drilling program is being planned for the end of 2023/beginning of 2024 to better define these metals for inclusion in an updated MRE and provide a bulk sample for detailed metallurgical test work in advance of a maiden PFS for the project.

Nickel stocks share prices today:

At Stockhead we tell it like it is. While MTM Critical Metals, Corazon Mining, and Leeuwin Metals are Stockhead clients, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.