It’s a lithium street party in the Pilbara. Here are the stocks with ground close to Azure Minerals

Mining

Mining

Last week, the Mark Creasey-backed Azure Minerals (ASX:AZS) stunned with a massive spodumene intersection of 209m grading 1.42% Li20 from its Andover project in Western Australia’s Pilbara region.

The news – which stood as one of the best lithium drilling results in the world – sent the ~$1 billion capped explorer above 20% in last Friday’s early morning trade.

Andover’s spodumene bearing potential has now undergone a combined 100,000m in diamond and RC drilling ahead of a resource estimate pencilled in for the first quarter of next year.

But if that wasn’t enough to whet your appetite, the explorer unveiled a newly minted exploration target yesterday of between 100Mt and 240Mt, grading 1% to 1.5% Li20 for target areas 1, 2, and 3 which provies some insight into just how much lithium the company thinks it might have.

For context, there are only about nine lithium deposits in the world with this scale and potential, and a few of them are in Western Australia including Pilbara Minerals’ (ASX:PLS) 414Mt Pilgangoora deposit, Mineral Resources’ (ASX:MIN) 259.2Mt Wodgina, and the 360Mt Greenbushes mine, co-owned by Talison Lithium and US miner Albermarle.

“This exploration target definitely puts us in the top 10 lithium deposits in the world,” AZS managing director Tony Rovira told Stockhead.

“If you take the upper part of the exploration target, that puts us in the top five lithium deposits in the world.”

Up 1,012.50% this year and with six drill rigs out on the project, Rovira said the next step for the company is to now prove up and convert the exploration target into a mineral resource estimate.

As AZS continues to march ahead with its lithium story, it is interesting to note how and why the company got here.

The stock was once heavily focused on the nickel-cobalt side of things at Andover up until a year and half ago when it started to test the “very obvious” pegmatites across the property.

“We discovered a lot of these pegmatites hosted very large amounts of visual spodumene and when we assayed them, very high grades of lithium returned,” Rovira said.

“As soon as we started informing the market of this, there was a very positive reaction to it and I think that is telling us a very strong message – ‘Azure Minerals, stick to your lithium’.”

Like moths to the flame, “nearology” continues to entice investors and explorers with hopes that ground within cooee of any company-making discovery might be prospective enough to match the original find.

After a big discovery is made, investors flock to these neighbouring companies, causing a crazy but often short-lived share price explosion.

While the strategy doesn’t always pan out, we take a look at the ASX stocks within the same postcode as Azure Minerals and what they are up to on the exploration front.

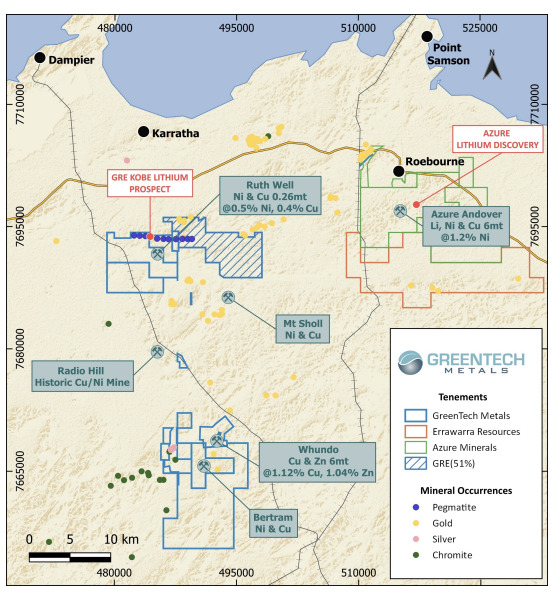

Right next door to Azure Minerals is Errawarra with its Andover West nickel project.

From the company’s point of view, the success of AZS and Greentech Metals provides it with confidence that the area remains prospective for lithium bearing pegmatites.

It is progressing its plans for further prospectivity after submitting rock chip samples to the lab for lithium assays.

So far, a total of 80 samples have been collected from pegmatites that outcrop in the northwestern portion of the Andover West project tenement, which is within the Andover mafic intrusion and some 10km along trend from the lithium pegmatite discoveries reported by Azure Minerals.

A subset of the samples representing 20% of the total samples taken reported geochemistry consistent with an affinity with LCT pegmatites.

In early July, GreenTech extended its Kobe lithium prospect in the West Pilbara after receiving rock chip assays of up to 1.8% lithium oxide, confirming a consistent mineralised zone more than 7.5km long.

The company said the outcropping mineralised pegmatites at Kobe were about 200m wide and striking east-west, extending into an adjoining tenement to the east under a joint venture by GRE (51%) and Artemis (49%).

About 25km to the east of GRE’s recent pegmatite find is Azure Minerals’ huge mineralised pegmatite swarm with hundreds of outcrops.

At the end of June, Raiden entered into a transaction to acquire an 80% interest in five tenements adjacent to both the company’s Roebourne lithium project and Azure Minerals’ Andover lithium discovery.

“The recent lithium discovery by Azure Minerals has positioned the Pilbara as one of the most desired jurisdictions for lithium explorers,” RDN managing director Dusko Ljubojevis said.

“With a credit to Raiden’s management team, the company has managed to secure prospective ground, immediately adjacent to one of the most exciting lithium discoveries this year.”

Accelerate Resources has started exploring for lithium at its East Pilbara project with a 10-day mapping and sampling program where previous reconnaissance identified numerous outcropping pegmatites within the project area for follow up.

In a further positive sign, a series of new targets have been identified across current and new tenements using the same exploration model applied by Global Lithium (ASX:GL1) at the nearby Archer Deposit.

AX8 is seeking to fast-track a granting of key tenements and associated permitting to advance drill-ready targets.

Golden State Mining has kicked off a 2,000m drill run with an RC rig at the Yule project, which straddles the Mallina Basin in WA’s Pilbara.

Following aeromagnetic surveys and a detailed ground gravity survey at the Nomad prospect, which generated exciting lithium targets, the company plans to target concealed, east-northeast trending, low-pattern density targets in close proximity to anomalous caesium values returned in first pass GSM RC drilling.

At Stockhead we tell it like it is. While Azure Minerals, GreenTech Metals, Raiden Resources, Golden State Mining, and Accelerate Resources are Stockhead advertisers, they did not sponsor this article.