Is this ASX junior steaming towards Papua New Guinea’s next great porphyry discovery?

(Getty Images)

Special Report:Gold Mountain (ASX: GMN) has made an exciting start to its bid to unearth a major porphyry deposit in Papua New Guinea this year, with results received from the first hole drilled at its flagship Wabag project indicating it is very much on the right track.

After extensive reconnaissance work over the preceding 18 months, drilling has kicked off. A nine-hole targeted diamond drilling campaign began before Christmas at the Monoyal prospect, the most advanced of several mouth-watering targets identified within the Wabag tenements, which lie 70km from the giant Porgera gold mine owned by Barrick Gold and Zijin Mining along the world-renowned Papuan Mobile Belt. Results are now coming back from the lab.

The Company intersected copper mineralisation with its very first hole and recently announced that assays from MCD003 had returned anomalous copper mineralisation averaging 850 parts per million over a very large interval of about 500m from surface, including a best intercept of 101m at 0.14% copper from 398m.

The results have bolstered Gold Mountain’s belief that it is on the brink of making a significant discovery.

“The fact that the entire 500m length of the hole is mineralised starting from surface, and that we have intersected significant widths of copper mineralisation great than 1,000ppm, plus the fact that we are also seeing anomalous levels of molybdenum in the hole, leads me to believe we are on the margins of a large porphyry system and reconfirms why BHP was pursuing these highly sought after tenures,” chief executive Tim Cameron said.

“We are testing a large copper-in-soil anomaly and have at least another seven holes to drill. We are updating our models with new information yielded by the drill program to date and from trenching data to ensure that we are refining our drill targets to maximise our chances of success.”

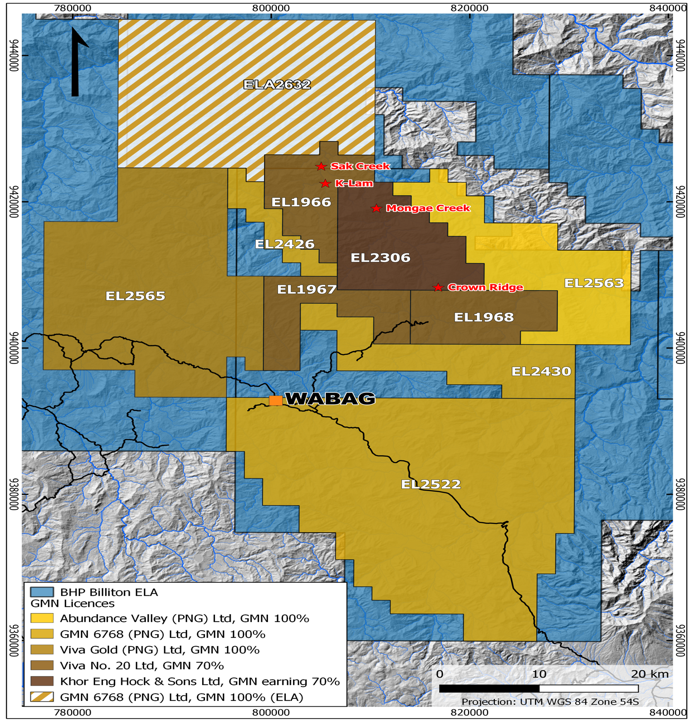

The Wabag Project covers 2,500km2 of highly prospective ground on the Papuan Mobile Belt, which, along with Porgera, hosts such major gold and copper-gold deposits as Ok Tedi, Wafi-Golpu, Grasberg and Frieda River.

It is ground that is highly sought after and was previously owned by BHP before (see tenure Map below) it had to surrender the exploration licences in the wake of its involvement with the Ok Tedi environmental disaster. BHP Billiton has a well-known appetite for focusing on areas with potential for Tier One scale assets and Gold Mountain is close to locking up BHP’s former tenement package around Wabag.

These days exciting copper exploration stories focusing on large porphyry systems are few and far between on the ASX and the right results can be the catalyst for a huge rerating. Gold Mountain has now drilled three of the nine diamond holes targeted as part of the current 3,500m program at Monoyal. Results from the second hole are eagerly awaited and expected to land later this month, while the third hole was drilled to a depth of 372.2m late last week.

Hole MCD003’s intersection of 500m is tantalising initial evidence that Gold Mountain could be onto something very material. The initial results are being reviewed by respected porphyry specialists engaged by the company to extract maximum value from them and use the information to pinpoint the core of the system and which hopefully will yield economic copper grades.

While Monoyal-Mongae Creek is the focus of the current activity, Gold Mountain has three other high calibre targets identified through sampling and trenching programs that each possess significant potential and will add new prospects as additional exploration work is carried out on the Wabag tenements.

This story was developed in collaboration with Gold Mountian, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.