Iron ore prices hurtle to a seven-year high, coking coal prices lag on quotas

Iron ore and coking coal players had very different weeks. Picture: Getty Images

- Iron ore prices traded this week at $US121.75 per tonne, up $US4.90 per tonne on a week ago

- Coking coal prices were steady this week at $US95 per tonne at Queensland ports

- China’s reinforcing bar (rebar) price is at $US605 per tonne, up $US22 per tonne on a week ago

For the key steelmaking ingredients of iron ore and coking coal, it was a tale of two different markets this week.

The price of iron ore punctured the $US120 per tonne ($164.70/tonne) barrier this week, its highest since early 2014

This was on account of a stronger market for steel in China which is targeting massive investment in its infrastructure.

For the 62 per cent grade iron ore fines product, spot prices were transacting around $US121.75 per tonne, according to Metal Bulletin.

A week ago, iron ore cargoes delivered to ports in China were trading around $US116.85 per tonne, the price reporting agency said.

There are market indications that China’s demand for iron ore will remain strong over the course of the economic cycle.

A dozen Chinese steel companies have struck long-term supply agreements with Fortescue Metals Group (ASX:FMG).

The deals were agreed on the sidelines of the China International Import Expo and included FMG shareholder, Hunan Valin Iron & Steel Group.

Other steel firms in China such as Baotou Iron & Steel Group, and Rizhao Steel also signed agreements for FMG’s iron ore.

“China’s steel industry continues to outperform expectations, with crude steel production in the nine months to September 2020 reaching 782 million tonnes, and annual steel production expected to exceed 1 billion tonnes in 2020,” FMG chief executive Elizabeth Gaines said.

ASX iron ore company share prices

| Code | Company name | Price | %Wk | %Mth | %Yr | MktCap |

|---|---|---|---|---|---|---|

| MAG | Magmatic Resrce Ltd | 0.22 | 16% | 10% | 57% | $ 39,816,519 |

| MGT | Magnetite Mines | 0.009 | -36% | 13% | 201% | $ 25,707,114 |

| SRK | Strike Resources | 0.1 | -9% | 11% | 150% | $ 19,677,755 |

| FEX | Fenix Resources Ltd | 0.13 | -7% | 8% | 195% | $ 53,838,306 |

| FMG | Fortescue Metals Grp | 17.6 | 4% | 2% | 84% | $ 54,220,572,206 |

| MIN | Mineral Resources. | 27.17 | 7% | 12% | 83% | $ 5,261,870,278 |

| ADY | Admiralty Resources. | 0.012 | -33% | -8% | 33% | $ 15,068,751 |

| TI1 | Tombador Iron | 0.029 | -17% | 4% | 38% | $ 22,597,515 |

| LCY | Legacy Iron Ore | 0.008 | 60% | 14% | 173% | $ 49,977,908 |

| CIA | Champion Iron Ltd | 3.99 | 25% | 13% | 97% | $ 1,920,958,355 |

| MGX | Mount Gibson Iron | 0.69 | -5% | 5% | -18% | $ 836,071,610 |

| EUR | European Lithium Ltd | 0.041 | -13% | 5% | -51% | $ 29,061,594 |

Prices for steel products in China climb on rising demand

Steel product prices in China are starting to rise, as are futures prices for hot rolled coil and reinforcing bar in China.

The price of steel reinforcing bar (rebar), which is used in construction and concrete, rose to $US605 per tonne, this week.

This is up $US22 per tonne on a week ago, according to reports.

Fresh environmental restrictions on steel plants in Tangshan are also creating demand for higher-grade iron ore.

Higher quality iron ore commands a higher price in the seaborne market, and the cost flows through the supply chain to consumers; in this case, steel mills in China.

Iron ore shipments to China are on a roll

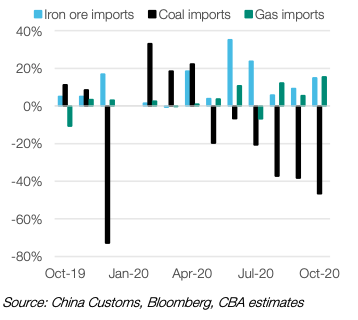

China’s imports of iron ore increased in October to 106 million tonnes, representing a rise of 15 per cent on-year.

“China’s demand for iron ore imports has increased on the back of strong steel demand and positive steel mill margins,” said analysts at Commonwealth Bank of Australia in a report this week.

Beijing has primed its economy with stimulus money to offset a decline in activity from COVID-19 restrictions earlier in the year.

“China’s infrastructure sector has led China’s steel demand growth due to policy support after COVID-19,” said the analysts.

Meanwhile, Brazil’s iron ore shipments to China have started to increase again after hitting a seven-month low.

Vale, the South American country’s largest shipper of iron ore, has plans to increase its exports with new mine projects.

Port-side stockpiles of iron ore in China have risen to 129 million tonnes as of last week.

Hard coking coal prices trade sideways in uncertain market

The price of hard coking coal at the Queensland shipping terminal of Dalrymple Bay was steady week on week at $US95 per tonne.

A Panamax shipment of hard coking coal with an early December loading time was heard sold in the market at $US107 per tonne.

Cargoes of Australian coking coal for delivery to ports in northeastern China were heard at $US125 per tonne, up $US12 on week.

Traders said Chinese importers appear to be taking more shipments of coking coal from North America, despite its higher price.

There is market speculation that China is preferring to book cargoes from Canada and the US over Australian cargoes.

ASX coal company share prices

| Code | Company name | Price | %Wk | %Mth | %Yr | MktCap |

|---|---|---|---|---|---|---|

| AHQ | Allegiance Coal Ltd | 0.054 | -5% | -21% | -58% | $ 40,217,684.18 |

| AKM | Aspire Mining Ltd | 0.072 | 0% | -8% | -40% | $ 36,042,225.94 |

| BCB | Bowen Coal Limited | 0.05 | 0% | -21% | -17% | $ 46,346,875.36 |

| BRL | Bathurst Res Ltd. | 0.042 | 8% | 17% | -60% | $ 71,799,816.10 |

| CKA | Cokal Ltd | 0.059 | -2% | 13% | 34% | $ 59,096,468.03 |

| CRN | Coronado Global Res | 0.835 | 18% | -3% | -62% | $ 1,107,103,120.00 |

| JAL | Jameson Resources | 0.125 | 14% | 4% | -34% | $ 37,916,486.25 |

| LNY | Laneway Res Ltd | 0.007 | 0% | 0% | 17% | $ 26,425,461.53 |

| MCM | Mc Mining Ltd | 0.19 | 90% | 81% | -65% | $ 29,339,715.45 |

| MEY | Marenica Energy Ltd | 0.097 | 10% | -2% | -8% | $ 13,189,616.52 |

| NAE | New Age Exploration | 0.014 | 27% | -7% | 367% | $ 15,550,925.74 |

| NCZ | New Century Resource | 0.17 | 14% | 18% | -55% | $ 189,076,597.09 |

| PAK | Pacific American Hld | 0.027 | 13% | 29% | -13% | $ 8,179,207.40 |

| PDZ | Prairie Mining Ltd | 0.19 | -7% | -17% | -16% | $ 43,387,466.91 |

| SMR | Stanmore Coal Ltd | 0.705 | -1% | -6% | -35% | $ 196,043,796.83 |

| TER | Terracom Ltd | 0.15 | 3% | -9% | -62% | $ 109,273,106.35 |

| WHC | Whitehaven Coal | 1.13 | 10% | 8% | -67% | $ 1,115,255,770.56 |

| YAL | Yancoal Aust Ltd | 1.94 | 1% | -2% | -36% | $ 2,528,641,521.86 |

Coking coal futures prices point to tightening supply

Futures contract prices for Australian coking coal on the Chicago Mercantile Exchange (CME) are trading in contango.

For December settlement, the futures price is U$122 per tonne, rising to $US134 per tonne for January 2021 and has hit $US173 per tonne for March 2021.

A steep price contango, whereby prices steadily increase, indicates a growing supply shortage next year — in this case of Australian coking coal.

This potential looming shortage could trigger significant price rises for Australian coking coal in 2021.

Immediate outlook for coking coal prices is mixed

Latest import figures show a slowing in the international trade for coking coal into the Chinese market.

China imported 13.7 million tonnes of coal in October, both thermal and coking, and the total was not broken down by category.

This represents a sharp year-on-year decline of 47 per cent, and a drop of 27 per cent on September’s imports total.

“The fall in China’s coal imports reflects China’s coal import quotas,” said analysts at Commonwealth Bank of Australia in a note.

China has strict annual limits on volumes of coal imports allowed to enter the Asian country and Beijing regulates the import trade.

This is because China tries to safeguard its own coal industry from competition from coal exporting countries.

“Policymakers [in China] are reportedly targeting total coal imports of ~270 million tonnes in 2020, implying a 29 per cent on year fall in China’s coal imports is required in November and December,” said the CommBank analysts.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.