IperionX plans to re-shore US titanium supply and take a slice of the massive stainless steel and aluminium markets

By recycling scrap, the company hope to make titanium a sustainable, fully circular metal. Pic: via Getty Images.

- IperionX is advancing development to re-shore US domestic titanium supply

- The metal is stronger, lighter and more corrosion resistant than stainless steel or aluminium

- The company sees large market opportunities in aerospace, defence, EVs, and consumer electronics, with existing customers in these areas

Back in 2020, the United States closed its last titanium plant, making the country almost 100% reliant on imports. Today ASX listed IperionX (ASX:IPX) has its sights set on a re-shored, low cost and sustainable U.S. titanium supply chain using its breakthrough titanium technology – the only commercially available method of fully recycling titanium metal.

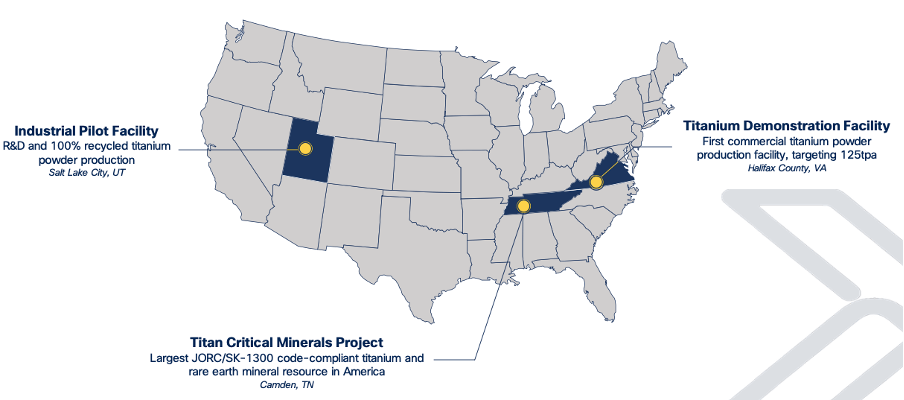

The company currently produces titanium purely from scrap metal at its operating pilot facility in Utah, and at an investor webinar last week hosted by Jane Morgan Management, CEO and MD Anastasios Arima outlined the company’s plans to scale up.

“We have a vision to make titanium metal cheap enough so that it competes against stainless steel and aluminium, because it’s a far superior metal that’s historically been held back because of its cost,” he said.

“The titanium that we typically manufacture today in our facility in Salt Lake City is three times as strong as stainless steel, far stronger than aluminium and is highly corrosion resistant.

“It’s typically 45% lighter than stainless steel, which is important for sectors like electric vehicles, defence, aerospace and consumer electronics.”

US supply key to national security

“Today around 70% of titanium refining capacity is in China and Russia which is not a great situation to be in from a national security standpoint for the United States and other western countries, because a lot of defence and aerospace applications rely on titanium metal, Arima says.

And the US military has already made moves to secure its slice of the company’s titanium tech.

Earlier this year IperionX won the US Department of Defence’s National Security Innovation Network (NSIN), Air Force Research Laboratory (AFRL) Grand Challenge for titanium recycling, a significant validation of their technology from a world leading research group.

“You can’t recycle broken parts, broken prototypes, and failed component builds from the military with existing titanium technologies, and you can’t put them into landfill because they’re classified components – but we can take them and recycle them.” Arima said.

IperionX also secured a deal in February with Carver Pump to additively manufacture titanium pump components for the US Navy, with Carver Pump supplying high performance pumps to every U.S. Navy shipbuilding program for the last 60 years.

“We can take broken parts off ships, put them through our recycling process, re-print them and put them back on the ship – keeping the ship in service and out of dry dock,” he added.

Taking market share from stainless steel and aluminium

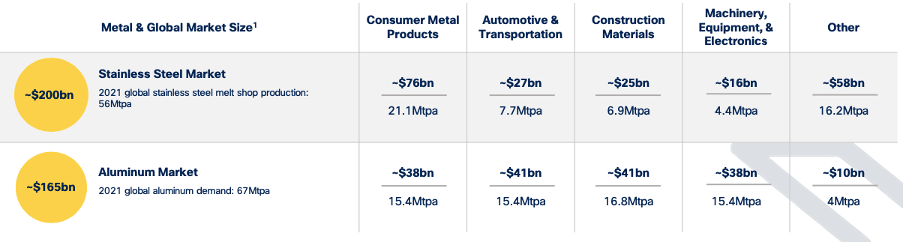

The titanium market is worth around ~US$4b, and IperionX is confident it can take market share from stainless steel and aluminium, worth ~US$200b and ~US$165b respectively.

The company is already moving into new markets, last year with Officine Panerai placing a first purchase order for titanium watch cases to be additively manufactured using IperionX’s low carbon, circular titanium.

Last month, IperionX sealed a deal with Germany’s Canyon Bicycles to replace carbon fibre and aluminium components with titanium and develop a more sustainable supply chain.

The company also recently teamed up with additive manufacturer SLM Solutions for the potential supply of spherical titanium metal powders from the company’s planned Titanium Demonstration Facility (TDF) in Virginia.

Not to mention, there’s opportunities to enter the green hydrogen economy through the use of the metal in water electrolysers, which Arima forecasts could be worth 10% of the titanium market by 2030.

“We also see some huge opportunities in the automotive sector, and we’re working behind the scenes with Tier 1s and OEMs across the US and Europe where there’s opportunities to start introducing more titanium metal,” he said.

Commercial facility operational by 2024

The plan over the next 6 to 12 months is to build a commercial, large scale facility in Halifax County, Virginia, which will target 125 metric tonnes per annum (mtpa).

The company plans to be operational by Q1 CY24, and has flagged a capital cost of around $20m, of which about $4.5m is being spent by Halifax County and the State of Virginia.

“We’ll be coming back to the market fairly soon with updated numbers and some guidance around capex, opex and production scale for our business in this facility and over the next five years,” Arima said.

“We’ve publicly announced we have aspirational targets for 10,000tpa – that’s a significant business and we believe we can hit that just on scrap metal.

“Over the long term once we’re able to recycle as much scrap as possible into circulation five to ten years out, we eventually want to backward integrate to become a source of titanium metals.

“That’s where IpeironX’s Titan critical mineral project comes in, being the largest titanium deposit in North America today and with co-products of rare earth and zircon minerals as well.”

Piedmont pathway but for titanium

Essentially, Arima wants to achieve similar success to what he did with Piedmont Lithium (ASX:PLL), which he started with Lamont Leatherman in the U.S. in 2016 – and that is to align strategic customers to a high quality material critical to U.S. industry.

“Is IperionX’s titanium as good as virgin metal? Yes it is. Does the process work? Yes it does. And securing those strategic and big-name customers really validates that in the minds of investors,” he said.

“Like when we secured Tesla for Piedmont, the share price tripled or quadrupled on the day they were secured.”

IPX share price today:

This article was developed in collaboration with IperionX, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.