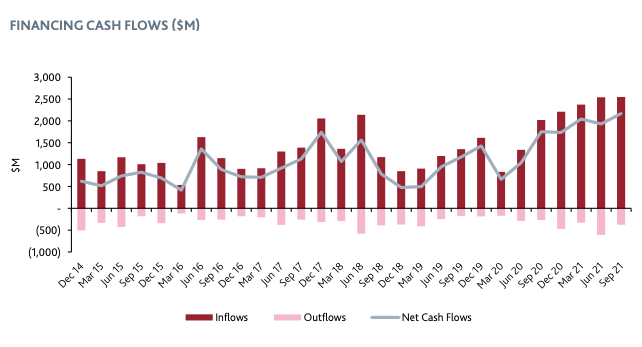

Investors pumped $2.55 billion into explorers in just three months in the hope of chasing the next breakout star

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

ASX-listed exploration companies are in rude shape at the moment, with seemingly unfettered access to capital markets driving a boom in IPOs and drilling investment.

It is not just the vibe of the thing either, hard figures back that up.

According to figures compiled by BDO, appendix 5B reports from ASX-listed explorers show instos, funds, professional and retail investors are backing the sector at a level not seen in years, if ever.

$2.55 billion was thrown into early stage companies on the Australian bourse in the three months to September 30, a record since BDO first released its explorer quarterly cash update in 2013 and keeping pace with the $2.54 billion tipped into the sector in the June quarter.

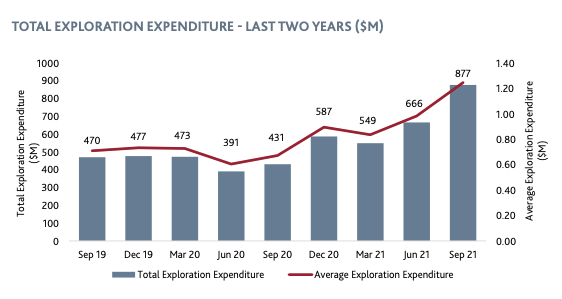

A near record $877 million was spent exploring around the world by the 704 exploration companies on the ASX in September, a remarkable 32% rise on the $666 million spent in the June quarter – already a seven-year high.

Given more than 850 resources juniors were on the boards the last time spending was higher in 2013 and early 2014, the $1.25 million spent per reporting company was an eight-year record.

BDO global head of natural resources Sherif Andrawes said IPOs were a big driver of the rise in investment, with 62 more resources companies reporting 5Bs than in September 2020.

“With the increased number of new entrants over recent periods, the exploration sector is showing no signs of slowing,” he said.

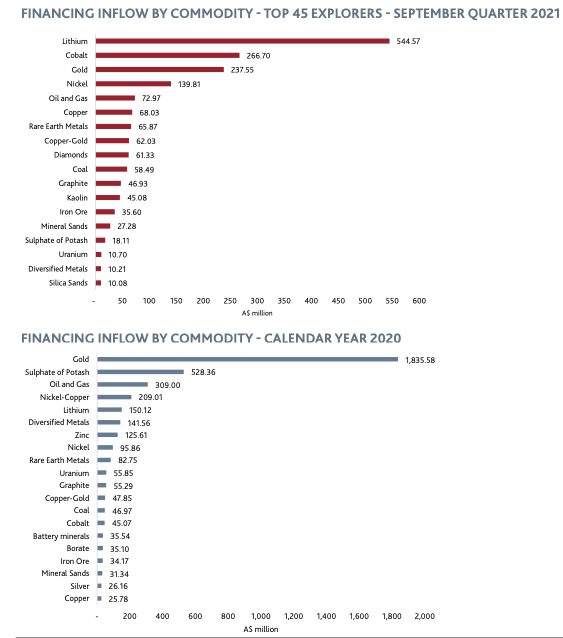

Among the biggest raisings were cobalt miner Jervois Mining’s (ASX:JRV) $266m equity deal to fund its purchase of Freeport’s cobalt business, Vulcan Energy’s (ASX:VUL) $200m equity raise for its Zero Carbon Lithium Project in Germany, Core Lithium (ASX:CXO) raising $116m for its Finniss lithium mine in the NT and Bellevue (ASX:BGL) raking in $106m in equity for its gold mine in WA.

Battery minerals on a tear

While gold investment accounted for the lion’s share of funding for resources companies in 2020, battery metals like lithium, nickel and copper are drawing the most support from investors at the moment.

The $544.5 million raised by lithium juniors in the September Quarter is more than three times the amount raised in all of 2020, BDO says.

“The rise of battery minerals is clearly linked to the global trends of rising electric vehicle adoption and lower carbon emission targets which is a key consideration of the market,” Andrawes said, noting that investors and governments are sharpening their focus on the energy transition.

“It is essential that all exploration companies, regardless of commodity exposure, constantly consider the relevance of ESG to their ongoing operations and also to any investment decisions and future strategies.

“The ones who are able to do so successfully will likely continue to be supported by investors and contribute to the push for a cleaner and greener economy.”

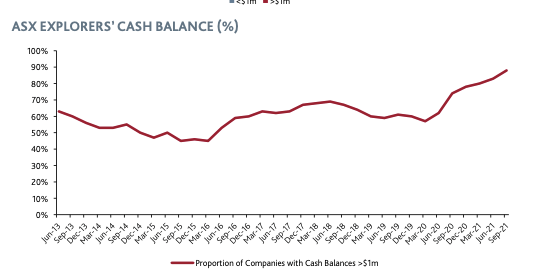

In general the health of exploration companies on the ASX is at its strongest point since BDO began its quarterly survey.

A record 88% of companies had cash balances of more than $1 million.

At the market’s nadir in 2016 less than 50% of explorers could lay claim to that level of funding, something reflected in the level of cash companies are willing to commit to drilling programs.

“With exploration spending peaking to this seven-year high, 56% of companies recorded net investing outflows, which is 13% higher than the two-year average,” Andrawes said.

Risks from labour shortages, inflation

While 10 explorers surveyed last week by Stockhead expect buoyant market conditions to continue into the new year, a number are concerned about labour shortages and inflationary pressures.

BDO noted administration costs were also on the rise, climbing 22% to a three-year high of $253 million or $360,000 a company, although BDO suggested this could be due to the heat in the market as well.

“This trend is in line with the cyclical nature of administration spending observed over the last four years, for which administration expenditure tends to be lower in the March and June quarters and higher in the September and December quarters,” report authors said.

“The increase is also linked to the increased level of exploration activity, capital raises, and listings, which have placed upward pressure on corporate expenses.

“Furthermore, it may also be a result of the corporate skilled labour shortages resulting in companies being required to increase remuneration of corporate staff for retention purposes as well as an increase in the fees that are being paid to external advisers.”

BDO said growth in the exploration sector could be constrained by the availability of resources, travel restrictions and a shortage of skilled labour.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.