MOTHER LODE: Pics of the top 10 gold strikes miners shared with us in 2018

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

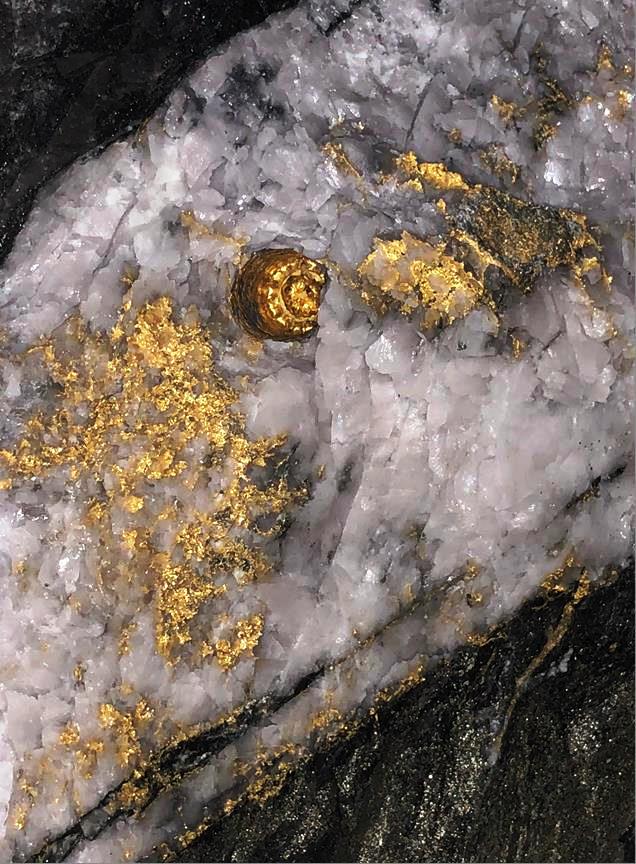

You can’t go past RNC Minerals’ massive gold find in Kambalda, Western Australia earlier this year and it is without a doubt the best gold hit of 2018.

In September, Canada’s RNC Minerals unveiled one of the richest gold veins ever found, hosting more than 25,000 ounces worth more than $C40 million ($55.7m) including some of the largest specimen stones ever found.

These big beauties — the biggest of which is a 95kg specimen containing some 2440 ounces of gold — are so popular they are going on tour.

“We’ve been approached by a number of museums, a number of collectors who are obviously very interested in seeing specimens,” chief Mark Selby said on the sidelines of the Precious Metals Investment Symposium in Perth in October.

“These are among the largest ever found. We’ve had a lot of interest from all over the world. So we will be taking them on tour.”

Mr Selby says the tour will continue through February next year and then sometime in the first quarter the valuable rocks will be sold at auction.

While most miners would be pretty chuffed with gold grades over 2 grams per tonne (g/t) in Australia, RNC is pulling grades of up to 15,000g/t.

No other recent gold finds can hold a candle to that sort of grade, but there have been several “bonanza” gold hits made this year by ASX listed gold explorers.

There is no agreed-upon, official definition for “bonanza” grade – but 5g/t of gold and above is considered high-grade.

Stockhead’s top gold hits of 2018

In February, West African Resources (ASX:WAF) revealed it had uncovered 860g/t in Burkina Faso.

Drilling at the M1 South prospect, part of the Sanbrado project, returned hits of 14m at 39.3g/t of gold, including 0.5m at 860g/t.

The West African country is Africa’s third largest exploration jurisdiction for gold and the continent’s fourth largest producer.

West African Resources then revealed in July new high-grade hits of up to 520g/t beneath the existing reserves at the M1 South prospect.

The company followed that up with the discovery of a new zone at the Sanbrado project that delivered grades of up to 138.4g/t.

The zone runs parallel to the M1 South discovery.

The Western Australia-focused gold explorers seem to be on the money, with several impressive high-grade hits reported this year.

Egan Street Resources (ASX:EGA) delivered a top hit of 776g/t at its Rothsay project.

The company reported 0.3m at 776g/t from within a broader intersection of 2m at 116g/t from 264m.

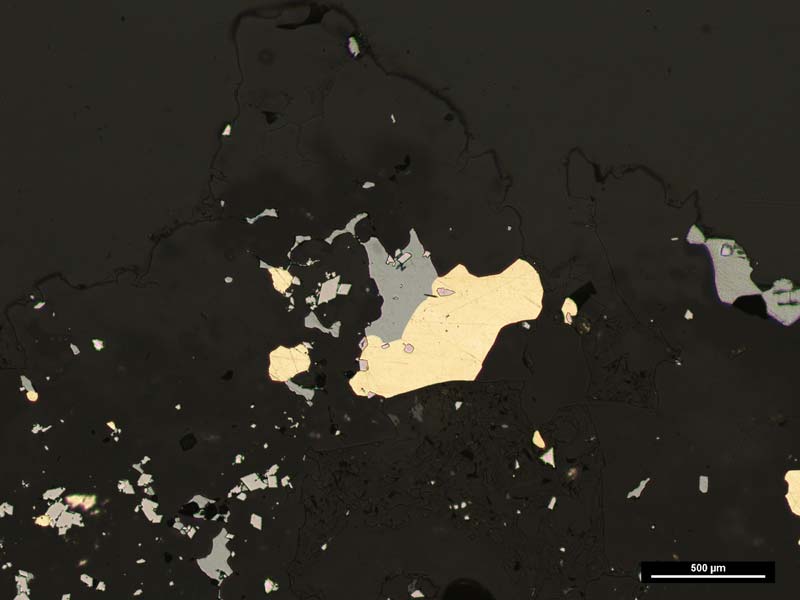

Doray Minerals (ASX:DRM) last week hit up to 724g/t and 18.8 per cent copper at its Deflector mine.

“These results continue to show the level of high-grade mineralisation present within the Deflector system,” managing director Leigh Junk said.

“The more we drill, the more mineralised surfaces we uncover. Some of these grades are exceptional, and bode well for inclusion in next year’s mineral resource estimate.”

In September, Silver Lake Resources (ASX:SLR) reported a hit of 526g/t, albeit from a short intercept of just 0.45m, from drilling at a prospect called “Easter Hollows”.

The area is part of the company’s larger producing Mount Monger project located in the Eastern Goldfields.

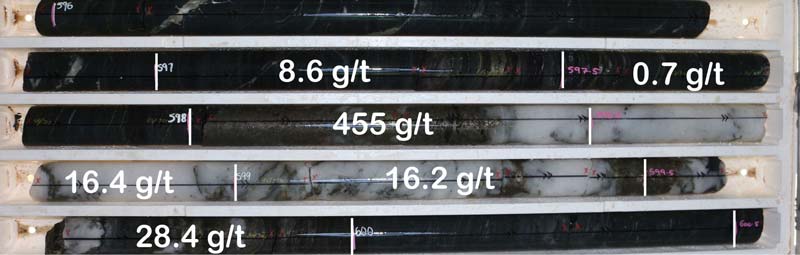

Next up is Bellevue Gold (ASX:BGL) with an impressive 455g/t hit returned from drilling of the “Viago” lode at its namesake project.

In October, Bellevue bumped up its “inferred” resource for the project, located 400km northwest of Kalgoorlie, to 1.04 million ounces at 12.3g/t gold.

Mineral resources are categorised in order of increasing geological confidence as inferred, indicated or measured.

It took Bellevue, which is backed by successful mining investor Tolga Kumova, less than 12 months to grow its resource to over 1 million ounces and the company’s goal is to double that in the next 12 months.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

“We’re the second highest grade deposit in the whole of Australia,” boss Steve Parsons told Stockhead at the time.

“Our goal is looking onto the next 12 months and we’d like to be able to replicate the same sort of thing.”

The Viago lode is just 150m from the historic Bellevue gold mine, which produced around 800,000 ounces at 15g/t between 1986 and 1997.

In October, First Au (ASX:FAU) struck 426g/t at the Gimlet project near Kalgoorlie.

Last week the company reported more shallow, high-grade gold intercepts, including 1m at 40g/t.

In August, Westgold Resources (ASX:WGX) uncovered 139.8g/t at its Paddy’s Flat mine in Meekatharra.

Drilling also returned an intersection with “abundant” visible gold.

Westgold said given the amount of visible gold in the intercept, the “results speak for themselves”.

“There is no point cutting and assaying cores like this, they go thousands of grams per tonne,” managing director Peter Cook said.

Notable mentions

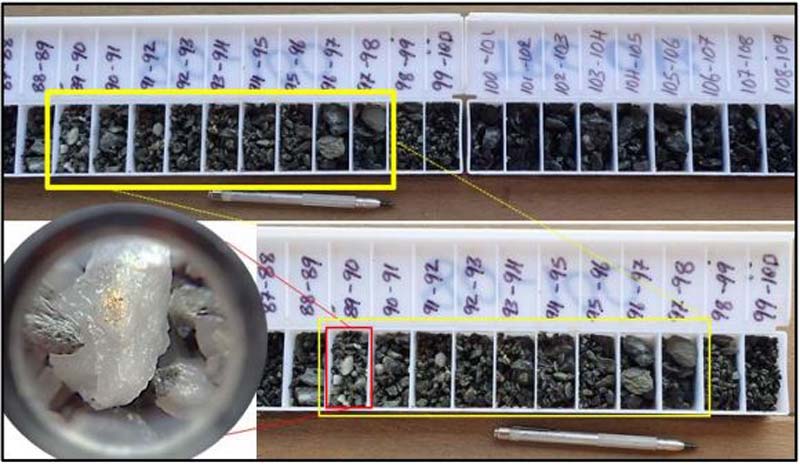

Troy Resources (ASX:TRY) shares went on a tear in early November after it told investors it had uncovered gold grades of up to 93.78g/t from just 2m down.

with visible gold in quartz. Pic: Troy Resources.

The results were from drilling at the Ohio Creek prospect, part of the Karouni project in Guyana.

Troy only acquired the Ohio Creek prospect in September.

Previous drilling done in 1995 delivered a bonanza hit of 1m at 868.8g/t from 61m – which Troy said represented the highest gold grade in the region.

Azumah Resources (ASX:AZM) last week reported a new high-grade discovery beneath an existing deposit in Ghana.

Drilling beneath the Bepkong deposit returned a 93m semi-continuous mineralised zone hosting grades as high as 88.71g/t.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.