Hot Chili grows Costa Fuego with Domeyko acquisition, where historical copper-gold mines are unexplored at depth

Mining

Mining

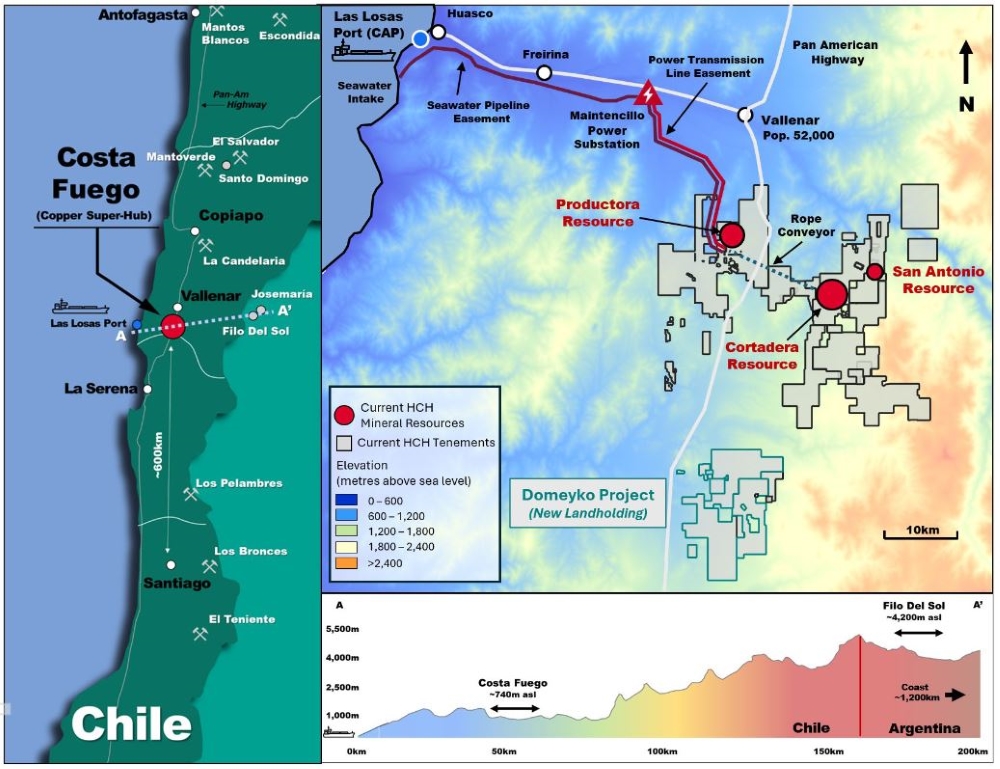

Special Report: Porphyry developer Hot Chili has acquired the ‘Domeyko cluster’ tenements to boost the size of its flagship 798Mt Costa Fuego copper-gold project in Chile by 25%.

Costa Fuego has a current resource of 798Mt at 0.45% copper equivalent for 2.9Mt copper, 2.6Moz gold, 12.9Moz silver and 68,000t molybdenum.

Two years of drilling and studies have the project now pegged as a low-risk, low-cost and long-life copper project in the world’s largest producer of the red metal.

Lately, Hot Chili (ASX:HCH) has been busy building out a network around its project with water supply and transport deals in the region.

It’s executed a five-year MoU deal with the nearby port to evaluate bulk tonnage loading alternatives for copper concentrate from Costa Fuego that would include a ‘take or pay volume’ clause based on at least 80% of the project’s future annual concentrate production.

The explorer has also announced a focus on water infrastructure and desalination in Chile’s Atacama region – one of the driest regions on earth.

Domeyko is the largest land consolidation undertaken by Hot Chili since Cortadera was added to Costa Fuego in 2019, adding 141km2 and representing a 25% lift in the company’s total tenure in the region.

The move contains several new tenement applications in addition to an option agreement to acquire 100% interest in several key tenements covering a highly prospective, 10km-long copper-gold mineralisation corridor.

The Domeyko mining centre hosts several significant historical copper-gold mines which were principally exploited for oxide mineralisation yet have had very limited exploration for copper sulphide mineralisation.

Both porphyry and structurally hosted styles of mineralisation are present in the area and historic datasets are currently being looked over across several highly prospective targets that have never been drilled.

The total exercisable option to purchase Domeyko comes to $4m, payable within two years to a private Chilean syndicate.

More drilling, exploration and development study workstreams across Costa Fuego are ongoing and further updates on progress of the company’s regional water supply business case study are expected soon.

This article was developed in collaboration with Hot Chili, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.