Horizon Gold chases $11m raise as money flows to precious metals stocks

HRN is the latest goldie heading back to the market for cash. Pic: Getty Images

- Morgans launches $4m placement for WA gold developer Horizon Gold after $75m junior enters trading halt

- Total to be raised set at $11m, with $7m to come from entitlement offer to existing holders including major shareholder Zeta Resources and HRN board

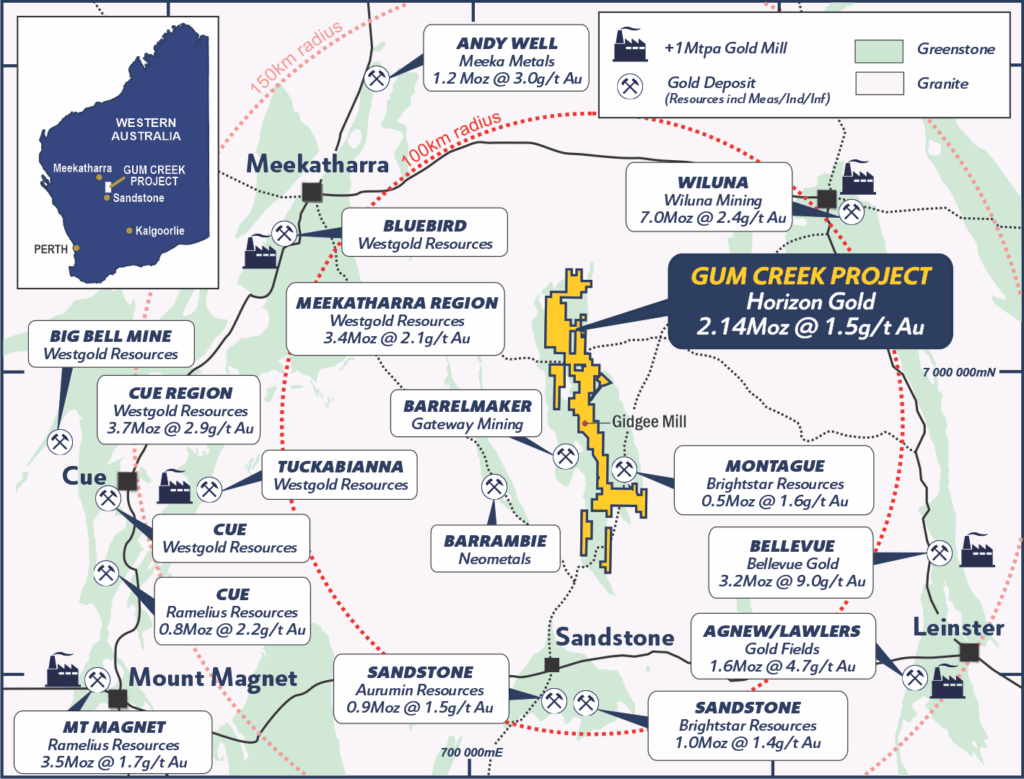

- Feasibility study on 2.1Moz Gum Creek gold project near Sandstone in 2026

Junior gold explorers are getting more confident about their potential to raise cash with prices for the precious metal sitting at US$3330/oz.

Look no further than Horizon Gold (ASX:HRN), one of a handful of large resource holders in WA not to catch a ride on the magic carpet that is the 2025 ASX gold market.

The $75 million explorer, a spinoff of failed nickel miner Panoramic Resources, owns the Gum Creek gold project near Sandstone, where the under the radar junior is planning a feasibility study next year.

Despite its low profile, HRN is holding onto 44.5Mt at 1.5gt Au for 2.1Moz, 63% of that in the indicated category, most of it free milling gold with better than 90% recoveries.

That’s according to a pitch sent to investors on Thursday. After heading into a trading halt, HRN is seeking $11m via a $4m Morgans-led placement at 48c, a 7.7% discount to its last traded price, and a $7m entitlement offer priced at 1 for 9.93 to existing shareholders.

It’ll be well supported given the tight grip major shareholder Zeta Resources and its board have on the stock – around 79.7% of the company.

They’ll be taking their full entitlement, a term sheet seen by Stockhead said.

Back to the future

Like so many other projects in WA and across Australia more broadly, Gum Creek was once a producer, turning out 1.1Moz of gold up to 2005.

Unsurprisingly, the company and its brokers think the market is a lot more attractive right now. In the two decades since its closure gold has travelled from $560/oz Aussie to over $5000/oz.

One handbrake previously had been the refractory nature of many of the resources at Horizon, not the done thing to develop if you’re a small, lightly capitalised gold company given the additional costs involved with processing methods designed for tougher ore like pressure oxidation, bug plants, roasters and ultra-fine grinding mills.

The current MRE now contains 1.3Moz of gold resources interpreted to be free milling – 32.97mt at 1.22g/t.

HRN is planning to locate a mill for the project centrally near the Gidgee Shear Zone deposit, which contains 886,000oz at 1.53g/t, with Howards (267,000oz) at 0.81g/t the other large ore source expected to underpin its base feed.

Given the historic Gidgee Mill, it’s already got a permitted site. A March 2024 scoping study suggested the project could produce 84,000ozpa at an all in sustaining cost of $1931/oz with a pre-production capital bill of $238.5m.

That was conducted at a now very quaint looking $3300/oz Aussie gold price.

Since the study there’s been a dramatic shift in the power dynamics in the region as well, notably with the aggressive M&A strategy of Brightstar Resources (ASX:BTR), which views Sandstone as potentially its largest production hub beyond the development of its Menzies and Laverton gold projects after the junior gold producer merged with Alto Metals and acquired the Montague project of Gateway Mining (ASX:GML).

BTR is now in discussions with Aurumin (ASX:AUN) over a deal for the last significant gold holding in the region outside Horizon’s.

Hot stuff.

Having just completed over 13,000m of drilling, Horizon is planning to put its funds towards a first half 2026 feasibility study and a resource update due in the second half of 2025. Just under half of the new capital is to be put towards exploration and development activities.

Its the latest significant capital raising in the gold and silver space, which has propped up the junior exploration sector in 2025 on the ASX.

Along with Horizon, near-term Mid West gold developer New Murchison Gold (ASX:NMG) pocketed $15m last month, while $320m capped Paterson Province explorer Antipa Minerals (ASX:AZY) raised $40m earlier in July for its 2.5Moz Minyari Dome project.

South American silver explorer Andean Silver (ASX:ASL) is also halted, tapping the market for fresh capital currently.

HRN is up only 4% YTD, but over 80% in the past 12 months, but the pitch is that it’s trading at a much lower value per resource ounce compared to developer peers.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.