Higher prices give PNX confidence to pursue Fountain Head gold development

Pic: John W Banagan / Stone via Getty Images

Special Report: Significant moves up in gold, silver and zinc prices has prompted PNX to retain full ownership of its Fountain Head project.

Continued strengthening in gold, silver and zinc prices has substantially improved the economics of PNX Metals’ (ASX:PNX) Fountain Head and Hayes Creek projects in the Northern Territory.

PNX had been considering bringing in a joint venture partner, but during the several months of negotiations witnessed a substantial increase in metals prices, particularly zinc and silver prices.

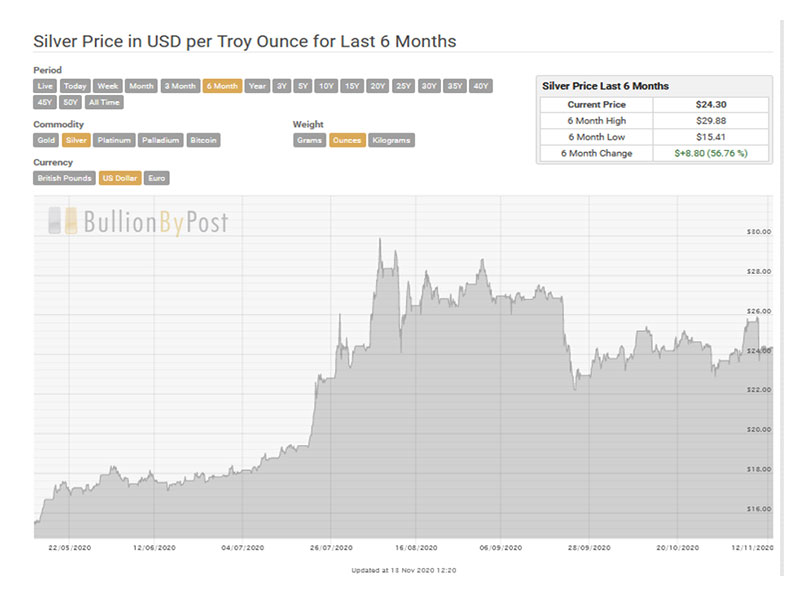

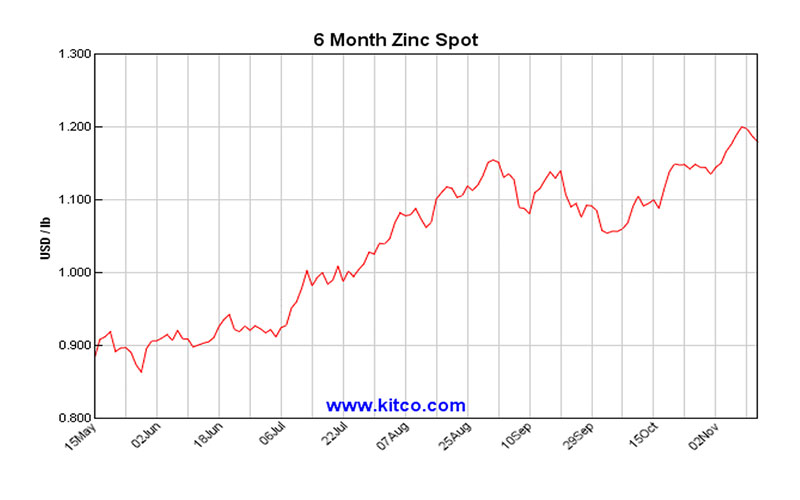

In the past six months gold has climbed 12.5 per cent to $US1881 an oz, silver is up 57 per cent to $US24.30 an oz and zinc has jumped 31 per cent to $1.18 per pound.

“The Fountain Head gold project and high-grade zinc-gold-silver Hayes Creek project continues to evolve and our discussions with potential earn-in partners has served to highlight the significant opportunities to grow the scale of the project both from within existing PNX tenements and from the numerous ‘stranded assets’ within the region,” managing director James Fox said.

“With the backing of major shareholders and support from NT governments eager to see expanding business and employment opportunities, we expect to expedite the feasibility study with the aim of commencing development activities during 2021.”

The forecast is for gold, silver and zinc prices to remain strong and at the same time PNX has identified additional gold prospects that may have the potential to augment overall project returns.

Stepping on the gas

This has prompted PNX to fast track the feasibility study and the development approvals process.

PNX aims to have the feasibility study completed in early 2021.

Fountain Head currently hosts a resource of 2.94 million tonnes at 1.7 grams per tonne (g/t) for 156,000oz of gold.

Adding to the upside, there is also material quantities of gold and silver contained in oxide mineralisation at Mt Bonnie that will be assessed in the feasibility study.

Mt Bonnie, which is part of the Hayes Creek project and situated 15km south by road to Fountain Head, has a resource of 1.55 million tonnes at 3.8 per cent zinc, 1.34g/t gold, 127g/t silver, 1.1 per cent lead and 0.2 per cent copper for 66,800oz of gold and 6.3 million oz of silver.

Including existing stockpiled material at Mt Bonnie, up to 28,000oz of gold and 1.5 million oz of silver are present in the oxide/transitional zone and may be recovered through the proposed carbon-in-leach plant.

The expanded feasibility study will investigate the technical and economic viability of

a multi-asset development.

Fountain Head will be developed as stage one, with the Hayes Creek zinc-gold-silver sulphides to follow as stage two.

Both projects, which sit on wholly owned mineral leases, are located in close proximity to each other within a historic mining area that comes complete with existing haul roads, water, rail, gas, grid power and telecommunications infrastructure.

Fountain Head could become a regional processing hub for mineral deposits in the Pine Creek region that are considered “stranded” due to their modest grades and distance from existing infrastructure.

Ticking the boxes on the way to production

PNX plans to continue talks with prospective parties, including Halifax Capital and its subsidiary Bridge Creek Mining, regarding infrastructure funding.

The company will complete the evaluation of known gold prospects – the so-called ‘stranded assets’ – in the region that could provide additional feed material to the proposed plant to extend the mine life and lower costs.

PNX will also look at its options for a currently available and suitable second-hand carbon-in-leach plant and equipment that could result in considerable cost savings.

On the exploration front, PNX will advance work on gold targets in the Pine Creek region to prove up more gold resources that could be processed at Fountain Head.

Exploration will re-commence with an airborne magnetic survey followed by drill-testing.

This article was developed in collaboration with PNX Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.