High Voltage: What sound should an EV make?

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Each week our High Voltage column wraps all the news driving ASX battery metals stocks with exposure to lithium, cobalt, graphite, manganese and vanadium.

Scroll down for a table showing the recent performance of 200 ASX battery metal stocks >>

INDUSTRY FOCUS

“There is no e-sound. It has to be invented,” said the head of acoustics at Porsche recently.

Electric vehicles are deathly quiet, and that’s a safety problem that needs solving.

Carmakers have been working on artificial noises that warn unsuspecting punters that a few tonnes of metal is headed their way.

Some make tinny artificial engine noises, some a relaxing whistling sound (which could defeat the purpose?) … and then there’s Mercedes-AMG, which is currently collaborating with rock band Linkin Park on a “potent” artificial sound.

Here’s a better option:

We’ll keep you posted.

How do we tell if a battery metals project is any good?

It is much harder for investors to evaluate how good a battery metals project is compared to more “conventional” minerals such as gold, coal or iron ore.

And exploration companies aren’t making it any easier, especially the ones that report results in a misleading way, says Dr Andrew Scogings of minerals consultancy KlipStone.

“Competition for scarce investment dollars has inspired innovative exploration approaches, as well as ‘creative’ ways to tell the story of exploration success,” he told delegates at the Paydirt 2019 Battery Minerals conference last week.

“Graphite and lithium projects are a more opaque and not as easy to evaluate based solely on the reported tonnage and grade.

“It should be quite clear by now to investors evaluating the merits of graphite or lithium pegmatite projects that ‘looks can be deceiving’ when it comes to these commodities and that the investor should be aware of potential pitfalls.”

SMALL CAP SPOTLIGHT

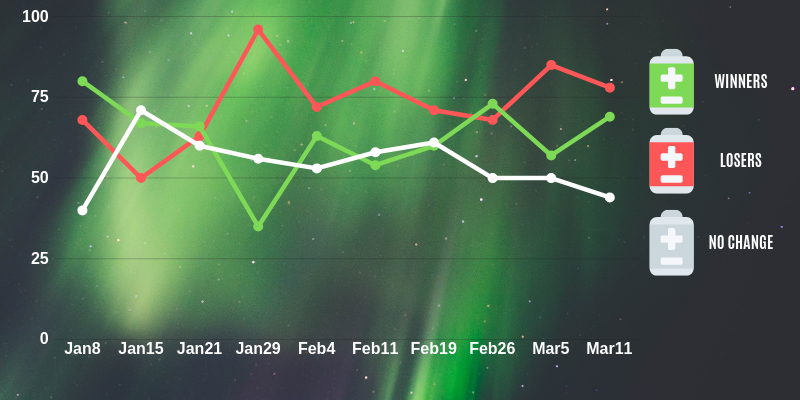

Of the companies on our list, 71 lost ground, 60 were ahead and 61 were steady this week.

Here’s how that looks for the year so far:

Junior explorer Strike Resources (ASX:SRK) jumped 90 per cent last week to 8c after securing the Solaroz lithium brine project in Argentina’s Lithium Triangle.

Strike had spent the best part of eight years focussing on its pretty decent iron ore project in Peru – but market conditions were not their friend, and the company effectively shelved those projects in 2014.

The explorer then spent some time in the wilderness – fending off a low-ball takeover offer, briefly investigating a number of “technology related ventures” – before buying a Queensland graphite project in 2016.

At Solaroz they will be smack bang in the action zone; directly adjacent to or surrounded by ground held by ASX-listed Orocobre (ASX:ORE) and TSX-listed Lithium Americas (TSX:LAC).

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

With cobalt in the doghouse, Northern Cobalt (ASX:N27) has been diversifying its project portfolio.

In addition to its cobalt project (Wollogorang) in the Northern Territory, they have a lithium project (Arunta) in the Northern Territory and a gold and vanadium project in Alaska (Snettisham).

Last week, it told investors a helicopter magnetic survey over their vanadium-gold Snettisham project had identified a mammoth magnetic anomaly.

Its near surface, 2.5km long, 600m wide and 2km deep, and this news sent the share price up 14 per cent to 6.5c.

Now they just have to go out and drill it.

Poor Galan Lithium (ASX:GLN) copped a thrashing last week, down 54 per cent to 28.5c.

A March 11 release can be blamed for the precipitous fall.

Drill hole number two at the Candelas lithium brine project in Argentina wasn’t replicating the success of the first just yet, Galan told investors.

The maiden drill hole had brine starting at about 200m and extending to the bottom of the hole at 401 metres, and included an “exceptional intercept” of 192 metres at 802 mg/l Li.

Hole 2, about 9.5km south of hole 1, had been drilled to about 465m and hit nothing so far.

Galan managing director Juan Pablo Vargas de la Vega says the market is overreacting.

“The bottom line is that we are still drilling hole 2 — and we are still drilling because we believe the brines could be down there,” he told Stockhead.

“Is hole 2 a dud? Until we get there we aren’t going to know.”

Either way, Candelas is large project, and Galan took a bit of a gamble drilling so far away from the successful first hole.

“Yeah, it was a bit ballsy — I’ll take that,” Mr Vargas de la Vega says.

“The potential is there for hole 2 to be a success, but if that doesn’t work out then it just means we drill elsewhere.

“…That’s what exploration is about.”

Here’s a table of ASX battery metal stocks with exposure to lithium, cobalt, graphite, manganese and vanadium>>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop

| Ticker | Name | 1 Week Price Change % | 1 Year Price Change % | Share Price [March 18] | Market Cap |

|---|---|---|---|---|---|

| KLH | KALIA | 100 | -50 | 0.004 | $10,057,390.00 |

| SRK | STRIKE RESOURCES | 90 | 38 | 0.08 | $15,260,098.00 |

| BMT | BERKUT MINERALS | 83 | 0 | 0.15 | $7,875,916.50 |

| SRN | SUREFIRE RESOURCES | 33 | -77 | 0.004 | $2,203,268.25 |

| MEI | METEORIC RESOURCES | 30 | -70 | 0.013 | $5,744,557.50 |

| MZN | MARINDI METALS | 25 | -50 | 0.005 | $9,923,794.00 |

| CZN | CORAZON MINING | 25 | -58 | 0.005 | $5,061,133.50 |

| HMX | HAMMER METALS | 24 | -43 | 0.026 | $8,486,021.00 |

| AYR | ALLOY RESOURCES | 20 | -50 | 0.003 | $4,731,233.00 |

| GPP | GREENPOWER ENERGY | 20 | -81 | 0.003 | $3,130,740.75 |

| N27 | NORTHERN COBALT | 14 | -85 | 0.065 | $3,232,744.50 |

| VMS | VENTURE MINERALS | 14 | -32 | 0.025 | $11,974,076.00 |

| AXE | ARCHER EXPLORATION | 13 | -18 | 0.076 | $14,593,411.00 |

| AOU | AUROCH MINERALS | 13 | -30 | 0.068 | $6,834,240.50 |

| GED | GOLDEN DEEPS | 12 | -27 | 0.037 | $6,341,089.00 |

| E25 | ELEMENT 25 | 12 | -42 | 0.19 | $16,792,870.00 |

| ENT | ENTERPRISE METALS | 11 | -44 | 0.01 | $3,880,627.50 |

| AJM | ALTURA MINING | 11 | -65 | 0.155 | $265,635,232.00 |

| CMC | CHINA MAGNESIUM | 10 | -12 | 0.022 | $10,173,648.00 |

| GWR | GWR GROUP | 10 | -45 | 0.11 | $27,886,918.00 |

| AZI | ALTA ZINC | 10 | -22 | 0.005 | $7,940,001.00 |

| TON | TRITON MINERALS | 10 | -45 | 0.045 | $40,794,068.00 |

| CHK | COHIBA MINERALS | 9 | 20 | 0.012 | $7,975,371.00 |

| AEE | AURA ENERGY | 8 | -41 | 0.013 | $15,632,709.00 |

| RTR | RUMBLE RESOURCES | 8 | 0 | 0.054 | $19,636,558.00 |

| RDS | REDSTONE RESOURCES | 8 | -3 | 0.014 | $6,122,536.00 |

| BAT | BATTERY MINERALS | 8 | -64 | 0.028 | $28,955,460.00 |

| KDR | KIDMAN RESOURCES | 7 | -37 | 1.34 | $536,356,544.00 |

| PM1 | PURE MINERALS | 7 | -12 | 0.015 | $4,086,927.75 |

| ESR | ESTRELLA RESOURCES | 7 | -35 | 0.015 | $7,378,249.50 |

| ANW | AUS TIN MINING | 7 | -42 | 0.015 | $31,810,732.00 |

| TRT | TODD RIVER RESOURCES | 7 | -26 | 0.08 | $12,115,860.00 |

| FEL | FE | 7 | -61 | 0.016 | $6,158,047.50 |

| IDA | INDIANA RESOURCES | 7 | -29 | 0.049 | $5,193,749.00 |

| SO4 | SALT LAKE POTASH | 6 | -7 | 0.575 | $115,511,528.00 |

| RNU | RENASCOR RESOURCES | 6 | -50 | 0.017 | $19,608,214.00 |

| NVA | NOVA MINERALS | 6 | -58 | 0.015 | $13,194,281.00 |

| EMH | EUROPEAN METALS | 6 | -8 | 0.35 | $51,324,780.00 |

| PGM | PLATINA RESOURCES | 6 | -45 | 0.072 | $19,281,216.00 |

| KAI | KAIROS MINERALS | 6 | -49 | 0.018 | $15,340,911.00 |

| TNG | TNG | 6 | -42 | 0.096 | $91,529,408.00 |

| SUH | SOUTHERN HEMISPHERE MINING | 5 | -45 | 0.039 | $3,450,309.25 |

| KSN | KINGSTON RESOURCES | 5 | -13 | 0.02 | $24,463,968.00 |

| TNO | TANDO RESOURCES | 5 | 10 | 0.105 | $19,383,708.00 |

| BDC | BARDOC GOLD | 5 | -57 | 0.045 | $46,223,940.00 |

| EUR | EUROPEAN LITHIUM | 5 | -62 | 0.091 | $48,739,684.00 |

| VRC | VOLT RESOURCES | 5 | -43 | 0.023 | $30,565,042.00 |

| BUX | BUXTON RESOURCES | 4 | -4 | 0.12 | $16,326,652.00 |

| POW | PROTEAN ENERGY | 4 | -70 | 0.012 | $3,114,372.50 |

| DEG | DE GREY MINING | 4 | -25 | 0.097 | $38,507,176.00 |

| BEM | BLACKEARTH MINERALS | 4 | -60 | 0.074 | $4,785,288.00 |

| DGR | DGR GLOBAL | 4 | 42 | 0.135 | $79,713,648.00 |

| JRV | JERVOIS MINING | 4 | -48 | 0.245 | $53,583,120.00 |

| MLM | METALLICA MINERALS | 3 | -39 | 0.03 | $9,379,975.00 |

| AUR | AURIS MINERALS | 3 | -54 | 0.03 | $12,260,430.00 |

| CHN | CHALICE GOLD MINES | 3 | 22 | 0.155 | $42,650,900.00 |

| ORN | ORION MINERALS | 3 | -24 | 0.032 | $65,580,672.00 |

| CLQ | CLEAN TEQ HOLDINGS | 3 | -75 | 0.325 | $231,361,072.00 |

| SGQ | ST GEORGE MINING | 3 | -20 | 0.165 | $49,189,176.00 |

| FGR | FIRST GRAPHENE | 3 | -20 | 0.165 | $66,188,640.00 |

| BOA | BOADICEA RESOURCES | 3 | 0 | 0.19 | $10,040,583.00 |

| DEV | DEVEX RESOURCES | 2 | -46 | 0.044 | $4,137,306.75 |

| MIN | MINERAL RESOURCES | 2 | -5 | 15.93 | $2,996,215,040.00 |

| OMH | OM HOLDINGS | 2 | 6 | 1.32 | $949,131,008.00 |

| ERX | EXORE RESOURCES | 1 | 42 | 0.078 | $35,846,764.00 |

| RIO | RIO TINTO | 1 | 35 | 91.65 | $133,135,122,432.00 |

| BSX | BLACKSTONE MINERALS | 1 | -74 | 0.097 | $10,883,862.00 |

| CZI | CASSINI RESOURCES | 1 | 34 | 0.098 | $32,823,174.00 |

| S32 | SOUTH32 | 1 | 18 | 3.81 | $19,429,103,616.00 |

| JMS | JUPITER MINES | 0 | 376 | 0.335 | $656,262,016.00 |

| SEI | SPECIALITY METALS | 0 | 13 | 0.034 | $16,646,293.00 |

| EME | ENERGY METALS | 0 | 8 | 0.105 | $22,016,748.00 |

| IEC | INTRA ENERGY | 0 | 0 | 0.014 | $5,428,136.50 |

| AUT | AUTECO MINERALS | 0 | 0 | 0.006 | $6,317,252.50 |

| BDI | BLINA MINERALS | 0 | 0 | 0.001 | $4,543,882.50 |

| BAU | BAUXITE RESOURCES | 0 | -5 | 0.06 | $12,865,340.00 |

| A4N | ALPHA HPA | 0 | -8 | 0.125 | $68,052,000.00 |

| CXO | CORE LITHIUM | 0 | -8 | 0.057 | $39,584,600.00 |

| VML | VITAL METALS | 0 | -11 | 0.008 | $13,940,890.00 |

| NZC | NZURI COPPER | 0 | -17 | 0.32 | $93,210,232.00 |

| ARE | ARGONAUT RESOURCES | 0 | -18 | 0.018 | $27,978,852.00 |

| KOR | KORAB RESOURCES | 0 | -21 | 0.027 | $8,339,111.50 |

| PLS | PILBARA MINERALS | 0 | -23 | 0.715 | $1,273,494,784.00 |

| ADN | ANDROMEDA METALS | 0 | -25 | 0.006 | $8,132,995.50 |

| PLL | PIEDMONT LITHIUM | 0 | -31 | 0.11 | $77,093,744.00 |

| NMT | NEOMETALS | 0 | -31 | 0.23 | $125,114,080.00 |

| SXX | SOUTHERN CROSS EXPLORATION | 0 | -33 | 0.006 | $6,461,059.00 |

| DTM | DART MINING | 0 | -36 | 0.005 | $4,640,214.00 |

| HAV | HAVILAH RESOURCES | 0 | -39 | 0.165 | $36,011,092.00 |

| KTA | KRAKATOA RESOURCES | 0 | -40 | 0.024 | $2,820,000.00 |

| HXG | HEXAGON RESOURCES | 0 | -43 | 0.135 | $39,390,760.00 |

| BYH | BRYAH RESOURCES | 0 | -43 | 0.08 | $4,868,009.50 |

| RMX | RED MOUNTAIN MINING | 0 | -44 | 0.005 | $3,890,184.00 |

| LCD | LATITUDE CONSOLIDATED | 0 | -48 | 0.016 | $4,402,864.00 |

| BSM | BASS METALS | 0 | -52 | 0.012 | $33,137,350.00 |

| MCT | METALICITY | 0 | -58 | 0.013 | $7,832,028.50 |

| OAR | OAKDALE RESOURCES | 0 | -60 | 0.012 | $805,052.25 |

| PSM | PENINSULA MINES | 0 | -67 | 0.004 | $3,451,488.25 |

| MTB | MOUNT BURGESS MINING | 0 | -67 | 0.004 | $1,807,517.63 |

| CAD | CAENEUS MINERALS | 0 | -67 | 0.001 | $18,619,644.00 |

| SI6 | SIX SIGMA METALS | 0 | -69 | 0.004 | $1,830,012.63 |

| TKM | TREK METALS | 0 | -70 | 0.006 | $1,873,821.63 |

| ZNC | ZENITH MINERALS | 0 | -70 | 0.06 | $12,765,728.00 |

| SBR | SABRE RESOURCES | 0 | -71 | 0.005 | $2,034,868.00 |

| TAR | TARUGA MINERALS | 0 | -71 | 0.064 | $9,034,703.00 |

| CUL | CULLEN RESOURCES | 0 | -71 | 0.012 | $2,033,577.88 |

| DHR | DARK HORSE RESOURCES | 0 | -79 | 0.004 | $7,904,346.50 |

| LRS | LATIN RESOURCES | 0 | -82 | 0.002 | $6,482,506.50 |

| RIE | RIEDEL RESOURCES | 0 | -85 | 0.01 | $4,180,697.00 |

| CGM | COUGAR METALS | 0 | -86 | 0.001 | $1,065,472.13 |

| NXE | NEW ENERGY MINERALS | 0 | -89 | 0.029 | $4,375,968.00 |

| NWC | NEW WORLD COBALT | 0 | -89 | 0.01 | $5,515,176.50 |

| RLC | REEDY LAGOON | 0 | -89 | 0.005 | $2,011,358.50 |

| GXY | GALAXY RESOURCES | -1 | -43 | 2.05 | $823,198,528.00 |

| SVM | SOVEREIGN METALS | -1 | -32 | 0.082 | $28,534,168.00 |

| INF | INFINITY LITHIUM | -1 | -39 | 0.082 | $15,594,031.00 |

| GME | GME RESOURCES | -1 | -54 | 0.075 | $36,160,516.00 |

| ARU | ARAFURA RESOURCES | -2 | -59 | 0.049 | $36,070,156.00 |

| ORE | OROCOBRE | -2 | -44 | 3.35 | $886,596,864.00 |

| HIG | HIGHLANDS PACIFIC | -2 | 21 | 0.105 | $114,737,056.00 |

| ASN | ANSON RESOURCES | -3 | -27 | 0.077 | $37,152,176.00 |

| CRL | COMET RESOURCES | -3 | -62 | 0.032 | $7,422,400.00 |

| PIO | PIONEER RESOURCES | -3 | -42 | 0.0145 | $21,057,570.00 |

| LIT | LITHIUM AUSTRALIA | -3 | -49 | 0.086 | $41,034,924.00 |

| VMC | VENUS METALS | -3 | -10 | 0.14 | $12,672,057.00 |

| AML | AEON METALS | -4 | -2 | 0.275 | $158,778,832.00 |

| WKT | WALKABOUT RESOURCES | -4 | 47 | 0.135 | $41,073,716.00 |

| LPD | LEPIDICO | -4 | -44 | 0.027 | $90,616,728.00 |

| IRC | INTERMIN RESOURCES | -4 | -42 | 0.125 | $29,423,558.00 |

| ARL | ARDEA RESOURCES | -4 | -70 | 0.5 | $50,949,804.00 |

| LPI | LITHIUM POWER INTERNATIONAL | -4 | -49 | 0.215 | $56,440,488.00 |

| POS | POSEIDON NICKEL | -5 | 11 | 0.042 | $110,993,480.00 |

| BPL | BROKEN HILL PROSPECTING | -5 | -73 | 0.021 | $3,697,085.00 |

| EUC | EUROPEAN COBALT | -5 | -79 | 0.021 | $15,995,644.00 |

| LTR | LIONTOWN RESOURCES | -5 | -48 | 0.02 | $27,190,534.00 |

| AVL | AUSTRALIAN VANADIUM | -5 | -59 | 0.019 | $41,450,720.00 |

| HWK | HAWKSTONE MINING | -5 | -44 | 0.018 | $10,265,724.00 |

| PSC | PROSPECT RESOURCES | -5 | -61 | 0.018 | $34,783,956.00 |

| INR | IONEER | -5 | -64 | 0.18 | $272,871,936.00 |

| CNJ | CONICO | -6 | -56 | 0.017 | $5,979,890.50 |

| VXR | VENTUREX RESOURCES | -6 | 7 | 0.225 | $58,190,912.00 |

| MXR | MAXIMUS RESOURCES | -6 | -35 | 0.075 | $2,361,295.25 |

| ARM | AURORA MINERALS | -6 | -50 | 0.015 | $1,756,999.25 |

| TMT | TECHNOLOGY METALS AUSTRALIA | -6 | -44 | 0.22 | $20,137,458.00 |

| GBE | GLOBE METALS AND MINING | -7 | -22 | 0.014 | $6,522,913.00 |

| TKL | TRAKA RESOURCES | -7 | -75 | 0.014 | $4,638,494.50 |

| AVZ | AVZ MINERALS | -7 | -86 | 0.041 | $93,611,136.00 |

| CAZ | CAZALY RESOURCES | -7 | -46 | 0.027 | $6,286,114.50 |

| SYR | SYRAH RESOURCES | -7 | -72 | 1.08 | $395,172,384.00 |

| AUZ | AUSTRALIAN MINES | -7 | -73 | 0.027 | $83,897,736.00 |

| CGN | CRATER GOLD MINING | -7 | -32 | 0.013 | $16,694,942.00 |

| MZZ | MATADOR MINING | -8 | -26 | 0.185 | $11,046,083.00 |

| FCC | FIRST COBALT | -8 | -83 | 0.185 | $62,774,536.00 |

| GPX | GRAPHEX MINING | -8 | -25 | 0.23 | $20,083,628.00 |

| PNN | PEPINNINI LITHIUM | -8 | -89 | 0.0035 | $2,456,023.25 |

| OAU | ORA GOLD | -8 | -54 | 0.011 | $7,107,054.50 |

| AMD | ARROW MINERALS | -8 | -66 | 0.011 | $3,459,946.75 |

| AGY | ARGOSY MINERALS | -8 | -71 | 0.105 | $102,200,288.00 |

| KNL | KIBARAN RESOURCES | -9 | -35 | 0.1 | $28,193,096.00 |

| 4CE | FORCE COMMODITIES | -9 | -89 | 0.01 | $4,245,158.50 |

| COB | COBALT BLUE | -9 | -86 | 0.145 | $18,689,030.00 |

| LKE | LAKE RESOURCES | -10 | -64 | 0.057 | $22,018,608.00 |

| BKT | BLACK ROCK MINING | -10 | 27 | 0.065 | $33,925,796.00 |

| HNR | HANNANS | -10 | -55 | 0.009 | $17,891,590.00 |

| MNS | MAGNIS ENERGY TECHNOLOGIES | -11 | -48 | 0.25 | $152,784,000.00 |

| BAR | BARRA RESOURCES | -11 | -38 | 0.031 | $17,783,394.00 |

| TLG | TALGA RESOURCES | -12 | -29 | 0.55 | $125,460,776.00 |

| CZR | COZIRON RESOURCES | -13 | -61 | 0.007 | $12,498,859.00 |

| CDT | CASTLE MINERALS | -13 | -70 | 0.007 | $1,566,571.88 |

| MQR | MARQUEE RESOURCES | -14 | -87 | 0.051 | $2,265,447.00 |

| THR | THOR MINING | -14 | -53 | 0.019 | $13,621,110.00 |

| LI3 | LITHIUM CONSOLIDATED | -14 | -52 | 0.05 | $4,995,216.50 |

| PAN | PANORAMIC RESOURCES | -14 | -26 | 0.395 | $195,338,560.00 |

| CLA | CELSIUS RESOURCES | -14 | -84 | 0.018 | $14,387,144.00 |

| HGM | HIGH GRADE METALS | -14 | -90 | 0.007 | $3,170,565.00 |

| BGS | BIRIMIAN | -15 | -66 | 0.17 | $42,321,620.00 |

| SVD | SCANDIVANADIUM | -15 | -57 | 0.011 | $3,870,527.00 |

| MLS | METALS AUSTRALIA | -17 | -38 | 0.003 | $5,854,494.50 |

| PMY | PACIFICO MINERALS | -17 | -44 | 0.005 | $8,232,189.50 |

| SYA | SAYONA MINING | -17 | -76 | 0.015 | $27,540,160.00 |

| MTC | METALSTECH | -17 | -87 | 0.025 | $2,806,893.25 |

| MTH | MITHRIL RESOURCES | -17 | -88 | 0.005 | $2,534,335.25 |

| WCN | WHITE CLIFF MINERALS | -17 | -96 | 0.005 | $2,822,081.25 |

| OKR | OKAPI RESOURCES | -20 | -60 | 0.16 | $5,838,287.50 |

| MRR | MINREX RESOURCES | -20 | -83 | 0.012 | $1,150,532.75 |

| PUR | PURSUIT MINERALS | -23 | -82 | 0.02 | $3,927,601.25 |

| ADV | ARDIDEN | -25 | -82 | 0.003 | $5,030,640.50 |

| WML | WOOMERA MINING | -26 | -79 | 0.035 | $4,846,290.50 |

| SCI | SILVER CITY MINERALS | -27 | -80 | 0.008 | $2,349,682.00 |

| LML | LINCOLN MINERALS | -29 | -84 | 0.005 | $3,449,902.00 |

| GLN | GALAN LITHIUM | -54 | 159 | 0.285 | $34,294,648.00 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.