High Voltage: DRC kicks off new cobalt export quota system

The country has introduced a new quota system for long-term control of cobalt exports. Pic: Getty Images.

- DRC launches new quota system for cobalt exports after previous suspension

- Quota set to limit excess production and secure downstream supply

- Country announces cap of 9600t for 2026

Our High Voltage column wraps all the news driving ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths and vanadium.

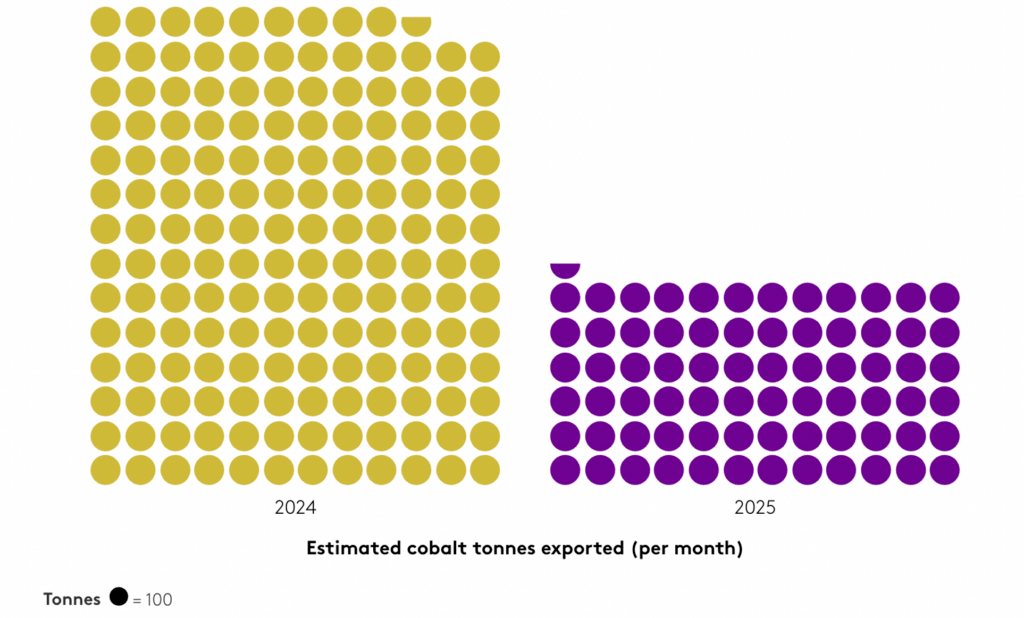

The Democratic Republic of Congo (DRC) has this week introduced a cobalt quota system after suspending a previous suspension on exports of the critical mineral.

The DRC, accounted for 78% of global cobalt production in 2024.

This new strict quota system is expected to govern mined output and exports until at least 2027, ruling out a return to free market exports and instead securing long-term state control of cobalt flowing out the of the country.

Benchmark Minerals Intelligence (BMI) reckons the DRC’s choice of quotas over free trade embeds policy‑driven tightness into the cobalt market through 2027.

“While this provides clarity, it leaves sentiment skewed to the upside, locking in a higher structural price floor at a time when downstream demand remains rangebound,” BMI said.

The DRC Board of Directors of the Regulatory and Control Authority for Strategic Mineral Substances markets (ARECOMS) will receive a ‘strategic quota’ which is capped at 9600 tonnes for 2026.

The strategic quota is reserved for projects of national strategic importance and ARECOMS also said it reserved the right to adjust quota volumes on a quarterly basis.

Fastmarkets says the system aims to balance the cobalt market and limit excess production while securing supply for downstream industries – and could go a long way to finally balancing the market.

Battery Metals Winners and Losers

Here’s how a basket of ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, magnesium, manganese and vanadium is performing >>>

Code Company Price % Week % Month % Six Month % Year Market Cap XTC XTC Lithium Limited 0.2 19900% 19900% 19900% 19900% $17,528,272 KGD Kula Gold Limited 0.029 142% 314% 383% 207% $31,099,149 DEV Devex Resources Ltd 0.155 78% 86% 61% 7% $61,836,694 WIN WIN Metals 0.031 55% 41% 72% -26% $21,314,795 EMT Emetals Limited 0.006 50% 20% 100% 50% $5,100,000 EV1 Evolutionenergy 0.015 50% 25% 31% -39% $7,527,949 RAS Ragusa Minerals Ltd 0.034 48% 31% 62% 113% $6,058,759 ADD Adavale Resource Ltd 0.036 44% 50% -28% -28% $9,135,288 RMX Red Mount Min Ltd 0.0215 43% 139% 169% 115% $9,417,564 OCN Oceanalithiumlimited 0.125 40% 45% 400% 304% $20,812,048 KOB Kobaresourceslimited 0.05 39% 61% -8% -49% $10,132,251 SGQ St George Min Ltd 0.12 38% 208% 567% 253% $350,636,003 FML Focus Minerals Ltd 0.93 36% 121% 365% 615% $276,529,092 FRS Forrestaniaresources 0.305 36% 69% 1120% 2246% $125,668,319 CHN Chalice Mining Ltd 2.305 35% 41% 68% 76% $894,942,859 CZN Corazon Ltd 0.004 33% 60% 33% 0% $4,938,289 1MC Morella Corporation 0.02 33% 29% 0% -33% $6,631,722 AUZ Australian Mines Ltd 0.0185 32% 131% 118% 131% $30,794,883 IDA Indiana Resources 0.054 32% 29% 65% 149% $34,761,553 LML Lincoln Minerals 0.0065 30% -28% 36% 14% $16,756,589 ANX Anax Metals Ltd 0.009 29% 38% 13% -55% $7,062,461 QXR Qx Resources Limited 0.005 25% 29% 47% -14% $6,551,644 VML Vital Metals Limited 0.225 25% 61% 50% 125% $27,833,876 G88 Golden Mile Res Ltd 0.01 25% 43% 11% 11% $5,632,965 TEM Tempest Minerals 0.01 25% 43% 150% 0% $8,814,360 RGL Riversgold 0.005 25% 25% 25% 0% $8,418,563 M79 Mammothmineralsltd 0.125 25% 26% 108% 29% $64,288,637 TMX Terrain Minerals 0.0025 25% -17% -38% -38% $8,045,443 GTE Great Western Exp. 0.02 25% 33% -13% -38% $11,355,159 BMG BMG Resources Ltd 0.013 24% 18% -7% 44% $12,927,560 FLG Flagship Min Ltd 0.11 24% 67% 150% 90% $24,824,969 SVY Stavely Minerals Ltd 0.021 24% 50% 17% -32% $13,695,728 LPM Lithium Plus 0.1 23% 20% 54% -5% $14,612,400 ENV Enova Mining Limited 0.008 23% 14% 33% -11% $12,632,229 GRL Godolphin Resources 0.016 23% 14% 23% 0% $7,796,950 NVA Nova Minerals Ltd 0.38 23% 31% 19% 130% $160,600,567 REC Rechargemetals 0.022 22% 47% 69% -8% $5,139,799 BC8 Black Cat Syndicate 1.4275 22% 64% 82% 248% $982,557,241 PMT Pmet Resources 0.4525 21% 9% 44% 26% $239,949,328 MRD Mount Ridley Mines 0.003 20% -14% 37% -66% $2,972,151 CNJ Conico Ltd 0.006 20% -14% -14% -70% $1,632,874 AS2 Askarimetalslimited 0.012 20% 20% 20% -40% $5,839,987 HAV Havilah Resources 0.22 19% 26% 13% 26% $74,851,215 IG6 Internationalgraphit 0.059 18% 9% 7% -16% $11,807,058 CNB Carnaby Resource Ltd 0.365 18% 11% 20% 4% $78,794,156 GAL Galileo Mining Ltd 0.2 18% 18% 43% 14% $41,501,235 LOT Lotus Resources Ltd 0.2175 18% 32% 12% -24% $610,641,511 HMX Hammer Metals Ltd 0.0435 18% 81% 50% 21% $37,495,865 LYC Lynas Rare Earths 16.895 17% 18% 135% 133% $16,419,646,458 LMG Latrobe Magnesium 0.027 17% 17% 93% -10% $60,593,480 SRZ Stellar Resources 0.027 17% 50% 69% 93% $58,239,690 ZNC Zenith Minerals Ltd 0.135 17% 125% 165% 214% $66,181,937 DRE Dreadnought Resources Ltd 0.0305 17% 154% 118% 103% $157,464,500 PUR Pursuit Minerals 0.1 16% 47% 54% -33% $11,099,069 DVP Develop Global Ltd 4.36 16% 19% 41% 111% $1,297,509,462 PFE Pantera Lithium 0.022 16% 47% 57% -4% $10,897,025 SYA Sayona Mining Ltd 3.38 16% -13% 25% -13% $562,652,529 AEE Aura Energy 0.265 15% 66% 83% 71% $242,117,923 INR Ioneer Ltd 0.155 15% 35% 0% -23% $426,849,543 ASL Andean Silver 1.86 15% 41% 55% 68% $364,164,906 HAW Hawthorn Resources 0.063 15% 17% 43% 13% $21,105,984 TON Triton Min Ltd 0.008 14% 14% 33% -20% $10,978,721 FUN Fortuna Metals Ltd 0.12 14% 122% 167% 78% $20,607,850 FUN Fortuna Metals Ltd 0.12 14% 122% 167% 78% $20,607,850 VUL Vulcan Energy 5 13% 37% 2% 28% $1,188,555,948 AUV Auravelle Metals 0.018 13% 13% 50% 20% $9,561,819 PVT Pivotal Metals Ltd 0.009 13% 0% 29% -18% $8,165,033 NST Northern Star 22.99 12% 27% 28% 44% $33,048,654,223 RXL Rox Resources 0.46 12% 31% 46% 254% $344,068,233 WR1 Winsome Resources 0.185 12% 6% -34% -61% $45,134,163 TMB Tambourahmetals 0.048 12% -9% 50% 26% $8,348,931 QPM QPM Energy Limited 0.04 11% 25% -11% 33% $120,484,485 PNT Panthermetalsltd 0.01 11% 11% -41% -62% $3,009,045 MHK Metalhawk. 0.15 11% -13% -63% 0% $18,508,884 MTC Metalstech Ltd 0.25 11% 39% 127% 52% $53,293,190 MLX Metals X Limited 0.7425 11% 31% 9% 67% $651,497,780 GED Golden Deeps 0.064 10% 49% 220% 68% $11,513,171 MQR Marquee Resource Ltd 0.011 10% -8% 10% -35% $7,333,990 WC1 Westcobarmetals 0.022 10% 10% 47% -26% $5,353,409 LRV Larvottoresources 0.725 10% 7% -19% 104% $374,358,536 ALK Alkane Resources Ltd 1.125 10% 23% 83% 147% $1,666,269,860 PVW PVW Res Ltd 0.034 10% 89% 143% 42% $6,762,762 SFR Sandfire Resources 13.675 10% 14% 17% 40% $5,826,627,319 IPX Iperionx Limited 7.25 10% 16% 135% 147% $2,366,589,801 ESR Estrella Res Ltd 0.035 9% 0% 25% 192% $79,137,057 VR8 Vanadium Resources 0.035 9% -10% 67% -17% $19,366,218 AZI Altamin Limited 0.032587 9% 80% 13% 23% $18,721,441 GA8 Goldarc Resources 0.024 9% 20% -20% -56% $14,187,983 BMM Bayanminingandmin 0.195 8% 9% 443% 395% $28,227,246 WMG Western Mines 0.26 8% 11% 136% 18% $25,268,969 PNN Power Minerals Ltd 0.092 8% 30% 26% 1% $15,446,440 NMT Neometals Ltd 0.053 8% 4% -18% -37% $43,918,018 CAE Cannindah Resources 0.027 8% 53% -67% -27% $18,201,999 MEI Meteoric Resources 0.145 7% 7% 113% 45% $369,730,790 PAT Patriot Resourcesltd 0.044 7% -2% 13% 10% $7,260,988 CWX Carawine Resources 0.09 7% 8% -9% -4% $21,251,290 BUX Buxton Resources Ltd 0.03 7% 9% -21% -53% $10,651,783 LIT Livium Ltd 0.015 7% 50% 58% -29% $25,531,607 ARU Arafura Rare Earths 0.1925 7% 1% 4% 24% $538,455,819 KAI Kairos Minerals Ltd 0.031 7% 35% 55% 138% $86,205,190 VTM Victory Metals Ltd 1.345 7% -15% 249% 199% $183,117,507 STK Strickland Metals 0.16 7% 19% 103% 99% $373,289,367 EVG Evion Group NL 0.032 7% -2% 68% 33% $13,175,300 IGO IGO Limited 5.105 7% 0% 21% -3% $3,801,484,421 EG1 Evergreenlithium 0.033 6% 3% -57% -20% $8,150,948 A8G Australasian Metals 0.086 6% -2% 15% -22% $4,978,516 ETM Energy Transition 0.069 6% -22% -5% 176% $138,598,600 SVM Sovereign Metals 0.695 6% -8% -29% 0% $456,091,786 MIN Mineral Resources. 40.75 6% 14% 67% 4% $8,017,922,775 RON Roninresourcesltd 0.18 6% 16% 9% 71% $6,460,002 KM1 Kalimetalslimited 0.18 6% 13% 91% 50% $16,471,342 GLN Galan Lithium Ltd 0.1375 6% -2% 25% 25% $148,100,353 PBL Parabellumresources 0.074 6% 25% 57% 35% $4,610,200 EMH European Metals Hldg 0.19 6% 6% 12% 27% $42,976,994 LLM Loyal Metals Ltd 0.285 6% 12% 265% 159% $37,915,810 PLS Pilbara Min Ltd 2.385 6% 13% 27% -18% $7,758,305,128 NC1 Nicoresourceslimited 0.099 5% -6% 22% 1% $11,974,706 ARL Ardea Resources Ltd 0.52 5% 11% 24% 30% $113,622,974 REE Rarex Limited 0.022 5% 10% 175% 69% $22,003,608 MLS Metals Australia 0.022 5% 7% 10% -12% $15,366,110 BCA Black Canyon Limited 0.455 5% 8% 622% 684% $72,334,817 LU7 Lithium Universe Ltd 0.012 4% -14% 50% 15% $18,810,735 ARR American Rare Earths 0.365 4% 6% 33% 24% $216,388,595 NH3 Nh3Cleanenergyltd 0.05 4% -12% 108% 117% $31,010,417 CTM Centaurus Metals Ltd 0.375 4% 7% 6% -17% $208,052,695 JMS Jupiter Mines. 0.255 4% 9% 55% 59% $481,376,046 LIN Lindian Resources 0.255 4% 6% 163% 143% $434,371,178 VHM Vhmlimited 0.26 4% 33% 0% -54% $59,882,689 KZR Kalamazoo Resources 0.135 4% 17% 50% 71% $31,943,124 TLM Talisman Mining 0.135 4% -16% -16% -40% $25,423,247 LSR Lodestar Minerals 0.028 4% 75% 138% -5% $22,327,058 OD6 Od6Metalsltd 0.056 4% -10% 81% 40% $11,140,051 RIO Rio Tinto Limited 120.35 3% 7% 1% 3% $43,632,753,794 WA1 Wa1Resourcesltd 18.66 3% 11% 35% 26% $1,369,135,499 HAS Hastings Tech Met 0.31 3% 0% -10% 17% $63,293,537 TOR Torque Met 0.31 3% 3% 213% 256% $172,679,846 SRK Strike Resources 0.031 3% 3% 0% -9% $8,796,250 ILU Iluka Resources 6.46 3% 6% 55% 1% $2,676,794,590 RVT Richmond Vanadium 0.067 3% 2% -55% -78% $14,677,362 FRB Firebird Metals 0.17 3% 3% 83% 31% $24,201,438 GT1 Greentechnology 0.035 3% 6% -8% -59% $16,630,952 BUR Burleyminerals 0.036 3% -3% -32% -13% $6,261,689 BHP BHP Group Limited 41.45 3% -1% 5% 1% $204,375,466,162 MTM Metallium Ltd 1.1 3% 64% 610% 1407% $683,211,898 STM Sunstone Metals Ltd 0.0215 2% 19% 207% 330% $131,685,675 PEK Peak Rare Earths Ltd 0.44 2% 31% 336% 157% $193,649,227 PEK Peak Rare Earths Ltd 0.44 2% 31% 336% 157% $193,649,227 L1M Lightning Minerals 0.046 2% 15% -36% -36% $8,703,353 ARN Aldoro Resources 0.495 2% 50% 46% 511% $104,350,029 CHR Charger Metals 0.052 2% -21% 16% -40% $4,180,694 AXE Archer Materials 0.28 2% -3% -7% 44% $71,357,164 A4N Alpha Hpa Ltd 0.875 2% -9% 7% -15% $989,426,429 PTR Petratherm Ltd 0.315 2% -2% 5% 600% $109,183,653 1AE Auroraenergymetals 0.075 1% 15% 56% 97% $12,534,462 NIC Nickel Industries 0.7225 1% -1% 15% -15% $3,103,769,151 S32 South32 Limited 2.655 1% -7% -24% -20% $11,664,414,963 LTR Liontown Resources 0.905 1% 8% 39% 34% $2,612,223,839 INF Infinity Metals Ltd 0.015 0% -12% -25% -53% $7,671,423 CXO Core Lithium 0.105 0% -19% 40% 5% $254,213,476 AGY Argosy Minerals Ltd 0.033 0% -11% 50% -11% $46,077,628 AZL Arizona Lithium Ltd 0.007 0% -13% 17% -56% $32,281,887 RIL Redivium Limited 0.004 0% 0% 0% 14% $13,609,422 MAN Mandrake Res Ltd 0.023 0% 0% 21% -26% $15,054,238 GBR Greatbould Resources 0.071 0% 27% 3% 45% $71,526,135 RYZ Ryzon Materials Ltd 0.042 0% 0% 0% 0% $50,378,922 BKT Black Rock Mining 0.018 0% -38% -22% -67% $32,160,239 SBR Sabre Resources 0.012 0% 9% 71% -20% $4,733,543 VRC Volt Resources Ltd 0.004 0% -11% 0% 0% $18,739,398 AAJ Aruma Resources Ltd 0.009 0% 0% -36% -47% $2,951,465 IXR Ionic Rare Earths 0.016 0% 0% 129% 100% $91,370,228 TKL Traka Resources 0.0025 0% 0% 150% 67% $6,055,348 RNU Renascor Res Ltd 0.063 0% -5% 40% -23% $157,675,570 GL1 Globallith 0.34 0% 66% 100% 89% $88,988,922 ALY Alchemy Resource Ltd 0.007 0% 17% 0% 0% $8,246,534 LEL Lithenergy 0.37 0% 0% 0% 17% $41,440,581 GW1 Greenwing Resources 0.03 0% -3% 0% -30% $10,363,544 MRC Mineral Commodities 0.026 0% 0% 0% 0% $25,596,288 LEG Legend Mining 0.008 0% -11% -11% -33% $23,315,817 SMX Strata Minerals 0.019 0% 12% -59% -37% $4,529,765 MRR Minrex Resources Ltd 0.009 0% 13% 13% 0% $9,763,808 EVR Ev Resources Ltd 0.012 0% 20% 140% 162% $29,547,550 EFE Eastern Resources 0.033 0% -3% 18% -18% $4,287,058 AX8 Accelerate Resources 0.007 0% -22% 17% -22% $5,720,321 AM7 Arcadia Minerals 0.03 0% -3% 50% -12% $3,521,503 BYH Bryah Resources Ltd 0.004 0% 0% 0% 0% $4,114,130 DTM Dart Mining NL 0.0025 0% 0% -50% -84% $2,749,113 EMS Eastern Metals 0.01 0% 0% 11% -47% $1,394,262 GSM Golden State Mining 0.014 0% 75% 56% 27% $5,128,059 RAG Ragnar Metals Ltd 0.025 0% 25% 19% 32% $12,323,635 CTN Catalina Resources 0.004 0% 14% 42% 42% $9,704,076 KOR Korab Resources 0.008 0% 0% 0% 0% $2,936,400 CMX Chemxmaterials 0.026 0% 0% 0% -33% $33,545,803 OMH OM Holdings Limited 0.275 0% 2% -14% -25% $214,551,904 CRR Critical Resources 0.008 0% 0% 100% -20% $22,160,684 ENT Enterprise Metals 0.006 0% 20% 100% 50% $8,647,904 SCN Scorpion Minerals 0.019 0% -5% -21% 0% $9,961,818 THR Thor Energy PLC 0.011 0% 10% -8% -35% $8,058,997 ODE Odessa Minerals Ltd 0.007 0% 8% 0% 133% $11,196,728 CLZ Classic Min Ltd 0.001 0% 0% 0% 0% $3,017,699 NVX Novonix Limited 0.455 0% -17% -14% -15% $302,858,944 M2R Miramar 0.003 0% 0% 0% -63% $2,389,846 WCN White Cliff Min Ltd 0.023 0% -12% 35% 21% $56,313,090 TAR Taruga Minerals 0.012 0% 33% 50% 41% $7,851,295 MEK Meeka Metals Limited 0.195 0% 39% 44% 255% $584,253,534 KFM Kingfisher Mining 0.068 0% 24% 54% 18% $5,849,390 AOA Ausmon Resorces 0.003 0% 0% 50% 0% $3,933,640 CY5 Cygnus Metals Ltd 0.105 0% 25% -9% 40% $117,086,746 LLL Leolithiumlimited 0.332997 0% 0% 0% 0% $401,204,047 SRN Surefire Rescs NL 0.0015 0% 0% -40% -70% $5,860,289 MHC Manhattan Corp Ltd 0.022 0% -4% 22% 10% $12,262,220 FIN FIN Resources Ltd 0.005 0% 0% -17% -17% $3,474,442 LM1 Leeuwin Metals Ltd 0.165 0% 14% 65% 94% $17,137,085 LCY Legacy Iron Ore 0.008 0% -6% -24% -36% $78,096,341 AMD Arrow Minerals 0.02 0% 0% -41% -50% $17,555,332 AYM Australia United Min 0.003 0% 0% 50% 50% $5,527,732 CUL Cullen Resources 0.007 0% 17% 75% 17% $4,853,813 RIE Riedel Resources Ltd 0.029 0% -6% -12% -64% $4,108,304 SER Strategic Energy 0.005 0% 0% 0% -75% $4,601,804 SYR Syrah Resources 0.2625 -1% -6% 4% 13% $314,769,297 SYR Syrah Resources 0.2625 -1% -6% 4% 13% $314,769,297 ASN Anson Resources Ltd 0.084 -1% -6% 62% 8% $126,924,454 DYM Dynamicmetalslimited 0.3 -2% 5% -24% 58% $14,777,802 LKE Lake Resources 0.0295 -2% -16% -13% -24% $64,761,930 TKM Trek Metals Ltd 0.053 -2% -20% 10% 71% $33,091,297 JLL Jindalee Lithium Ltd 0.51 -2% 29% 162% 113% $40,970,851 QGL Quantum Graphite 0.48 -2% -3% 0% -11% $165,594,537 TLG Talga Group Ltd 0.45 -2% -14% 8% 25% $207,439,665 CRI Critica Ltd 0.0225 -2% 25% 50% 73% $59,360,007 AXN Alliance Nickel Ltd 0.041 -2% 14% 24% 0% $30,579,424 A11 Atlantic Lithium 0.195 -3% 26% 18% -22% $129,439,463 NTU Northern Min Ltd 0.038 -3% 9% 81% 100% $309,214,765 ASM Ausstratmaterials 0.555 -3% -3% 46% 7% $130,851,849 BSX Blackstone Ltd 0.068 -3% -3% -7% 62% $111,519,916 EMN Euromanganese 0.17 -3% 0% -21% -31% $8,553,601 DLI Delta Lithium 0.17 -3% 5% 6% -24% $121,929,405 PGM Platina Resources 0.026 -4% 18% 24% 18% $16,123,258 EMC Everest Metals Corp 0.13 -4% 8% -21% 4% $29,273,563 ICL Iceni Gold 0.051 -4% -22% -39% 38% $17,508,371 HRE Heavy Rare Earths 0.047 -4% 9% 124% 58% $9,777,592 GCM Green Critical Min 0.023 -4% -23% 77% 667% $63,044,813 KTA Krakatoa Resources 0.0105 -5% -25% 17% 5% $10,165,407 BNR Bulletin Res Ltd 0.062 -5% 38% 51% 44% $18,204,026 WC8 Wildcat Resources 0.195 -5% 18% 15% -19% $267,393,688 CMO Cosmometalslimited 0.019 -5% 0% 0% -14% $7,928,391 M24 Mamba Exploration 0.018 -5% 29% 50% 50% $5,312,981 HWK Hawk Resources. 0.018 -5% 13% -22% -40% $5,147,660 ORN Orion Minerals Ltd 0.017 -6% 70% 13% 0% $127,540,831 ITM Itech Minerals Ltd 0.05 -6% -11% 11% -26% $10,752,605 VRX VRX Silica Ltd 0.1175 -6% -6% 167% 320% $89,678,851 EUR European Lithium Ltd 0.091 -6% -7% 128% 128% $130,203,093 PGD Peregrine Gold 0.2525 -6% -11% 74% 53% $24,621,026 AR3 Austrare 0.1075 -7% -10% 34% 65% $23,428,047 ATM Aneka Tambang 0.97 -7% -9% -3% -6% $1,251,503 DM1 Desert Metals 0.013 -7% -55% -43% -41% $6,102,869 WSR Westar Resources 0.0065 -7% 8% 8% -28% $2,591,711 BM8 Battery Age Minerals 0.09 -7% 14% 48% -18% $16,734,048 PSC Prospect Res Ltd 0.19 -7% -5% 46% 96% $126,654,017 RR1 Reach Resources Ltd 0.012 -8% 9% 20% -8% $10,493,176 RR1 Reach Resources Ltd 0.012 -8% 9% 20% -8% $10,493,176 OM1 Omnia Metals Group 0.012 -8% 9% 20% -85% $2,822,192 VMC Venus Metals Cor Ltd 0.115 -8% 10% 5% 92% $21,574,155 FG1 Flynngold 0.023 -8% -17% -3% -20% $9,782,912 BOA BOA Resources Ltd 0.022 -8% -4% 16% -12% $2,713,763 NWM Norwest Minerals 0.011 -8% -8% 17% -39% $11,331,176 ADV Ardiden Ltd 0.16 -9% 0% 19% 19% $10,315,388 CDT Castle Minerals 0.073 -9% 0% -3% -19% $10,990,327 MNB Minbos Resources Ltd 0.052 -9% -28% 13% -13% $51,677,629 TVN Tivan Limited 0.1 -9% 3% 5% 108% $234,183,638 YAR Yari Minerals Ltd 0.01 -9% -9% 100% 233% $8,394,638 SUM Summitminerals 0.038 -10% -3% -42% -86% $3,884,578 GRE Greentechmetals 0.056 -10% -13% -8% -38% $6,463,523 CLA Celsius Resource Ltd 0.009 -10% 29% 29% -25% $31,354,885 AVL Aust Vanadium Ltd 0.009 -10% -18% -25% -40% $82,029,252 EGR Ecograf Limited 0.36 -10% -1% 26% 271% $175,801,092 IMI Infinitymining 0.009 -10% -10% -25% -36% $3,807,142 E25 Element 25 Ltd 0.27 -10% -11% 8% -25% $71,532,598 ZEU Zeus Resources Ltd 0.018 -10% 6% 157% 100% $12,913,860 COB Cobalt Blue Ltd 0.047 -11% -13% -27% -32% $22,432,265 AQD Ausquest Limited 0.037 -12% -3% -34% 282% $52,914,755 SLM Solismineralsltd 0.08 -12% -27% -6% -15% $11,991,815 KNI Kunikolimited 0.065 -12% -18% -52% -57% $6,793,458 IPT Impact Minerals 0.007 -13% -22% 17% -43% $32,906,640 MOH Moho Resources 0.007 -13% 40% 75% 17% $5,217,898 S2R S2 Resources 0.1 -13% 20% 45% 30% $50,146,904 SRL Sunrise 4.38 -13% 161% 1522% 842% $547,182,965 SLZ Sultan Resources Ltd 0.006 -14% 20% -20% 0% $1,827,585 AKN Auking Mining Ltd 0.006 -14% 0% -14% 0% $4,895,979 AVW Avira Resources Ltd 0.012 -14% 71% 50% -40% $2,760,000 SFM Santa Fe Minerals 0.25 -15% 14% 510% 558% $28,204,697 FBM Future Battery 0.032 -16% 3% 68% 60% $22,263,814 RLC Reedy Lagoon Corp. 0.0025 -17% 25% 25% 25% $1,941,767 KNG Kingsland Minerals 0.13 -19% -24% 8% -32% $10,884,137 RBX Resource B 0.04 -20% -7% 21% 18% $4,607,379 ABX ABX Group Limited 0.07 -22% 63% 89% 67% $19,614,805 ARV Artemis Resources 0.006 -25% 20% -25% -57% $26,396,455 FGR First Graphene Ltd 0.065 -28% 63% 48% 38% $55,190,707 HLX Helix Resources 0.001 -33% -33% -52% -73% $5,346,291 QEM QEM Limited 0.022 -44% -33% -64% -74% $5,673,608 OB1DD Orbminco Limited 0.02 -50% 0% 0% -40% $3,572,696 PLL Piedmont Lithium Inc 0 -100% -100% -100% -100% $67,063,990 WKT Walkabout Resources 0 -100% -100% -100% -100% $63,769,838 Code Company Price % Week % Month % Six Month % Year Market Cap XTC XTC Lithium Limited 0.2 19900% 19900% 19900% 19900% $17,528,272

Weekly Small Cap Standouts

Kula Gold (ASX:KGD)

KGD has flagged a high grade – and extensive – niobium soil anomaly at its Wozi project in Malawi.

Soil sampling has returned results over 1% Nb2O5 with the anomaly more than 1.5km in strike length and up to 400m wide at +0.4% Nb2O5.

The company says the low tantalum and uranium ratios suggest there’s good potential for direct reduction to ferro-niobium (FeNb).

“The Wozi Niobium Project offers a strategic, low-cost entry into the critical minerals space, complementing our core focus at Mt Palmer,” MD Ric Dawson said.

“We’ve initiated a targeted RC drill program to quickly assess Wozi’s potential and define its value uplift.

“Subject to results, we’ll consider engaging a specialist rare earths partner to support technical development and subsequently seek the best corporate options to add value to Kula’s shareholders.”

Mt Palmer remains the priority, while Wozi adds a quick high impact value add potential to Kula’s portfolio of projects without diverting significant resources, Dawson said.

Morella Mining (ASX:1MC)

Rock chip assays at the company’s Dixon Well project in WA confirm titanium mineralisation up to 17.0% TiO2.

“The Dixon Well project represents an important step in Morella’s strategy to diversify into critical minerals that support both the clean energy transition and high-value industrial applications,” MD James Brown said.

“Titanium is recognised by both Australian and US governments as a critical mineral, and our early results confirm the presence of prospective mineralisation at Dixon Well.

“By adding titanium to our exploration mix, Morella is positioning itself in another high-value critical mineral with long-term demand drivers in aerospace, defence, and advanced manufacturing.”

While the project is at an early stage, Brown said it complemented existing lithium and rubidium assets, and underscored Morella’s ability to identify and secure quality opportunities in Tier 1 jurisdictions.

To date, no systematic exploration has been conducted for titanium at the project, which was historically explored for base metals, gold and platinum group elements.

PMET Resources (ASX:PMT)

The company has successfully produced marketable tantalite concentrates from the CV5 pegmatite deposit at its Shaakichiuwaanaan project in James Bay, Quebec.

Testwork returned 8.7% Ta2O5 at 45% global recovery and 6.6% Ta2O5 at 49% global recovery (MC002) which is in-line with industry peers.

PMT says low-cost processing methods – similar to those used at Greenbushes, Pulgangoora, Wodgina and Tanco – could see valuable tantalite produced as a by/co-product from lithium production at the project.

“Tantalum – which is a critical and strategic metal in numerous jurisdictions globally and at Shaakichiuwaanaan – offers an attractive future opportunity to realize value from a portion of the project’s waste material,” executive vice president exploration Darren Smith said.

“A follow-up testwork program is scheduled to commence shortly, which will target data collection sufficient to support the inclusion of the tantalum co-product opportunity at Shaakichiuwaanaan, with a view to further enhance the economic and financial returns of the project.”

Notably, Shaakichiuwaanaan ranks as one of the largest tantalum pegmatite resources globally in terms of both grade and tonnage, hosting 108.0 Mt at 1.40% Li2O, 0.11% Cs2O, 166 ppm Ta2O5, and 66 ppm Ga (indicated).

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.