High Voltage: Sprott sees opportunities for savvy investors if lithium prices hit bottom

Low lithium prices could mean a short-term opportunity for investors. Pic via Getty Images

- Sprott thinks low lithium prices may have bottomed out

- Lithium deficit could happen as soon as 2025

- This could mean buying opportunities for investors

Our High Voltage column wraps all the news driving ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, and vanadium.

Lithium miners have underperformed so far this year, but Sprott’s Jacob White reckons that there are still opportunities in the battery metal for investors to take advantage of the long term outlook of a supply deficit as soon as 2025, as electric vehicles (EV) proliferation intensifies.

Benchmark Mineral Intelligence says even as more mines and exploration projects come online, added supply may likely not be able to keep up with demand – and that higher lithium prices may be necessary to incentivise the required future production.

Asset managers Sprott reckons the lithium price may have bottomed, and that means opportunities for savvy investors.

“There may be a short-term opportunity at hand,” White says.

“Despite the long-term investment outlook for lithium miners, many producers of this critical mineral have seen their stock prices drop considerably in 2024.

“Given the scale of this descent juxtaposed with the stark demand-supply imbalance in the upcoming years, lithium miners may be well positioned going forward.

“This means that investors who want to add an allocation to lithium miners to their portfolio may have an opportunity to do so at prices significantly lower than 2023.”

Opportunities along the entire supply chain

White points to lithium opportunities along the entire supply chain, including exploration, mining, processing and compound manufacturing.

“Lithium miners and companies involved in the processing and refining of raw lithium may likely be poised to benefit as the demand for lithium grows,” he said.

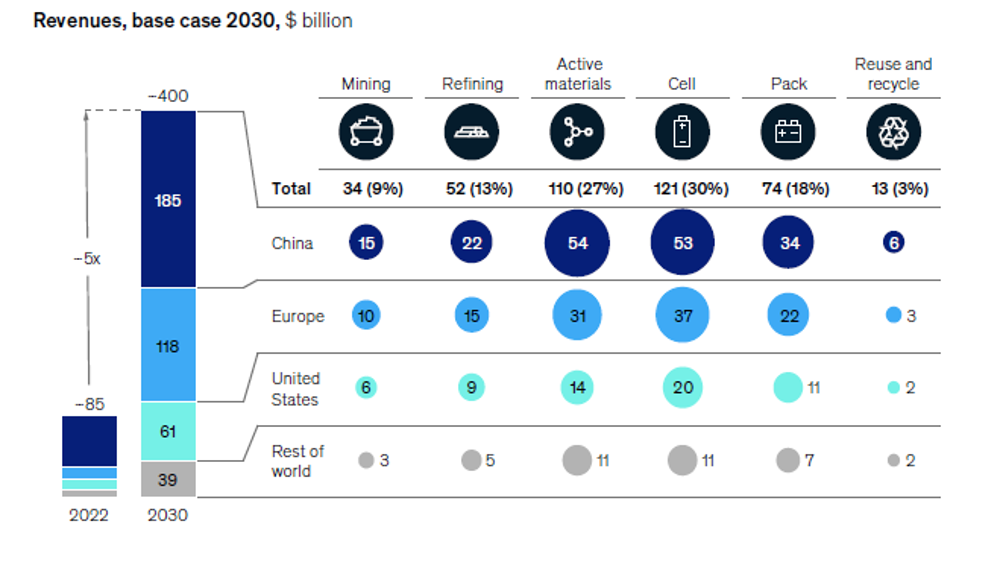

“The lithium battery industry is projected to create $400 billion in annual revenue opportunities worldwide.

“The lithium production component of the chain has recorded margins as high as 65%, potentially making it a highly profitable sector.

“Lithium miners, in particular, may be well positioned as they can give leverage to rebounding lithium prices. In contrast, non-vertically integrated lithium processing/refining companies may see their expenses rise.”

Battery Metals Winners and Losers

Here’s how a basket of ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, magnesium, manganese, and vanadium is performing>>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop:

| Code | Company | Price | % Week | % Month | % Six Month | % Year | Market Cap |

|---|---|---|---|---|---|---|---|

| XTC | XTC Lithium Limited | 0.2 | 19900% | 19900% | 19900% | -17% | $17,528,272 |

| LPD | Lepidico Ltd | 0.003 | 50% | 0% | -55% | -79% | $17,178,250 |

| DYM | Dynamicmetalslimited | 0.185 | 42% | 19% | 32% | -34% | $6,120,000 |

| LM1 | Leeuwin Metals Ltd | 0.082 | 39% | 61% | -34% | -77% | $3,841,837 |

| QXR | Qx Resources Limited | 0.008 | 33% | 14% | -58% | -65% | $8,880,623 |

| PEK | Peak Rare Earths Ltd | 0.225 | 29% | 18% | -22% | -55% | $46,625,365 |

| FIN | FIN Resources Ltd | 0.009 | 29% | 13% | -47% | -40% | $3,895,612 |

| LCY | Legacy Iron Ore | 0.018 | 29% | 38% | 6% | -5% | $138,843,869 |

| ESR | Estrella Res Ltd | 0.005 | 25% | 25% | -17% | -44% | $7,037,487 |

| S2R | S2 Resources | 0.125 | 25% | 25% | -14% | -34% | $49,814,379 |

| EFE | Eastern Resources | 0.005 | 25% | -17% | -38% | -55% | $6,209,732 |

| M2R | Miramar | 0.01 | 25% | 32% | -56% | -76% | $2,171,288 |

| DTM | Dart Mining NL | 0.023 | 21% | 21% | 64% | -31% | $5,168,657 |

| VHM | Vhmlimited | 0.58 | 20% | 38% | -3% | -7% | $89,436,161 |

| A8G | Australasian Metals | 0.084 | 20% | 11% | -33% | -48% | $4,169,640 |

| MOH | Moho Resources | 0.006 | 20% | 71% | -40% | -57% | $3,235,069 |

| AML | Aeon Metals Ltd. | 0.006 | 20% | -14% | -37% | -67% | $6,578,404 |

| TEM | Tempest Minerals | 0.009 | 20% | 13% | 35% | -37% | $4,890,387 |

| LEG | Legend Mining | 0.013 | 18% | 18% | 0% | -63% | $37,823,203 |

| KGD | Kula Gold Limited | 0.013 | 18% | 30% | 8% | -28% | $8,361,755 |

| VMC | Venus Metals Cor Ltd | 0.087 | 18% | 14% | -11% | -30% | $16,506,395 |

| EV1 | Evolutionenergy | 0.031 | 15% | -6% | -77% | -83% | $9,435,866 |

| LRV | Larvottoresources | 0.12 | 14% | 22% | 88% | -15% | $35,811,683 |

| WCN | White Cliff Min Ltd | 0.017 | 13% | 0% | 13% | 42% | $26,070,199 |

| POS | Poseidon Nick Ltd | 0.0045 | 13% | -10% | -44% | -84% | $18,567,674 |

| BYH | Bryah Resources Ltd | 0.0045 | 13% | -36% | -59% | -72% | $2,264,791 |

| CRR | Critical Resources | 0.009 | 13% | 29% | -40% | -84% | $16,023,153 |

| SRI | Sipa Resources Ltd | 0.019 | 12% | 36% | -14% | -27% | $4,106,846 |

| HAW | Hawthorn Resources | 0.067 | 12% | 3% | -32% | -53% | $23,116,077 |

| ASO | Aston Minerals Ltd | 0.01 | 11% | 11% | -50% | -85% | $12,950,643 |

| CY5 | Cygnus Metals Ltd | 0.063 | 11% | 26% | -22% | -78% | $22,348,607 |

| ZNC | Zenith Minerals Ltd | 0.053 | 10% | -4% | -67% | -46% | $18,676,187 |

| OCN | Oceanalithiumlimited | 0.043 | 10% | 2% | -40% | -85% | $3,547,414 |

| GSM | Golden State Mining | 0.012 | 9% | 9% | 9% | -68% | $3,352,448 |

| ASR | Asra Minerals Ltd | 0.006 | 9% | 50% | 0% | -33% | $12,216,476 |

| KZR | Kalamazoo Resources | 0.073 | 9% | -16% | -22% | -53% | $13,130,279 |

| BNR | Bulletin Res Ltd | 0.05 | 9% | -2% | -38% | -11% | $14,387,053 |

| AM7 | Arcadia Minerals | 0.038 | 9% | -24% | -46% | -65% | $4,447,904 |

| MTM | MTM Critical Metals | 0.038 | 9% | -16% | -50% | -64% | $10,682,060 |

| FG1 | Flynngold | 0.027 | 8% | 13% | -42% | -44% | $7,381,796 |

| ABX | ABX Group Limited | 0.055 | 8% | 10% | -24% | -45% | $13,752,217 |

| KFM | Kingfisher Mining | 0.07 | 8% | 8% | -42% | -76% | $3,760,050 |

| SRN | Surefire Rescs NL | 0.007 | 8% | -13% | -22% | -59% | $13,904,155 |

| AXE | Archer Materials | 0.3 | 7% | -14% | -13% | -48% | $79,002,574 |

| KOB | Kobaresourceslimited | 0.16 | 7% | 7% | 19% | -9% | $22,198,626 |

| HRE | Heavy Rare Earths | 0.032 | 7% | 7% | -42% | -67% | $2,056,590 |

| PAT | Patriot Lithium | 0.051 | 6% | -12% | -67% | -81% | $5,277,504 |

| QPM | Queensland Pacific | 0.035 | 6% | 6% | -13% | -68% | $88,241,260 |

| VTM | Victory Metals Ltd | 0.36 | 6% | 26% | 71% | 6% | $32,467,152 |

| FTL | Firetail Resources | 0.077 | 5% | 10% | 35% | -6% | $12,138,829 |

| MLS | Metals Australia | 0.02 | 5% | -5% | -38% | -38% | $13,788,671 |

| RAG | Ragnar Metals Ltd | 0.02 | 5% | 18% | -13% | -13% | $9,479,619 |

| RBX | Resource B | 0.04 | 5% | 18% | -47% | -76% | $3,307,379 |

| ETM | Energy Transition | 0.02 | 5% | -13% | -53% | -65% | $28,088,542 |

| E25 | Element 25 Ltd | 0.23 | 5% | -4% | -23% | -65% | $52,778,976 |

| WIN | WIN Metals | 0.023 | 5% | -15% | -71% | -89% | $7,659,745 |

| DRE | Dreadnought Resources Ltd | 0.023 | 5% | -12% | 5% | -62% | $80,800,678 |

| IPX | Iperionx Limited | 2.35 | 4% | 19% | 40% | 110% | $584,575,911 |

| QEM | QEM Limited | 0.135 | 4% | 0% | -29% | -37% | $21,194,840 |

| DM1 | Desert Metals | 0.03 | 3% | 43% | -9% | -51% | $7,962,771 |

| REC | Rechargemetals | 0.031 | 3% | -3% | -62% | -90% | $4,330,389 |

| SGQ | St George Min Ltd | 0.032 | 3% | 28% | 7% | -22% | $30,644,753 |

| AXN | Alliance Nickel Ltd | 0.038 | 3% | -3% | 9% | -60% | $27,581,905 |

| ARU | Arafura Rare Earths | 0.19 | 3% | 6% | 46% | -39% | $438,957,416 |

| A11 | Atlantic Lithium | 0.38 | 3% | 0% | 3% | -17% | $246,874,240 |

| AZL | Arizona Lithium Ltd | 0.0195 | 3% | -7% | -15% | -41% | $85,002,476 |

| BUX | Buxton Resources Ltd | 0.08 | 3% | 16% | -43% | -41% | $16,321,290 |

| IG6 | Internationalgraphit | 0.085 | 2% | 13% | -41% | -60% | $16,839,575 |

| LIT | Lithium Australia | 0.023 | 2% | 15% | -18% | -32% | $25,668,125 |

| CMX | Chemxmaterials | 0.046 | 2% | -6% | -39% | -45% | $5,716,004 |

| CNB | Carnaby Resource Ltd | 0.52 | 2% | -7% | -21% | -52% | $91,126,740 |

| EG1 | Evergreenlithium | 0.059 | 2% | 9% | -55% | -82% | $3,317,570 |

| LTR | Liontown Resources | 0.97 | 2% | 4% | 7% | -66% | $2,388,629,807 |

| NVX | Novonix Limited | 0.675 | 2% | 7% | 24% | -30% | $332,584,366 |

| VUL | Vulcan Energy | 4.52 | 1% | 13% | 122% | -2% | $809,210,855 |

| MRD | Mount Ridley Mines | 0.001 | 0% | 0% | -50% | -60% | $7,784,883 |

| CZN | Corazon Ltd | 0.005 | 0% | -29% | -62% | -72% | $3,339,528 |

| RLC | Reedy Lagoon Corp. | 0.003 | 0% | 0% | -40% | -66% | $1,858,622 |

| FRS | Forrestaniaresources | 0.034 | 0% | -15% | 17% | -70% | $5,500,715 |

| HXG | Hexagon Energy | 0.013 | 0% | 0% | 30% | 18% | $6,667,907 |

| MNS | Magnis Energy Tech | 0.042 | 0% | 0% | 0% | -60% | $50,378,922 |

| 0 | 0% | 0% | 0% | 0% | |||

| SBR | Sabre Resources | 0.014 | 0% | -18% | -46% | -60% | $5,501,467 |

| VRC | Volt Resources Ltd | 0.005 | 0% | 0% | -17% | -62% | $20,793,391 |

| GED | Golden Deeps | 0.034 | 0% | -15% | -15% | -69% | $4,123,260 |

| ADV | Ardiden Ltd | 0.135 | 0% | -4% | -16% | -52% | $8,439,863 |

| AAJ | Aruma Resources Ltd | 0.012 | 0% | -20% | -33% | -72% | $2,362,698 |

| CWX | Carawine Resources | 0.086 | 0% | -14% | -18% | -21% | $20,306,789 |

| PAN | Panoramic Resources | 0.035 | 0% | 0% | 0% | -64% | $103,937,992 |

| PRL | Province Resources | 0.041 | 0% | 0% | 0% | 0% | $48,441,219 |

| 0 | 0% | 0% | 0% | 0% | |||

| ADD | Adavale Resource Ltd | 0.004 | 0% | 0% | -53% | -84% | $4,261,061 |

| GL1 | Globallith | 0.27 | 0% | -2% | -48% | -84% | $75,476,937 |

| 0 | 0% | 0% | 0% | 0% | |||

| EGR | Ecograf Limited | 0.115 | 0% | -8% | -21% | -32% | $52,213,659 |

| ATM | Aneka Tambang | 1.07 | 0% | 0% | -9% | -3% | $1,394,904 |

| ALY | Alchemy Resource Ltd | 0.008 | 0% | 33% | 0% | -43% | $8,246,534 |

| RMX | Red Mount Min Ltd | 0.001 | 0% | 0% | -43% | -77% | $3,423,577 |

| AQD | Ausquest Limited | 0.011 | 0% | 0% | 10% | -27% | $9,076,641 |

| REE | Rarex Limited | 0.015 | 0% | 15% | -29% | -63% | $11,851,973 |

| MRC | Mineral Commodities | 0.026 | 0% | 30% | -13% | -44% | $25,596,288 |

| WKT | Walkabout Resources | 0.105 | 0% | -5% | -5% | -16% | $73,838,760 |

| AR3 | Austrare | 0.092 | 0% | 15% | -26% | -70% | $14,344,814 |

| CNJ | Conico Ltd | 0.001 | 0% | 0% | -75% | -86% | $2,201,528 |

| NKL | Nickelxltd | 0.024 | 0% | 4% | -25% | -61% | $2,283,194 |

| MQR | Marquee Resource Ltd | 0.01 | 0% | -9% | -50% | -74% | $4,547,228 |

| EVR | Ev Resources Ltd | 0.005 | 0% | 0% | -50% | -62% | $8,227,629 |

| EMS | Eastern Metals | 0.028 | 0% | -7% | -22% | -55% | $3,523,964 |

| LSR | Lodestar Minerals | 0.001 | 0% | -33% | -58% | -84% | $2,600,780 |

| WML | Woomera Mining Ltd | 0.003 | 0% | 0% | -50% | -77% | $3,654,417 |

| LMG | Latrobe Magnesium | 0.043 | 0% | 5% | -20% | -23% | $102,306,876 |

| KOR | Korab Resources | 0.008 | 0% | -11% | -47% | -64% | $2,936,400 |

| CMO | Cosmometalslimited | 0.058 | 0% | 7% | -3% | -24% | $7,433,077 |

| ENT | Enterprise Metals | 0.003 | 0% | 0% | -25% | -40% | $3,279,952 |

| ENV | Enova Mining Limited | 0.01 | 0% | -29% | -50% | 67% | $9,579,293 |

| PNT | Panthermetalsltd | 0.036 | 0% | 24% | -28% | -54% | $3,137,982 |

| AVW | Avira Resources Ltd | 0.001 | 0% | 0% | -50% | -50% | $2,938,790 |

| CAI | Calidus Resources | 0.115 | 0% | 10% | -41% | -43% | $93,678,206 |

| PGD | Peregrine Gold | 0.19 | 0% | -17% | -37% | -28% | $9,842,371 |

| RAS | Ragusa Minerals Ltd | 0.016 | 0% | -6% | -54% | -75% | $2,281,581 |

| YAR | Yari Minerals Ltd | 0.003 | 0% | -25% | -70% | -83% | $1,447,073 |

| ODE | Odessa Minerals Ltd | 0.003 | 0% | 0% | -63% | -63% | $2,608,206 |

| LNR | Lanthanein Resources | 0.004 | 0% | 33% | -33% | -83% | $9,774,545 |

| CLZ | Classic Min Ltd | 0.001 | 0% | -50% | -98% | -98% | $1,130,385 |

| VMS | Venture Minerals | 0.019 | 0% | -21% | 138% | 27% | $43,905,270 |

| IDA | Indiana Resources | 0.085 | 0% | 10% | 11% | 18% | $53,921,558 |

| TAR | Taruga Minerals | 0.009 | 0% | 29% | 13% | -18% | $6,354,241 |

| AOA | Ausmon Resorces | 0.003 | 0% | 20% | 0% | -25% | $2,117,999 |

| WC1 | Westcobarmetals | 0.031 | 0% | -18% | -44% | -72% | $4,727,510 |

| GRL | Godolphin Resources | 0.016 | 0% | -16% | -59% | -62% | $2,994,477 |

| LNR | Lanthanein Resources | 0.004 | 0% | 33% | -33% | -83% | $9,774,545 |

| CDT | Castle Minerals | 0.004 | 0% | -20% | -33% | -71% | $5,311,305 |

| L1M | Lightning Minerals | 0.066 | 0% | -12% | -31% | -65% | $5,959,808 |

| RVT | Richmond Vanadium | 0.3 | 0% | 13% | -6% | -31% | $25,862,342 |

| OM1 | Omnia Metals Group | 0.078 | 0% | 0% | 0% | -68% | $4,550,568 |

| LLL | Leolithiumlimited | 0.505 | 0% | 0% | 0% | -56% | $605,079,142 |

| WSR | Westar Resources | 0.008 | 0% | -20% | -55% | -67% | $3,189,799 |

| LU7 | Lithium Universe Ltd | 0.015 | 0% | 7% | -38% | -50% | $9,205,660 |

| TOR | Torque Met | 0.13 | 0% | -4% | -35% | -16% | $24,432,060 |

| KNG | Kingsland Minerals | 0.21 | 0% | -9% | -16% | -38% | $12,289,960 |

| CHR | Charger Metals | 0.061 | -1% | -12% | -53% | -80% | $4,722,635 |

| OMH | OM Holdings Limited | 0.43 | -1% | -8% | -11% | -22% | $333,321,708 |

| SYR | Syrah Resources | 0.305 | -2% | -16% | -24% | -58% | $310,467,530 |

| SYR | Syrah Resources | 0.305 | -2% | -16% | -24% | -58% | $310,467,530 |

| TVN | Tivan Limited | 0.055 | -2% | -25% | -2% | -23% | $94,759,917 |

| MHK | Metalhawk. | 0.052 | -2% | 2% | -42% | -60% | $5,234,840 |

| STK | Strickland Metals | 0.095 | -2% | -17% | -10% | 157% | $212,373,230 |

| LTM | Arcadium Lithium PLC | 5.07 | -3% | 2% | -35% | 0% | $1,896,230,897 |

| LEL | Lithenergy | 0.365 | -3% | -6% | -17% | -48% | $40,880,573 |

| LKE | Lake Resources | 0.036 | -3% | -23% | -63% | -86% | $60,066,750 |

| GAL | Galileo Mining Ltd | 0.18 | -3% | -14% | -16% | -68% | $35,572,487 |

| AZI | Altamin Limited | 0.035 | -3% | -8% | -40% | -55% | $15,798,565 |

| PLL | Piedmont Lithium Inc | 0.165 | -3% | 10% | -38% | -81% | $68,053,079 |

| AVL | Aust Vanadium Ltd | 0.0165 | -3% | 3% | -18% | -48% | $137,870,372 |

| SYA | Sayona Mining Ltd | 0.032 | -3% | -9% | -20% | -81% | $339,678,768 |

| PFE | Panteraminerals | 0.032 | -3% | 0% | -35% | -60% | $11,749,828 |

| BKT | Black Rock Mining | 0.06 | -3% | 13% | -10% | -43% | $76,353,416 |

| INR | Ioneer Ltd | 0.14 | -3% | -7% | 27% | -58% | $338,926,814 |

| NC1 | Nicoresourceslimited | 0.14 | -3% | 8% | -45% | -71% | $16,417,586 |

| ARR | American Rare Earths | 0.275 | -4% | 10% | 96% | 67% | $133,494,291 |

| PLS | Pilbara Min Ltd | 2.89 | -4% | -7% | -12% | -41% | $8,699,068,256 |

| FGR | First Graphene Ltd | 0.051 | -4% | -2% | -15% | -39% | $33,621,838 |

| VR8 | Vanadium Resources | 0.05 | -4% | -18% | 6% | -35% | $28,131,260 |

| EMC | Everest Metals Corp | 0.125 | -4% | 4% | 58% | -26% | $23,285,389 |

| ARL | Ardea Resources Ltd | 0.48 | -4% | -8% | 16% | -34% | $96,846,214 |

| ANX | Anax Metals Ltd | 0.024 | -4% | -8% | 20% | -63% | $17,974,245 |

| BHP | BHP Group Limited | 41.28 | -4% | -4% | -11% | -8% | $210,265,667,673 |

| EMN | Euromanganese | 0.067 | -4% | -1% | -22% | -68% | $14,609,312 |

| DLI | Delta Lithium | 0.215 | -4% | -7% | -20% | -76% | $153,382,536 |

| GLN | Galan Lithium Ltd | 0.1525 | -5% | -10% | -71% | -82% | $75,786,319 |

| LRS | Latin Resources Ltd | 0.1525 | -5% | -18% | -13% | -62% | $433,910,017 |

| NVA | Nova Minerals Ltd | 0.2 | -5% | 0% | -39% | -38% | $46,237,229 |

| KNI | Kunikolimited | 0.2 | -5% | -7% | -18% | -61% | $17,353,854 |

| AUZ | Australian Mines Ltd | 0.0095 | -5% | 19% | 6% | -62% | $12,586,609 |

| STM | Sunstone Metals Ltd | 0.0095 | -5% | -14% | -21% | -63% | $34,667,133 |

| PBL | Parabellumresources | 0.038 | -5% | -5% | -37% | -89% | $2,492,000 |

| RNU | Renascor Res Ltd | 0.089 | -5% | -5% | 16% | -54% | $223,642,364 |

| JMS | Jupiter Mines. | 0.255 | -6% | -18% | 50% | 28% | $499,801,356 |

| SCN | Scorpion Minerals | 0.017 | -6% | 0% | -39% | -77% | $6,960,755 |

| KAI | Kairos Minerals Ltd | 0.0085 | -6% | -11% | -35% | -67% | $22,277,754 |

| ARN | Aldoro Resources | 0.083 | -6% | 4% | -13% | -50% | $10,904,523 |

| COB | Cobalt Blue Ltd | 0.082 | -6% | 9% | -59% | -81% | $34,161,071 |

| BCA | Black Canyon Limited | 0.08 | -6% | -6% | -27% | -59% | $5,821,741 |

| NIC | Nickel Industries | 0.7925 | -6% | -4% | 42% | -3% | $3,364,360,756 |

| LIN | Lindian Resources | 0.1125 | -6% | -2% | -22% | -68% | $132,586,057 |

| IGO | IGO Limited | 5.585 | -6% | 0% | -23% | -62% | $4,263,417,787 |

| HAS | Hastings Tech Met | 0.34 | -7% | 26% | -41% | -71% | $61,480,886 |

| MAN | Mandrake Res Ltd | 0.027 | -7% | -10% | -31% | -39% | $16,652,518 |

| GT1 | Greentechnology | 0.067 | -7% | -11% | -59% | -90% | $22,522,647 |

| BC8 | Black Cat Syndicate | 0.335 | -7% | 14% | 46% | -19% | $128,548,909 |

| MEK | Meeka Metals Limited | 0.04 | -7% | 25% | 1% | 14% | $46,918,939 |

| LYC | Lynas Rare Earths | 5.855 | -7% | -4% | 1% | -12% | $5,627,003,474 |

| CAE | Cannindah Resources | 0.052 | -7% | -13% | -40% | -65% | $31,794,397 |

| CLA | Celsius Resource Ltd | 0.013 | -7% | 18% | 8% | -48% | $31,562,866 |

| BM8 | Battery Age Minerals | 0.13 | -7% | -10% | -30% | -70% | $12,093,138 |

| DVP | Develop Global Ltd | 1.9 | -7% | -16% | -4% | -42% | $485,140,732 |

| WA1 | Wa1Resourcesltd | 15.14 | -7% | -12% | 51% | 157% | $972,337,982 |

| EMH | European Metals Hldg | 0.25 | -7% | -14% | -14% | -67% | $53,935,623 |

| LLI | Loyal Lithium Ltd | 0.125 | -7% | -32% | -46% | -61% | $11,341,633 |

| WC8 | Wildcat Resources | 0.245 | -8% | -26% | -41% | 36% | $307,673,896 |

| OD6 | Od6Metalsltd | 0.049 | -8% | -6% | -65% | -78% | $6,305,818 |

| M24 | Mamba Exploration | 0.012 | -8% | -29% | -76% | -83% | $2,208,987 |

| JLL | Jindalee Lithium Ltd | 0.29 | -8% | -9% | -70% | -84% | $18,537,528 |

| GW1 | Greenwing Resources | 0.046 | -8% | 7% | -58% | -79% | $8,700,071 |

| 1MC | Morella Corporation | 0.045 | -8% | -28% | -55% | -78% | $10,627,583 |

| LML | Lincoln Minerals | 0.0055 | -8% | -21% | 10% | -39% | $12,337,557 |

| INF | Infinity Lithium | 0.053 | -9% | -2% | -41% | -54% | $24,517,381 |

| MIN | Mineral Resources. | 52.51 | -9% | -6% | -3% | -25% | $10,694,542,430 |

| GBR | Greatbould Resources | 0.051 | -9% | -15% | -12% | -34% | $32,751,394 |

| IXR | Ionic Rare Earths | 0.01 | -9% | 0% | -44% | -55% | $48,313,011 |

| G88 | Golden Mile Res Ltd | 0.01 | -9% | -17% | -33% | -79% | $4,523,451 |

| TON | Triton Min Ltd | 0.01 | -9% | -13% | -50% | -67% | $15,683,887 |

| PVT | Pivotal Metals Ltd | 0.02 | -9% | 54% | 0% | -5% | $15,490,602 |

| ICL | Iceni Gold | 0.068 | -9% | 1% | 36% | -43% | $18,274,990 |

| EUR | European Lithium Ltd | 0.048 | -9% | -6% | -44% | -47% | $65,711,764 |

| IPT | Impact Minerals | 0.014 | -10% | -13% | 17% | -13% | $45,891,506 |

| TMB | Tambourahmetals | 0.045 | -10% | -31% | -49% | -81% | $3,732,316 |

| PVW | PVW Res Ltd | 0.026 | -10% | 18% | -48% | -70% | $2,636,524 |

| FRB | Firebird Metals | 0.13 | -10% | -26% | 30% | 0% | $18,506,982 |

| PSC | Prospect Res Ltd | 0.125 | -11% | -22% | 56% | 0% | $59,834,986 |

| PGM | Platina Resources | 0.025 | -11% | -7% | 32% | -4% | $15,579,508 |

| AS2 | Askarimetalslimited | 0.04 | -11% | -17% | -71% | -85% | $4,298,399 |

| WMG | Western Mines | 0.24 | -11% | -30% | 33% | -64% | $19,416,258 |

| THR | Thor Energy PLC | 0.016 | -11% | 7% | -54% | -60% | $3,760,392 |

| PMT | Patriotbatterymetals | 0.475 | -11% | -17% | -32% | -69% | $308,418,581 |

| CTM | Centaurus Metals Ltd | 0.355 | -11% | -24% | 22% | -60% | $178,637,641 |

| RXL | Rox Resources | 0.1325 | -12% | -2% | -11% | -49% | $59,050,125 |

| BMM | Balkanminingandmin | 0.075 | -12% | 44% | -18% | -62% | $4,830,755 |

| TKM | Trek Metals Ltd | 0.03 | -12% | -12% | -21% | -74% | $16,431,132 |

| NWC | New World Resources | 0.029 | -12% | -9% | -22% | -9% | $82,232,837 |

| NTU | Northern Min Ltd | 0.029 | -12% | -9% | 16% | -24% | $177,329,377 |

| DEV | Devex Resources Ltd | 0.25 | -12% | -18% | -6% | -23% | $112,503,621 |

| SLZ | Sultan Resources Ltd | 0.007 | -13% | -22% | -53% | -83% | $1,383,105 |

| NWM | Norwest Minerals | 0.028 | -13% | 12% | 17% | -55% | $11,643,585 |

| CHN | Chalice Mining Ltd | 1.05 | -13% | -23% | 3% | -82% | $422,025,185 |

| PAM | Pan Asia Metals | 0.08 | -13% | -50% | -53% | -64% | $15,026,986 |

| EVG | Evion Group NL | 0.02 | -13% | -5% | -23% | -47% | $6,939,264 |

| ILU | Iluka Resources | 5.88 | -13% | -9% | -11% | -45% | $2,648,911,646 |

| CXO | Core Lithium | 0.095 | -14% | 14% | -51% | -89% | $209,419,683 |

| PTR | Petratherm Ltd | 0.019 | -14% | 19% | -37% | -71% | $4,300,077 |

| BSX | Blackstone Ltd | 0.043 | -14% | 2% | -32% | -65% | $22,633,600 |

| JRV | Jervois Global Ltd | 0.018 | -14% | -22% | -44% | -69% | $51,352,512 |

| VML | Vital Metals Limited | 0.003 | -14% | 0% | -40% | -70% | $20,632,734 |

| RGL | Riversgold | 0.006 | -14% | 20% | -33% | -54% | $7,824,151 |

| MEI | Meteoric Resources | 0.12 | -14% | -25% | -38% | -49% | $238,814,381 |

| TMX | Terrain Minerals | 0.003 | -14% | 0% | -40% | -50% | $4,295,012 |

| MLX | Metals X Limited | 0.4275 | -15% | 3% | 58% | 34% | $398,735,069 |

| NMT | Neometals Ltd | 0.069 | -15% | -28% | -57% | -86% | $44,872,663 |

| AKN | Auking Mining Ltd | 0.017 | -15% | -6% | -59% | -76% | $4,567,680 |

| SRZ | Stellar Resources | 0.0195 | -15% | 8% | 179% | 50% | $38,835,036 |

| BUR | Burleyminerals | 0.11 | -15% | 12% | -15% | -37% | $16,540,804 |

| WR1 | Winsome Resources | 0.585 | -16% | -27% | 0% | -65% | $128,718,845 |

| ASN | Anson Resources Ltd | 0.125 | -17% | 9% | 33% | -22% | $161,316,026 |

| CTN | Catalina Resources | 0.0025 | -17% | -17% | -17% | -50% | $3,096,217 |

| GCM | Green Critical Min | 0.0025 | -17% | -38% | -64% | -84% | $4,159,755 |

| FBM | Future Battery | 0.024 | -17% | -27% | -61% | -78% | $16,556,898 |

| GRE | Greentechmetals | 0.12 | -17% | -14% | -52% | -70% | $9,969,597 |

| S32 | South32 Limited | 2.935 | -18% | -21% | -11% | -23% | $13,497,190,533 |

| TLG | Talga Group Ltd | 0.43 | -18% | -35% | -26% | -68% | $167,238,356 |

| LOT | Lotus Resources Ltd | 0.2825 | -18% | -20% | -7% | 45% | $531,212,403 |

| MRR | Minrex Resources Ltd | 0.009 | -18% | 0% | -31% | -44% | $9,763,808 |

| SLM | Solismineralsltd | 0.135 | -18% | 61% | 13% | -77% | $10,388,799 |

| ASL | Andean Silver | 0.8 | -20% | -1% | 281% | 167% | $87,326,046 |

| BOA | Boadicea Resources | 0.02 | -20% | -20% | -35% | -53% | $2,467,057 |

| IMI | Infinitymining | 0.016 | -20% | -16% | -87% | -90% | $1,900,054 |

| RR1 | Reach Resources Ltd | 0.012 | -20% | -33% | -13% | -74% | $10,493,176 |

| EMT | Emetals Limited | 0.004 | -20% | -20% | -43% | -56% | $4,250,000 |

| RR1 | Reach Resources Ltd | 0.012 | -20% | -33% | -13% | -74% | $10,493,176 |

| RON | Roninresourcesltd | 0.12 | -20% | 0% | -23% | -29% | $4,419,001 |

| KM1 | Kalimetalslimited | 0.16 | -22% | -42% | -70% | 0% | $14,597,249 |

| ITM | Itech Minerals Ltd | 0.078 | -22% | 26% | -14% | -68% | $9,904,969 |

| ASM | Ausstratmaterials | 0.615 | -23% | -24% | -41% | -48% | $124,076,487 |

| SRL | Sunrise | 0.4 | -24% | -6% | 5% | -70% | $38,797,824 |

| SUM | Summitminerals | 0.19 | -24% | -62% | 98% | 27% | $14,375,588 |

| PUR | Pursuit Minerals | 0.003 | -25% | 0% | -50% | -77% | $10,906,200 |

| MHC | Manhattan Corp Ltd | 0.0015 | -25% | -25% | -63% | -85% | $4,405,470 |

| LPM | Lithium Plus | 0.11 | -27% | -33% | -50% | -63% | $14,557,400 |

| PNN | Power Minerals Ltd | 0.1025 | -27% | -7% | -43% | -72% | $11,561,029 |

| 1AE | Auroraenergymetals | 0.065 | -28% | -2% | -52% | 10% | $11,639,143 |

| KTA | Krakatoa Resources | 0.01 | -29% | -17% | -47% | -70% | $4,248,965 |

| RIL | Redivium Limited | 0.002 | -33% | -50% | -69% | -82% | $5,461,710 |

| TKL | Traka Resources | 0.001 | -33% | 0% | -50% | -86% | $1,945,659 |

| AGY | Argosy Minerals Ltd | 0.049 | -40% | -43% | -46% | -87% | $117,929,596 |

| AX8 | Accelerate Resources | 0.012 | -45% | -67% | -59% | -49% | $7,449,047 |

| VIA | Viagold Rare Earth | 0 | -100% | -100% | -100% | -100% | $166,624,808 |

| LPI | Lithium Pwr Int Ltd | 0 | -100% | -100% | -100% | -100% | $361,898,974 |

| AZS | Azure Minerals | 0 | -100% | -100% | -100% | -100% | $1,692,527,632 |

| GSR | Greenstone Resources | 0 | -100% | -100% | -100% | -100% | $15,761,980 |

| ESS | Essential Metals Ltd | 0 | -100% | -100% | -100% | -100% | $135,278,382 |

| AVZ | AVZ Minerals Ltd | 0 | -100% | -100% | -100% | -100% | $2,752,409,203 |

| AKE | Allkem Limited | 0 | -100% | -100% | -100% | -100% | $6,304,350,967 |

| TMT | Technology Metals | 0 | -100% | -100% | -100% | -100% | $67,134,856 |

| FFX | Firefinch Ltd | 0 | -100% | -100% | -100% | -100% | $236,569,315 |

Weekly Small Cap Standouts

St George Mining is gearing up to acquire the world-class Araxá niobium-REE-phosphate project in Brazil where historical drilling has already defined extensive high-grade niobium, REE and phosphate mineralisation including:

- More than 500 intercepts of high-grade niobium, >1% Nb2O5

- Ultra-high grades up to 8% Nb2O5, 33% TREO and 32% P2O5; and

- Mineralisation commencing from surface and open in all directions

The project is in Minas Gerais, adjacent to and in the same carbonatite complex as the world’s largest niobium mine owned by CBMM, which produces around 80% of the world’s niobium.

Mandrake – together with Idaho National Laboratories (INL), the National Renewable Energy Laboratory (NREL) and the University of Utah – has been awarded US$1M by the US Department of Energy (DoE) to characterise and estimate reserves of lithium and other critical minerals in the Paradox Basin.

“The successful qualification for US$1M of US Federal DoE funding is a fantastic vote of confidence from the US government on the lithium potential of Mandrake’s Utah lithium project and the greater Paradox Basin,” managing director James Allchurch said.

“Partnering with INL, NREL and the University of Utah will give Mandrake access to the foremost US scientists and sophisticated US-funded laboratories and thrust both Mandrake and the lithium potential of the Paradox Basin into the US national spotlight.

“Outstanding funding opportunities and general support from the US government are currently available for US-based critical minerals projects as the US seeks to promote a domestic supply of critical minerals and navigate the geopolitical permutations of the new energy transition.”

Mandrake has an additional three DoE applications for funding waiting in the wings.

The company has produced battery-grade lithium carbonate via Direct Lithium Extraction (DLE) at its Prairie lithium brine project in Canada.

The lithium carbonate was produced from the DLE eluent of the ILiad pilot that operated at the Prairie project from November 2023 – February 2024.

DLE eluent was sent to Saltworks facility in Vancouver, Canada where it was converted into battery grade lithium carbonate.

“The battery-grade product we produced is in sufficient quantities to go out to all the offtakers and strategic partners we are in conversation with,” managing director Paul Lloyd said.

“Our team remains focused on bringing Pad #1 at the Prairie project into production in 2025.”

That’s the same Pad #1 that was just conditionally approved for an up to a $21.6m investment incentive under the Saskatchewan Government’s Oil & Gas Processing Investment Incentive Program (OGPII) last month.

Wildcat has reported 67m at 1.9% lithium, including 46m at 2.5% lithium from the Leia pegmatite at its Tabba Tabba project in WA.

Tabba Tabba is near some of the world’s largest hard-rock lithium mines, 47km from Pilbara Minerals’ (ASX:PLS) 414Mt Pilgangoora project and 87km from Mineral Resources’ (ASX:MIN) 259Mt Wodgina project.

Since acquiring the Tabba Tabba project a year ago, and commencing drilling in July 2023, the company has drilled ~105,020m, comprising 236 RC holes for 59,648m and 128 diamond drill holes for 45,372m.

Exploration has defined a 3.2km long LCT pegmatite field hosting at least six Star Wars named pegmatite bodies – Leia, Luke, Chewy, Tabba Tabba, Han and The Hutt.

At Stockhead we tell it like it is. While St George Mining and Arizona Lithium are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.