High Voltage: Pressure mounts on EV transition amid rising lithium costs

Pic: Getty

Our High Voltage column wraps all the news driving ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, and vanadium.

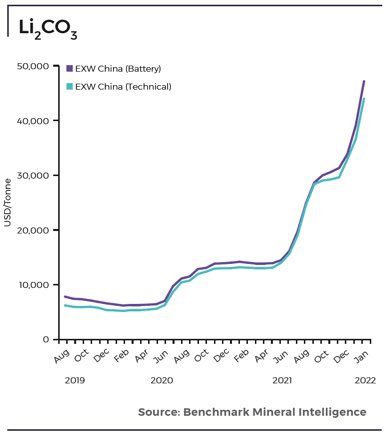

There is a lot of chat around lithium prices right now as they continue to soar.

Battery-grade lithium carbonate is up 21% YTD on the Chinese domestic market, trading as high as US$51,800/tonne in some cases amid tightness in the domestic China market which continues to exert influence on seaborne tradeable levels.

Over in Europe, electric vehicle sales exceeded that of diesel cars for the first time ever, where more than a fifth of vehicles sold were electric in comparison to less than 19% being diesel.

And in China, electric cars are on track to reach the 20% nationwide penetration goal this year, well-above the government’s 2025 forecast.

But some market analysts say that while a strong demand for EVs is a great incentive for lithium mining, prices cannot go up forever.

A strong demand for EVs is a great incentive for #lithium mining. But Li prices cannot go up forever. As I have long argued, #Australia is the only geographical place where significant incremental production can occur in the next 2-3 yrs. This could help lower the price. https://t.co/eEEvDtSmLG

— Juan Carlos Zuleta (@jczuleta) January 17, 2022

Argus Media says it is likely mine expansion will “progress and help soften the lithium carbonate market in the second half of 2022” but in the long term, the further diversification of supply will be key to overcoming bottlenecks.

Lithium deals

Chinese electric carmaker BYD won a government tender in Chile last week for the right to extract 80,000 tonnes of lithium, equivalent to 425,000 tonnes LCE, as part of a move by outgoing President Sebastián Piñera to open up the sector despite mounting political opposition, Benchmark Mineral Intelligence says.

Chile awarded two of five contracts on offer – one to BYD and the other to local firm Servicios y Operaciones Mineras del Norte.

This comes at a time of political turmoil in the country, with outgoing President Sebastian Pinera looking to reverse a decline in the country’s share of the global lithium market.

However, the move has attracted criticism from Chilean opposition groups who claim that while the current administration has the right to award contracts, its decision resembles “those laws that tie you up at the last minute when a government is about to end”.

The car company offered $61 million for the right to explore and produce lithium, according to the country’s Mining and Energy Ministry, while Servicios y Operaciones offered $60 million.

Together, the two contracts represent about 1.8% of Chile’s known lithium reserves.

On January 16, Chile’s mining ministry said it was analysing the decision and for now, has suspended the auction of a lithium extraction contract as requested by the regional governor of the Atacama region.

But with restricted lithium supply in China and ongoing political issues in Chile hampering development of new supply, the need for other countries to increase output is becoming more and more apparent.

Argus Media says while China and Chile accounted for a combined 35% of global lithium production in 2021, Australia maintains its position as the dominant supplier, accounting for 53% of global production in 2021.

Battery Metals winners and losers

Here’s how a basket of ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, and vanadium are performing>>>

Battery metals stocks missing from our list? Email [email protected]

| CODE | COMPANY | % WEEK CHANGE | % MONTH CHANGE | % 6 MONTH CHANGE | % YEAR CHANGE | PRICE | MARKET CAP |

|---|---|---|---|---|---|---|---|

| ESS | Essential Metals | 78% | 200% | 304% | 304% | 0.525 | $126,811,574.40 |

| CHR | Charger Metals | 70% | 153% | 323% | 0% | 0.91 | $29,148,241.85 |

| ARR | American Rare Earths | 58% | 76% | 249% | 150% | 0.3 | $117,109,831.20 |

| CAE | Cannindah Resources | 54% | 71% | 400% | 1100% | 0.3 | $157,324,545.30 |

| AVL | Aust Vanadium | 50% | 66% | 153% | 167% | 0.048 | $157,507,637.09 |

| SHH | Shree Minerals | 50% | 67% | 0% | -29% | 0.015 | $15,948,553.38 |

| AS2 | Askarimetalslimited | 46% | 89% | 63% | 0% | 0.35 | $10,745,508.90 |

| LPI | Lithium Pwr Int | 43% | 105% | 253% | 207% | 0.83 | $289,478,973.84 |

| PAM | Pan Asia Metals | 43% | 62% | 454% | 336% | 0.72 | $53,034,223.68 |

| WCN | White Cliff Min | 42% | 59% | 108% | -16% | 0.027 | $16,016,302.77 |

| ARL | Ardea Resources | 41% | 43% | 45% | 45% | 0.685 | $95,098,700.02 |

| ESR | Estrella Res | 39% | 39% | -32% | -58% | 0.032 | $37,665,399.68 |

| MRC | Mineral Commodities | 39% | 63% | 7% | -57% | 0.16 | $85,598,501.44 |

| RNU | Renascor Res | 38% | 135% | 270% | 1488% | 0.27 | $510,449,444.73 |

| EVR | Ev Resources | 37% | 55% | 257% | 204% | 0.082 | $75,623,193.82 |

| BMM | Balkanminingandmin | 37% | 40% | 49% | 0% | 0.56 | $18,340,000.00 |

| AML | Aeon Metals . | 36% | 23% | -33% | -65% | 0.049 | $42,424,635.51 |

| HNR | Hannans | 36% | 68% | 724% | 724% | 0.057 | $148,557,474.13 |

| CNB | Carnaby Resource | 35% | 289% | 407% | 373% | 1.75 | $219,013,614.75 |

| AZL | Arizona Lithium | 33% | 59% | 383% | 460% | 0.14 | $276,808,885.78 |

| LSR | Lodestar Minerals | 33% | 26% | 20% | -25% | 0.012 | $16,691,248.18 |

| GSM | Golden State Mining | 33% | 33% | -33% | -35% | 0.11 | $9,139,678.35 |

| CXO | Core Lithium | 32% | 80% | 309% | 349% | 0.92 | $1,540,527,872.56 |

| 1MC | Morella Corporation | 32% | 150% | -60% | -60% | 0.025 | $128,355,349.65 |

| WR1 | Winsome Resources | 32% | 75% | 0% | 0% | 0.48 | $64,540,797.12 |

| LRV | Larvottoresources | 31% | 64% | 0% | 0% | 0.23 | $8,079,900.00 |

| GL1 | Globallith | 31% | 142% | 469% | 0% | 1.535 | $208,945,081.09 |

| BNR | Bulletin Res | 31% | 60% | 89% | 42% | 0.115 | $31,919,121.36 |

| IXR | Ionic Rare Earths | 31% | 52% | 94% | 129% | 0.064 | $217,977,568.90 |

| ADV | Ardiden | 29% | 64% | 100% | -18% | 0.018 | $39,030,036.41 |

| AOU | Auroch Minerals | 29% | 8% | -34% | -41% | 0.135 | $48,741,992.87 |

| LEG | Legend Mining | 26% | 43% | -14% | -34% | 0.083 | $228,676,264.84 |

| LPD | Lepidico | 24% | 27% | 327% | 124% | 0.047 | $292,421,040.93 |

| CZN | Corazon | 23% | 26% | 16% | -14% | 0.043 | $13,128,655.38 |

| AAJ | Aruma Resources | 23% | 40% | 61% | 20% | 0.098 | $12,344,227.29 |

| BSX | Blackstone | 22% | 23% | 84% | 78% | 0.71 | $319,214,271.15 |

| AR3 | Austrare | 22% | 28% | 59% | 0% | 1.12 | $85,894,584.16 |

| AR3 | Austrare | 22% | 28% | 59% | 0% | 1.12 | $85,894,584.16 |

| MAN | Mandrake Res | 20% | 36% | -50% | -30% | 0.06 | $28,862,284.20 |

| SYA | Sayona Mining | 20% | 20% | 95% | 181% | 0.15 | $1,057,785,978.75 |

| QPM | Queensland Pacific | 20% | 27% | 40% | 338% | 0.21 | $324,053,757.51 |

| RAG | Ragnar Metals | 20% | 63% | -28% | -15% | 0.049 | $18,261,559.56 |

| RLC | Reedy Lagoon Corp. | 19% | 48% | 153% | 105% | 0.043 | $23,557,860.89 |

| COB | Cobalt Blue | 19% | 54% | 105% | 33% | 0.585 | $176,370,327.32 |

| TMT | Technology Metals | 19% | 27% | 23% | 15% | 0.38 | $77,391,328.20 |

| GME | GME Resources | 19% | 23% | 37% | 2% | 0.07 | $41,579,353.34 |

| AM7 | Arcadia Minerals | 18% | 51% | 69% | 0% | 0.295 | $10,167,890.38 |

| ASN | Anson Resources | 18% | 50% | 126% | 57% | 0.165 | $168,530,881.20 |

| TNG | TNG Limited | 18% | 19% | 55% | -7% | 0.093 | $129,122,894.65 |

| EFE | Eastern Resources | 17% | 32% | 335% | 693% | 0.074 | $70,100,021.07 |

| AXE | Archer Materials | 17% | 10% | -5% | 138% | 1.25 | $309,459,008.75 |

| BEM | Blackearth Minerals | 17% | 48% | 62% | 278% | 0.17 | $36,999,695.39 |

| INF | Infinity Lithium | 17% | 24% | 46% | -11% | 0.205 | $84,888,338.48 |

| A8G | Australasian Metals | 17% | 29% | 379% | 0% | 0.695 | $27,918,493.33 |

| GBR | Greatbould Resources | 17% | 35% | 88% | 239% | 0.175 | $62,516,266.58 |

| SLZ | Sultan Resources | 17% | 24% | 11% | 5% | 0.21 | $14,602,221.69 |

| JRL | Jindalee Resources | 17% | 42% | 20% | 127% | 2.95 | $159,606,699.70 |

| ADD | Adavale Resource | 16% | 49% | -23% | -11% | 0.064 | $22,536,435.39 |

| EMS | Eastern Metals | 16% | 37% | 0% | 0% | 0.26 | $9,256,000.00 |

| GW1 | Greenwing Resources | 15% | 36% | 80% | 80% | 0.495 | $58,605,720.53 |

| NMT | Neometals | 15% | 61% | 203% | 405% | 1.655 | $907,562,935.38 |

| NMT | Neometals | 15% | 61% | 203% | 405% | 1.655 | $907,562,935.38 |

| BUX | Buxton Resources | 14% | 1% | -30% | 16% | 0.081 | $11,020,489.99 |

| WKT | Walkabout Resources | 14% | 50% | 19% | 128% | 0.285 | $124,459,952.30 |

| LTR | Liontown Resources | 14% | 14% | 146% | 374% | 1.765 | $3,855,475,981.08 |

| MRR | Minrex Resources | 14% | 78% | 267% | 164% | 0.066 | $45,672,053.26 |

| VML | Vital Metals Limited | 14% | 18% | 14% | 32% | 0.058 | $241,598,018.87 |

| TMB | Tambourahmetals | 14% | 26% | 0% | 0% | 0.29 | $11,945,853.42 |

| AX8 | Accelerate Resources | 14% | 14% | 20% | -30% | 0.042 | $10,645,273.76 |

| JRV | Jervois Global | 13% | 31% | 39% | 68% | 0.72 | $1,093,180,220.64 |

| NWC | New World Resources | 13% | 15% | 5% | 42% | 0.085 | $135,545,489.87 |

| TKL | Traka Resources | 13% | 31% | 21% | -32% | 0.017 | $10,575,834.20 |

| PNN | PepinNini Minerals | 13% | 46% | 73% | 104% | 0.57 | $34,809,554.58 |

| FGR | First Graphene | 13% | 5% | -8% | -20% | 0.22 | $121,070,616.92 |

| SRI | Sipa Resources | 13% | 26% | -20% | -13% | 0.053 | $10,866,314.56 |

| LIT | Lithium Australia NL | 13% | 29% | 17% | 0% | 0.135 | $138,857,423.31 |

| VMC | Venus Metals Cor | 13% | 9% | -3% | -12% | 0.18 | $27,194,162.94 |

| FG1 | Flynngold | 13% | 6% | 9% | 0% | 0.18 | $11,418,489.00 |

| BYH | Bryah Resources | 11% | 18% | -3% | -12% | 0.059 | $13,346,223.33 |

| NKL | Nickelx | 11% | 30% | -19% | 0% | 0.15 | $8,302,500.00 |

| TEM | Tempest Minerals | 11% | 36% | 53% | 0% | 0.03 | $11,937,026.94 |

| WML | Woomera Mining | 11% | 18% | -8% | -16% | 0.02 | $12,376,681.88 |

| NIC | Nickel Mines Limited | 11% | 18% | 45% | 31% | 1.61 | $4,049,196,772.11 |

| POS | Poseidon Nick | 11% | 15% | 6% | 40% | 0.105 | $321,715,750.23 |

| AUZ | Australian Mines | 11% | 5% | -9% | -37% | 0.21 | $90,375,116.37 |

| MNS | Magnis Energy Tech | 10% | 36% | 107% | 247% | 0.59 | $565,548,273.05 |

| IGO | IGO Limited | 10% | 18% | 51% | 81% | 12.89 | $9,761,182,109.57 |

| IGO | IGO Limited | 10% | 18% | 51% | 81% | 12.89 | $9,761,182,109.57 |

| RMX | Red Mount Min | 10% | 22% | 16% | -21% | 0.011 | $16,109,041.32 |

| S2R | S2 Resources | 10% | 25% | 55% | 10% | 0.225 | $80,184,342.38 |

| PLS | Pilbara Min | 10% | 40% | 144% | 227% | 3.86 | $11,490,434,555.62 |

| AZS | Azure Minerals | 10% | 19% | 48% | -18% | 0.4 | $124,294,288.40 |

| GAL | Galileo Mining | 10% | 10% | -23% | -18% | 0.23 | $38,734,117.15 |

| ALY | Alchemy Resource | 9% | 9% | -18% | -32% | 0.012 | $11,428,138.68 |

| EUR | European Lithium | 8% | 27% | 155% | 100% | 0.14 | $154,950,017.18 |

| IPT | Impact Minerals | 8% | 0% | -7% | -22% | 0.014 | $28,333,128.87 |

| REE | Rarex Limited | 7% | 7% | 30% | -30% | 0.105 | $47,417,286.42 |

| HYM | Hyperion Metals | 7% | 12% | 4% | 146% | 0.985 | $137,396,163.64 |

| VR8 | Vanadium Resources | 7% | 18% | 34% | 117% | 0.078 | $36,902,765.17 |

| SRL | Sunrise | 7% | 24% | 17% | -28% | 2.22 | $199,928,491.38 |

| AKE | Allkem Limited | 7% | 28% | 59% | 126% | 11.61 | $7,401,672,053.46 |

| MOH | Moho Resources | 7% | 3% | -10% | -28% | 0.064 | $8,049,625.73 |

| GLN | Galan Lithium | 7% | 1% | 88% | 292% | 1.88 | $558,095,576.12 |

| TLG | Talga Group | 6% | 12% | 26% | -3% | 1.735 | $528,662,340.47 |

| MIN | Mineral Resources. | 6% | 30% | 7% | 67% | 64.35 | $12,152,511,077.85 |

| RXL | Rox Resources | 6% | 4% | -8% | -38% | 0.36 | $56,738,741.04 |

| LEL | Lithenergy | 6% | 63% | 208% | 0% | 1.215 | $54,675,000.00 |

| RBX | Resource B | 6% | 0% | 6% | 459% | 0.19 | $7,590,041.15 |

| IMI | Infinitymining | 5% | 0% | 0% | 0% | 0.2 | $11,500,000.00 |

| PEK | Peak Rare Earths | 5% | 3% | -10% | 10% | 0.87 | $173,010,403.71 |

| BHP | BHP Group Limited | 5% | 13% | -10% | 3% | 46.7 | $137,776,740,099.80 |

| DTM | Dart Mining NL | 4% | 13% | -28% | -48% | 0.093 | $11,577,656.49 |

| G88 | Golden Mile Res | 4% | -6% | -20% | -4% | 0.048 | $8,304,879.74 |

| ARN | Aldoro Resources | 4% | 1% | -4% | 88% | 0.385 | $34,433,856.77 |

| ARN | Aldoro Resources | 4% | 1% | -4% | 88% | 0.385 | $34,433,856.77 |

| CLA | Celsius Resource | 4% | 50% | -18% | -44% | 0.027 | $28,457,408.19 |

| MQR | Marquee Resource | 4% | 13% | 160% | 69% | 0.135 | $28,367,226.27 |

| PLL | Piedmont Lithium Inc | 4% | -3% | -20% | 38% | 0.73 | $402,915,178.00 |

| DEV | Devex Resources | 3% | -8% | 77% | 115% | 0.495 | $155,521,064.66 |

| CWX | Carawine Resources | 3% | -3% | -17% | -26% | 0.175 | $23,858,510.73 |

| CNJ | Conico | 3% | 3% | 9% | 31% | 0.038 | $38,008,165.21 |

| MMC | Mitremining | 3% | 8% | 0% | 0% | 0.2 | $5,417,020.00 |

| SYR | Syrah Resources | 2% | 61% | 76% | 91% | 2.08 | $1,037,368,223.84 |

| QEM | QEM Limited | 2% | 17% | 24% | 159% | 0.21 | $23,818,899.93 |

| EMH | European Metals Hldg | 2% | 2% | -8% | 3% | 1.39 | $180,827,831.35 |

| CHN | Chalice Mining | 2% | 0% | 19% | 103% | 8.46 | $3,003,075,590.04 |

| ILU | Iluka Resources | 2% | 10% | 24% | 66% | 11 | $4,655,225,762.00 |

| FRS | Forrestaniaresources | 1% | 38% | 0% | 0% | 0.4 | $11,220,000.00 |

| LYC | Lynas Rare Earths | 1% | 23% | 80% | 161% | 11.09 | $10,007,744,133.86 |

| CTM | Centaurus Metals | 1% | 12% | 55% | 50% | 1.285 | $441,691,831.82 |

| INR | Ioneer | 1% | -1% | 95% | 187% | 0.79 | $1,619,933,235.21 |

| VIA | Viagold Rare Earth | 0% | 0% | 2339% | 5614% | 2 | $166,624,808.00 |

| PVW | PVW Res | 0% | 38% | 253% | 253% | 0.53 | $36,714,093.75 |

| AGY | Argosy Minerals | 0% | 40% | 233% | 248% | 0.4 | $510,000,984.00 |

| GED | Golden Deeps | 0% | -8% | -15% | -15% | 0.011 | $8,534,365.84 |

| HAS | Hastings Tech Met | 0% | 17% | 59% | 29% | 0.27 | $469,387,444.05 |

| PAN | Panoramic Resources | 0% | 6% | 69% | 64% | 0.27 | $553,746,781.08 |

| PRL | Province Resources | 0% | 4% | 0% | 625% | 0.145 | $163,800,672.60 |

| BRB | Breaker Res NL | 0% | -14% | 50% | 28% | 0.255 | $83,089,436.90 |

| AQD | Ausquest Limited | 0% | 0% | -14% | -18% | 0.018 | $14,834,686.01 |

| LML | Lincoln Minerals | 0% | 0% | 0% | 0% | 0.008 | $4,599,869.49 |

| ARU | Arafura Resource | 0% | 25% | 88% | 5% | 0.225 | $348,843,899.70 |

| RFR | Rafaella Resources | 0% | 12% | -22% | 0% | 0.076 | $14,496,423.77 |

| MLS | Metals Australia | 0% | 0% | 0% | 0% | 0.002 | $10,477,114.72 |

| TSC | Twenty Seven Co. | 0% | 0% | -20% | -43% | 0.004 | $10,643,255.62 |

| OZL | OZ Minerals | 0% | 4% | 32% | 42% | 28.39 | $9,472,464,683.47 |

| PSC | Prospect Res | -1% | 24% | 192% | 330% | 0.86 | $368,530,240.10 |

| HXG | Hexagon Energy | -1% | 3% | -9% | -35% | 0.071 | $31,666,981.72 |

| NVA | Nova Minerals | -1% | -1% | -16% | -40% | 1.055 | $190,113,410.68 |

| PGM | Platina Resources | -2% | 17% | -31% | 27% | 0.061 | $26,497,322.86 |

| NTU | Northern Min | -2% | 4% | 37% | 24% | 0.052 | $252,538,847.55 |

| MCR | Mincor Resources NL | -2% | 26% | 46% | 54% | 1.75 | $847,607,880.00 |

| BOA | Boadicea Resources | -2% | 21% | 12% | 17% | 0.235 | $18,259,475.33 |

| VUL | Vulcan Energy | -2% | -20% | 5% | 9% | 9.8 | $1,289,754,460.40 |

| TON | Triton Min | -3% | 17% | -3% | -31% | 0.035 | $43,496,626.36 |

| GSR | Greenstone Resources | -3% | 8% | 33% | 12% | 0.028 | $22,598,203.29 |

| LKE | Lake Resources | -4% | 2% | 147% | 513% | 0.95 | $1,160,956,640.90 |

| VRC | Volt Resources | -4% | 8% | -23% | 93% | 0.027 | $72,259,483.19 |

| MLX | Metals X Limited | -4% | 12% | 116% | 293% | 0.53 | $480,851,015.51 |

| PUR | Pursuit Minerals | -4% | -7% | -58% | -35% | 0.026 | $24,584,279.04 |

| SGQ | St George Min | -4% | 17% | 0% | -36% | 0.074 | $43,600,129.34 |

| STK | Strickland Metals | -4% | 0% | 41% | 96% | 0.069 | $88,304,325.48 |

| ATM | Aneka Tambang | -4% | 0% | 10% | 10% | 1.1 | $1,434,013.90 |

| LOT | Lotus Resources | -5% | 0% | 76% | 100% | 0.29 | $283,018,979.93 |

| MRD | Mount Ridley Mines | -6% | -6% | 88% | 88% | 0.0075 | $42,802,094.29 |

| EGR | Ecograf Limited | -6% | 2% | -10% | 165% | 0.65 | $292,716,748.35 |

| QXR | Qx Resources Limited | -7% | 110% | 200% | 133% | 0.042 | $28,491,217.48 |

| BKT | Black Rock Mining | -8% | 17% | 71% | 109% | 0.24 | $208,474,934.40 |

| AVZ | AVZ Minerals | -9% | 11% | 310% | 321% | 0.8 | $2,761,650,464.00 |

| FFX | Firefinch | -9% | 3% | 69% | 277% | 0.735 | $865,930,107.00 |

| SBR | Sabre Resources | -11% | -20% | 0% | -60% | 0.004 | $6,911,254.60 |

Weekly small cap standouts

ESS is the biggest winner, for the second week in a row.

New lithium targets at the Pioneer Dome Project in WA’s Eastern Goldfields will be tested by air core drilling across unexplained anomalism generated from the August 2021 program at Dome North.

This includes testing a 250m wide zone of lithium anomalism in lower saprolite between the Davy and Cade deposits, as well as testing anomalism along strike to the northeast of the Heller deposit.

As work is being done to advance the Dome North resource, exploration is underway across its entire 450km project tenure.

Diamond drilling has commenced at the project, designed to test near-surface mineralisation at both Cade and Davy ahead of bulk samples for metallurgical test work.

Managing director Tim Spencer says: “The more we learn about Dome North, the more excited we are about its future.”

Askari expanded its lithium portfolio through the lodgement of exploration licence applications covering ground in the Pilbara region of Western Australia – highly prospective for lithium-tin-tantalum mineralisation.

Its new ‘Yarrie Lithium Project’ is within a 70km radius of world-class lithium and tantalum producers such as Pilbara Minerals’ (ASX:PLS) Pilgangoora project and Mineral Resources’ (ASX:MRL) Wodgina project.

Executive director Gino D’Anna said the lithium market continues to gain strong investor and end-user support as customers turn to the next class of lithium producers to secure future supply.

“We are seeing offtake deals complete on projects much earlier in the development cycle than we have seen historically,” he said.

“This is indicative of a market that recognises the need to come down the exploration curve and invest in earlier stage projects while experts expect prices to rise even further in the first quarter of 2022.

“We are confident that we have a high chance of exploration success and look forward to getting on the ground.”

Work will kick off with a data review ahead of rock and chip sampling, designed to target the lithium hotspots.

ADV’s joint venture Seymour Lithium Project with Green Technology Metals (ASX:GT1) hit a thick 40m intersection at 1.54% lithium earlier this week, sending its share price flying.

This was only the first hole of the phase-1 diamond drilling program being carried out at the North Aubry deposit.

The 11-hole for 3,500m program – expected to be completed in March – is seeking to expand the current mineral resource estimate of 4.8 Mt at 1.25% lithium.

ARL confirmed a massive nickel-copper-PGE sulphide discovery at 2.72m with 5.42% nickel and 0.85% copper from 391.04m at its Emu Lake core hole within the Kalpini Project, northeast of Kalgoorlie.

Managing director Andrew Penkethman said the company now has three adjoining drill holes with nickel sulphide mineralisation on the same contact, means that a discovery has been made.

“Importantly, the interpreted 3D geometry of the AELD0003 discovery suggests the mineralisation is open in all directions for further drill exploration,” he said.

“With Ardea holding 20km of fertile komatiite strike at Emu Lake, there is significant scope to extend this nickel sulphide discovery and make additional discoveries.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.