High Voltage: Momentum builds for magnet projects, and car makers move to secure home-grown battery supply chains

Pic: Schroptschop / E+ via Getty Images

- GM secures US supply chain with magnet production deals

- Volkswagen plans to build a battery cathode plant

- WoodMac reckons battery recycling won’t take off before 2030

Our High Voltage column wraps all the news driving ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, and vanadium.

Momentum is building to diversify and expand supply chains for high-performance sintered neodymium iron boron (NdFeB) magnets needed for electric vehicle (EV) motors.

This week Argus flagged two potential magnet projects – one in the US and one in Europe – that GM has swooped in to secure deals with.

MP Materials owns and operates the Mountain Pass light rare earth mine in California, and plans to build a metal, alloy and magnet plant in Fort Worth, Texas. It has a provisional start date of 2023 and a proposed initial capacity of 1,000 t/yr of NdFeB magnets.

The company also concluded a binding long-term supply agreement with GM for US-sourced and manufactured rare earth materials, alloy and finished magnets.

It’s a smart move for GM, with magnets at the heart of an EV motor.

To further establish a strong, sustainable EV supply chain, we’ve also announced our plans to build a new magnet factory in the U.S. in collaboration with VAC. Learn more: https://t.co/BlwVjOceA0 pic.twitter.com/NplaHn4YT6

— General Motors (@GM) December 10, 2021

GM also concluded a non-binding preliminary agreement with German magnetic material and sintered rare earth magnet producer Vacuumschmelze, which announced plans to build a magnet plant in the US in 2024.

“We are building a resilient and sustainable EV manufacturing value chain in North America from raw materials to components to drive GM’s growth and support a mass market for EVs,” GM vice-president, global purchasing and supply chain Shilpan Amin said.

In Europe, Canadian specialty materials and bonded rare earth magnet producer Neo Performance Materials plans to expand its operations at its Silmet light rare earth separation facility in Estonia.

The plan is to build an alloy, metal and magnet manufacturing plant, with phase one capacity of 1,000 t/yr of sintered EV motor magnets which would only require around 300 t/yr of metal and 400 t/yr of oxide.

For comparison, Aussie producer Lynas (ASX:LYC) produced 5,461t of neodymium-praseodymium oxide — the main input for NdFeB magnets — in the financial year ending 30 June.

Volkswagen secures EU supply chain

And GM isn’t the only car maker stepping up efforts to create home-grown battery supply chains.

Volkswagen has agreed to build a battery cathode plant with Belgium’s Umicore and signed a long-term supply agreement with Vulcan Energy (ASX:VUL) for lithium from Germany.

The German automaker said the JV would start producing enough material for 20 GWh of batteries in 2025, scaling up to 160 GWh by the end of the decade, which would supply about 2.2 million electric vehicles.

Benchmark Minerals Intelligence reckons battery raw materials prices show no sign of slowing down.

Cobalt prices are trading at a three-year high as battery demand starts to meaningfully take off, and automakers are facing up to China’s dominance in graphite, which is used in lithium ion battery anodes – and demand is set to rise by more than seven times this decade.

Battery recycling won’t take off before 2030

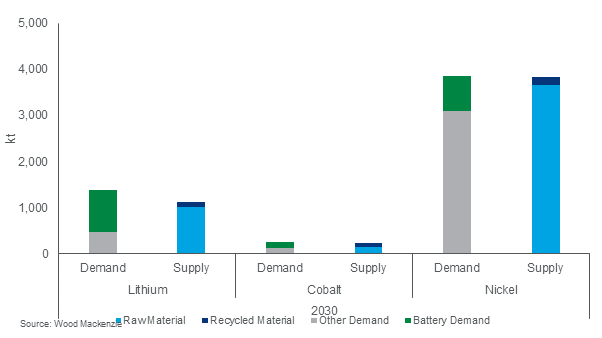

While production is kicking off, Wood Mackenzie reckons lithium-ion battery recycling isn’t going to take off before 2030.

“Underneath the surface of this electric future lies a relatively young supply chain struggling to keep up,” Wood Mackenzie research analyst Max Reid said.

“The Li-ion battery demand market can fluctuate over months and expanding upstream and midstream to produce battery materials involves lead times of several years.”

Currently, EV packs are complex to disassemble into individual cells, so recyclers are left to discharge packs in conductive baths before mechanically shredding them into a mix of constituent materials.

And new batteries cost less to produce – so there’s little incentive to recycling when the value of recovered material is reduced.

Then there’s the introduction of new materials, such as solid-state electrolytes, which will require recyclers to retrofit their processes.

Even though EV manufacturing is set to boom before 2030, the number of end-of-life (EoL) batteries available for recycling will remain limited for two main reasons: EV penetration at the beginning of the decade is much lower than at the end, and EVs have an increasingly long lifespan reaching up to 15 years.

Battery Metals Winners and Losers

Here’s how a basket of ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, and vanadium are performing>>>

Code Company Price % Week % Month % Six Month % Year Market Cap BKT Black Rock Mining 0.23 28 -2 35 167 $ 186,081,249.99 INR Ioneer Ltd 0.79 24 5 136 204 $ 1,384,120,169.33 VUL Vulcan Energy 11.91 19 16 45 407 $ 1,430,093,045.50 PAN Panoramic Resources 0.24 14 17 45 92 $ 481,964,790.94 AVZ AVZ Minerals Ltd 0.7 14 41 338 614 $ 1,942,057,617.20 RNU Renascor Res Ltd 0.125 14 -4 58 862 $ 217,192,008.40 MLX Metals X Limited 0.51 13 44 100 415 $ 462,705,694.17 ILU Iluka Resources 9.87 13 12 26 69 $ 3,986,566,061.64 HYM Hyperion Metals Ltd 0.94 13 -1 -12 292 $ 131,119,181.54 AZS Azure Minerals 0.36 13 -8 36 -52 $ 111,864,859.56 SYR Syrah Resources 1.265 12 0 19 25 $ 620,924,730.14 IXR Ionic Rare Earths 0.045 10 15 67 165 $ 149,265,578.62 TLG Talga Group Ltd 1.59 10 -21 12 -11 $ 457,056,778.50 PLS Pilbara Min Ltd 2.68 9 17 94 242 $ 7,735,194,422.80 GLN Galan Lithium Ltd 1.645 9 5 114 384 $ 454,160,020.77 FRS Forrestaniaresources 0.31 9 -25 $ 8,555,250.00 S2R S2 Resources 0.195 8 8 39 8 $ 65,929,348.18 LKE Lake Resources 0.865 8 -11 220 1069 $ 1,023,864,218.16 MIN Mineral Resources. 48.42 8 31 -1 39 $ 8,983,604,537.27 LEG Legend Mining 0.056 8 -3 -55 -49 $ 162,553,007.54 BSX Blackstone Ltd 0.59 7 1 64 51 $ 209,294,558.91 PEK Peak Resources 0.78 7 15 -40 11 $ 159,030,026.40 ARR American Rare Earths 0.165 6 -3 99 94 $ 64,410,407.16 BUX Buxton Resources Ltd 0.085 6 -10 -23 31 $ 10,884,434.56 MRD Mount Ridley Mines 0.0085 6 21 42 240 $ 45,132,273.50 AGY Argosy Minerals Ltd 0.265 6 -18 152 279 $ 322,963,586.60 PNN PepinNini Minerals 0.445 6 -33 59 178 $ 22,583,500.28 ESS Essential Metals Ltd 0.18 6 -14 80 114 $ 43,477,195.32 REE Rarex Limited 0.105 5 9 35 -13 $ 45,159,320.40 VR8 Vanadium Resources 0.065 5 -11 25 86 $ 28,386,742.44 PVW PVW Res Ltd 0.44 5 0 226 193 $ 31,865,062.50 LIT Lithium Australia NL 0.115 5 -23 5 72 $ 112,978,085.66 BEM Blackearth Minerals 0.115 5 -4 5 167 $ 25,000,455.71 PLL Piedmont Lithium Inc 0.835 4 -2 -9 142 $ 469,147,810.00 EUR European Lithium Ltd 0.12 4 -23 94 155 $ 124,254,635.12 LTR Liontown Resources 1.6275 4 -13 180 482 $ 3,582,425,274.20 GL1 Globallith 0.605 4 1 124 $ 65,248,287.60 MCR Mincor Resources NL 1.25 4 1 22 16 $ 583,638,568.80 OZL OZ Minerals 27.5 4 12 9 48 $ 9,012,020,820.73 COB Cobalt Blue Ltd 0.39 4 -5 8 225 $ 110,570,743.39 IPT Impact Minerals 0.0135 4 -4 -16 -33 $ 26,309,333.95 IGO IGO Limited 10.525 4 13 41 109 $ 8,027,038,817.80 IGO IGO Limited 10.525 4 13 41 109 $ 8,027,038,817.80 CHR Charger Metals 0.43 4 -4 $ 13,292,879.53 GSR Greenstone Resources 0.029 4 21 32 0 $ 22,598,203.29 PUR Pursuit Minerals 0.03 3 -12 -63 43 $ 25,299,375.73 CTM Centaurus Metals Ltd 1.05 3 0 52 72 $ 378,101,957.20 AZL Arizona Lithium Ltd 0.091 3 -13 203 810 $ 174,911,069.43 LPI Lithium Pwr Int Ltd 0.47 3 2 135 68 $ 155,202,582.36 MRC Mineral Commodities 0.1 3 -26 -52 -73 $ 53,499,063.40 INF Infinity Lithium 0.175 3 -15 94 30 $ 68,324,760.24 WKT Walkabout Resources 0.195 3 -7 5 34 $ 79,274,778.65 RBX Resource B 0.2 3 14 488 488 $ 8,588,730.78 BHP BHP Group Limited 41.095 2 15 -15 -3 $ 117,892,045,704.24 SYA Sayona Mining Ltd 0.1325 2 -12 98 1418 $ 951,899,380.88 CNB Carnaby Resource Ltd 0.285 2 -3 -16 -25 $ 31,879,071.99 BRB Breaker Res NL 0.31 2 -23 82 59 $ 99,381,483.35 SGQ St George Min Ltd 0.065 2 7 -24 -43 $ 38,297,410.91 AXE Archer Materials 1.15 0 -26 58 107 $ 277,275,271.84 EVR Ev Resources Ltd 0.057 0 30 128 97 $ 45,480,639.83 MLS Metals Australia 0.002 0 -20 0 33 $ 5,238,557.36 CNJ Conico Ltd 0.038 0 13 41 15 $ 38,008,165.21 AR3 Austrare 0.97 0 14 $ 75,732,948.09 AML Aeon Metals Ltd. 0.04 0 -18 -53 -70 $ 33,766,546.63 AJM Altura Mining Ltd 0.063161 0 0 0 0 $ 324,282,089.57 LML Lincoln Minerals 0.008 0 0 0 0 $ 4,599,869.49 TNG TNG Limited 0.078 0 -22 13 -9 $ 111,073,457.76 ATM Aneka Tambang 1.05 0 -5 5 5 $ 1,362,313.21 RXL Rox Resources 0.36 0 -1 -23 -52 $ 56,738,741.04 AUZ Australian Mines Ltd 0.021 0 -9 8 43 $ 86,071,182.28 AVL Aust Vanadium Ltd 0.029 0 26 32 107 $ 88,598,045.86 AAJ Aruma Resources Ltd 0.067 0 -21 6 -26 $ 8,565,382.20 VRC Volt Resources Ltd 0.027 0 -4 -23 145 $ 66,906,928.88 SBR Sabre Resources 0.005 0 0 0 -44 $ 8,446,568.25 JRL Jindalee Resources 2.26 0 -14 -18 176 $ 116,864,566.56 GBR Greatbould Resources 0.135 0 -4 44 194 $ 48,226,834.22 SRL Sunrise 1.79 0 -2 -10 -27 $ 160,303,024.62 LPD Lepidico Ltd 0.041 0 -23 215 356 $ 242,613,387.00 CAE Cannindah Resources 0.18 0 -36 161 500 $ 94,269,724.38 NWC New World Resources 0.075 0 -1 -25 42 $ 114,797,003.18 LOT Lotus Resources Ltd 0.31 0 -14 59 210 $ 310,804,510.72 CXO Core Lithium 0.525 0 -13 106 465 $ 834,422,424.00 PAM Pan Asia Metals 0.46 0 -1 217 254 $ 32,778,096.58 PSC Prospect Res Ltd 0.69 0 45 273 393 $ 291,396,003.80 VIA Viagold Rare Earth 2 0 0 2339 10426 $ 166,624,808.00 EGR Ecograf Limited 0.685 -1 15 6 291 $ 290,465,081.06 AKE Allkem Limited 9.08 -1 -1 35 131 $ 5,629,350,924.38 A8G Australasian Metals 0.43 -1 -37 161 $ 17,235,017.36 ARN Aldoro Resources 0.41 -1 -19 17 193 $ 36,587,821.49 ARN Aldoro Resources 0.41 -1 -19 17 193 $ 36,587,821.49 BNR Bulletin Res Ltd 0.081 -1 7 22 4 $ 21,094,375.85 ARU Arafura Resource Ltd 0.1875 -1 -20 7 63 $ 286,827,206.42 CHN Chalice Mining Ltd 8.91 -2 -9 1 105 $ 3,251,557,021.84 MAN Mandrake Res Ltd 0.047 -2 -20 -80 -49 $ 22,101,876.22 MNS Magnis Energy Tech 0.455 -2 -29 63 146 $ 436,675,507.65 ASN Anson Resources Ltd 0.1125 -2 -20 65 275 $ 117,460,917.20 POS Poseidon Nick Ltd 0.088 -2 1 17 31 $ 272,692,397.81 FGR First Graphene Ltd 0.22 -2 7 -10 -15 $ 115,567,407.06 BOA Boadicea Resources 0.2 -2 0 -31 -5 $ 15,151,479.53 MMC Mitremining 0.2 -2 -9 $ 5,417,020.00 BMM Balkanminingandmin 0.39 -3 -35 $ 12,117,500.00 EMH European Metals Hldg 1.335 -3 -10 -21 70 $ 173,022,313.45 CWX Carawine Resources 0.185 -3 -12 -24 -26 $ 26,541,863.99 VMC Venus Metals Cor Ltd 0.175 -3 -5 -15 -24 $ 25,683,376.11 QPM Queensland Pacific 0.175 -3 -20 6 430 $ 237,232,297.93 JRV Jervois Global Ltd 0.525 -3 -5 -9 50 $ 819,615,165.48 VML Vital Metals Limited 0.0515 -3 -8 -6 47 $ 212,439,637.28 TMT Technology Metals 0.31 -3 -14 -10 -11 $ 64,153,337.85 PRL Province Resources 0.145 -3 -17 4 936 $ 163,800,672.60 LYC Lynas Rare Earths 8.9 -4 15 63 122 $ 8,266,089,834.64 NTU Northern Min Ltd 0.052 -4 -9 49 44 $ 252,460,414.23 NIC Nickel Mines Limited 1.35 -4 33 28 30 $ 3,407,864,364.11 ADV Ardiden Ltd 0.011 -4 -15 10 -35 $ 23,686,688.92 NVA Nova Minerals Ltd 1.2 -4 -11 -23 -27 $ 217,143,753.43 GAL Galileo Mining Ltd 0.215 -4 5 -20 -12 $ 35,365,933.05 ARL Ardea Resources Ltd 0.5 -5 8 5 24 $ 68,026,807.31 QXR Qx Resources Limited 0.02 -5 -26 33 43 $ 14,245,608.74 EFE Eastern Iron 0.059 -5 11 354 532 $ 54,778,899.04 HXG Hexagon Energy 0.076 -5 -31 -11 13 $ 33,897,050.85 GME GME Resources Ltd 0.054 -5 -27 -11 4 $ 32,075,501.15 QEM QEM Limited 0.18 -5 -12 -3 137 $ 21,550,433.27 STK Strickland Metals 0.066 -6 -13 78 57 $ 83,854,365.43 SLZ Sultan Resources Ltd 0.16 -6 -3 -38 -32 $ 11,125,502.24 NMT Neometals Ltd 1.1 -6 5 117 415 $ 573,053,333.82 NMT Neometals Ltd 1.1 -6 5 117 415 $ 573,053,333.82 HAS Hastings Tech Met 0.235 -6 -6 47 57 $ 425,925,643.68 MOH Moho Resources 0.059 -6 -2 -21 -41 $ 7,420,748.72 LEL Lithenergy 0.75 -7 -27 95 $ 32,850,000.00 MQR Marquee Resource Ltd 0.135 -7 0 133 93 $ 23,674,486.73 RFR Rafaella Resources 0.06 -8 -27 -34 -12 $ 12,207,514.75 TKL Traka Resources 0.012 -8 -8 -29 -48 $ 7,465,294.73 GED Golden Deeps 0.012 -8 0 0 -14 $ 10,086,068.72 HNR Hannans Ltd 0.035 -8 -17 406 445 $ 93,825,773.14 NKL Nickelxltd 0.11 -8 -15 -35 $ 6,088,500.00 CZN Corazon Ltd 0.032 -9 -16 -14 -47 $ 9,122,162.14 AOU Auroch Minerals Ltd 0.105 -9 -30 -42 -25 $ 37,104,887.09 RLC Reedy Lagoon Corp. 0.031 -9 -30 72 158 $ 16,980,474.13 ALY Alchemy Resource Ltd 0.01 -9 -23 -27 -40 $ 9,523,448.90 DEV Devex Resources Ltd 0.545 -9 36 31 148 $ 169,659,343.26 RMX Red Mount Min Ltd 0.009 -10 -18 -14 -25 $ 13,180,124.72 AQD Ausquest Limited 0.017 -11 13 -23 -6 $ 14,834,686.01 PGM Platina Resources 0.051 -12 -20 -31 19 $ 23,022,264.13 FFX Firefinch Ltd 0.71 -12 10 67 373 $ 775,296,263.34 G88 Golden Mile Res Ltd 0.049 -13 -4 -20 0 $ 8,550,916.40 CLA Celsius Resource Ltd 0.021 -13 -19 -45 -52 $ 21,079,561.62 TON Triton Min Ltd 0.034 -13 -21 -11 -32 $ 42,253,865.60 GW1 Greenwing Resources 0.4075 -16 -1 36 81 $ 47,267,593.20 ADD Adavale Resource Ltd 0.036 -16 -35 -60 -29 $ 12,285,670.57 WR1 Winsome Resources 0.3 -18 $ 43,027,198.08 MRR Minrex Resources Ltd 0.037 -20 68 68 76 $ 21,622,321.04 ESR Estrella Res Ltd 0.024 -20 -29 -58 -80 $ 29,426,093.50 SRI Sipa Resources Ltd 0.041 -21 -23 -25 -39 $ 8,611,041.73

Only 59 of the 152 ASX battery metals stocks on our list posted gains last week.

Over the past year 56 stocks have posted a gain of 100% or more.

And three of them –Sayona (ASX:SYA) , Lake (ASX:LKE) and ViaGold (ASX:VIA) – have posted a gain of 1000% or higher.

In fact ViaGold is up a ridiculous 10,426% this year.

The company, which acts as an investment holding company with some subsidiaries in rare earth refining and separation, recently released its half-year report for the year ended 31 September 2021.

Viagold said its rare earth refining and separation segment bounced back in the second quarter of 2021, recording an upsurge of revenue of $10,217,000 – compared to $5,041,000 in 2020.

Black Rock Mining (ASX:BKT)

The company could be one of the players to enjoy unprecedented graphite demand, with the Mahenge graphite project in Tanzania under its belt.

And it’s one of the top movers this week, up 28% and 167% year-to-date.

BKT has just completed the operation of a large-scale qualification plant campaign, which processed 500 tonnes of bulk graphite.

The plant in Shandong province, China, commenced operations in August 2021 with ore parcel samples processed composited from 18 locations across the entire strike length of the Ulanzi orebody at Mahenge.

“The positive outcomes from this large-scale qualification plant campaign effectively provide a robust platform for our strong customer base to now base their decisions to confidently partner with Black Rock for the long-term,” MD and CEO, John de Vries said.

“This in turn provides confidence to financiers that the robust economics of the project are supported through a clear path to market.”

Ioneer (ASX:INR)

Despite some potentially sticky environmental issues, the North American lithium developer has hit several key milestones at its ‘Rhyolite Ridge’ project in 2021 – including signing binding offtakes and selling 50% of the project for $US460m to help fund development.

The company is now focussed on US offtake, a US listing, the remainder of project financing, and all-important development permits.

“We anticipate finalising our final lithium off-take contracts by the end of Q1, calendar year 2022,” exec chairman James Calaway said early November.

“[And] with the equity in place, we are now confident that prior to FID we will be able to secure favourable project debt.”

INR says it is on track to be construction ready by Q4 next year.

The $1.58bn market cap stock is up 24% over the past week and 204% year-to-date.

Vulcan Energy (ASX:VUL)

The company has acquired an operational geothermal renewable energy power plant in the Upper Rhine Valley at Insheim, Germany through the acquisition of shares in the entity that owns and operates the plant.

A new Germany subsidiary of Vulcan, based in Karlsruhe, will be the owner and operator of the €31.5 million operation which was purchased by a portion of the proceeds from VUL’s recent $200m capital raise.

The company says the acquisition establishes it as an operational renewable energy business and plans are in place to formally take over the plant from January 1, 2022.

“German State and Federal policy increasingly supports decarbonising heating and power grids, with a focus on decentralised, renewable energy and Vulcan intends to build a number of distributed geothermal renewable energy plants across the Upper Rhine Valley region,” managing director Dr Francis Wedin said.

The company is up 19% this week and a whopping 407% for the year-to-date.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.