High Voltage: Lithium prices beaten up but analysts eye strong, long game

Pic via Getty Images

- Yes, we know, Goldman Sachs – ‘spot’ lithium prices are in the toilet. But let’s zoom out

- RFC Ambrian has done just that with its latest analysis. And there are positive takeaways

- Weekly ASX battery metal gainers led by: RGL, VHM, EMN

Our High Voltage column wraps the news driving ASX stocks with exposure to lithium, graphite, cobalt, nickel, rare earths, manganese, magnesium, and vanadium

At the risk of sounding like a broken record here, the broad update on the most news-hogging of battery metals (that’d be lithium) is as follows:

‘Spot prices’ are still tanking amid a supply glut and slowed demand this year… and yet, a strong long-term future for lithium and other battery metals still appears to be the consensus.

There’s no denying how ugly these two charts look right now, though…

2023-11-29#Lithium Carbonate 99.5% Min China Spot

Price: $18,480.00

1 day: $210.00 (-1.12%) 📉

YTD: -74.92%#Spodumene Concentrate (6%, CIF China)Price: $1,800.00

1 day: -40 (-2.17%) 📉

YTD: -69.10%Sponsored by @SiennaResources $SIE $SNNAFhttps://t.co/BEpSjDtUL7

— Lithium Price Bot (@LithiumPriceBot) November 29, 2023

Led by Goldman Sachs, bearish outlooks for lithium prices have been dominating the battery metal’s headlines just lately.

Lithium carbonate and spodumene pricing has been on a continuous slide for about a month, with further gloomy forecasting ahead in the near term for the limelight-hogging electric vehicle battery metal.

Per Josh’s Ground Breakers column from the other day:

In a note on Monday, Chinese industry monitor MySteel moved in lockstep with lithium persona non grata Goldman Sachs, predicting [spodumene] prices would head below US$1400/t in 2024.

Ouch.

And yet, as this column is wont to tell you, it’s the opposite of doom and gloom on a zoomed-out lens according to leading analysts. As a bloke called Axl once said, “all we need, is just a little patience…”

The crystal ball reckons… hang in there

One such group of leading analysts is RFC Ambrian – a global investment advisor – and it’s just put out a detailed report on how it views, through a worldwide mining-sector lens, the lithium market now and into the future.

The group based their analysis and benchmarking on 69 global projects, including eight new mines to come onstream this year.

Some key takeaways…

• “We expect the consolidation of the lithium industry to continue as the larger producers look to acquire the better-quality projects, oil and gas companies seek energy transition opportunities, and junior companies merge to attain critical mass and potential synergies.”

• The report predicts that there will eventually be a supply deficit to demand longer term – by 2030, for example – and that it’s a positive for the mining industry.

• But… that supply deficit “may not be as large as currently indicated by consensus because the pace of new supply is picking up. Nevertheless, the mine supply pipeline beyond 2030 still has plenty of scope for longer-term capacity but will require further encouragement and financing of early-stage exploration projects.”

• “Demand growth is expected to continue with strong forecasts for the next two decades” amid the expected pick-up in electric vehicle uptake globally.

• “The strong long-term demand outlook, recent higher prices, and government support for the lithium supply chain is also driving strong interest and activity in mergers, acquisitions, and consolidation of the lithium industry.”

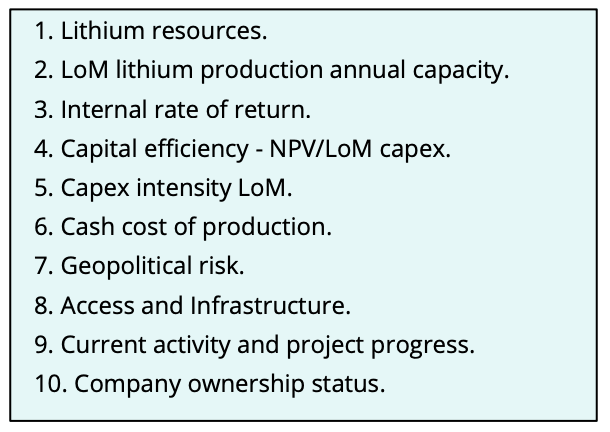

LTR’s Kathleen Valley gets a top 5 project nod

The top five ranked projects in RFC Ambrian’s analysis were:

Grota do Cirilo (Brazil) – Sigma Lithium

Bonnie Claire (USA) – Nevada Lithium

Kathleen Valley (Australia, WA) – Liontown Resources (ASX:LTR)

Zeus (USA) – Noram Lithium

TLC (USA) – American Lithium

Here’s the full list of the analyst’s “high profile” lithium projects category, ranked on the following factors…

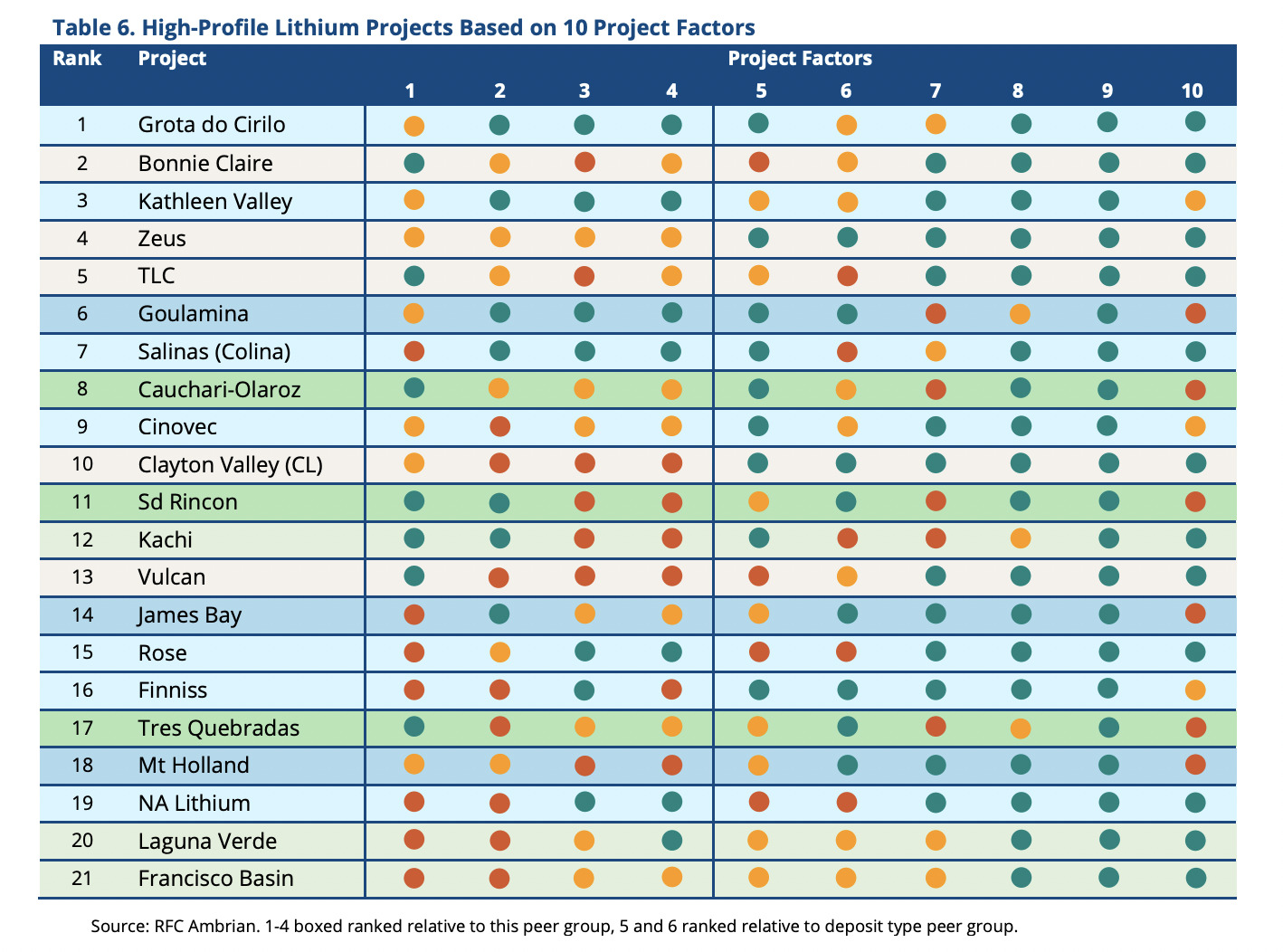

The report is seriously table and graph-tastic, but here’s another that caught our eyes and is worth a look from an ASX-stock-focused bent…

It’s 15 of the companies it classifies as high profile, ranked by Enterprise Value (EV) – not to be confused with the other EV central to this whole narrative, of course!

“The table shows the market capitalisation and Enterprise Value (EV) of these companies and a crude comparative valuation based on EV/t LCE resources, and EV/NPV of the projects.”

What’s hot, what’s not this week?

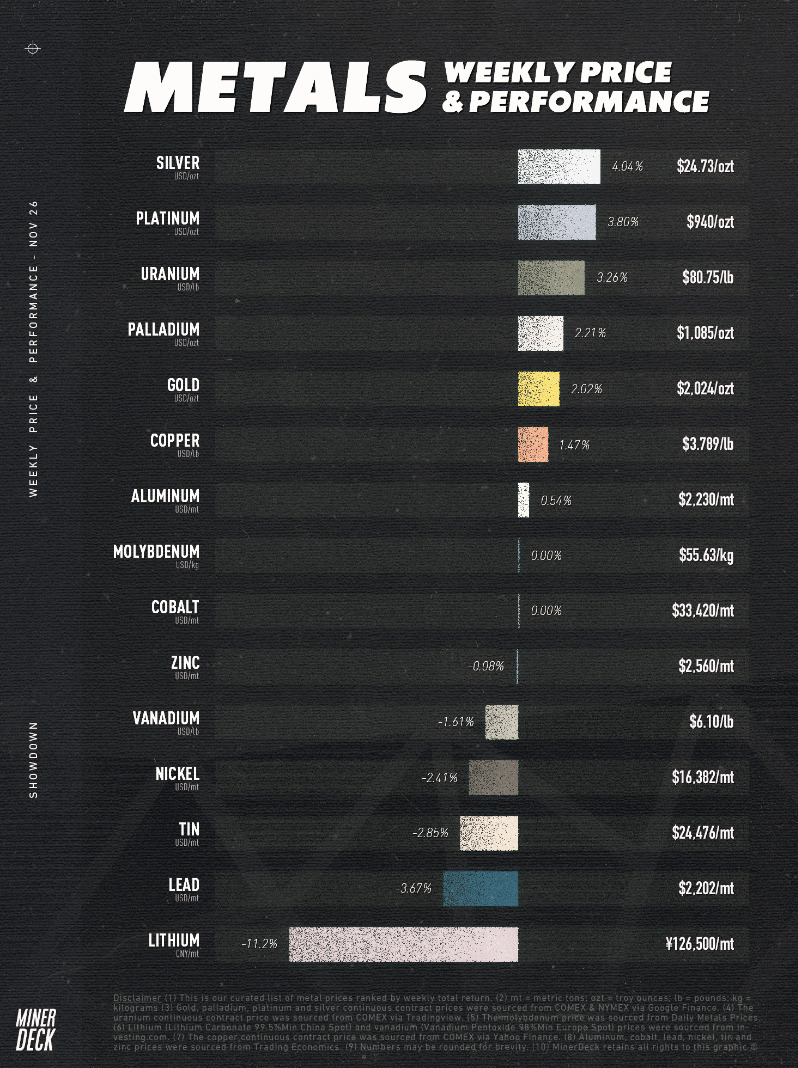

Battery metals weekly gains and falls, circa ASX closing bell, November 29.

Charged up

Riversgold (ASX:RGL) +55%

VHM (ASX:VHM) +36%

Euro Manganese (ASX:EMN) +33% (See Wednesday’s Resources Top 4)

Westar Resources (ASX:WSR) +26%

Low on juice

Ardiden (ASX:ADV) -30%

Arizona Lithium (ASX:AZL) -24%

GreenTech Metals (ASX:GRE) -24%

Zenith Minerals (ASX:ZNC) -21%

Battery metals form guide

Here’s a snapshot of ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, magnesium, manganese, and vanadium are performing lately>>>

Battery metals stocks missing from our list? Shoot a mail to [email protected]

(Note: table’s data accurate as of roughly 5pm, Nov 29.)

| Code | Company | Price | % Week | % Month | % Year | % YTD | Market Cap |

|---|---|---|---|---|---|---|---|

| PVW | PVW Res Ltd | 0.049 | -11% | -14% | -57% | -5% | $4,968,834 |

| A8G | Australasian Metals | 0.175 | 3% | 6% | -30% | -2% | $9,121,086 |

| INF | Infinity Lithium | 0.105 | -9% | 24% | -42% | -2% | $46,259,209 |

| LPI | Lithium Pwr Int Ltd | 0.545 | 2% | 3% | 7% | 11% | $344,270,646 |

| PSC | Prospect Res Ltd | 0.089 | -6% | 0% | -46% | -3% | $45,869,864 |

| PAM | Pan Asia Metals | 0.155 | 3% | 3% | -66% | -26% | $25,888,322 |

| CXO | Core Lithium | 0.29 | -22% | -18% | -78% | -74% | $673,134,696 |

| LOT | Lotus Resources Ltd | 0.3 | -2% | 30% | 50% | 10% | $482,868,651 |

| AGY | Argosy Minerals Ltd | 0.185 | 12% | 9% | -67% | -39% | $280,881,500 |

| AZS | Azure Minerals | 3.95 | -4% | 13% | 1363% | 373% | $1,816,371,117 |

| NWC | New World Resources | 0.039 | 3% | 39% | 5% | 1% | $90,469,682 |

| QXR | Qx Resources Limited | 0.026 | -13% | 13% | -52% | -2% | $30,960,380 |

| GSR | Greenstone Resources | 0.009 | 13% | 13% | -65% | -2% | $10,944,908 |

| CAE | Cannindah Resources | 0.093 | -2% | 2% | -60% | -15% | $53,761,436 |

| AZL | Arizona Lithium Ltd | 0.038 | -24% | 153% | -48% | -2% | $137,125,091 |

| HNR | Hannans Ltd | 0.007 | 0% | -13% | -67% | -1% | $21,846,838 |

| COB | Cobalt Blue Ltd | 0.285 | 4% | 14% | -55% | -30% | $106,983,896 |

| LPD | Lepidico Ltd | 0.008 | -11% | 0% | -50% | -1% | $61,106,464 |

| MRD | Mount Ridley Mines | 0.002 | 0% | 0% | -60% | 0% | $15,569,766 |

| CZN | Corazon Ltd | 0.018 | -5% | 20% | 9% | 0% | $11,080,762 |

| LKE | Lake Resources | 0.14 | -13% | -18% | -85% | -66% | $213,366,706 |

| DEV | Devex Resources Ltd | 0.25 | -4% | -14% | -17% | -3% | $110,297,668 |

| INR | Ioneer Ltd | 0.17 | 6% | 17% | -68% | -21% | $380,054,186 |

| AVZ | AVZ Minerals Ltd | 0.78 | 0% | 0% | 0% | 0% | $2,752,409,203 |

| MAN | Mandrake Res Ltd | 0.039 | 5% | 11% | -5% | 0% | $25,861,917 |

| RLC | Reedy Lagoon Corp. | 0.007 | 0% | 75% | -40% | 0% | $4,316,785 |

| GBR | Greatbould Resources | 0.064 | 10% | 0% | -25% | -3% | $28,939,569 |

| FRS | Forrestaniaresources | 0.031 | 15% | 3% | -81% | -11% | $4,530,001 |

| STK | Strickland Metals | 0.18 | 9% | 80% | 329% | 14% | $293,175,022 |

| MLX | Metals X Limited | 0.265 | -7% | -7% | 6% | -12% | $240,425,508 |

| CLA | Celsius Resource Ltd | 0.014 | 17% | 27% | -18% | 0% | $24,706,568 |

| FGR | First Graphene Ltd | 0.067 | -4% | -13% | -46% | -5% | $39,873,411 |

| HXG | Hexagon Energy | 0.01 | 11% | 25% | -41% | -1% | $5,129,159 |

| TLG | Talga Group Ltd | 0.99 | -11% | -10% | -31% | -41% | $360,754,172 |

| MNS | Magnis Energy Tech | 0.054 | -8% | -27% | -85% | -32% | $69,570,893 |

| PLL | Piedmont Lithium Inc | 0.4 | -10% | -11% | -51% | -25% | $147,054,720 |

| EUR | European Lithium Ltd | 0.076 | -7% | 10% | -10% | 0% | $111,539,134 |

| BKT | Black Rock Mining | 0.094 | -6% | -15% | -39% | -4% | $105,342,686 |

| QEM | QEM Limited | 0.18 | -5% | -5% | 3% | 0% | $28,764,425 |

| LYC | Lynas Rare Earths | 6.62 | -4% | -7% | -21% | -123% | $6,168,982,618 |

| ESR | Estrella Res Ltd | 0.006 | 20% | 0% | -50% | -1% | $10,554,431 |

| ARL | Ardea Resources Ltd | 0.46 | -3% | -13% | -53% | -25% | $86,624,552 |

| GLN | Galan Lithium Ltd | 0.615 | -15% | -6% | -54% | -46% | $211,933,368 |

| JRL | Jindalee Resources | 1.015 | -6% | -25% | -53% | -87% | $57,299,361 |

| VUL | Vulcan Energy | 2.69 | 5% | 21% | -62% | -364% | $426,741,060 |

| SBR | Sabre Resources | 0.036 | -18% | -25% | -10% | 0% | $13,759,373 |

| CHN | Chalice Mining Ltd | 1.49 | -6% | -19% | -71% | -481% | $583,444,956 |

| VRC | Volt Resources Ltd | 0.007 | 17% | -7% | -56% | -1% | $28,910,747 |

| NMT | Neometals Ltd | 0.2 | -18% | -35% | -79% | -58% | $130,329,175 |

| AXN | Alliance Nickel Ltd | 0.052 | -5% | -15% | -43% | -4% | $39,921,179 |

| PNN | Power Minerals Ltd | 0.24 | -4% | 0% | -58% | -29% | $21,804,328 |

| IGO | IGO Limited | 8.53 | -7% | -20% | -41% | -493% | $6,376,194,985 |

| GED | Golden Deeps | 0.052 | 0% | 4% | -48% | -4% | $6,122,684 |

| ADVDB | Ardiden Ltd | 0.18 | -30% | -16% | -53% | -12% | $13,128,676 |

| SRI | Sipa Resources Ltd | 0.025 | 25% | 4% | -38% | -1% | $5,703,953 |

| NTU | Northern Min Ltd | 0.035 | 21% | 13% | -17% | -1% | $212,795,253 |

| AXE | Archer Materials | 0.395 | -5% | -7% | -40% | -22% | $104,487,275 |

| PGM | Platina Resources | 0.0245 | -13% | 7% | 23% | 1% | $15,579,508 |

| AAJ | Aruma Resources Ltd | 0.033 | -6% | -3% | -56% | -2% | $6,300,528 |

| IXR | Ionic Rare Earths | 0.02 | -13% | 0% | -47% | -1% | $84,360,194 |

| NIC | Nickel Industries | 0.72 | -11% | -8% | -23% | -25% | $3,064,354,064 |

| EVG | Evion Group NL | 0.033 | -6% | -18% | -63% | -4% | $11,416,653 |

| CWX | Carawine Resources | 0.11 | 5% | -7% | 23% | 1% | $25,973,799 |

| PLS | Pilbara Min Ltd | 3.56 | -3% | -9% | -19% | -19% | $10,773,876,323 |

| HAS | Hastings Tech Met | 0.685 | -11% | -11% | -81% | -284% | $90,556,656 |

| BUX | Buxton Resources Ltd | 0.185 | -8% | -14% | 89% | 7% | $33,636,894 |

| ARR | American Rare Earths | 0.17 | 10% | 21% | -15% | -2% | $75,891,961 |

| SGQ | St George Min Ltd | 0.033 | -6% | -20% | -57% | -4% | $33,458,943 |

| TKL | Traka Resources | 0.004 | 0% | -20% | -33% | 0% | $3,501,317 |

| PAN | Panoramic Resources | 0.035 | 0% | -3% | -79% | -14% | $103,937,992 |

| PRL | Province Resources | 0.041 | 0% | 0% | -38% | -2% | $48,441,219 |

| IPT | Impact Minerals | 0.0105 | -5% | 17% | 5% | 0% | $28,647,039 |

| LIT | Lithium Australia | 0.03 | -6% | -3% | -40% | -2% | $37,887,942 |

| AKE | Allkem Limited | 8.5 | -9% | -16% | -35% | -274% | $5,389,478,500 |

| ARN | Aldoro Resources | 0.083 | -2% | -16% | -75% | -8% | $11,308,394 |

| JRV | Jervois Global Ltd | 0.038 | -21% | 27% | -89% | -23% | $108,100,827 |

| MCR | Mincor Resources NL | 0 | -100% | -100% | -100% | -151% | $751,215,521 |

| SYR | Syrah Resources | 0.64 | -9% | -9% | -72% | -142% | $439,333,525 |

| FBM | Future Battery | 0.072 | -9% | -28% | 29% | 2% | $39,262,761 |

| ADD | Adavale Resource Ltd | 0.009 | 13% | 13% | -68% | -1% | $6,208,139 |

| LTR | Liontown Resources | 1.345 | -12% | -20% | -27% | 3% | $3,285,526,258 |

| CTM | Centaurus Metals Ltd | 0.475 | -9% | -2% | -57% | -65% | $240,005,952 |

| VML | Vital Metals Limited | 0.01 | 0% | 0% | -63% | -1% | $53,061,498 |

| BSX | Blackstone Ltd | 0.092 | -1% | -12% | -43% | -4% | $43,579,380 |

| POS | Poseidon Nick Ltd | 0.017 | 0% | 13% | -59% | -2% | $59,330,842 |

| CHR | Charger Metals | 0.265 | -4% | 47% | -51% | -18% | $15,218,020 |

| AVL | Aust Vanadium Ltd | 0.022 | -4% | -15% | -15% | 0% | $109,309,349 |

| AUZ | Australian Mines Ltd | 0.013 | -13% | 8% | -78% | -4% | $9,809,604 |

| TMT | Technology Metals | 0.22 | -2% | -8% | -38% | -13% | $57,214,346 |

| RXL | Rox Resources | 0.19 | -7% | -16% | 12% | 2% | $68,406,091 |

| RNU | Renascor Res Ltd | 0.15 | 0% | -6% | -52% | -7% | $368,214,087 |

| GL1 | Globallith | 1.32 | 4% | 6% | -43% | -53% | $345,857,455 |

| ASN | Anson Resources Ltd | 0.145 | -6% | -9% | -36% | -4% | $186,432,180 |

| SYA | Sayona Mining Ltd | 0.065 | -16% | -21% | -68% | -13% | $689,650,833 |

| FFX | Firefinch Ltd | 0.2 | 0% | 0% | 0% | 0% | $236,569,315 |

| EGR | Ecograf Limited | 0.175 | -13% | 0% | -43% | -5% | $77,185,409 |

| ATM | Aneka Tambang | 1.18 | 0% | 0% | 12% | 28% | $1,538,306 |

| TVN | Tivan Limited | 0.075 | 3% | 12% | -21% | 0% | $125,773,413 |

| ALY | Alchemy Resource Ltd | 0.01 | 0% | -9% | -63% | -1% | $11,780,763 |

| GAL | Galileo Mining Ltd | 0.28 | 0% | -16% | -72% | -60% | $55,334,980 |

| BHP | BHP Group Limited | 46.19 | -3% | 3% | 5% | 56% | $235,341,588,310 |

| LEL | Lithenergy | 0.6025 | 10% | -10% | -33% | -17% | $57,685,600 |

| MMC | Mitremining | 0.205 | -16% | -11% | -11% | -8% | $9,296,771 |

| RMX | Red Mount Min Ltd | 0.004 | 0% | 0% | -11% | 0% | $10,694,304 |

| GW1 | Greenwing Resources | 0.11 | -19% | -21% | -69% | -17% | $18,296,406 |

| LML | Lincoln Minerals | 0.006 | -14% | -33% | -12% | 0% | $10,163,072 |

| 1MC | Morella Corporation | 0.006 | -14% | 9% | -65% | -1% | $36,981,556 |

| REE | Rarex Limited | 0.028 | -10% | -15% | -40% | -3% | $19,818,211 |

| MRC | Mineral Commodities | 0.03 | 0% | -16% | -56% | -3% | $25,809,186 |

| PUR | Pursuit Minerals | 0.009 | -5% | -10% | -18% | -1% | $26,495,743 |

| QPM | Queensland Pacific | 0.054 | -5% | -8% | -57% | -6% | $108,677,177 |

| EMH | European Metals Hldg | 0.59 | -5% | -6% | -21% | -5% | $79,296,075 |

| BMM | Balkanminingandmin | 0.14 | -10% | 4% | -53% | -19% | $9,977,040 |

| PEK | Peak Rare Earths Ltd | 0.375 | 0% | -9% | -20% | -8% | $97,917,342 |

| LEG | Legend Mining | 0.019 | -10% | -17% | -47% | -2% | $49,376,112 |

| MOH | Moho Resources | 0.01 | 25% | 43% | -60% | -1% | $5,100,666 |

| AML | Aeon Metals Ltd. | 0.012 | 33% | 0% | -60% | -2% | $12,060,407 |

| G88 | Golden Mile Res Ltd | 0.023 | -4% | 15% | 3% | 0% | $6,587,790 |

| WKT | Walkabout Resources | 0.14 | -3% | 12% | -19% | 0% | $95,264,603 |

| TON | Triton Min Ltd | 0.023 | -8% | -12% | -18% | -1% | $35,911,271 |

| AR3 | Austrare | 0.155 | -21% | -18% | -52% | -25% | $24,666,554 |

| ARU | Arafura Rare Earths | 0.225 | 15% | 7% | -44% | -24% | $422,672,938 |

| MIN | Mineral Resources. | 61.23 | -7% | 1% | -25% | -1597% | $12,019,580,236 |

| VMC | Venus Metals Cor Ltd | 0.11 | 22% | 10% | 26% | 3% | $20,870,155 |

| S2R | S2 Resources | 0.17 | 3% | -11% | 13% | 0% | $71,766,016 |

| CNJ | Conico Ltd | 0.005 | 25% | 0% | -50% | 0% | $7,850,475 |

| VR8 | Vanadium Resources | 0.045 | 7% | 10% | -20% | -1% | $24,756,104 |

| PVT | Pivotal Metals Ltd | 0.017 | 6% | -11% | -54% | -3% | $9,313,761 |

| BOA | Boadicea Resources | 0.039 | -3% | -7% | -59% | -6% | $5,415,973 |

| IPX | Iperionx Limited | 1.35 | -6% | 8% | 85% | 66% | $290,896,390 |

| SLZ | Sultan Resources Ltd | 0.016 | 0% | -11% | -82% | -7% | $2,371,041 |

| NKL | Nickelxltd | 0.06 | 0% | 3% | -40% | -2% | $5,093,280 |

| NVA | Nova Minerals Ltd | 0.26 | 2% | 2% | -63% | -42% | $53,776,940 |

| MLS | Metals Australia | 0.037 | 0% | 12% | -18% | -1% | $22,465,303 |

| MQR | Marquee Resource Ltd | 0.029 | -3% | 12% | -47% | -1% | $11,988,147 |

| MRR | Minrex Resources Ltd | 0.019 | -10% | 36% | -54% | -1% | $19,527,615 |

| EVR | Ev Resources Ltd | 0.01 | -13% | -9% | -50% | 0% | $9,545,883 |

| EFE | Eastern Resources | 0.01 | -9% | 25% | -76% | -2% | $12,419,465 |

| CNB | Carnaby Resource Ltd | 0.665 | 8% | -8% | -21% | -27% | $97,707,802 |

| BNR | Bulletin Res Ltd | 0.175 | 6% | 3% | 52% | 8% | $52,846,398 |

| AX8 | Accelerate Resources | 0.05 | -17% | 22% | 72% | 3% | $27,376,127 |

| AM7 | Arcadia Minerals | 0.085 | -6% | -6% | -69% | -12% | $9,269,259 |

| AS2 | Askarimetalslimited | 0.185 | -3% | 9% | -55% | -25% | $14,309,789 |

| BYH | Bryah Resources Ltd | 0.014 | -18% | 0% | -43% | -1% | $6,065,602 |

| DTM | Dart Mining NL | 0.017 | -6% | -6% | -75% | -4% | $3,641,274 |

| EMS | Eastern Metals | 0.032 | -20% | 3% | -66% | -4% | $2,637,640 |

| FG1 | Flynngold | 0.081 | -5% | 25% | -35% | -2% | $11,456,137 |

| GSM | Golden State Mining | 0.018 | -5% | -10% | -67% | -3% | $4,299,485 |

| IMI | Infinitymining | 0.13 | -7% | 8% | -61% | -15% | $9,732,465 |

| LRV | Larvottoresources | 0.1 | 8% | 14% | -33% | -4% | $6,501,379 |

| LSR | Lodestar Minerals | 0.004 | 0% | -20% | -20% | 0% | $9,105,288 |

| RAG | Ragnar Metals Ltd | 0.023 | 0% | 0% | 34% | 1% | $10,901,562 |

| CTN | Catalina Resources | 0.004 | 14% | 0% | -58% | -1% | $4,953,948 |

| TMB | Tambourahmetals | 0.15 | 7% | 25% | 0% | 5% | $12,441,053 |

| TEM | Tempest Minerals | 0.009 | 0% | 50% | -68% | -1% | $4,602,451 |

| EMC | Everest Metals Corp | 0.085 | -8% | -15% | 70% | 1% | $13,715,781 |

| WML | Woomera Mining Ltd | 0.026 | -4% | 189% | 86% | 1% | $27,454,975 |

| KZR | Kalamazoo Resources | 0.11 | -8% | 17% | -51% | -10% | $21,421,184 |

| LMG | Latrobe Magnesium | 0.058 | -17% | 35% | -24% | -2% | $107,749,281 |

| KOR | Korab Resources | 0.017 | -6% | 6% | -37% | -1% | $6,606,900 |

| CMX | Chemxmaterials | 0.073 | -4% | 0% | -59% | -11% | $3,832,744 |

| NC1 | Nicoresourceslimited | 0.305 | -9% | 2% | -59% | -31% | $31,950,173 |

| GRE | Greentechmetals | 0.52 | -24% | 30% | 259% | 38% | $35,139,600 |

| CMO | Cosmometalslimited | 0.049 | 0% | -2% | -65% | -9% | $1,700,137 |

| FRB | Firebird Metals | 0.155 | -3% | 3% | -16% | 0% | $14,293,325 |

| S32 | South32 Limited | 3.06 | -6% | -8% | -23% | -94% | $14,040,701,561 |

| OMH | OM Holdings Limited | 0.465 | 0% | 6% | -37% | -23% | $343,459,852 |

| JMS | Jupiter Mines. | 0.175 | 3% | -8% | -8% | -5% | $333,028,476 |

| E25 | Element 25 Ltd | 0.555 | 18% | 42% | -49% | -33% | $108,765,168 |

| EMN | Euromanganese | 0.14 | 33% | 17% | -60% | -22% | $24,581,548 |

| KGD | Kula Gold Limited | 0.033 | -11% | 144% | -6% | 1% | $12,161,607 |

| LRS | Latin Resources Ltd | 0.19 | -10% | -25% | 58% | 9% | $485,188,585 |

| CRR | Critical Resources | 0.024 | -17% | -14% | -58% | -2% | $44,446,257 |

| ENT | Enterprise Metals | 0.003 | -25% | -25% | -67% | -1% | $2,398,413 |

| SCN | Scorpion Minerals | 0.045 | -13% | -22% | -39% | -3% | $18,301,779 |

| GCM | Green Critical Min | 0.01 | 11% | 25% | -38% | -1% | $11,365,850 |

| ENV | Enova Mining Limited | 0.009 | 0% | 29% | -18% | -1% | $5,768,364 |

| RBX | Resource B | 0.084 | 2% | -27% | -5% | 0% | $6,945,497 |

| AKN | Auking Mining Ltd | 0.06 | 3% | 62% | -36% | -4% | $13,130,161 |

| RR1 | Reach Resources Ltd | 0.0055 | -8% | -54% | 22% | 0% | $16,051,486 |

| EMT | Emetals Limited | 0.008 | 0% | 14% | -38% | 0% | $6,800,000 |

| PNT | Panthermetalsltd | 0.057 | -17% | -24% | -67% | -13% | $3,485,550 |

| WIN | Widgienickellimited | 0.135 | -10% | -25% | -73% | -20% | $40,222,582 |

| WMG | Western Mines | 0.215 | -17% | -26% | 72% | 6% | $15,031,473 |

| AVW | Avira Resources Ltd | 0.0015 | -25% | 0% | -50% | 0% | $3,200,685 |

| CAI | Calidus Resources | 0.19 | 6% | -3% | -46% | -8% | $109,842,661 |

| GT1 | Greentechnology | 0.335 | -15% | -16% | -64% | -49% | $99,412,485 |

| KAI | Kairos Minerals Ltd | 0.016 | -6% | -20% | -39% | 0% | $41,934,595 |

| MTM | MTM Critical Metals | 0.028 | 4% | 27% | -75% | -5% | $2,880,775 |

| NWM | Norwest Minerals | 0.03 | -9% | -17% | -42% | -2% | $8,627,085 |

| PGD | Peregrine Gold | 0.305 | 9% | 13% | -34% | -8% | $17,587,976 |

| RAS | Ragusa Minerals Ltd | 0.042 | -16% | 5% | -68% | -7% | $5,989,149 |

| RGL | Riversgold | 0.017 | 55% | 42% | -51% | -1% | $16,171,445 |

| SRZ | Stellar Resources | 0.008 | -11% | 0% | -38% | -1% | $9,334,585 |

| STM | Sunstone Metals Ltd | 0.017 | 6% | 6% | -54% | -2% | $49,311,758 |

| ZNC | Zenith Minerals Ltd | 0.13 | -21% | 46% | -60% | -14% | $52,857,132 |

| WC8 | Wildcat Resources | 0.775 | -13% | 0% | 2572% | 75% | $1,003,718,486 |

| ASO | Aston Minerals Ltd | 0.03 | -9% | -6% | -63% | -5% | $41,442,057 |

| THR | Thor Energy PLC | 0.028 | -7% | 4% | -69% | -3% | $5,594,769 |

| YAR | Yari Minerals Ltd | 0.014 | 0% | -18% | -30% | 0% | $7,717,725 |

| IG6 | Internationalgraphit | 0.17 | -6% | 0% | -42% | -10% | $16,017,860 |

| LPM | Lithium Plus | 0.425 | -8% | -13% | -24% | 6% | $34,825,221 |

| ODE | Odessa Minerals Ltd | 0.008 | -11% | 14% | -43% | -1% | $7,576,895 |

| KOB | Kobaresourceslimited | 0.077 | -4% | 13% | -52% | -6% | $8,117,083 |

| AZI | Altamin Limited | 0.053 | 4% | -9% | -43% | -3% | $20,760,988 |

| FTL | Firetail Resources | 0.09 | -4% | -14% | -51% | -7% | $13,401,500 |

| CLZ | Classic Min Ltd | 0.001 | 0% | 0% | -92% | -1% | $12,357,082 |

| NVX | Novonix Limited | 0.685 | -6% | -6% | -69% | -79% | $337,146,227 |

| OCN | Oceanalithiumlimited | 0.13 | -10% | -4% | -74% | -22% | $7,165,328 |

| SUM | Summitminerals | 0.11 | -12% | 22% | -39% | -4% | $5,957,141 |

| DVP | Develop Global Ltd | 2.99 | -1% | -8% | 9% | -19% | $732,464,727 |

| XTC | Xantippe Res Ltd | 0.001 | 0% | 0% | -72% | 0% | $17,528,005 |

| OD6 | Od6Metalsltd | 0.195 | 15% | 26% | -67% | -14% | $10,177,867 |

| HRE | Heavy Rare Earths | 0.085 | 6% | -11% | -39% | -3% | $5,141,474 |

| LIN | Lindian Resources | 0.16 | -6% | -11% | -33% | 1% | $190,067,169 |

| PEK | Peak Rare Earths Ltd | 0.375 | 0% | -9% | -20% | -8% | $97,917,342 |

| ILU | Iluka Resources | 6.95 | -5% | -7% | -31% | -258% | $2,956,664,176 |

| ASM | Ausstratmaterials | 1.4 | -14% | 5% | -18% | -4% | $244,350,254 |

| ETM | Energy Transition | 0.041 | 8% | 17% | -16% | -2% | $58,802,512 |

| VMS | Venture Minerals | 0.011 | 0% | 10% | -58% | -1% | $21,450,143 |

| IDA | Indiana Resources | 0.062 | 5% | 24% | 10% | 1% | $34,908,912 |

| VTM | Victory Metals Ltd | 0.23 | -8% | 2% | -10% | 1% | $18,606,921 |

| M2R | Miramar | 0.019 | -21% | -27% | -80% | -6% | $2,828,521 |

| WCN | White Cliff Min Ltd | 0.011 | 0% | -8% | -37% | 0% | $14,042,153 |

| TAR | Taruga Minerals | 0.01 | 0% | 0% | -73% | -1% | $7,060,268 |

| ABX | ABX Group Limited | 0.072 | 0% | 1% | -47% | -4% | $17,933,220 |

| MEK | Meeka Metals Limited | 0.04 | 8% | -5% | -40% | -3% | $45,066,439 |

| RR1 | Reach Resources Ltd | 0.0055 | -8% | -54% | 22% | 0% | $16,051,486 |

| DRE | Dreadnought Resources Ltd | 0.033 | 3% | 6% | -66% | -7% | $114,079,195 |

| KFM | Kingfisher Mining | 0.175 | 0% | 30% | -68% | -30% | $8,594,400 |

| AOA | Ausmon Resorces | 0.003 | 0% | -14% | -57% | 0% | $3,020,998 |

| WC1 | Westcobarmetals | 0.059 | -4% | -16% | -68% | -11% | $5,925,154 |

| GRL | Godolphin Resources | 0.04 | 11% | 5% | -51% | -4% | $6,261,955 |

| DM1 | Desert Metals | 0.04 | 0% | 0% | -87% | -16% | $3,001,643 |

| PTR | Petratherm Ltd | 0.049 | -2% | 9% | -18% | -1% | $11,237,557 |

| ITM | Itech Minerals Ltd | 0.13 | -19% | 4% | -55% | -14% | $17,105,699 |

| KTA | Krakatoa Resources | 0.044 | 2% | 100% | -20% | 0% | $21,309,998 |

| M24 | Mamba Exploration | 0.032 | -9% | 7% | -74% | -11% | $1,890,483 |

| LNR | Lanthanein Resources | 0.007 | 0% | 17% | -80% | -1% | $6,729,453 |

| TKM | Trek Metals Ltd | 0.046 | -4% | -8% | -46% | -3% | $22,891,444 |

| BCA | Black Canyon Limited | 0.14 | 0% | -7% | -40% | -10% | $9,239,212 |

| CDT | Castle Minerals | 0.0105 | 0% | -13% | -64% | -1% | $12,857,176 |

| DLI | Delta Lithium | 0.47 | -6% | -22% | -12% | 1% | $290,517,113 |

| A11 | Atlantic Lithium | 0.515 | -2% | 27% | -33% | -11% | $321,426,872 |

| KNI | Kunikolimited | 0.27 | 2% | 6% | -50% | -24% | $23,194,692 |

| CY5 | Cygnus Metals Ltd | 0.13 | -19% | -19% | -73% | -25% | $37,863,688 |

| WR1 | Winsome Resources | 1.065 | -9% | -24% | -3% | -17% | $190,026,697 |

| LLI | Loyal Lithium Ltd | 0.33 | -20% | -32% | -34% | 4% | $29,311,602 |

| BC8 | Black Cat Syndicate | 0.265 | -2% | 26% | -16% | -9% | $72,903,682 |

| BUR | Burleyminerals | 0.17 | 0% | -21% | -28% | -5% | $16,207,481 |

| PBL | Parabellumresources | 0.345 | 0% | 0% | -24% | 1% | $18,879,263 |

| L1M | Lightning Minerals | 0.155 | 15% | 19% | -23% | -1% | $6,544,885 |

| WA1 | Wa1Resourcesltd | 8.24 | -2% | 9% | 355% | 685% | $355,081,245 |

| EV1 | Evolutionenergy | 0.14 | 0% | -22% | -42% | -9% | $31,813,284 |

| 1AE | Auroraenergymetals | 0.08 | 3% | -19% | -61% | -7% | $12,736,554 |

| RVT | Richmond Vanadium | 0.315 | -13% | -17% | 0% | 8% | $27,155,459 |

| PMT | Patriotbatterymetals | 1.04 | -1% | -20% | 0% | 29% | $392,996,300 |

| PAT | Patriot Lithium | 0.195 | -7% | 5% | 0% | -7% | $13,703,426 |

| BM8 | Battery Age Minerals | 0.235 | 0% | -2% | -53% | -27% | $20,501,484 |

| OM1 | Omnia Metals Group | 0.078 | 0% | 0% | -46% | -8% | $3,786,192 |

| VHM | Vhmlimited | 0.75 | 36% | 53% | 0% | 0% | $104,662,965 |

| LLL | Leolithiumlimited | 0.505 | 0% | 0% | 5% | 2% | $498,553,663 |

| SRN | Surefire Rescs NL | 0.0095 | 6% | -37% | -27% | 0% | $16,530,778 |

| SRL | Sunrise | 0.58 | -8% | -24% | -72% | -134% | $55,038,774 |

| SYR | Syrah Resources | 0.64 | -9% | -9% | -72% | -142% | $439,333,525 |

| EG1 | Evergreenlithium | 0.17 | -11% | -26% | 0% | 0% | $9,840,250 |

| WSR | Westar Resources | 0.024 | 26% | 26% | -52% | -3% | $4,448,580 |

| LU7 | Lithium Universe Ltd | 0.033 | -13% | -13% | -18% | 0% | $14,375,310 |

| MEI | Meteoric Resources | 0.205 | -9% | -15% | 1364% | 15% | $408,260,396 |

| REC | Rechargemetals | 0.11 | -12% | -21% | -21% | -3% | $12,248,717 |

| SLM | Solismineralsltd | 0.17 | -15% | -24% | 115% | 10% | $12,845,036 |

| DYM | Dynamicmetalslimited | 0.175 | -13% | 6% | 0% | 0% | $5,600,000 |

| TOR | Torque Met | 0.19 | 9% | -14% | 3% | 1% | $24,875,575 |

| ICL | Iceni Gold | 0.061 | 5% | 5% | -56% | -2% | $14,631,286 |

| TMX | Terrain Minerals | 0.004 | -11% | 0% | -43% | 0% | $6,090,425 |

| MHC | Manhattan Corp Ltd | 0.004 | 0% | -33% | -33% | 0% | $11,747,919 |

| MHK | Metalhawk. | 0.18 | -20% | 80% | -27% | 2% | $14,841,728 |

| ANX | Anax Metals Ltd | 0.027 | 0% | -23% | -55% | -3% | $13,465,694 |

| FIN | FIN Resources Ltd | 0.026 | 0% | 0% | 18% | 1% | $15,580,049 |

| LM1 | Leeuwin Metals Ltd | 0.19 | -16% | -36% | 0% | 0% | $10,076,625 |

| HAW | Hawthorn Resources | 0.09 | -3% | -5% | -22% | -3% | $31,826,483 |

| LCY | Legacy Iron Ore | 0.017 | -6% | 0% | -15% | 0% | $108,916,045 |

| RON | Roninresourcesltd | 0.2 | 0% | 38% | 8% | 4% | $7,010,610 |

| ASR | Asra Minerals Ltd | 0.008 | -20% | 33% | -53% | -1% | $11,649,645 |

| PFE | Panteraminerals | 0.061 | 0% | -5% | -49% | -5% | $6,424,353 |

Plugged in

Seen around the traps on the head of Tesla’s social media platform…

Congrats @GoldmanSachs winner of the @globallithium 2023 “Clueless #lithium analysis” award. According to GS, China becomes the world’s largest producer from domestic resources in 2027. I will take that bet. pic.twitter.com/8ekQjQUSyO

— Joe Lowry (@globallithium) November 28, 2023

Over the course of human history, we’ve produced 700M tons of copper.

To reach Net Zero by 2050, we’d need to produce 1.4B tons of copper over the next 27 years.

Doubling all of human history production in < 3 decades.

Lol. pic.twitter.com/Yz09FodiAX

— Brandon Beylo (@marketplunger1) November 26, 2023

IMO, Rock God Chris Ellison sees spodumene like iron ore where BHP, Rio, FMG, Vale market power enables persistently higher margins than other commodities. MIN will have big seat at spodumene oligopoly table which will target software margins w/o causing demand destruction

— Howard Klein (@LithiumIonBull) November 27, 2023

Benchmark launches sustainable #lithium price – CIF Asia, spot @benchmarkmin

The lithium industry is evolving its pricing to a number of different mechanisms demanded by end users.

“this is the first step in identifying price trends within the Sustainability Index’s Industry… pic.twitter.com/wCAM44HkGp

— Simon Moores (@sdmoores) November 26, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.