High Voltage: Here’s all the news driving battery metals stocks

Pic: Tyler Stableford / Stone via Getty Images

Each week our High Voltage column wraps all the news driving ASX battery metals stocks with exposure to lithium, cobalt, graphite, manganese and vanadium.

Scroll down for a table showing the recent performance of 200 ASX battery metal stocks >>

Industry focus

It’s a pretty tough market for junior explorers right now, there’s no doubt about it.

But investor confidence could be returning to the beaten-up lithium small cap space as metal prices stabilise and a slew of significant global announcements puts electric vehicle (EV) adoption on the fast track.

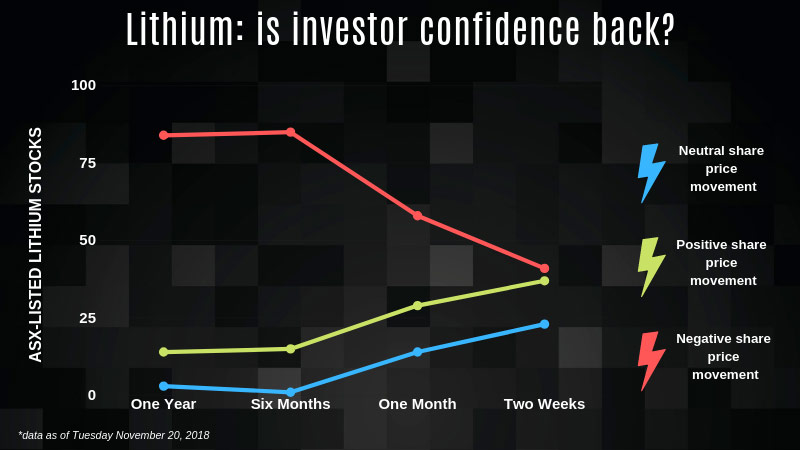

Over the last year just under 14 per cent of the lithium-facing stocks on our list have made share price gains (see graph below).

But this has been trending up over the last month or so, and in the last fortnight – to Tuesday November 20 — more than 36 per cent had made share price gains.

The number of stocks moving into negative territory has also dropped significantly over this time.

A number of big announcements are supercharging investor confidence, as fears of lithium oversupply subside.

For starters, Australia’s mid-tier lithium miners are making good profits and actually expanding as customers demand more product.

PwC’s 12th Aussie Mine Report, which analyses the 50 biggest ASX-listed mining companies with market values under $5 billion (MT50), shows overall market capitalisation up 28 per cent to $58.7 billion.

The push to electric vehicles means lithium miners are now the second biggest contributor to growth in terms of dollar value to the group’s total market capitalisation.

There are now seven lithium-related companies in the 50 mid-tier ASX miners list.

“Lithium was a standout, but we’re also seeing interest in other tech metals like manganese, nickel and rare earth,” says PwC Australia mining leader, Chris Dodd.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

At the same time, global lithium heavyweight Albemarle (NYSE:ALB) is stepping up its investment in Australia because of “a significant acceleration in demand for lithium hydroxide” from EV battery makers.

Lithium hydroxide is often cheaper to produce from hard rock mines — like those found in Western Australia — than brine operations, like those found in Chile.

This echoes commentary from fellow lithium producer SQM (NYSE:SQM).

“We have been positively surprised by the demand growth in the lithium market, especially lithium hydroxide,” SQM’s chief executive Patricio de Solminihac told investors last week.

“We believe that total lithium demand growth will surpass 25 per cent this year. As a result, prices in the lithium market remain strong.”

We are pleased to announce that we have entered into an Exclusivity Agreement with Albemarle Corporation for the potential sale of a 50% interest in Wodgina Lithium and the formation of a 50:50 joint venture. https://t.co/RH5sqK9qVd#MiningLife #lithium pic.twitter.com/i7Q9vvthEG

— Mineral Resources (@MRLMinRes) November 23, 2018

Australian mid cap Mineral Resources (ASX:MIN) revealed last week that it had inked an “exclusivity agreement” with Albemarle for a potential $1.5 billion sale of 50 per cent in its Wodgina lithium mine in WA’s Pilbara.

Investors loved the news, driving MinRes shares up over 32 per cent.

Albemarle already has a 49 per cent stake in Talison Lithium, which operates the Greenbushes mine — the world’s largest hard rock lithium mine — 250km south of Perth.

Small cap spotlight

Of the ~200 battery metals stocks on our list, about 102 lost ground, 48 were ahead and 41 were steady.

Major small cap winners included Pepinnini Lithium (ASX:PNN) up 40 per cent, Six Sigma Metals (ASX:SI6) up 20 per cent, and Pacifico Minerals (ASX:PMY), also up 20 per cent.

At Metals Australia’s (ASX:MLS) Lac Rainy graphite project in Quebec, a sampling program returned results including 20.4m at an average grade of 15.6 per cent total carbon-within-graphite (Cg), including 4.5 metres at an average grade of 20 per cent Cg.

Investors liked the news, sending the explorer’s share price up 33 per cent to 0.4c for the week.

(Typical graphite grades average around 10-15 per cent, so 20 per cent and above is very good.)

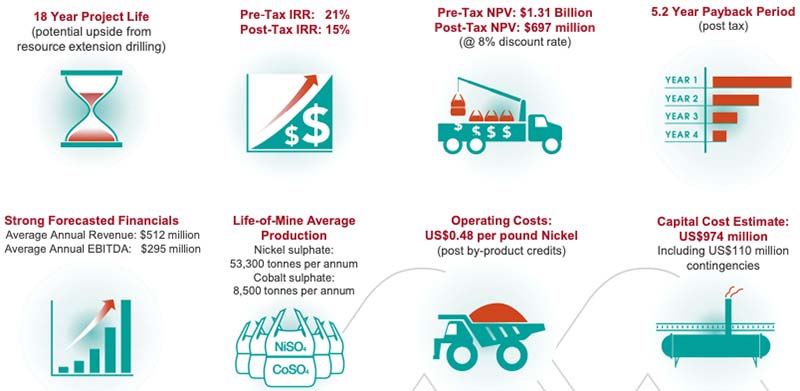

Australian Mines (ASX:AUZ) dropped 23 per cent to about 4c after the explorer released a bankable feasibility study (BFS) on its mammoth Sconi nickel cobalt project in Queensland.

The battery metals project in Queensland could make profits of $2.6 billion over an initial 18-year life — but it will also cost over $1.3 billion to build, and that has made investors wary.

The market is now waiting for Australian Mines to finalise project funding through a combination of debt and equity before it gets too excited.

Here’s a table of ASX battery metal stocks with exposure to lithium, cobalt, graphite, manganese and vanadium:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop

| Ticker | Company Name | One Week Change | One Year Change | Price November 26 (intra-day) $AU | Market Cap |

|---|---|---|---|---|---|

| MOX | MONAX MINING | 0.5 | -0.625 | 0.002 | 2.2M |

| PNN | PEPINNINI LITHIU | 0.4 | -0.825 | 0.01 | 4.8M |

| MLS | METALS AUSTRALIA | 0.3333 | -0.2 | 0.004 | 9.4M |

| IEC | INTRA ENERGY | 0.25 | 1.5 | 0.02 | 5.8M |

| THR | THOR MINING | 0.2 | -0.1176 | 0.04 | 20.3M |

| SI6 | SIX SIGMA METALS | 0.2 | -0.6667 | 0.01 | 2.7M |

| PMY | PACIFICO MINERALS | 0.2 | -0.1429 | 0.01 | 9.8M |

| MRR | MINREX RESOURCES | 0.2 | -0.8333 | 0.02 | 2.9M |

| ANW | AUS TIN MINING | 0.1765 | 1 | 0.02 | 39.6M |

| BOA | BOADICEA RESOURCES | 0.1667 | 0.0938 | 0.18 | 9.2M |

| MIN | MINERAL RESOURCES | 0.1561 | -0.1744 | 14.45 | 2.9B |

| INF | INFINITY LITHIUM | 0.1538 | -0.5135 | 0.09 | 17.1M |

| TRT | TODD RIVER RESOURCES | 0.1205 | -0.4071 | 0.09 | 8.8M |

| CXO | CORE LITHIUM | 0.1132 | -0.2625 | 0.06 | 37.4M |

| NMT | NEOMETALS | 0.1111 | -0.4118 | 0.24 | 136.0M |

| CMC | CHINA MAGNESIUM | 0.1071 | 0.2917 | 0.03 | 9.8M |

| ARL | ARDEA RESOURCES | 0.104 | -0.5519 | 0.63 | 72.4M |

| GPX | GRAPHEX MINING | 0.0909 | -0.2258 | 0.25 | 19.3M |

| JRV | JERVOIS MINING | 0.0857 | -0.6885 | 0.19 | 42.4M |

| BPL | BROKEN HILL PROSPECTING | 0.0833 | -0.25 | 0.04 | 5.8M |

| AML | AEON METALS | 0.0769 | 0.0566 | 0.28 | 164.5M |

| TAW | TAWANA RESOURCES | 0.0755 | -0.25 | 0.28 | 164.8M |

| HXG | HEXAGON RESOURCES | 0.0741 | -0.0938 | 0.14 | 42.3M |

| PM1 | PURE MINERALS | 0.0714 | -0.3478 | 0.02 | 4.7M |

| GBE | GLOBE METALS & MINING | 0.0714 | -0.1176 | 0.01 | 7.0M |

| DGR | DGR GLOBAL | 0.0714 | 0.4286 | 0.15 | 92.0M |

| SO4 | SALT LAKE POTASH | 0.0698 | -0.08 | 0.45 | 94.0M |

| THX | THUNDELARRA | 0.0667 | -0.5556 | 0.02 | 10.2M |

| NZC | NZURI COPPER | 0.0625 | 0.275 | 0.27 | 75.5M |

| LCD | LATITUDE CONSOLIDATED | 0.0588 | -0.3571 | 0.02 | 5.0M |

| OKR | OKAPI RESOURCES | 0.0571 | -0.6509 | 0.19 | 6.4M |

| MCT | METALICITY | 0.05 | -0.4324 | 0.02 | 12.7M |

| ARM | AURORA MINERALS | 0.05 | -0.4615 | 0.02 | 2.5M |

| HGM | HIGH GRADE METALS | 0.0455 | -0.549 | 0.02 | 9.1M |

| LTR | LIONTOWN RESOURCES | 0.0435 | -0.04 | 0.02 | 27.2M |

| PLL | PIEDMONT LITHIUM | 0.04 | -0.3158 | 0.13 | 72.7M |

| BMT | BERKUT MINERALS | 0.038 | -0.6653 | 0.08 | 4.5M |

| IDA | INDIANA RESOURCE | 0.037 | -0.3261 | 0.06 | 5.4M |

| FGR | FIRST GRAPHENE | 0.0323 | 0.7391 | 0.16 | 64.6M |

| KDR | KIDMAN RESOURCES | 0.0321 | -0.0375 | 1.27 | 513.4M |

| MLM | METALLICA MINERALS | 0.0286 | -0.2941 | 0.03 | 11.6M |

| E25 | ELEMENT 25 | 0.0278 | -0.3833 | 0.18 | 15.5M |

| CZI | CASSINI RESOURCES | 0.0217 | 0.2533 | 0.09 | 32.5M |

| LIT | LITHIUM AUSTRALIA | 0.0211 | -0.5268 | 0.1 | 45.0M |

| TAR | TARUGA MINERALS | 0.0169 | -0.3023 | 0.06 | 8.5M |

| GME | GME RESOURCES | 0.0133 | -0.4903 | 0.08 | 36.6M |

| SYR | SYRAH RESOURCES | 0.0116 | -0.6014 | 1.69 | 601.3M |

| HIG | HIGHLANDS PACIFIC | 0.0104 | 0.1279 | 0.1 | 106.0M |

| ZEU | ZEUS RESOURCES | 0 | -0.2353 | 0.01 | 2.3M |

| WCN | WHITE CLIFF MINERALS | 0 | -0.9216 | 0.01 | 3.0M |

| VML | VITAL METALS | 0 | -0.2222 | 0.01 | 12.2M |

| VMC | VENUS METALS | 0 | 0 | 0.16 | 14.8M |

| TNO | TANDO RESOURCES | 0 | 0.5637 | 0.11 | 21.3M |

| SUH | SOUTHERN HEMISPHERE MINING | 0 | -0.7135 | 0.04 | 4.6M |

| SRK | STRIKE RESOURCES | 0 | -0.1791 | 0.06 | 8.0M |

| SGQ | ST GEORGE MINING | 0 | -0.5373 | 0.16 | 46.2M |

| SBR | SABRE RESOURCES | 0 | -0.1111 | 0.01 | 3.3M |

| RNU | RENASCOR RESOURCES | 0 | -0.3571 | 0.02 | 20.8M |

| RLC | REEDY LAGOON | 0 | -0.8568 | 0.01 | 2.8M |

| RDS | REDSTONE RESOURCES | 0 | 0.3586 | 0.02 | 7.9M |

| PUR | PURSUIT MINERALS | 0 | -0.7931 | 0.03 | 4.1M |

| PLS | PILBARA MINERALS | 0 | -0.1347 | 0.82 | 1.5B |

| MTB | MOUNT BURGESS | 0 | -0.5 | 0.01 | 2.2M |

| LRS | LATIN RESOURCES | 0 | -0.5556 | 0 | 11.4M |

| LPD | LEPIDICO | 0 | -0.7703 | 0.02 | 57.1M |

| IRC | INTERMIN RESOURCES | 0 | -0.0882 | 0.14 | 36.5M |

| HAV | HAVILAH RESOURCES | 0 | -0.0513 | 0.19 | 40.4M |

| GXY | GALAXY RESOURCES | 0 | -0.2722 | 2.58 | 1.1B |

| GWR | GWR GROUP | 0 | 0.1 | 0.11 | 27.8M |

| FEL | FE LTD | 0 | -0.5 | 0.01 | 5.2M |

| DHR | DARK HORSE RESOURCES | 0 | -0.5385 | 0.01 | 11.9M |

| DEV | DEVEX RESOURCES | 0 | -0.6045 | 0 | 4.4M |

| CZN | CORAZON MINING | 0 | -0.6111 | 0.01 | 8.9M |

| CNJ | CONICO | 0 | -0.4054 | 0.02 | 7.7M |

| CLL | COLLERINA COBALT | 0 | -0.0481 | 0.12 | 68.1M |

| CGN | CRATER GOLD MINING | 0 | -0.2308 | 0.02 | 5.6M |

| CDT | CASTLE MINERALS | 0 | -0.7556 | 0.01 | 2.5M |

| CCZ | CASTILLO COPPER | 0 | -0.4043 | 0.03 | 16.2M |

| CAD | CAENEUS MINERALS | 0 | -0.6667 | 0 | 14.1M |

| BUX | BUXTON RESOURCES | 0 | 0.1154 | 0.14 | 16.8M |

| BSX | BLACKSTONE MINERALS | 0 | -0.734 | 0.13 | 12.0M |

| BSM | BASS METALS | 0 | 0.0556 | 0.02 | 48.2M |

| BGS | BIRIMIAN | 0 | -0.4937 | 0.2 | 46.7M |

| BDI | BLINA MINERALS | 0 | -0.5 | 0 | 4.3M |

| BAU | BAUXITE RESOURCES | 0 | -0.3133 | 0.06 | 12.2M |

| BAT | BATTERY MINERALS | 0 | -0.6029 | 0.03 | 30.1M |

| AYR | ALLOY RESOURCES | 0 | 0 | 0 | 6.3M |

| AUR | AURIS MINERALS | 0 | -0.2258 | 0.04 | 19.6M |

| ARE | ARGONAUT RESOURCES | 0 | -0.2083 | 0.02 | 29.5M |

| BYH | BRYAH RESOURCES | -0.0101 | -0.4703 | 0.1 | 5.5M |

| MZZ | MATADOR MINING | -0.0189 | 0.0833 | 0.26 | 14.0M |

| FCC | FIRST COBALT | -0.0189 | 0.26 | 88.2M | |

| POS | POSEIDON NICKEL | -0.0217 | 0.0465 | 0.05 | 118.9M |

| AJM | ALTURA MINING | -0.0233 | -0.4545 | 0.21 | 382.3M |

| BAR | BARRA RESOURCES | -0.0278 | -0.2857 | 0.03 | 18.9M |

| BKT | BLACK ROCK MINING | -0.0294 | -0.5 | 0.04 | 17.7M |

| WKT | WALKABOUT RESOURCES | -0.0309 | -0.2167 | 0.09 | 28.6M |

| RIO | RIO TINTO | -0.0319 | 0.0662 | 74.05 | 111.4B |

| CHN | CHALICE GOLD MINES | -0.0323 | -0.1892 | 0.16 | 40.0M |

| CLA | CELSIUS RESOURCES | -0.0328 | -0.528 | 0.06 | 42.8M |

| N27 | NORTHERN COBALT | -0.0333 | -0.826 | 0.09 | 4.4M |

| JMS | JUPITER MINES | -0.0333 | 0.29 | 568.1M | |

| KNL | KIBARAN RESOURCES | -0.0357 | -0.129 | 0.13 | 37.2M |

| AVZ | AVZ MINERALS | -0.037 | -0.675 | 0.08 | 147.3M |

| SYA | SAYONA MINING | -0.0385 | -0.5455 | 0.02 | 42.9M |

| OMH | OM HOLDINGS | -0.0387 | 1.6 | 1.38 | 1.0B |

| KTA | KRAKATOA RESOURCES | -0.04 | -0.5385 | 0.02 | 2.8M |

| CUL | CULLEN RESOURCES | -0.04 | -0.4545 | 0.02 | 2.8M |

| POW | PROTEAN ENERGY | -0.0417 | -0.2581 | 0.02 | 7.1M |

| KAI | KAIROS MINERALS | -0.0417 | -0.6567 | 0.02 | 19.6M |

| DEG | DE GREY MINING | -0.0417 | -0.4889 | 0.12 | 44.4M |

| WML | WOOMERA MINING | -0.0426 | 0.09 | 10.1M | |

| ORN | ORION MINERALS | -0.0435 | -0.3529 | 0.02 | 41.2M |

| EUR | EUROPEAN LITHIUM | -0.0435 | 0.0476 | 0.11 | 60.3M |

| KSN | KINGSTON RESOURCES | -0.0455 | 0.1053 | 0.02 | 25.7M |

| KRC | KING RIVER COPPER | -0.0465 | 2.4167 | 0.04 | 50.8M |

| ESR | ESTRELLA RESOURCES | -0.0476 | -0.3333 | 0.02 | 9.8M |

| PGM | PLATINA RESOURCES | -0.05 | -0.6647 | 0.06 | 15.1M |

| VXR | VENTUREX RESOURCES | -0.0526 | -0.3684 | 0.19 | 43.2M |

| AXE | ARCHER EXPLORATION | -0.0533 | -0.4741 | 0.08 | 13.6M |

| RTR | RUMBLE RESOURCES | -0.0566 | -0.2958 | 0.05 | 17.9M |

| CLQ | CLEAN TEQ HOLDINGS | -0.0575 | -0.7153 | 0.39 | 306.0M |

| PIO | PIONEER RESOURCES | -0.0588 | -0.4839 | 0.02 | 24.1M |

| COB | COBALT BLUE | -0.0612 | -0.193 | 0.22 | 26.7M |

| S32 | SOUTH32 | -0.0651 | -0.0678 | 3.1 | 16.1B |

| SVM | SOVEREIGN METALS | -0.0667 | -0.44 | 0.07 | 19.4M |

| AMD | ARROW MINERALS | -0.0667 | -0.7455 | 0.01 | 4.4M |

| TON | TRITON MINERALS | -0.0682 | -0.4533 | 0.04 | 38.0M |

| PAN | PANORAMIC RESOURCES | -0.0698 | -0.053 | 0.38 | 197.8M |

| ARU | ARAFURA RESOURCES | -0.0725 | -0.3683 | 0.06 | 40.3M |

| GLN | GALAN LITHIUM | -0.0741 | 2.5714 | 0.25 | 24.2M |

| PSC | PROSPECT RESOURCES | -0.0769 | -0.5472 | 0.03 | 49.1M |

| HNR | HANNANS | -0.0769 | -0.25 | 0.01 | 23.9M |

| HWK | HAWKSTONE MINING | -0.0833 | -0.2903 | 0.02 | 12.5M |

| 4CE | FORCE COMMODITIES | -0.0833 | -0.6207 | 0.02 | 9.3M |

| LPI | LITHIUM POWER | -0.0847 | -0.5091 | 0.27 | 70.9M |

| SPI | SPITFIRE MATERIALS | -0.0857 | -0.488 | 0.07 | 58.6M |

| MNS | MAGNIS ENERGY | -0.0857 | -0.2558 | 0.32 | 195.6M |

| ORE | OROCOBRE | -0.086 | -0.3015 | 4.09 | 1.1B |

| CRL | COMET RESOURCES | -0.0882 | -0.6702 | 0.03 | 6.4M |

| ASN | ANSON RESOURCES | -0.0889 | -0.287 | 0.08 | 40.5M |

| LI3 | LITHIUM CONSOLIDATED | -0.0899 | -0.5737 | 0.08 | 7.3M |

| VRC | VOLT RESOURCES | -0.0909 | -0.2593 | 0.02 | 29.1M |

| TNG | TNG LTD | -0.0909 | -0.3333 | 0.11 | 96.1M |

| MTC | METALSTECH | -0.0909 | -0.871 | 0.04 | 4.7M |

| CFE | CAPE LAMBERT RESOURCES | -0.0909 | -0.0909 | 0.02 | 20.2M |

| BEM | BLACKEARTH MINERALS | -0.0909 | 0.09 | 5.5M | |

| AEE | AURA ENERGY | -0.0952 | -0.2692 | 0.02 | 20.4M |

| EMH | EUROPEAN METALS | -0.0976 | -0.5287 | 0.36 | 52.3M |

| MZN | MARINDI METALS | -0.1 | -0.7472 | 0.01 | 8.9M |

| TKL | TRAKA RESOURCES | -0.1071 | -0.5455 | 0.03 | 8.3M |

| TLG | TALGA RESOURCES | -0.1111 | -0.3043 | 0.41 | 87.1M |

| OAR | OAKDALE RESOURCES | -0.1111 | -0.6279 | 0.02 | 1.0M |

| MEI | METEORIC RESOURCES | -0.1111 | -0.7538 | 0.02 | 9.2M |

| KOR | KORAB RESOURCES | -0.1111 | -0.1111 | 0.03 | 7.4M |

| EUC | EUROPEAN COBALT | -0.1111 | -0.8182 | 0.04 | 30.5M |

| ZNC | ZENITH MINERALS | -0.1176 | -0.3478 | 0.08 | 16.0M |

| RMX | RED MOUNTAIN MINING | -0.125 | -0.6111 | 0.01 | 4.7M |

| GPP | GREENPOWER ENERGY | -0.125 | -0.8158 | 0 | 5.5M |

| DTM | DART MINING | -0.125 | 0.0256 | 0.01 | 6.0M |

| AGY | ARGOSY MINERALS | -0.125 | -0.0233 | 0.21 | 193.9M |

| ADN | ANDROMEDA METALS | -0.125 | -0.125 | 0.01 | 7.6M |

| CAZ | CAZALY RESOURCES | -0.1304 | -0.5122 | 0.02 | 4.6M |

| SCI | SILVER CITY MINERALS | -0.1333 | -0.5667 | 0.01 | 3.2M |

| HMX | HAMMER METALS | -0.1333 | -0.2973 | 0.03 | 7.2M |

| SXX | SOUTHERN CROSS | -0.1429 | -0.4 | 0.01 | 6.5M |

| SEI | SPECIALITY METALS | -0.1429 | -0.2 | 0.01 | 6.7M |

| LML | LINCOLN MINERALS | -0.1429 | -0.8421 | 0.01 | 3.4M |

| AOU | AUROCH MINERALS | -0.1429 | -0.7391 | 0.06 | 5.9M |

| ADV | ARDIDEN | -0.1429 | -0.6667 | 0.01 | 10.1M |

| NWC | NEW WORLD COBALT | -0.1471 | -0.7769 | 0.03 | 15.4M |

| MQR | MARQUEE RESOURCES | -0.1538 | -0.692 | 0.08 | 3.3M |

| LKE | LAKE RESOURCES | -0.1538 | -0.4054 | 0.11 | 39.6M |

| ENT | ENTERPRISE METALS | -0.1538 | -0.5 | 0.01 | 4.2M |

| CZR | COZIRON RESOURCES | -0.1538 | -0.5926 | 0.01 | 19.6M |

| VMS | VENTURE MINERALS | -0.16 | -0.5532 | 0.02 | 10.9M |

| NVA | NOVA MINERALS | -0.16 | 0.4 | 0.02 | 16.4M |

| TMT | TECHNOLOGY METALS | -0.1667 | 0.9565 | 0.43 | 31.5M |

| TKM | TREK METALS | -0.1667 | -0.697 | 0.01 | 3.1M |

| PSM | PENINSULA MINES | -0.1667 | -0.7619 | 0.01 | 4.3M |

| AZI | ALTA ZINC | -0.1667 | -0.6429 | 0.01 | 6.8M |

| GED | GOLDEN DEEPS | -0.1778 | -0.26 | 0.04 | 6.3M |

| KLH | KALIA | -0.2 | -0.75 | 0 | 10.1M |

| SRN | SUREFIRE RESOURCES | -0.2222 | -0.5917 | 0.01 | 3.1M |

| MTH | MITHRIL RESOURCES | -0.2272 | -0.8409 | 0.01 | 1.2M |

| AUZ | AUSTRALIAN MINES | -0.2333 | -0.4524 | 0.04 | 129.4M |

| AVL | AUSTRALIAN VANADIUM | -0.25 | 0.5 | 0.03 | 45.9M |

| CHK | COHIBA MINERALS | -0.2857 | -0.375 | 0.01 | 2.8M |

| EME | ENERGY METALS | -0.3333 | -0.2308 | 0.1 | 21.0M |

| CGM | COUGAR METALS | -0.3333 | -0.8571 | 0 | 1.9M |

| RIE | RIEDEL RESOURCES | -0.4667 | -0.7975 | 0.02 | 6.7M |

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.