High Voltage: Copper becomes a minted critical mineral, put it on your list

Copper has joined the United States' exclusive critical minerals list. Pic via Getty.

Our High Voltage column wraps the news driving ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, manganese, magnesium, and vanadium – and today, copper too.

With the recent addition of copper to the US Department of Energy’s critical minerals list, perhaps we should start talking about copper here too as our need for battery-related metals skyrockets to meet our energy transition from fossil fuels.

The final list of minerals as part of America’s critical mineral strategy to pivot from dependence on Chinese exports and to burgeon our energy transition is extensive.

It includes: aluminium, cobalt, copper, dysprosium, electrical steel (grain-oriented steel, non-grain-oriented steel, and amorphous steel), fluorine, gallium, iridium, lithium, magnesium, graphite, neodymium, nickel, platinum, praseodymium, terbium, silicon, and silicon carbide.

And it’s a safe bet there’s a whole bunch of miners and explorers talking about it too – and all other critical minerals we need right now – at the annual Diggers & Dealers conference.

In battery news, EnergyAustralia – owned by Hong Kong conglomerate CLP – reckons it’s ready to make an FID on the proposed 350MW four-hour (1400MWh) Wooreen battery to replace energy requirements from the due-to-be-shuttered Yallourn coal generator by 2028.

It also wants to build a 500MW two or four-hour battery to replace its Mt Piper coal station and a 335MW, eight-hour pumped hydro station nearby.

“As our coal assets approach retirement starting with Yallourn in mid-2028, better financial performance enables us to accelerate the development of renewable and renewables-firming projects that will shape our future and support Australia’s clean energy transformation,” the company stated.

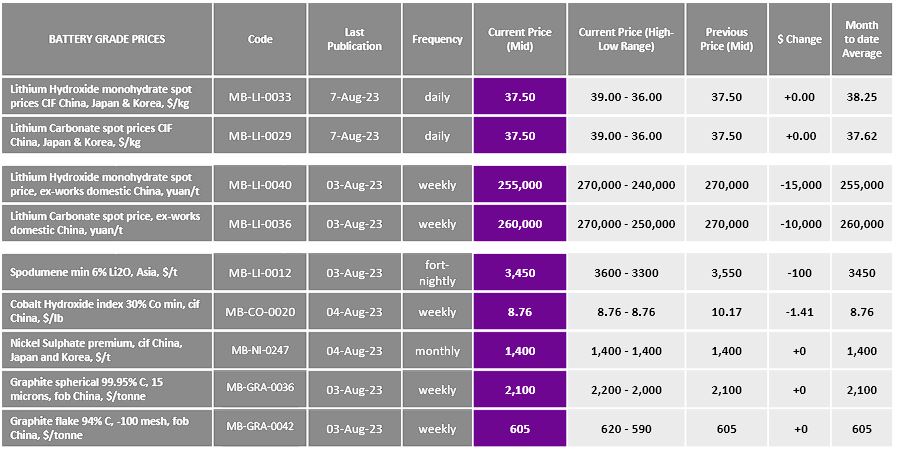

Fastmarkets’ battery grade lithium spot price CIF China, Japan & Korea was at $36-39/kg on Monday August 7, no change from the previous pricing session, and there weas very little change for concentrates of cobalt, nickel and graphite either.

Here’s a snapshot of ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, magnesium, manganese, and vanadium are performing lately>>>

Battery metals stocks missing from our list? Shoot a mail to reuben@stockhead.com.au.

EAGLE MOUNTAIN MINING (ASX:EM2)

This is seen as a boon for ASX-listed companies – especially those operating in the US, like Eagle Mountain Mining (ASX:EM2) with its Oracle Ridge copper-gold project in Arizona – getting ready to locally feed one of the largest markets in the world.

It’s upgrading its MRE which currently stands at 16.5Mt @ 1.45% copper, 15.1g/t silver and 0.19g/t gold for 240,000t contained copper, 8Moz contained silver and 102Koz contained gold.

Impressive drilling and channel sampling results demonstrated optionality in regard to different mining and processing methods to maximise the value of the project.

Drill core assays intersected broad mineralised zones with hits up to 19m at 2.08% copper, while channel sampling assays were generally higher than the current resource model and included results like 32.6m at 2.23% copper and 1.6m at 9.47% copper.

EM2 managing director Tim Mason says the results support the decision to undertake a new MRE, which will not only incorporate these new results but will better reflect the style of mineralisation that is now recognised.

RENASCOR RESOURCES (ASX:RNU)

Renascor Resources (ASX:RNU) is racing ahead with its 150,000tpa Siviour graphite project in South Australia which is pegged to have an annual EBITDA of $363m at a post-tax IRR of 26%.

An optimised Battery Anode Material (BAM) study has confirmed compelling economics of Renascor’s integrated graphite mine and downstream Purified Spherical Graphite (PSG) facility in South Australia which will churn out 100,000tpa.

The company says the BAM study supersedes all previous studies after delivering an estimated Purified Spherical Graphite (PSG) gross operating cost of US$1,782 per tonne over the first 10 years and US$1,846 per tonne over 40-year mine life (LOM).

While the Australian Government has approved a loan facility of $185m for the development of BAM, estimated capital for the initial upstream operation of $214.5 million is expected to be funded via Renascor’s existing cash balance ($129 million as at 30 June 2023) and debt facilities.

GALAN LITHIUM (ASX:GLN)

It’s all systems go for Galan Lithium (ASX:GLN) after construction permits for Phase 1 brine production at its Hombre Muerto West (HMW) lithium project in Argentina were granted by the Catamarca provincial government.

Galan will start developing Phase 1 which will see an initial production rate of 5.4ktpa of LCE to be used to fund the rest of a four-phase mining operation that will produce 60,000tpa.

At a capital cost of US$104m (minus contingency) and operational expenses of US$3,963/t of recoverable LCE, Phase 1 will deliver a post-tax NPV of US$460m, IRR of 36% and free cash flow of US$54m per year. And with a payback period of about two years, it will facilitate funding for further expansions.

The granting of permits means full construction can now begin with the aim of delivering lithium chloride production in the first half of 2025 at HMW.

Galan MD Juan Pablo (JP) Vargas de la Vega says the company is proud to be starting construction.

“These permits cover the full Phase 1 DFS production rate of 5.4ktpa LCE including full spec ponds design and size plus the carbonate plant using the lithium concentration feed from the existing ponds already built,” Vargas de la Vega says.

“All required infrastructure is also approved, which means it is all systems go to meet our production target in H1 2025.”

Optimisation work continues and will culminate in the release of a Phase 2 DFS in September 2023, addressing a full 20ktpa LCE production rate.

At Stockhead we tell it like it is. While Eagle Mountain Mining, Renascor Resources, and Galan Lithium are Stockhead advertisers, they did not sponsor this article.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.