High Voltage: Citi and other analysts eye lithium long game as Rinehart raises Liontown stakes

Pic via Getty Images

- Lithium prices are down but a positive spin from Citi has been doing the rounds

- Meanwhile, Hancock Prospecting has just raised its stake in Liontown (again) inching its way to a possible takeover bid

Our High Voltage column wraps the news driving ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, manganese, magnesium, and vanadium.

The spot price of lithium continues to trend down (see below) for now amid concerns around destocking and a recent pullback in demand from the Chinese market. A commodity of abundance, albeit tricky to extract, yes; a safe haven asset it ain’t.

2023-10-10#Lithium Carbonate 99.5% Min China Spot

Price: $23,543.83

1 day: $0 (0%) ➡️

YTD: -68.05%#Spodumene Concentrate (6%, CIF China)Price: $2,560.00

1 day: $0 (0%) ➡️

YTD: -56.05%Sponsored by @SiennaResources $SIE $SNNAFhttps://t.co/RDoMp6nwF0

— Lithium Price Bot (@LithiumPriceBot) October 10, 2023

Plenty of the ASX lithium-focused stocks aren’t having the most positive time of things just lately, either, in terms of pure price action at least (see table further below). Although there are those very much bucking the current trend, of course.

Broadly speaking, while there are certainly headwinds here and there, there’s still plenty of positivity to be mined from the world’s most craved battery metal narrative – now and ahead – some of which we’ll cover in this column within specific stocks focus.

Rinehart’s Liontown power play

Holder of the most envied bank account in Australia, Gina Rinehart is certainly frothing for her slice of the Aussie lithium market, continuing to make a bold move for the much-vaunted* Liontown Resources (ASX:LTR) company and its Kathleen Valley prospect.

The latest update there is that Rinehart’s Hancock Prospecting has increased its stake in LTR further this week, twice, to where it now sits at 19.9 per cent at the time of writing, finding another few hundred million to throw at the WA lithium stock to go with the $152m it added to the pile last week.

Per a Hancock Prospecting note late Wednesday afternoon:

Hancock Prospecting Pty Ltd (Hancock) has achieved its strategic stake objective of 19.9% of the ordinary shares in Liontown Resources Limited (Liontown), paying no more than $3.00 per share. Hancock now looks forward to having a prominent influence on Liontown’s future, as its largest shareholder.”

The stake target of 19.9 per cent is the required platform from which Hancock can potentially launch a takeover offer of its own for Liontown – an offer that would rival what’s already on the table from moneybags New York mining and chemical processing firm giant Albemarle: AUD $6.6 billion.

Hancock has now forked out more than $1.2 billion on LTR shares, mostly at $3 – the same price Albemarle, which is the world’s largest producer of the battery metal, came in.

And it’s all for a company and project that’s yet to produce anything. Wild.

That said, per a recent Hancock Prospecting media release: “Liontown’s indicated production rate of 3mtpa (increasing to 4mtpa) at its Kathleen Valley project is significant for an underground operation.” To say the least.

What happens next, then? In its analysis of the situation, the Financial Times noted: “Hancock has a long history of joint ventures on virtually all of the assets that it owns, making some form of partnership the most likely outcome and Albemarle a desirable partner for its expertise in chemical processing.”

All options, including the possibility of a joint venture, remain on the table.

Meanwhile, the clock is ticking for Albemarle, and for LTR investors. The US company’s period of due diligence on Liontown has just been extended by a week and its exclusivity period, in which it needs to decide whether to turn its non-binding proposal into a finalised offer, also draws to a close soon.

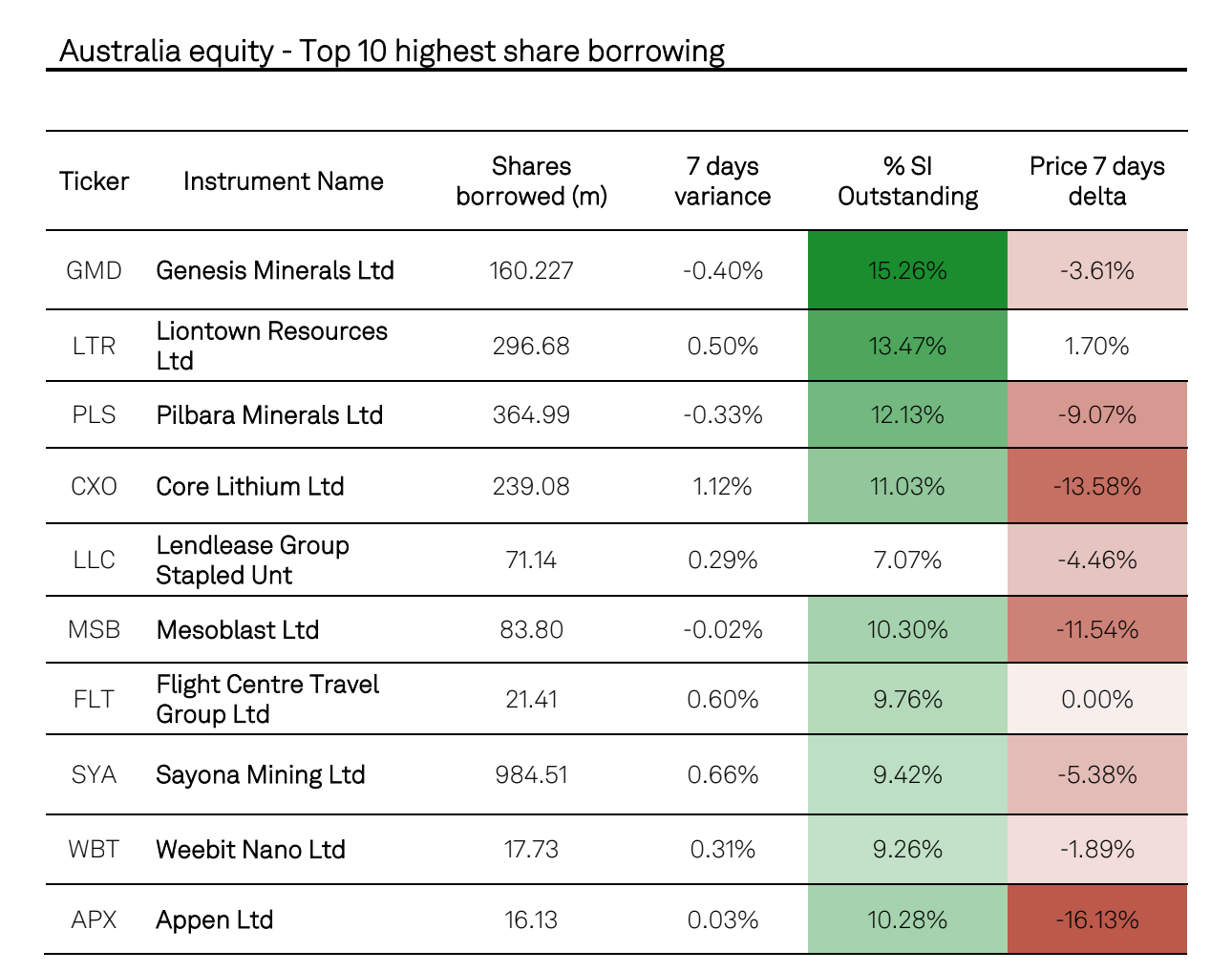

*We say ‘much-vaunted’, which is true, but LTR is also one of the most shorted stocks on the ASX at the moment, according to S&P Global Market Intelligence (see below). As Eddy pointed out the other day:

“The metric used to calculate the short interest is the percentage of outstanding shares on loan, which is part of the mechanic of shorting a stock.”

LTR is down about 4% over the past month, according to Market Index data, but it’s still up more than 121% year to date.

Citi thinks sideways then eventually up

A note from Citi has been doing the rounds, which can be construed as a net positive for Australia’s and global lithium stocks.

The broker says it’s expecting some sideways chop on lithium prices for the next 12-18 months, but is bullish over the longer term for the commodity.

ASX-listed lithium miners are higher today after Citi said it expects lithium prices to track sideways for the next 12-18 months but remain positive over the long term. The bullish outlook saw Core Lithium $CXO jump 8.8% with Sayona Mining $SYA 6.5% higher, leading gains.

— CommSec (@CommSec) October 10, 2023

Does Citi like any ASX lithium stocks in particular? It mentioned two standouts: Allkem (ASX:AKE) and Pilbara Minerals (ASX:PLS), both with buy ratings and the former with the best growth outlook over the long term.

Shorter term, it gives AKE a $13.50 price target (currently $11.18), while it believes PLS can shoot for $4.50 (currently $3.96).

What say other big-bucks analysts?

Meanwhile, as mentioned last week, Goldman Sachs analysts believe lithium carbonate prices will fall even further over the next 12 months, and yet… like Citi, they do also like the look of Allkem (ASX:AKE).

Goldman also reportedly rates the $7.26bn market capper a ‘buy’ – with a $16.80 price target – based on strong production outlook and growth narratives.

As for JP Morgan and UBS, they, too have downgraded near-term lithium price forecasts. UBS by 10-30% over FY24-26 and JP Morgan by 37-47%.

https://twitter.com/asxpeasant/status/1711325083288101138

Per an excellent report from Stockhead‘s Christian “Mr Versatile” Edwards:

JP Morgan now ranks base metals as its preferred exposure, followed by iron ore, with lithium now least preferred. What a turn up for the books.

PLS and Core Lithium are now JP neutrals, with an underweight (i.e. sell) label on IGO. Allkem remains a standout for them with a $15-20 price target well beyond the $7b market capper’s current $11.05 price.

Meanwhile, UBS’ preferences are for asset quality. IGO is their preferred buy, with their Greenbushes mine still lowest on the cost curve, followed by Pilbara Minerals in neutral gear with MinRes rated a sell.

Those two stocks, AKE and PLS, are clearly the ones the big gun analysts are eyeing up. But what are they possibly not quite willing to entertain further down the market cap? We’ll get to some of those in a sec. But not before a few hot takes from…

Mr Lithium

Global Lithium’s Joe Lowry, aka ‘Mr Lithium’, is at it again with some frank and fearless thoughts on the sector. And he’s still particularly bullish long term, as you’d expect.

Lowry is of the belief lithium prices will not return to levels that saw the industry routed between 2018 and 2020 and, wrote Stockhead‘s Josh Chiat last month, also recently made the bold call that the lithium market will never be oversupplied in his lifetime, saying an influx of high cost material to satisfy the demands of Chinese battery and electric vehicle makers has moved the cost curve higher than it’s ever been.

Here are some of his latest sticking-to-guns postings to his 25k+ Twitter/X followers… he’s also playing the long game…

https://twitter.com/globallithium/status/1711399577473966226

And regarding the dipping spot lithium prices, Mr Lithium doesn’t think the current weakened demand for the commodity from China means this “period of low prices & cash negative converters” is sustainable.

Does China “sentiment” re: #EV / #GWH growth govern the long term future of #lithium demand? I don’t think so. The 2022 “price panic” in China created a false high price signal just as destocking in 2023 is creating an unsustainable period of low prices & cash negative converters pic.twitter.com/kYeilD2nAF

— Joe Lowry (@globallithium) October 10, 2023

Battery metals form guide

Here’s a snapshot of how ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, magnesium, manganese, and vanadium are performing lately>>>

Battery metals stocks missing from our list? Shoot a mail to [email protected] and/or [email protected]

| Code | Company | Price | % Week | % Month | % Year | Market Cap |

|---|---|---|---|---|---|---|

| LM1 | Leeuwin Metals | 0.33 | 5% | 8% | 0% | $13,883,350 |

| VIA | Viagold Rare Earth | 0 | -100% | -100% | -100% | $166,624,808 |

| PVW | PVW Res Ltd | 0.068 | 0% | -16% | -51% | $6,895,525 |

| A8G | Australasian Metals | 0.205 | 3% | 24% | -28% | $10,684,701 |

| INF | Infinity Lithium | 0.088 | 4% | -7% | -52% | $40,245,512 |

| LPI | Lithium Pwr Int Ltd | 0.3425 | -4% | 43% | -40% | $213,940,770 |

| PSC | Prospect Res Ltd | 0.076 | -5% | -18% | -24% | $35,131,719 |

| PAM | Pan Asia Metals | 0.215 | 8% | -10% | -42% | $32,558,394 |

| CXO | Core Lithium | 0.3725 | -11% | -3% | -67% | $779,981,474 |

| LOT | Lotus Resources Ltd | 0.225 | -6% | -12% | 2% | $311,530,870 |

| AGY | Argosy Minerals Ltd | 0.1825 | 1% | -17% | -62% | $245,771,312 |

| AZS | Azure Minerals | 2.25 | -18% | -20% | 878% | $916,214,330 |

| NWC | New World Resources | 0.028 | -7% | -15% | -10% | $63,328,777 |

| QXR | Qx Resources Limited | 0.026 | 4% | 4% | -70% | $22,542,176 |

| GSR | Greenstone Resources | 0.009 | 0% | -10% | -72% | $12,288,747 |

| CAE | Cannindah Resources | 0.105 | 0% | -13% | -48% | $59,690,395 |

| AZL | Arizona Lithium Ltd | 0.016 | 0% | -6% | -80% | $47,920,345 |

| HNR | Hannans Ltd | 0.007 | 0% | -22% | -67% | $19,072,234 |

| COB | Cobalt Blue Ltd | 0.24 | -8% | -19% | -67% | $90,091,702 |

| ESS | Essential Metals Ltd | 0.495 | 2% | 15% | -8% | $130,397,084 |

| LPD | Lepidico Ltd | 0.011 | 0% | 0% | -42% | $84,021,387 |

| MRD | Mount Ridley Mines | 0.002 | 0% | 0% | -71% | $15,569,766 |

| CZN | Corazon Ltd | 0.012 | 0% | -8% | -25% | $7,387,175 |

| LKE | Lake Resources | 0.195 | 11% | 3% | -80% | $263,152,271 |

| DEV | Devex Resources Ltd | 0.34 | -4% | 1% | 6% | $126,064,716 |

| INR | Ioneer Ltd | 0.2025 | -8% | -12% | -67% | $422,205,265 |

| AVZ | AVZ Minerals Ltd | 0.78 | 0% | 0% | 0% | $2,752,409,203 |

| MAN | Mandrake Res Ltd | 0.038 | -5% | -3% | 6% | $22,752,877 |

| RLC | Reedy Lagoon Corp. | 0.006 | -14% | 0% | -56% | $3,700,102 |

| GBR | Greatbould Resources | 0.057 | 10% | -15% | -41% | $26,781,407 |

| FRS | Forrestaniaresources | 0.035 | -22% | -22% | -84% | $3,580,556 |

| STK | Strickland Metals | 0.086 | 23% | 105% | 126% | $131,219,762 |

| MLX | Metals X Limited | 0.275 | -4% | -2% | -8% | $254,034,499 |

| CLA | Celsius Resource Ltd | 0.011 | -8% | -8% | -21% | $24,706,568 |

| FGR | First Graphene Ltd | 0.11 | 100% | 62% | 0% | $67,937,993 |

| HXG | Hexagon Energy | 0.01 | 11% | 0% | -39% | $5,129,159 |

| TLG | Talga Group Ltd | 1.175 | -5% | -13% | 2% | $414,867,298 |

| MNS | Magnis Energy Tech | 0.074 | 0% | -13% | -79% | $88,762,863 |

| OZL | OZ Minerals | 0 | -100% | -100% | -100% | $8,918,404,433 |

| PLL | Piedmont Lithium Inc | 0.56 | -7% | -19% | -33% | $206,740,350 |

| EUR | European Lithium Ltd | 0.069 | -5% | -1% | -12% | $98,990,981 |

| BKT | Black Rock Mining | 0.093 | 9% | 6% | -45% | $93,255,718 |

| QEM | QEM Limited | 0.2 | 0% | 3% | -7% | $30,278,342 |

| LYC | Lynas Rare Earths | 6.675 | 2% | -6% | -12% | $6,060,462,446 |

| ESR | Estrella Res Ltd | 0.007 | 0% | 0% | -30% | $11,868,575 |

| ARL | Ardea Resources Ltd | 0.595 | 2% | -11% | -37% | $115,823,839 |

| GLN | Galan Lithium Ltd | 0.6125 | -7% | -13% | -50% | $221,159,248 |

| JRL | Jindalee Resources | 1.6 | -8% | -8% | -28% | $90,084,977 |

| VUL | Vulcan Energy | 2.76 | -3% | -12% | -61% | $459,555,372 |

| SBR | Sabre Resources | 0.033 | -8% | -35% | -49% | $9,619,044 |

| CHN | Chalice Mining Ltd | 2.31 | 2% | -26% | -40% | $925,732,664 |

| VRC | Volt Resources Ltd | 0.0085 | 6% | 6% | -70% | $31,515,391 |

| NMT | Neometals Ltd | 0.3525 | 14% | -24% | -67% | $196,424,318 |

| AXN | Alliance Nickel Ltd | 0.049 | -25% | -48% | -57% | $36,291,981 |

| PNN | Power Minerals Ltd | 0.245 | 0% | -11% | -48% | $19,530,464 |

| IGO | IGO Limited | 11.335 | -8% | -21% | -26% | $8,655,571,103 |

| GED | Golden Deeps | 0.055 | 6% | -8% | -63% | $6,238,207 |

| ADV | Ardiden Ltd | 0.005 | 0% | -17% | -29% | $16,130,012 |

| SRI | Sipa Resources Ltd | 0.022 | 5% | 5% | -52% | $4,335,005 |

| NTU | Northern Min Ltd | 0.029 | 7% | -6% | -31% | $171,418,398 |

| AXE | Archer Materials | 0.475 | -4% | 3% | -42% | $117,229,626 |

| PGM | Platina Resources | 0.024 | -8% | -14% | 26% | $16,202,689 |

| AAJ | Aruma Resources Ltd | 0.032 | -11% | -11% | -51% | $6,300,528 |

| IXR | Ionic Rare Earths | 0.023 | -4% | 0% | -50% | $90,990,413 |

| NIC | Nickel Industries | 0.76 | 3% | -3% | -1% | $3,214,357,410 |

| EVG | Evion Group NL | 0.032 | -14% | -6% | -68% | $10,378,776 |

| CWX | Carawine Resources | 0.13 | -4% | 13% | 37% | $25,586,271 |

| PLS | Pilbara Min Ltd | 4.035 | -1% | -11% | -23% | $11,917,472,134 |

| HAS | Hastings Tech Met | 0.74 | 5% | -26% | -78% | $87,969,323 |

| BUX | Buxton Resources Ltd | 0.195 | -5% | -11% | 117% | $33,399,321 |

| ARR | American Rare Earths | 0.13 | -7% | 4% | -35% | $60,267,145 |

| SGQ | St George Min Ltd | 0.038 | -5% | -12% | 0% | $30,476,699 |

| TKL | Traka Resources | 0.005 | 0% | 0% | -17% | $4,356,646 |

| PAN | Panoramic Resources | 0.0375 | 1% | -15% | -79% | $115,816,619 |

| PRL | Province Resources | 0.041 | 0% | 0% | -49% | $48,441,219 |

| IPT | Impact Minerals | 0.012 | -4% | 0% | 60% | $31,511,743 |

| LIT | Lithium Australia | 0.034 | 0% | -6% | -36% | $40,332,325 |

| AKE | Allkem Limited | 11.27 | 1% | -15% | -20% | $7,147,612,056 |

| ARN | Aldoro Resources | 0.1 | 12% | -9% | -53% | $13,462,374 |

| JRV | Jervois Global Ltd | 0.035 | 0% | -13% | -94% | $86,480,662 |

| MCR | Mincor Resources NL | 0 | -100% | -100% | -100% | $751,215,521 |

| SYR | Syrah Resources | 0.4925 | -3% | -14% | -72% | $324,430,910 |

| FBM | Future Battery | 0.115 | 0% | -4% | 74% | $56,089,658 |

| ADD | Adavale Resource Ltd | 0.013 | 8% | 8% | -56% | $9,494,801 |

| LTR | Liontown Resources | 2.96 | 0% | -3% | 93% | $6,606,766,758 |

| CTM | Centaurus Metals Ltd | 0.56 | -15% | -24% | -41% | $276,033,173 |

| VML | Vital Metals Limited | 0.01 | 0% | 0% | -69% | $53,061,498 |

| BSX | Blackstone Ltd | 0.1175 | -10% | -10% | -36% | $54,474,224 |

| POS | Poseidon Nick Ltd | 0.016 | -16% | -27% | -65% | $63,039,020 |

| CHR | Charger Metals | 0.13 | -4% | -35% | -73% | $7,453,724 |

| AVL | Aust Vanadium Ltd | 0.026 | -4% | -10% | -30% | $134,152,383 |

| AUZ | Australian Mines Ltd | 0.015 | 0% | -6% | -77% | $9,686,847 |

| TMT | Technology Metals | 0.25 | -6% | -15% | -41% | $66,114,356 |

| RXL | Rox Resources | 0.225 | -4% | 13% | -6% | $82,807,374 |

| RNU | Renascor Res Ltd | 0.1225 | 2% | -13% | -34% | $304,728,900 |

| GL1 | Globallith | 1.265 | -7% | -18% | -43% | $311,832,839 |

| BRB | Breaker Res NL | 0 | -100% | -100% | -100% | $158,126,031 |

| ASN | Anson Resources Ltd | 0.15 | 3% | 0% | -50% | $180,003,484 |

| SYA | Sayona Mining Ltd | 0.092 | -3% | -12% | -60% | $936,689,937 |

| FFX | Firefinch Ltd | 0.2 | 0% | 0% | 0% | $236,569,315 |

| EGR | Ecograf Limited | 0.125 | -4% | 0% | -61% | $56,573,985 |

| ATM | Aneka Tambang | 1.19 | 0% | 3% | 3% | $1,551,342 |

| TVN | Tivan Limited | 0.068 | -13% | -13% | -30% | $109,954,514 |

| ALY | Alchemy Resource Ltd | 0.01 | -9% | -17% | -70% | $11,780,763 |

| GAL | Galileo Mining Ltd | 0.36 | -13% | 13% | -74% | $72,133,098 |

| BHP | BHP Group Limited | 44.68 | 2% | 3% | 12% | $223,784,861,596 |

| LEL | Lithenergy | 0.55 | -3% | -24% | -53% | $58,200,650 |

| MMC | Mitremining | 0.265 | 0% | 6% | 56% | $12,017,777 |

| RMX | Red Mount Min Ltd | 0.005 | 25% | 11% | -17% | $13,367,880 |

| GW1 | Greenwing Resources | 0.135 | 4% | -13% | -64% | $23,523,950 |

| AQD | Ausquest Limited | 0.012 | -8% | 0% | -33% | $10,726,940 |

| LML | Lincoln Minerals | 0.007 | 40% | 40% | 2% | $9,944,983 |

| 1MC | Morella Corporation | 0.0055 | -21% | -8% | -74% | $36,831,934 |

| REE | Rarex Limited | 0.031 | -3% | -14% | -49% | $20,501,597 |

| MRC | Mineral Commodities | 0.0375 | 21% | -22% | -50% | $23,509,502 |

| PUR | Pursuit Minerals | 0.009 | -10% | 0% | -31% | $26,495,743 |

| QPM | Queensland Pacific | 0.064 | -4% | -3% | -57% | $129,019,758 |

| EMH | European Metals Hldg | 0.625 | -11% | -16% | -6% | $78,017,531 |

| BMM | Balkanminingandmin | 0.18 | -12% | -18% | -39% | $12,385,291 |

| PEK | Peak Rare Earths Ltd | 0.405 | 8% | -10% | 11% | $103,210,172 |

| LEG | Legend Mining | 0.027 | 17% | 0% | -29% | $78,420,884 |

| MOH | Moho Resources | 0.008 | 0% | -11% | -70% | $2,380,311 |

| AML | Aeon Metals Ltd. | 0.016 | 0% | -11% | -43% | $16,446,009 |

| G88 | Golden Mile Res Ltd | 0.0215 | -26% | -35% | -21% | $6,587,790 |

| WKT | Walkabout Resources | 0.1125 | -2% | -6% | -35% | $73,343,055 |

| TON | Triton Min Ltd | 0.021 | -5% | -9% | -9% | $32,788,468 |

| AR3 | Austrare | 0.22 | 0% | -12% | -35% | $34,687,341 |

| ARU | Arafura Rare Earths | 0.2375 | -7% | -5% | -23% | $496,640,703 |

| MIN | Mineral Resources. | 61.78 | -4% | -11% | -13% | $11,877,094,144 |

| VMC | Venus Metals Cor Ltd | 0.12 | -4% | 9% | 38% | $23,716,085 |

| S2R | S2 Resources | 0.1925 | 17% | 10% | 33% | $79,967,847 |

| CNJ | Conico Ltd | 0.005 | -17% | -9% | -69% | $7,850,475 |

| VR8 | Vanadium Resources | 0.049 | -13% | -30% | -47% | $23,679,752 |

| PVT | Pivotal Metals Ltd | 0.025 | 32% | 56% | -39% | $13,615,008 |

| BOA | Boadicea Resources | 0.038 | -5% | -16% | -68% | $4,923,612 |

| IPX | Iperionx Limited | 1.27 | -12% | -8% | 50% | $249,240,285 |

| SLZ | Sultan Resources Ltd | 0.021 | 11% | -25% | -77% | $3,111,991 |

| NKL | Nickelxltd | 0.072 | 36% | 7% | -56% | $5,445,423 |

| NVA | Nova Minerals Ltd | 0.24 | 0% | -14% | -65% | $51,668,040 |

| MLS | Metals Australia | 0.032 | -3% | -18% | -26% | $19,969,158 |

| MQR | Marquee Resource Ltd | 0.027 | -7% | -21% | -54% | $10,891,378 |

| MRR | Minrex Resources Ltd | 0.016 | 14% | 0% | -72% | $17,357,880 |

| EVR | Ev Resources Ltd | 0.013 | -7% | -7% | -54% | $10,295,825 |

| EFE | Eastern Resources | 0.009 | 0% | 0% | -78% | $11,177,518 |

| CNB | Carnaby Resource Ltd | 0.845 | -3% | -12% | 13% | $140,047,850 |

| BNR | Bulletin Res Ltd | 0.12 | 52% | 114% | -8% | $32,295,021 |

| AX8 | Accelerate Resources | 0.029 | 26% | 38% | -17% | $11,798,654 |

| AM7 | Arcadia Minerals | 0.105 | 0% | 0% | -67% | $10,997,448 |

| AS2 | Askarimetalslimited | 0.17 | -3% | -28% | -54% | $13,645,881 |

| BYH | Bryah Resources Ltd | 0.013 | 0% | -24% | -45% | $4,661,869 |

| DTM | Dart Mining NL | 0.022 | 10% | -19% | -72% | $3,806,269 |

| EMS | Eastern Metals | 0.031 | -6% | -9% | -78% | $2,062,735 |

| FG1 | Flynngold | 0.068 | 17% | -3% | -35% | $9,274,016 |

| GSM | Golden State Mining | 0.04 | 8% | -2% | 0% | $7,070,266 |

| IMI | Infinitymining | 0.13 | -7% | -13% | -43% | $11,647,708 |

| LRV | Larvottoresources | 0.12 | -4% | -11% | -41% | $8,406,840 |

| LSR | Lodestar Minerals | 0.005 | -17% | -17% | -17% | $10,116,987 |

| RAG | Ragnar Metals Ltd | 0.024 | 0% | 4% | -13% | $11,375,543 |

| CTN | Catalina Resources | 0.004 | 0% | -20% | -56% | $4,953,948 |

| TMB | Tambourahmetals | 0.155 | -11% | -21% | -3% | $12,441,053 |

| TEM | Tempest Minerals | 0.008 | 0% | -33% | -75% | $4,091,068 |

| EMC | Everest Metals Corp | 0.125 | 14% | 4% | 25% | $16,660,389 |

| WML | Woomera Mining Ltd | 0.01 | 0% | -17% | -56% | $9,561,946 |

| KZR | Kalamazoo Resources | 0.095 | -5% | -24% | -53% | $16,110,457 |

| LMG | Latrobe Magnesium | 0.046 | 7% | -4% | -43% | $76,081,844 |

| KOR | Korab Resources | 0.016 | -16% | -16% | -53% | $5,505,750 |

| CMX | Chemxmaterials | 0.088 | 4% | -23% | -48% | $4,723,843 |

| NC1 | Nicoresourceslimited | 0.355 | -19% | -23% | -40% | $30,334,126 |

| GRE | Greentechmetals | 0.305 | -22% | -28% | 91% | $17,544,622 |

| CMO | Cosmometalslimited | 0.053 | 0% | -24% | -62% | $1,838,923 |

| FRB | Firebird Metals | 0.145 | 4% | -3% | -17% | $10,595,875 |

| S32 | South32 Limited | 3.435 | 1% | 5% | -9% | $15,556,349,191 |

| OMH | OM Holdings Limited | 0.465 | -3% | -12% | -27% | $343,459,852 |

| JMS | Jupiter Mines. | 0.195 | 0% | -3% | 1% | $382,003,251 |

| E25 | Element 25 Ltd | 0.39 | -9% | 0% | -46% | $83,749,179 |

| EMN | Euromanganese | 0.12 | -20% | -31% | -55% | $28,120,200 |

| KGD | Kula Gold Limited | 0.012 | -8% | -25% | -67% | $4,478,543 |

| LRS | Latin Resources Ltd | 0.2825 | 5% | -9% | 183% | $750,157,934 |

| CRR | Critical Resources | 0.037 | -5% | -5% | -39% | $62,224,760 |

| ENT | Enterprise Metals | 0.004 | 0% | 0% | -64% | $3,197,884 |

| SCN | Scorpion Minerals | 0.059 | -14% | -2% | -16% | $21,433,784 |

| GCM | Green Critical Min | 0.007 | 0% | -13% | -42% | $7,956,095 |

| ENV | Enova Mining Limited | 0.008 | 14% | 33% | -43% | $3,909,293 |

| RBX | Resource B | 0.14 | -3% | -13% | 46% | $11,575,828 |

| AKN | Auking Mining Ltd | 0.056 | -18% | 10% | -38% | $11,633,911 |

| RR1 | Reach Resources Ltd | 0.013 | 0% | 8% | 160% | $38,403,565 |

| EMT | Emetals Limited | 0.007 | 0% | 0% | -56% | $5,950,000 |

| PNT | Panthermetalsltd | 0.071 | -11% | -9% | -63% | $4,463,950 |

| WIN | Widgienickellimited | 0.21 | -7% | 0% | -22% | $59,589,011 |

| WMG | Western Mines | 0.3375 | 13% | 11% | 141% | $21,267,963 |

| AVW | Avira Resources Ltd | 0.0015 | -25% | 50% | -63% | $3,200,685 |

| CAI | Calidus Resources | 0.15 | 3% | -3% | -68% | $91,181,979 |

| GT1 | Greentechnology | 0.46 | 14% | -8% | -37% | $96,904,773 |

| KAI | Kairos Minerals Ltd | 0.021 | 5% | -13% | -23% | $57,660,068 |

| MTM | MTM Critical Metals | 0.0355 | -1% | -7% | -73% | $3,576,135 |

| NWM | Norwest Minerals | 0.026 | -13% | -24% | -37% | $7,476,807 |

| PGD | Peregrine Gold | 0.295 | 5% | -14% | -49% | $16,291,507 |

| RAS | Ragusa Minerals Ltd | 0.04 | 5% | -9% | -87% | $5,561,353 |

| RGL | Riversgold | 0.014 | 8% | 17% | -71% | $13,317,660 |

| SRZ | Stellar Resources | 0.012 | 9% | 20% | -14% | $11,065,607 |

| STM | Sunstone Metals Ltd | 0.015 | 0% | -35% | -56% | $49,311,758 |

| ZNC | Zenith Minerals Ltd | 0.1 | -17% | -5% | -68% | $35,238,088 |

| WC8 | Wildcat Resources | 0.425 | -10% | 20% | 1228% | $269,575,113 |

| ASO | Aston Minerals Ltd | 0.034 | 3% | -15% | -59% | $42,090,871 |

| THR | Thor Energy PLC | 0.028 | -22% | -18% | -69% | $4,937,422 |

| YAR | Yari Minerals Ltd | 0.014 | -18% | -26% | -36% | $7,235,367 |

| IG6 | Internationalgraphit | 0.17 | -6% | -11% | -48% | $15,127,979 |

| LPM | Lithium Plus | 0.445 | -21% | 27% | -27% | $29,364,749 |

| ODE | Odessa Minerals Ltd | 0.011 | -8% | -27% | -42% | $9,471,118 |

| KOB | Kobaresourceslimited | 0.08 | 0% | -16% | -33% | $8,749,583 |

| AZI | Altamin Limited | 0.064 | 7% | -10% | -24% | $23,503,005 |

| FTL | Firetail Resources | 0.1 | 1% | -13% | -52% | $14,890,556 |

| LNR | Lanthanein Resources | 0.008 | 0% | -33% | -79% | $8,972,605 |

| CLZ | Classic Min Ltd | 0.001 | 0% | 0% | -94% | $12,357,082 |

| NVX | Novonix Limited | 0.69 | -12% | -14% | -62% | $341,909,414 |

| OCN | Oceanalithiumlimited | 0.16 | -24% | -27% | -69% | $9,023,005 |

| SUM | Summitminerals | 0.1 | -17% | -17% | -43% | $4,765,713 |

| DVP | Develop Global Ltd | 3.2 | -1% | 13% | 19% | $628,944,763 |

| XTC | Xantippe Res Ltd | 0.001 | 0% | 0% | -79% | $17,528,005 |

| OD6 | Od6Metalsltd | 0.155 | -9% | -18% | -16% | $8,527,402 |

| HRE | Heavy Rare Earths | 0.072 | -12% | 11% | -60% | $4,355,131 |

| LIN | Lindian Resources | 0.205 | 0% | -24% | -29% | $241,903,670 |

| PEK | Peak Rare Earths Ltd | 0.405 | 8% | -10% | 11% | $103,210,172 |

| ILU | Iluka Resources | 7.545 | 2% | -6% | -19% | $3,195,242,265 |

| ASM | Ausstratmaterials | 1.475 | 1% | -20% | -29% | $240,990,216 |

| ETM | Energy Transition | 0.037 | -5% | -10% | -20% | $51,518,272 |

| VMS | Venture Minerals | 0.011 | 0% | -15% | -56% | $19,500,130 |

| IDA | Indiana Resources | 0.06 | 0% | 3% | 3% | $33,936,592 |

| VTM | Victory Metals Ltd | 0.195 | -5% | -9% | 15% | $16,179,931 |

| M2R | Miramar | 0.045 | 22% | -8% | -53% | $6,847,999 |

| WCN | White Cliff Min Ltd | 0.012 | -8% | 33% | -52% | $15,084,223 |

| TAR | Taruga Minerals | 0.011 | 0% | 10% | -63% | $7,766,295 |

| ABX | ABX Group Limited | 0.073 | -6% | -12% | -53% | $17,206,198 |

| MEK | Meeka Metals Limited | 0.035 | -10% | -30% | -42% | $39,679,522 |

| RR1 | Reach Resources Ltd | 0.013 | 0% | 8% | 160% | $38,403,565 |

| DRE | Dreadnought Resources Ltd | 0.044 | -10% | -23% | -52% | $154,961,259 |

| KFM | Kingfisher Mining | 0.17 | -8% | -15% | -58% | $9,400,125 |

| AOA | Ausmon Resorces | 0.003 | 0% | 0% | -63% | $2,907,868 |

| WC1 | Westcobarmetals | 0.066 | -23% | -20% | -76% | $7,285,025 |

| GRL | Godolphin Resources | 0.04 | 3% | 8% | -54% | $6,600,439 |

| DM1 | Desert Metals | 0.04 | -15% | -38% | -91% | $2,901,643 |

| PTR | Petratherm Ltd | 0.059 | -8% | -6% | -21% | $13,709,819 |

| ITM | Itech Minerals Ltd | 0.12 | -8% | -31% | -66% | $14,032,027 |

| KTA | Krakatoa Resources | 0.02 | -13% | -5% | -71% | $8,697,958 |

| M24 | Mamba Exploration | 0.045 | -10% | -10% | -69% | $2,744,250 |

| LNR | Lanthanein Resources | 0.008 | 0% | -33% | -79% | $8,972,605 |

| TKM | Trek Metals Ltd | 0.032 | -40% | -48% | -42% | $15,811,843 |

| BCA | Black Canyon Limited | 0.13 | 8% | -16% | -43% | $7,877,325 |

| CDT | Castle Minerals | 0.011 | 10% | 10% | -54% | $12,369,423 |

| DLI | Delta Lithium | 0.685 | -4% | -5% | 15% | $351,554,721 |

| A11 | Atlantic Lithium | 0.47 | 2% | 7% | -28% | $296,937,205 |

| KNI | Kunikolimited | 0.29 | -3% | -28% | -59% | $24,053,755 |

| CY5 | Cygnus Metals Ltd | 0.145 | -19% | -26% | -67% | $43,506,396 |

| WR1 | Winsome Resources | 1.205 | -15% | -28% | 239% | $188,388,027 |

| LLI | Loyal Lithium Ltd | 0.51 | -18% | -38% | 21% | $46,002,932 |

| BC8 | Black Cat Syndicate | 0.21 | 0% | -2% | -36% | $63,156,055 |

| BUR | Burleyminerals | 0.145 | -6% | 26% | 16% | $14,181,546 |

| PBL | Parabellumresources | 0.345 | 0% | 0% | 25% | $18,879,263 |

| L1M | Lightning Minerals | 0.13 | 4% | -7% | 0% | $5,111,366 |

| WA1 | Wa1Resourcesltd | 4.4 | -11% | -22% | 2488% | $190,239,279 |

| EV1 | Evolutionenergy | 0.165 | -6% | -6% | -33% | $24,853,125 |

| 1AE | Auroraenergymetals | 0.11 | -21% | 57% | -49% | $19,900,866 |

| RVT | Richmond Vanadium | 0.39 | 1% | -1% | 0% | $32,327,927 |

| PMT | Patriotbatterymetals | 1.14 | -4% | -15% | 0% | $395,881,937 |

| PAT | Patriot Lithium | 0.17 | -6% | -15% | 0% | $10,860,875 |

| BM8 | Battery Age Minerals | 0.24 | -4% | -25% | -52% | $22,221,722 |

| OM1 | Omnia Metals Group | 0.078 | -8% | -19% | -48% | $3,554,532 |

| VHM | Vhmlimited | 0.495 | -1% | 3% | 0% | $73,110,159 |

| LLL | Leolithiumlimited | 0.505 | 0% | -10% | -12% | $498,553,663 |

| SRN | Surefire Rescs NL | 0.013 | -7% | -13% | 0% | $21,467,725 |

| SRL | Sunrise | 0.725 | -5% | -16% | -70% | $65,414,936 |

| SYR | Syrah Resources | 0.4925 | -3% | -14% | -72% | $324,430,910 |

| EG1 | Evergreenlithium | 0.25 | -11% | -7% | 0% | $14,057,500 |

| WSR | Westar Resources | 0.02 | -5% | -20% | -59% | $3,707,150 |

| LU7 | Lithium Universe Ltd | 0.049 | -4% | -4% | 23% | $18,649,051 |

| MEI | Meteoric Resources | 0.22 | 2% | -6% | 1471% | $417,241,282 |

| REC | Rechargemetals | 0.15 | -12% | -27% | 0% | $14,781,826 |

| SLM | Solismineralsltd | 0.265 | 8% | -18% | 279% | $20,202,444 |

| DYM | Dynamicmetalslimited | 0.185 | -8% | -20% | 0% | $6,475,000 |

| TOR | Torque Met | 0.32 | 7% | -10% | 73% | $36,187,502 |

| ICL | Iceni Gold | 0.071 | -5% | -21% | -21% | $17,029,857 |

| TMX | Terrain Minerals | 0.005 | 0% | -17% | -29% | $6,288,219 |

| MHC | Manhattan Corp Ltd | 0.005 | -29% | -38% | -29% | $14,684,899 |

| MHK | Metalhawk. | 0.088 | -10% | -27% | -52% | $6,931,849 |

| FIN | Fin Resources | 0.018 | +50% | +64% | -10% | $12,420,707 |

| ANX | Anax Metals Ltd | 0.035 | 9% | -27% | -44% | $15,046,637 |

Who’s charging up the ASX lately?

This lithium-hunting junior is a standout ASX battery metals performer of late – up 52% for the week and more than 106% for the month – and Stockhead (via ressie soothsayer Barry ‘Garimpeiro’ FitzGerald) pretty much called it early doors.

Well done if you’ve been following his column, paying attention and decided to take a chance.

This is about week-old news now, but the Environmental Protection Authority (EPA) has essentially given the company the green light to get the drills spinning at its Ravensthorpe lithium project in WA.

The EPA came to the conclusion it was “unnecessary” to assess the environmental impacts of clearing and drilling. This decision is not open for appeal.

Stockhead resources guru Reuben Adams reported early last week:

BNR – dobbed into the EPA by a “third party” — will now resume the clearing permit application process with drilling to kick off soon after approval.

It’s been a long road to reach this point at Ravensthorpe, 12km along strike of Allkem’s (ASX:AKE) Mt Cattlin mine, which BNR acquired April 2021 and then expanded the following year.

Limited to surface sampling and surveying until now, the company has defined three peggie trends with rock chips grading up to 8.21% lithium. Outrageous.

The proof of the project’s prospectivity will now be in the drilling. If they do hit paydirt, Barry Fitz surmises that Ravensthorpe could be an easy solution to Mt Cattlin’s lack of feed past 2027.

The cashed-up junior had almost $12m in the bank at the end of June.

BNR share price

The South Australian graphite explorer is up a tasty 40% for the month.

It has the following news, which landed on Tuesday this week:

We've increased and upgraded Mineral Resources at our Koppio #Graphite Deposit, part of our Kookaburra Gully Graphite Project in South Australia, adding a further 48kt graphite and upgrading the MRE from Inferred to Indicated status: https://t.co/dw6E82uSPe$LML #resources #ASX pic.twitter.com/eP2QhsDjlp

— Lincoln Minerals (@LincolnMinerals) October 10, 2023

LML has updated its Mineral Resource estimate for its wholly owned Koppio deposit within the Kookaburra Gully graphite project area in South Australia, adding a further 48kt to its total discovered graphite resource.

The Koppio resource gets an upgrade from Inferred to Indicated.

Lincoln’s interim CEO, Sam Barden, said: “This resource upgrade confirms that the Board and management’s strategic direction and actions over the past 12 months are moving our company in the right direction.

“Our path out of suspension on the ASX, to a resource upgrade via our recent drilling program is further proof we are providing value for all shareholders.”

A next round of drilling is scheduled over the coming summer months and the company is expecting further resource upgrades.

LML share price

Accelerate Resources (ASX:AX8)

Pilbara lithium hunter Accelerate Resources is up 26% for the week, 38% for the month.

It recently added four ‘transformational’ Karratha tenements to its growing battery metals portfolio, which is a major highlight of the investor presentation the company released into the wild yesterday.

As Stockhead detailed in a recent special report, Karratha is right in the heart of the Pilbara’s 40km-long Karratha-Roeburne lithium belt, where recent discoveries include Azure Minerals’ (ASX:AZS) monstrous Andover project (exploration target 100-240Mt at 1-1.5% Li2O).

Karratha comprises four projects – Prinsep and Mt Sholl (100% owned), Roebourne South and Mt Sholl East (75% owned).

Lithium hunters sure love a good nearology plot (see FIN, above), and why not, eh? Discoveries such as Andover have driven up share prices for lithium explorers over the past six months, even if the spot price of the commodity itself has been trending lower and lower.

The great battery metals hunt is still very much on, with lithium still the most sought after commodity in this frothy sub-sector. And that’s another trend set to keep rolling and rolling through Australia’s west, into Brazil, North America and beyond.

AX8 share price

New lithium bull shark Fin Resources is carving its way through ASX waters, up 58% over the past seven days, and 72% for the month.

This week its maiden fieldwork program identified abundant spodumene crystals within a broad pegmatite outcrop at Cancet West in James Bay, Canada.

Big nearology feels there, just 45km west of Winsome Resources’ (ASX:WR1) Cancet lithium deposit and 100km west of Patriot Battery Metals’ (ASX:PMT) 109.2Mt at 1.42% Li2O world-class Corvette deposit.

Then there’s the explorer’s 98km2 Ross project, close to Critical Elements Lithium’s (TSXV:CRE) Graab prospect and Nemaska Lithium’s 36.6Mt at 1.3% Li2O Whabouchi deposit – about 65km and 100km to the southwest respectively. Fieldwork has now begun at Ross targeting nine priority areas.

But regarding Cancet West, the company reports at least five pegmatite bodies have been identified outcropping across the western and eastern blocks of the area, with roughly total strike lengths of each outcrop ranging from 200-400m.

“These pegmatite bodies may extend for significant distances, along strike and below surface,” notes a company ASX release this week.

Read more on FIN’s latest discovery, here.

FIN share price

At Stockhead we tell it like it is. While Accelerate Resources and Fin Resources are Stockhead advertisers at the time of writing, they did not sponsor this article. Also at the time of writing, the author of this piece has a plankton-level investment in BNR.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.