High purity alumina demand could increase 300% by 2028. Here are the ASX stocks helping to plug the gap

Picture: Getty Images

High purity alumina, or HPA, is the battery material we don’t hear enough about.

The high-purity (+99.99%) form of aluminium oxide (Al2O3) is a high value critical mineral used in electric vehicles and LED lights.

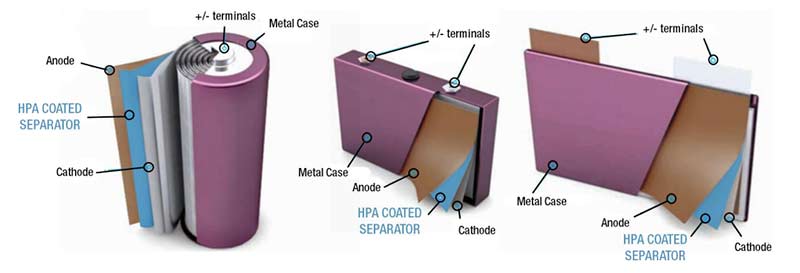

In EVs, it is used to coat the separators that keep apart the cathode and anode in lithium-ion batteries.

There’s about 5kg of HPA in every EV, on average. But it also being successfully tested for use in the anode and the cathode, which could send demand through the proverbial roof.

On top of all that is demand from the established, but still growing, LED market.

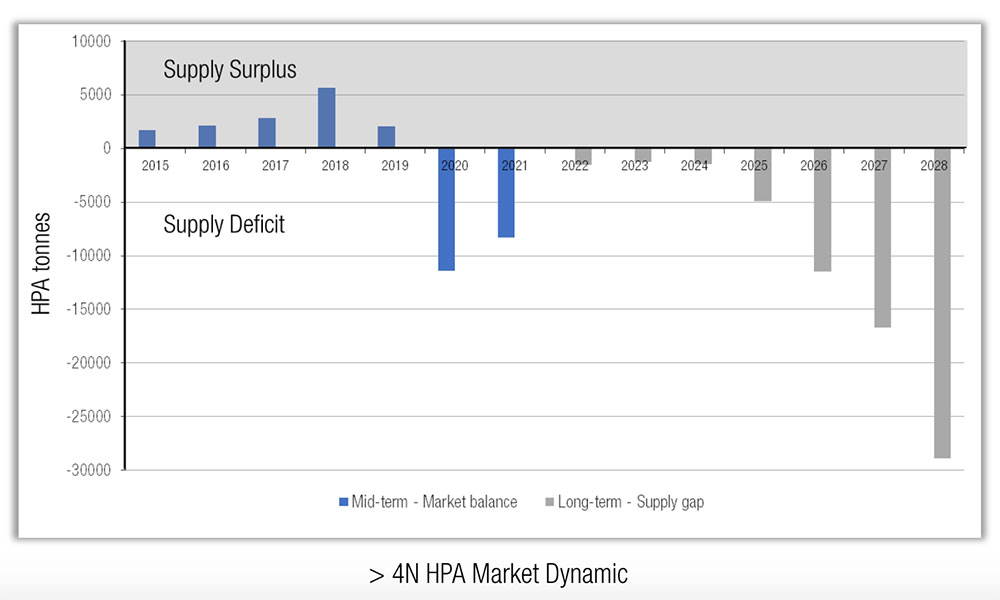

In late 2019, CRU reported that even if every HPA project in the pipeline comes online, we will still not have enough supply to meet estimated demand over the next decade and beyond.

This included all projects approaching or at pre-feasibility stage, as well as announcements for any planned changes in production from existing producers.

But here has been a dearth of commentary for investors since then, (unless you can afford to pay $50,000 – $80,000 for an in-depth report).

Stockhead hit up CRU for an update, who said ‘not right now’. We then went to the next best thing – Roly Hill, managing director at advanced HPA play FYI Resources.

CRU in 2019 said ‘supply would not meet estimated demand even if every project comes online’.

Hill:“That’s about 100% correct at this stage.”

CRU also said the 30,000tpa 4N (4 nines, or 99.99% HPA) market would build to a supply deficit of nearly 30,000t by 2028. Is it still tracking towards that?

Hill: “Supply is essentially shrinking while the demand is increasing, so we will see that deficit come forward a couple of years.”

“The thinking is as early as 2024-2025, and it will be a similar amount.

“Depending on what you read, they also say that by about 2028 demand might get to ~120,000t.”

The total market is still only 30,000tpa?

Hill: “Yes. This is not coming from the new wave of producers.

“It is mostly coming from current production, dominated by the Chinese, which have very expensive and slow processes and where the quality and the purity is very questionable.”

I have another stat to run past you. CRU said each EV includes about 5kg of HPA. Is that right?

Hill: “About right. It depends on the size of the battery – you can have up to 30kg of HPA in a battery.

“I think there is a Volvo battery that has about 30kg.”

If we just look at the separator side of it — ignoring the anode and cathode potential — how much of demand is going to the EV market?

Hill: “I think they are looking at 20% of current production that is going to the LIB market.

“What is likely to be in the future is a bit hard to tell, but you suspect that given the performance expectations on batteries, that 20% is likely to increase.

“The bigger market at the moment [80% of production] is sapphire glass [for LEDs].”

Is that growth market?

Hill: “It is definitely a growth market.

“We are also seeing sniffs of the advent of micro-LEDs, which are about 90% more efficient than current LEDs.”

Punter’s guide to HPA stocks on the ASX

Now we know that demand could potentially increase by 300%, or more, by 2028. That makes the handful of HPA stocks on the ASX look very attractive.

Each of these stocks uses a different method of production, but one thing they have in common are their huge operating cost advantages over existing producers.

Currently HPA is sourced from expensive feedstock, such as refined aluminium metal, which puts current global operating cash costs for 4N at around $US15,000/t.

The ASX players reckon they can do it for between $US6,000 and $10,000/t.

Here are some of the companies that investors should be keeping an eye on.

FYI RESOURCES (ASX:FYI)

Market Cap: $60m

FYI has been all in on HPA since 2017 and is now one of the most advanced and knowledgeable stocks in the sector.

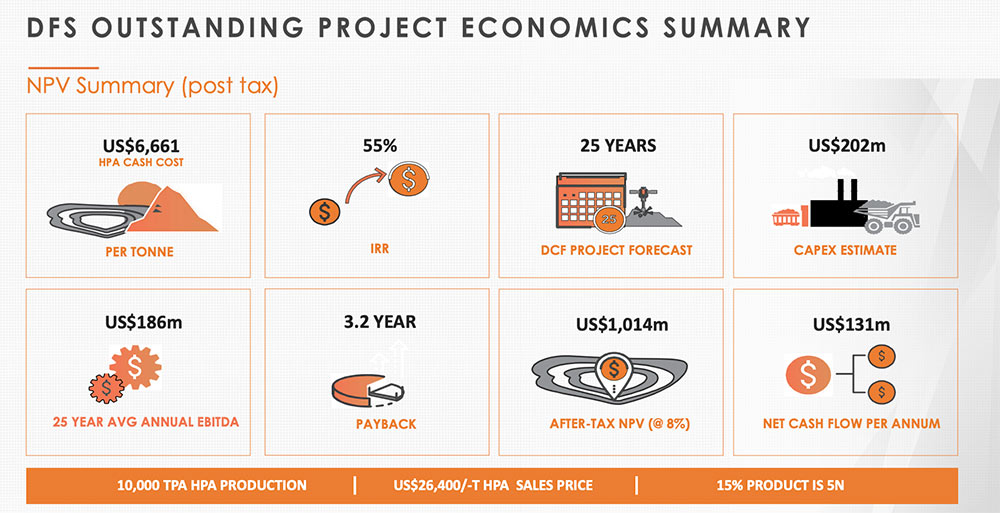

An April 2021 DFS – the most advanced of project studies – on its namesake 9,000tpa project revealed some impressive numbers:

It has since inked a JV deal with Alcoa, whereby the world’s biggest alumina produce can acquire 65% of the project by spending $US243m on project development.

A final investment decision is expected in December. After that, a demonstration facility would be constructed.

All going well, the construction of a full-scale plant will kick off in 2023.

But there’s a bonus: FYI has been working with fellow WA project developer EcoGraf (ASX:EGR) on a HPA coated anode, which Roly Hill says is “exciting” and “coming along very nicely”.

ALPHA HPA (ASX:A4N)

Market Cap: $320m

In March, the Queensland high purity alumina (HPA) project developer was awarded a $45m government grant, all part of a wider $250m cash splash designed to build our own industrial capacity and reduce reliance on China for critical metals.

The cash will go to building the full-scale ‘HPA First’ project, which is expected to produce ~10,000tpa HPA for sale to the lithium-ion battery and LED lighting industries.

A4N’s project will make +$US191m in free cashflow per year and cost $US209m to build.

The stock is already fully funded to build a smaller Stage 1 precursor production facility, which is scheduled to commence commercial production in the current quarter.

It says it is “in the mature phases of market outreach and project financing with respect to the full scale HPA First project, with the expectation of positioning the HPA First project to final investment decision”.

ALTECH (ASX:ATC)

Market Cap: $120m

This HPA trailblazer has been trying to get financing for its 4,500tpa Johor HPA project in Malaysia for several years.

It needs ~$200m on top of the committed senior loan facility of US$190m from German government owned KfW IPEX-Bank.

The project generates $US76 million of free annual cash flow at full production, ATC says.

Meanwhile, ATC has inked a deal with German battery institute Fraunhofer IKTS to commercialise IKTS’ revolutionary CERENERGY Sodium Alumina Solid State (SAS) Battery.

Altech will be the majority owner (75%) of the JV, which will commercialise a 100 MWh project to be constructed on Altech’s land in Schwarze Pumpe, Germany.

The target market for this project will specifically focus on the grid (stationary) energy storage market which is expected to grow from US$4.4 billion in 2022 to US$15.1 billion by 2027.

SUVO STRATEGIC MINERALS (ASX:SUV)

Market Cap: $40m

Kaolin producer SUV is acquiring a 26% share in green HPA player Dingo, which is developing a tech to produce HPA from recycled aluminium feedstock.

SUV can acquire up to 76% subject to various milestones being met.

Dingo intends to take advantage of “urban mining”, transforming waste aluminium feedstock (like beer cans) into HPA.

Dingo’s IP is currently at the concept study level, and Dingo intends to use funds from the SUV placement towards a scoping study, the first proper look at the economics of building a project.

SUV says that 300% growth in HPA demand by 2028 could be understating it.

“Recent market reports show that demand for HPA in powder form is expected to grow to 187,000 tonnes per annum by 2028, with this growth likely to be constrained by supply limitations, leading to a potential spike in prices as supply struggles to keep pace with demand,” SUV chairman Henk Ludnik says.

“Dingo’s bespoke IP offers a potential pathway for Suvo to produce a sustainable source of HPA with a low carbon footprint, compared to traditional HPA production, and take advantage of rising demand and prices.”

CHEMX MATERIALS (ASX:CMX)

Market Cap: $8m

Recently listed CMX has a dual focus — exploring the ‘Eyre Peninsula’ halloysite, kaolin and manganese projects and developing its HiPurA high purity alumina (HPA) processing tech in WA.

Initial test work has indicated that the process is low cost and low in energy consumption, compared to alternative tech.

CMX says a key competitive advantage is that the HiPurA process is not tied to mine production, with the feedstock being a widely available chemical.

Following a successful pre-feasibility study, the company is now building a $2.5m, 50tpa pilot plant in Perth to produce larger quantities for customer qualification.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.