Here’s why Australian Mines answered the clarion call from its Brazilian critical minerals projects

Brazil’s critical minerals exploration proved irresistible to Australian Mines. Pic via Getty Images

- New Brazilian critical minerals projects have plenty of potential to deliver Tier 1 discoveries for the soon-to-be-rebranded Australian Mines

- Jequie is next to the 510Mt Rocha de Rocha REE project held by the Gina Rinehart-backed Brazilian Rare Earths

- The company’s other asset, the Resende lithium project, is also near an existing lithium mine

Junior explorers differ from their larger counterparts in several ways, but one of the key differences is the ability to (almost) turn on a dime and embrace new opportunities if needed.

This is exactly the approach Australian Mines (ASX:AUZ) adopted when it became clear its Sconi project – while a solid, low-risk nickel-cobalt play in Australia – would struggle to pass the necessary development hurdles in a depressed nickel market.

So when the opportunity arose in late 2023 to acquire two critical mineral projects in Brazil from a local vendor, the company wasted no time picking up the Jequie ionic clay-hosted rare earths-niobium project as well as the Resende lithium project.

“We are a junior mining company and we have to keep current and new investors excited about what we do and the potential of our projects,” AUZ chief executive officer Andrew Nesbitt said.

He added that acquiring the new projects also exposed its shareholders to additional opportunities with the potential to host Tier 1 critical mineral discoveries.

To further underscore the company’s shift in focus, AUZ plans to change its name to EcoMetal Resources to reflect its increased exposure to battery metals.

Brazilian samba rocking critical minerals space

AUZ’s decision to pick up the Brazilian projects is based on several solid reasons.

For starters, Brazil is a relatively stable mining jurisdiction that is home to some of the largest mines in the world.

It has also been steadily building a reputation as one of the hottest addresses for critical minerals exploration, with plenty of juniors snapping up ground prospective for rare earths and lithium.

And it is this environment that helped the company acquire the Jequie rare earth-niobium project in the state of Bahia in north-east Brazil and the Resende lithium project within the Sao Joao del Rey pegmatite province from the vendor for $1.14m, consisting of $150,000 in cash and 90,000,000 AUZ shares.

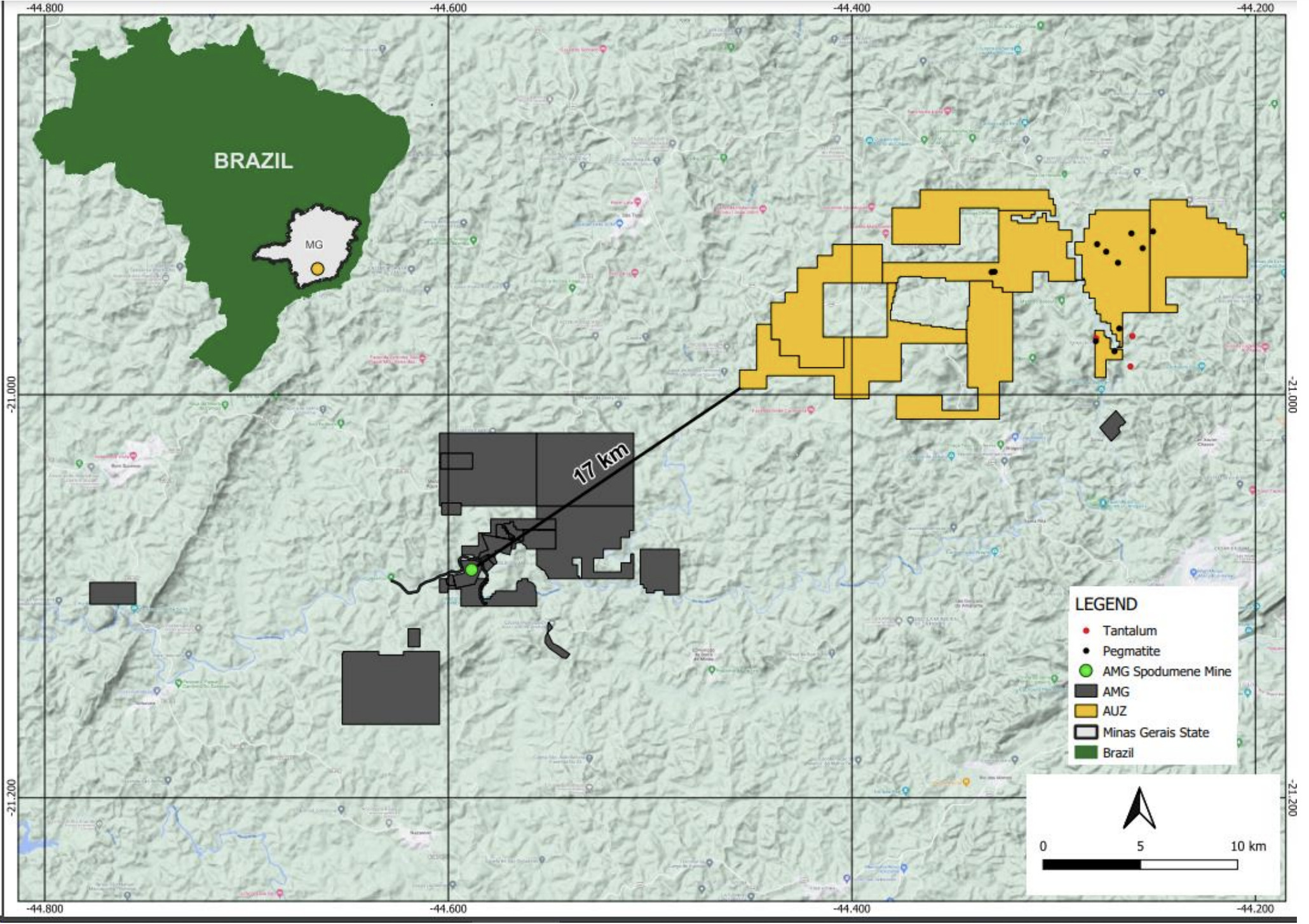

The ~826km2 Jequie project is immediately adjacent to the Gina Rinehart-backed Brazilian Rare Earths’ (ASX:BRE) 510Mt Rocha de Rocha rare earths project, while Resende is just 17km to the east of AMG Lithium’s producing Mibra spodumene mine which has been in operation since 1945.

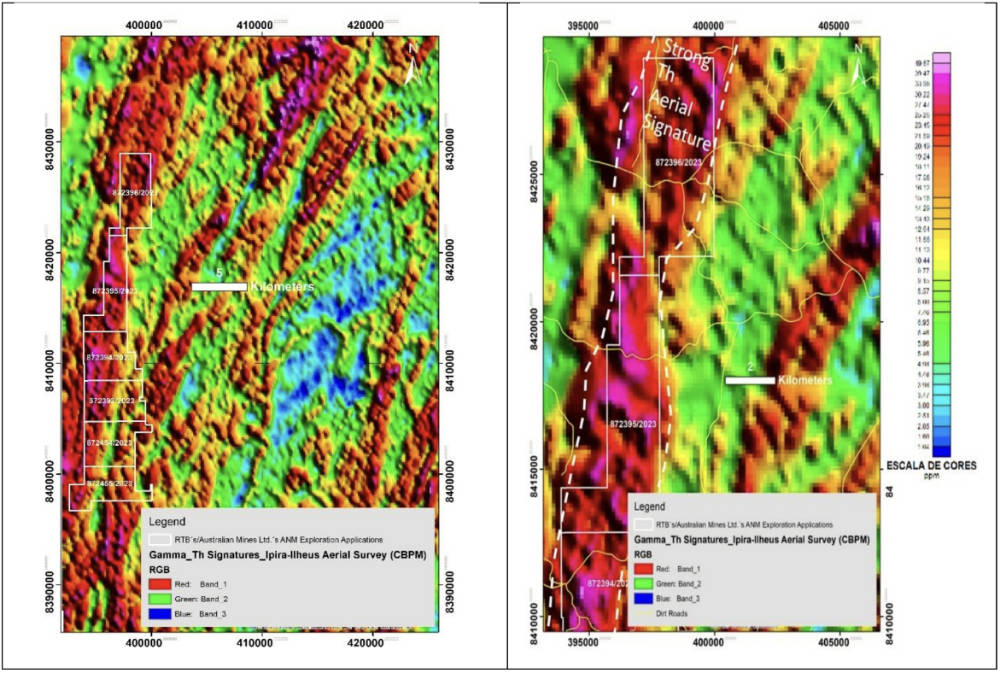

Nesbitt said nearology was one of the factors used by the company to make its purchase decision though the thorium anomalies – a pathfinder for REE mineralisation – also played a significant role for Jequie.

“When we first made the announcement, all we really had was nearology and a large, 25km long thorium anomaly,” he noted.

“However, once we got on the ground, we started to see the right ingredients for proper mineralisation – chalconites, granites, and then very importantly, weathered profiles of saprolites.”

He added that, to date, the company has only looked at ~20% of total tenement package – and even that 20% coverage has a lot of holes.

“It’s early stage, but it is proof that we have managed to get on the ground, find the right ingredients, package samples to send for assay and hopefully they come back successful,” Nesbitt said.

Having Rinehart involved in the neighbouring project also brings several advantages.

“It is just easy to promote, you don’t have to spend the first 20 minutes of speaking to somebody convincing them it is a relatively easy place to operate because she has kind of given it the tick of approval,” Nesbitt said.

“It is the confidence that if she is willing to get involved in something there does reduce the risk on the transactions.”

REE first, then lithium

While both Brazilian projects have tremendous potential to deliver rich rewards, AUZ has chosen to focus on Jequie initially – and for some very good reasons.

Besides the large thorium anomaly and proximity to Rocha de Rocha, Jequie has the ability to quickly add value for the company, according to Nesbitt.

“Right now, my take is that I can go to the Jequie project and do a relatively easy exploration program in terms of sampling, followed by drilling and putting the resource on the board,” he noted.

“At Resende, I would have to do stream sampling, vectoring, figuring out the mineralisation, then we would still have to do risk exploration because we can’t see the mineralisation. You have to accept more risk.

“Whereas at Jequie, you are walking on the mineralisation, you can see it, it’s there. Jequie is easy to drill, trenching, taking samples off road cuttings.

“In the event of success, mining of ionic adsorption clay type REE is easy and if you can concentrate them correctly, it’s fairly simple.”

That’s not to say that Resende is a distant second.

Nesbitt noted that the AMG Lithium, which operates the nearby Mibra mine, is a chemical company not known for its exploration chops.

“That’s why we acquired those assets. We know from the geophysics, we can see deep seat conduits for igneous type flows and on surface you can see a whole lot of pegmatites,” he said.

“And while they are not as developed as we would have liked to see, when you look at it again, the regolith is different compared to the operating mine.

“The fact that there is a different regolith has hidden any potential pegmatites that do contain lithium. We are confident that there is something there, but it will require some work.”

He added that while Resende is a secondary project, people typically invest in juniors because they are dynamic.

Sconi not forgotten

Despite the company’s focus on its Brazilian projects, Nesbitt believes the Sconi project can still have its day.

“We know the nickel price is in the doldrums, Australian operations are suffering and even in a good market, the Sconi project will always be quite difficult to compete on an economic scale as the capex is significant.”

However, he expects the project to have low operating costs once it is in production, though that is not its only advantage.

“The advantages of Sconi are that it is Australian, it has been mined before so obviously there is a technical solution, and given Australian mining legislation and the different processes, it is a project that you really can stamp a date on when first production will occur once you decide to proceed,” Nesbitt said.

“It is a simple concept, it is extremely levered to the nickel price, so any improvement to the nickel price will allow it to react more than other projects.

“In the meantime, we will carry on de-risking things like time to production.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.