Here’s a list of the best-performing ASX CleanTech stocks

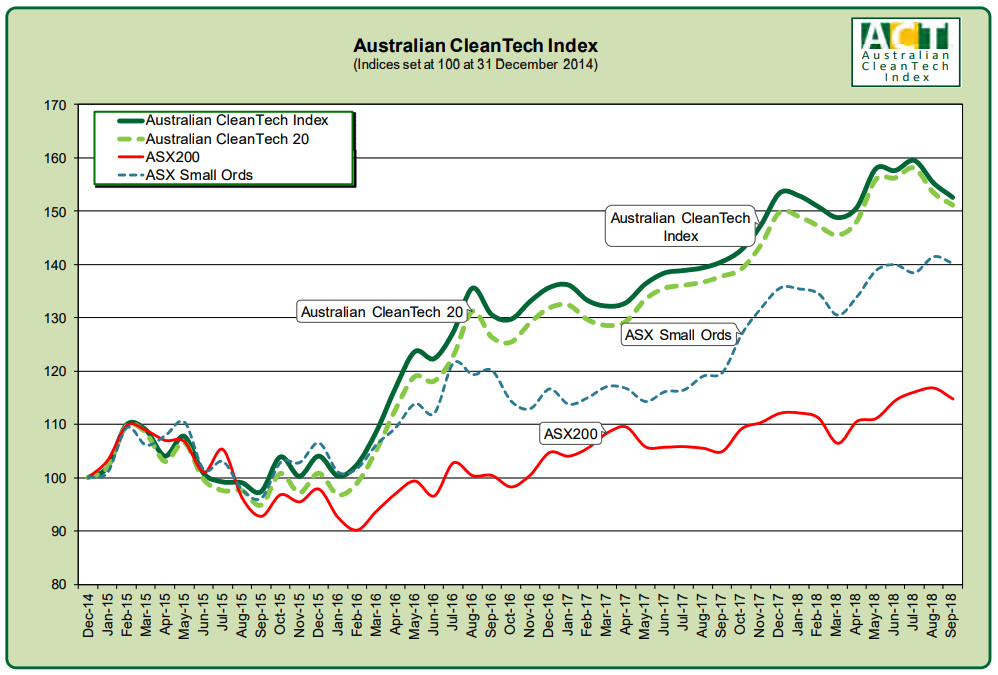

The Australian CleanTech Index has underperformed the wider market this quarter, falling 3.2 per cent.

The Cleantech Index, run by Deloitte-owned industry group Australian CleanTech, was dragged down by companies in the minerals, energy storage and efficiency, waste and water sectors.

Renewable energy was the one sector that ended the quarter in positive territory, up 2.2 per cent.

The ASX200 and Small Ordinaries ticked up 0.2 per cent in the September quarter.

The ‘green’ sector has been buffeted by a variety of headwinds this quarter, from the government nixing yet another energy and emissions policy to volatile interest in stocks representing the various battery metals.

The new federal energy minister Angus Taylor is an avowed wind power sceptic who claimed last week at the Outlook Conference that no emissions policy is better than a low emissions target, while new investment in Australian renewable energy is back down to 2016 levels.

Over the long term however the Index has outperformed the traditional indices.

Which stocks are driving the ups, the downs

The Cleantech Index consists of 94 companies spanning energy generation, energy metals, water, air quality, electric vehicles, waste and energy efficiency.

It has a collective market cap of $45 billion.

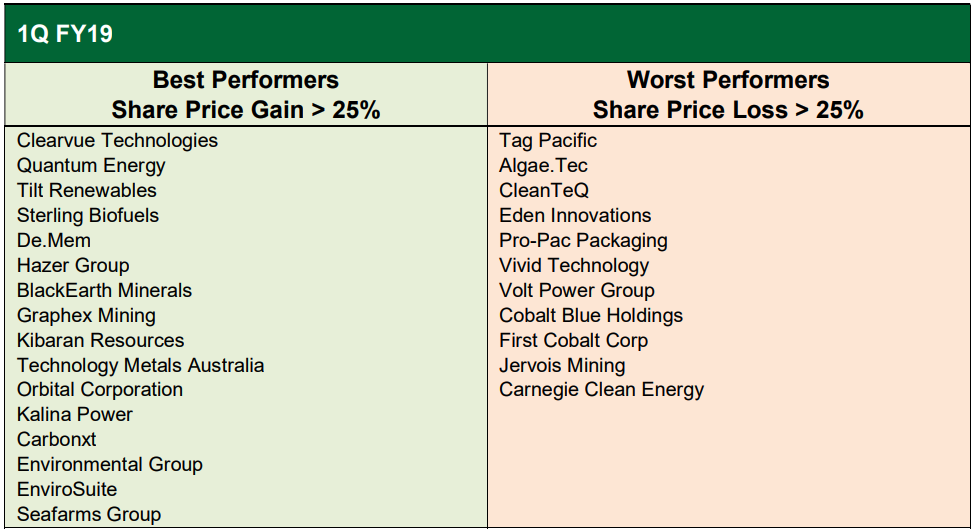

The quarter’s performance was driven by 16 companies with gains of more than 25 per cent.

The greatest percentage gains were recorded by Clearvue Technologies (ASX:CPV), Kalina Power (ASX:KPO) and Seafarms Group (ASX:SFG). The greatest gain in market capitalisation over the quarter was from large cap Cleanaway Waste (CWY).

But the gains were offset by the 11 companies that recorded losses of more than 25 per cent.

Cobalt Blue (ASX:COB) led the fall, assisted by Carnegie Clean Energy (ASX:CCE) and Pro-Pac Packaging (ASX:PPG). The greatest loss in market capitalisation over the quarter was from the ever-volatile Sims Metal Management (ASX:SGM).

There has been movement among the top 20 cleantech stocks on the ASX as Pro-Pac, led by former Australia Post boss Ahmed Fahour, has been bumped out as has battery hopeful Magnis Resources (ASX:MNS).

They’ve been replaced by Seafarms and Phoslock Water Solutions (ASX:PHK), a water cleaning company that struck it big earlier this year after making its maiden profit.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.