Guy on Rocks: Volatility reigns… but metals hold strong

Pic: Tyler Stableford / Stone via Getty Images

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week.

Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions

The end of a volatile week with news of another round of credit tightening in China taking the shine off industrial commodities, with some commentators saying the PBOC (People’s Bank of China) will begin tapering stimulus.

Given China’s real GDP growth of 6.5 per cent YOY (or 2020 GDP of 2.3 per cent), slightly ahead of consensus estimates of 6.2 per cent (Morgan Stanley, 2021), this is not surprising.

Industrial production was also strong, rising 7.3 per cent in November 2020 with PMI in expansion at 51.9 (52.1 Nov), so overall this is all supportive of commodities.

Iron ore remains stubbornly high at US$155.2 (62% Fines) despite China’s Ministry of Industry and Information (MIIT) reiterating its plans to reduce China’s annual steel production from 2021 as part of efforts to cut carbon dioxide emissions before 2030.

However, most market sources remained sceptical, as steel demand at both at home and abroad was expected to increase in 2021.

Notably, MIIT announced planned to cut 150-200 million tonnes of steel production capacity six months ago but this hasn’t transpired.

You can’t blame the Chinese government for talking down steel demand as iron ore prices eat into steel margins.

Weekly shipment volumes out of Australia were also impacted by weather (down 13% WoW, a 49-week low in Australia), with Cyclone Lucas causing shutdowns in Australian and higher rainfall impacting Vale; all contributing to high iron ore prices.

In China, iron ore imports fell slightly to 97mnt (-1% MoM, +4%YoY), the lowest monthly volume since May 20, mostly attributable to lower Australian shipments.

Base metals and bulk commodities on Chinese local exchanges traded mostly rangebound last week. Copper, aluminium and nickel markets saw new longs amid the broader risk-on sentiment following Biden’s inauguration and expansionist policy leaning.

Overall, I am bullish on commodity prices over 2021 with inventories remaining broadly low and demand looking strong.

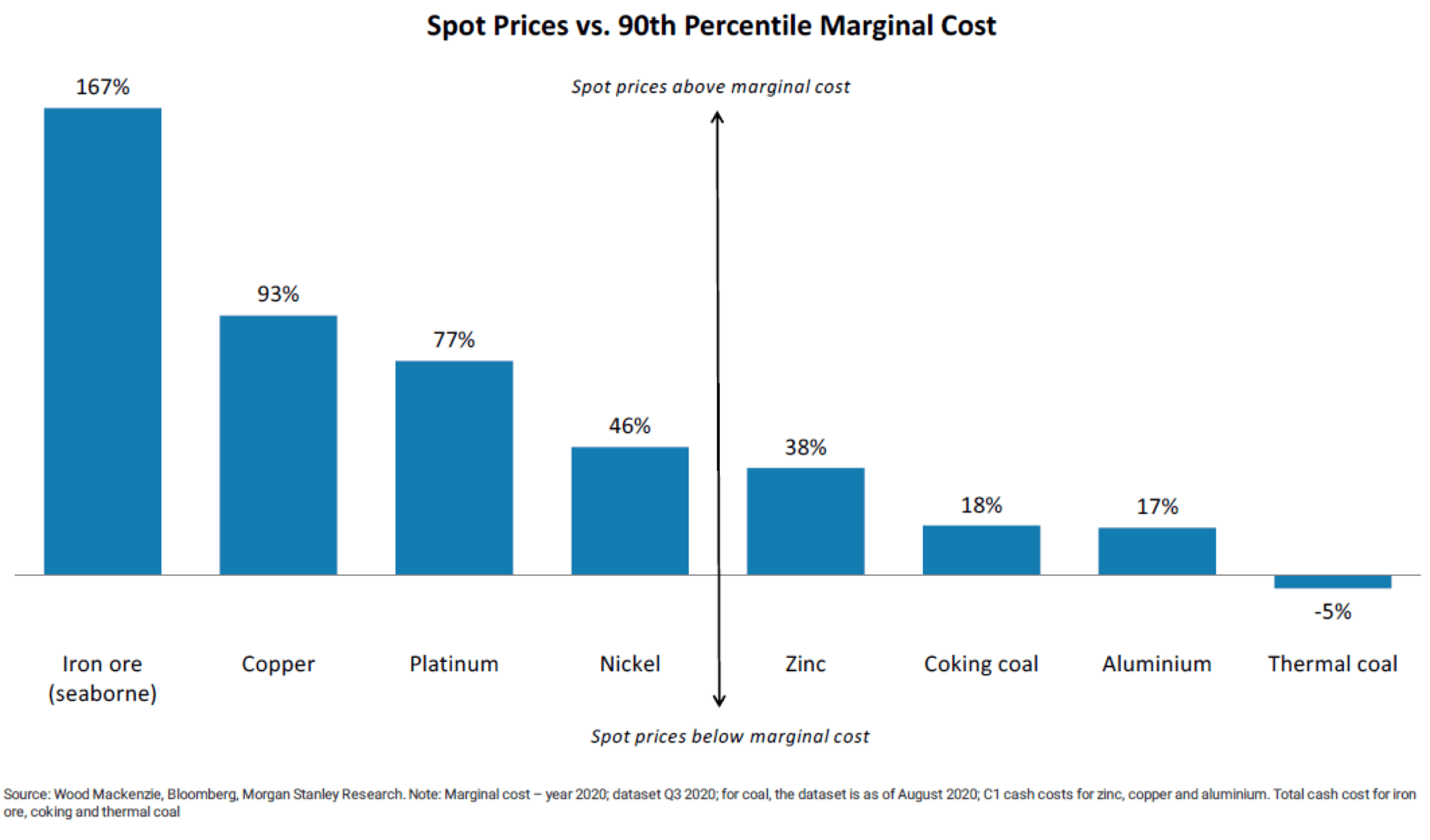

It is worth taking stock of commodity prices and where producers sit in respect to margins. If we look at Figure 4, it is not surprising that exploration is being rewarded given producer margins remain strong among our favoured metals iron ore, nickel and copper:

So where do we sit in the mining cycle? There are indications that valuations of large cap miners (which filter down to small to mid-cap miners) are still trading at a discount based on projected price to earnings multiple and book values coming off a very low base in 2016. Trailing and forward-looking price to earnings ratios also show we are moving towards longer term averages.

The takeaway is that there is still room to move in mining valuations which are likely to be pulled up further as metal prices continue to rise.

Company News

It will take a while to sift through the quarterlies and announcements late in January.

There were a couple of standout announcements over the week, including Challenger Exploration (ASX: CEL) announcing that a 45,000 metre RC program at the Hualilan Gold Project (San Juan Province, Argentina) returned multiple new zones of high-grade skarn mineralisation outside the boundaries of the existing historical resource.

Highlights included 12m at 20.9g/t (AuEq2-20.4g/t Au, 4.8g/t Ag,1.0% Zn) from 289m downhole and 110.5m at 3.0 g/t AuEq (2-2 .5 g/t Au, 7.4 g/t Ag, 0.9% Zn) from 81.5m downhole.

Kris Knauer described these as a “transformational set of results” and I am inclined to agree with him.

American Borate (ASX:ABR), recently off to $1.47 from their recent $1.84 highs, are likely to complete their US$30 million finance by the early February 2021 which should seem them fully funded into Phase1B of Fort Cady borate mine with Sinar Mas Mining appointed to support ongoing financing.

Ausmex Mining Group (ASX:AMG) is starting to show a little share price appreciation providing a good summary of high-grade gold results from recent drilling campaigns at Mt Freda (Queensland) where an upgraded JORC resource is due out shortly.

Diamond drilling at Trump copper/gold project intersected a separate zone of gold.

Mining/pre-feasibility studies are also near completion at Mt Freda gold mine (updated JORC Resource imminent) so perhaps this is a year that could “make AUG great again”, or something similar…

While East Kundana JV (Kalgoorlie) gold production was slightly lower than anticipated Tribune Resources (ASX:TBR) still netted 24Koz of gold over the quarter.

A total of 6,792 metres (of a 45,000-metre program) of RC drilling continued to deliver excellent results at their Ghanaian Adiembra Prospect (JORC Inferred and Indicated Resource of 1.8Moz) with Diwalwal (Philippines) returning numerous high-grade gold intercepts on the Balite vein including UBADH-003 with 2.5 metres at 6.58g/t gold from 173.8 metres downhole and UBADH-006 with 1.9 metres at 35g/t gold from 157.4 metres downhole.

I am expecting a significant resource upgrade at Adiembra mid-year and a maiden resource at Diwalwal late 2021.

The new look (post 1:25 consolidation) Boab Metals (ASX:BML) (formerly Pacifico Minerals), is pushing hard at its Sorby Hills Lead-Silver Project (Kimberley, Western Australia) where a DFS is in full swing including a Phase IV drilling program that has a very good chance of increasing global JORC resources which currently stand at 44.1Mt at 3.3% Pb, 38g/t Ag and 0.5% Zn, and proved and probable reserves of 13.6Mt at 3.6% Pb, and 40g/t Ag.

The company is in a strong cash position ($15m at 31/12/2020) and valuation targets ranging from $0.75 (Euroz) and $1.02 (Shaw and Partners) are realistic.

At an NPV8 of around $300 million (pre-tax, $227 million attributable to BML) I think, with the support of Henan Yuguang Gold and Lead Co, this project has a reasonable chance of making it into production.

Notably silver represents around 24% of revenue and is trading at US$27/ounce with PFS numbers based on US$21.10/ounce.

New Ideas

Often those undervalued companies in the pre-development, post DFS/BFS phase present excellent risk-return propositions. Everyone playing with small cap miners wants leverage to world class, or potentially world class mining assets.

Highfield Resources (ASX:HFR) has been on the radar for a couple of years and like Greenland Minerals Ltd (ASX:GGG) has been marking time waiting for a mining licence.

HFR is an emerging potash producer on the back of its Muga MoP (muriate of potash, KCL) project in Spain.

Environmental approvals have been granted and the final phase is the granting of a mining concession which we are confident of (fingers crossed) this calendar year.

The DFS contemplates production of 1Mtpa of MoP (phase 2) and 0.50Mtpa (phase 1) over a 30-year mine life based on a very achievable CAPEX of $580 million with C1 costs of US$95/t (figure 14) and AISC US$104/t (lowest cost quartile), life of mine operating margins in excess of US$170/tonne and a $3b NPV8 (Phase 1+2).

At a market capitalisation of $200 million there is plenty of upside potential here.

Furthermore, there are no government royalties and a local work force with good access to port/infrastructure.

With Europe a net importer of potash and prices moving up sharply, the imminent granting of a mining licence should see a significant re-rating.

With peers such as ABR up 520% in 12 months (current market cap of $450 million), I am optimistic of HFR being re-rated well above $1.00 this calendar year following the granting of a mining license

American Borate Ltd (ASX:ABR) has been very good to us since it came across my desk in the mid 20s and I think for those who like buying value and waiting it out, then Highfield Resources Ltd (ASX:HFR) may be a good medium to long term play.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.