Guy on Rocks: Christmas in July comes early

Ho ho ...oh. Picture: Getty Images

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week.

Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market ructions

I know we celebrate Christmas in July and December each year in Perth (because there’s so much to celebrate), but it feels like the July festivities have started early in the form of copper at 10-year highs (figure 1) and currently trading at $US4.47 ($5.79) a pound (lb).

The red metal has been spurred on by strikes in Chile (again) as President Sebastián Piñera moved to block a bill allowing people to make a third round of early withdrawals from their pension funds.

Adding to Chile’s woes are discussions of tax hikes of up to 75 per cent on cash generated above $US4/lb. Fortunately this looks unlikely to pass the congressional mining committee.

Goldman Sachs has even come out of its comfort zone, predicting $US6.80/lb ($US15,000/tonne) by 2025. Interestingly, the copper market remains in backwardation suggesting the traders believe copper is set for a fall.

A quick look at some key economic indicators in China might give us a clue as to what is driving copper…

Gold had a volatile week, off 1 per cent to $US1,768 with the rising US dollar and rising treasuries. Meanwhile, Palladium hit another all-time high of $US2,841, up 2.8 per cent for the week.

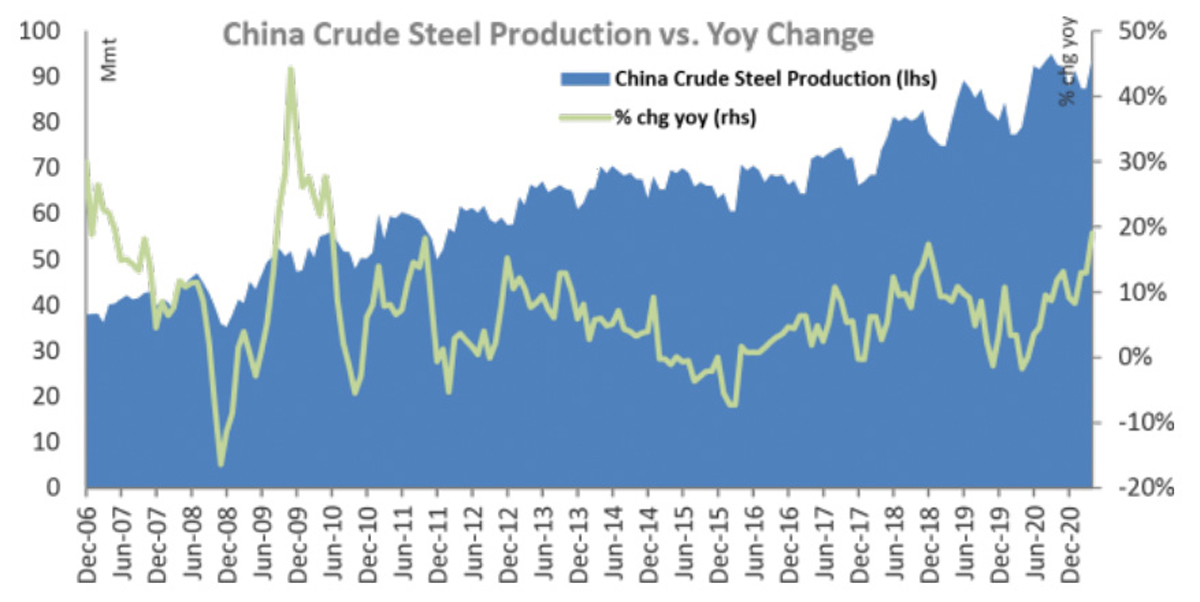

Iron ore appears to be on an unstoppable march towards $US190/tonne (I am planning some festivities at Cigar Social if it goes north of $US200/tonne) as China’s crude steel production reached 94 million tonnes (+19 per cent year-on-year) in March – 14.4 per cent on a quarterly basis and the second strongest month on record behind August 2020.

Port stocks expanded to 9 million tonnes (+7 per cent) year-to-date, reaching the highest volume level since May 2019, marginally higher than the long-run average of 32 days of consumption.

World Steel (2021) also reported global steel production was up 15 per cent year-on-year and 2 per cent month-on-month in March with a strong performance from China (figure 6).

I think new car sales in Perth are another useful economic indicator of a commodities boom and I couldn’t take my eyes off a new electric $400K Porsche Taycan parked outside the office – driven, as it turns out, by one of our lawyer friends who kindly took me on a drive around the block.

I am not sure if any of the Stockhead faithful have driven around West Perth at 150km/hr, but it certainly looks different at that speed.

Movers and shakers

Caeneus Minerals (ASX:CAD) seems to be on the march (figure 7) ahead of its maiden 19,500m drill program (late May/early June?) that will be following up a number of aeromagnetic features at its 100 per cent owned Roberts Hill project.

The tenements are situated within the Mallina Basin about 6km from De Grey Mining’s (ASX:DEG) Hemi prospect and have had very limited exploration conducted on them to date, including one water bore and limited soil geochemistry.

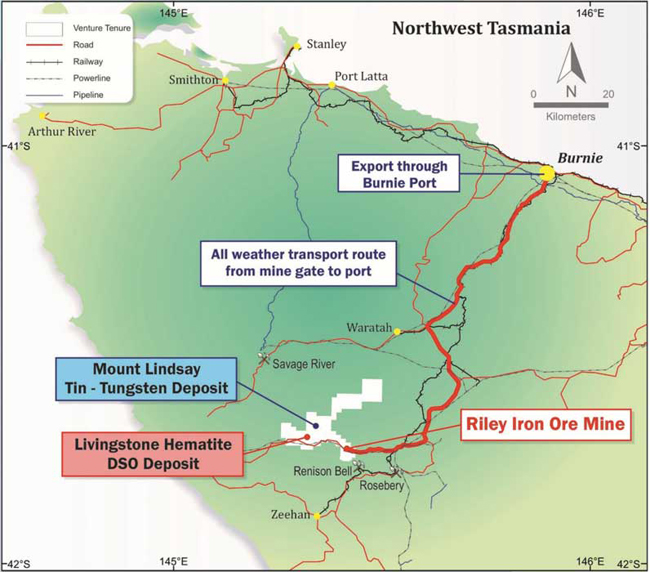

Another company moving up strongly (figure 9) that we identified last year around 1.5c is Venture Minerals (ASX:VMS).

The company has just made a series of senior appointments as it moves into production at its 100 per cent owned Ridley iron ore project in Tasmania (figure 10).

Construction of the wet plant is underway (figure 11) and while the reserve is small by iron ore standards (1.6 million tonnes at 57 per cent iron) the project should generate in excess of $200m over an 18-month life of mine, which is impressive compared to a current market capitalisation of around $130m.

The company also has an active exploration portfolio including the Orcus prospect, situated just north of Golden Grove (WA), which returned up to 7 per cent zinc from earlier drilling, and a joint venture with Chalice Mining (ASX:CHN) to earn-in on a possible Julimar look-a-like at the South-West project.

Mt Lindsay (Figure 10) is also being looked at again and contains 80,000 tonnes of tin and 3.2 million tonne units of tungsten trioxide.

Plenty going on here and with strong cash flow coming from Riley you would have to agree the company has never been in a stronger position.

Hamish Halliday (non-executive director) if you are reading, you could do something useful and organise some ski accommodation for me in NZ this year. As long as it doesn’t cost more than $300 it won’t be considered a soft-dollar benefit.

Forgot to mention those who climbed aboard Rumble Resources (ASX:RTR), which is now trading at 61c… well done. And well done to me for calling it around the mid-teens.

Hot stocks to watch

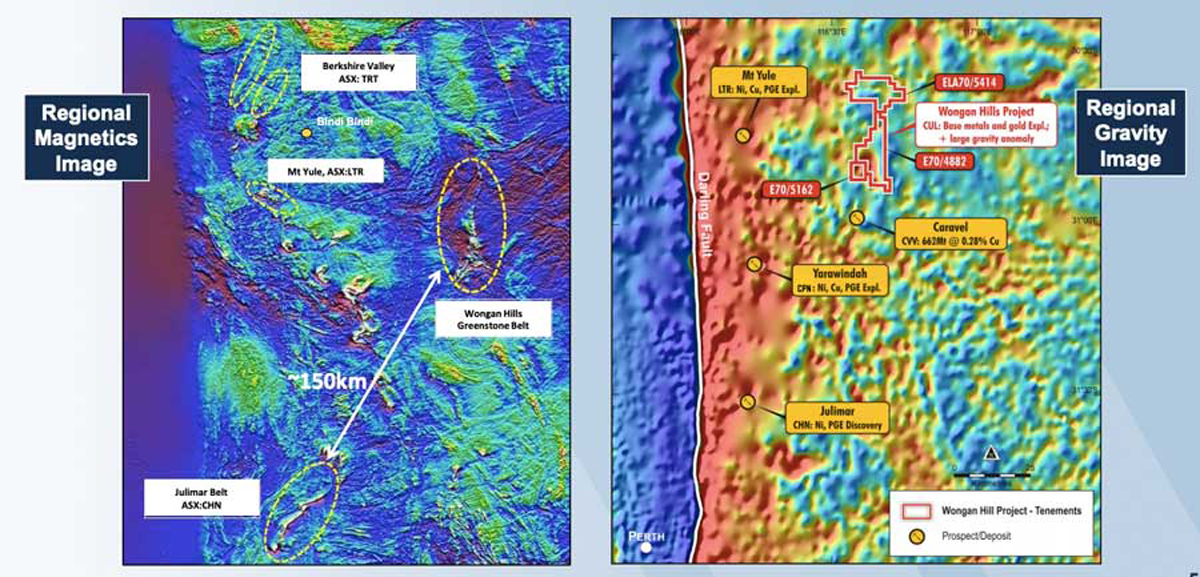

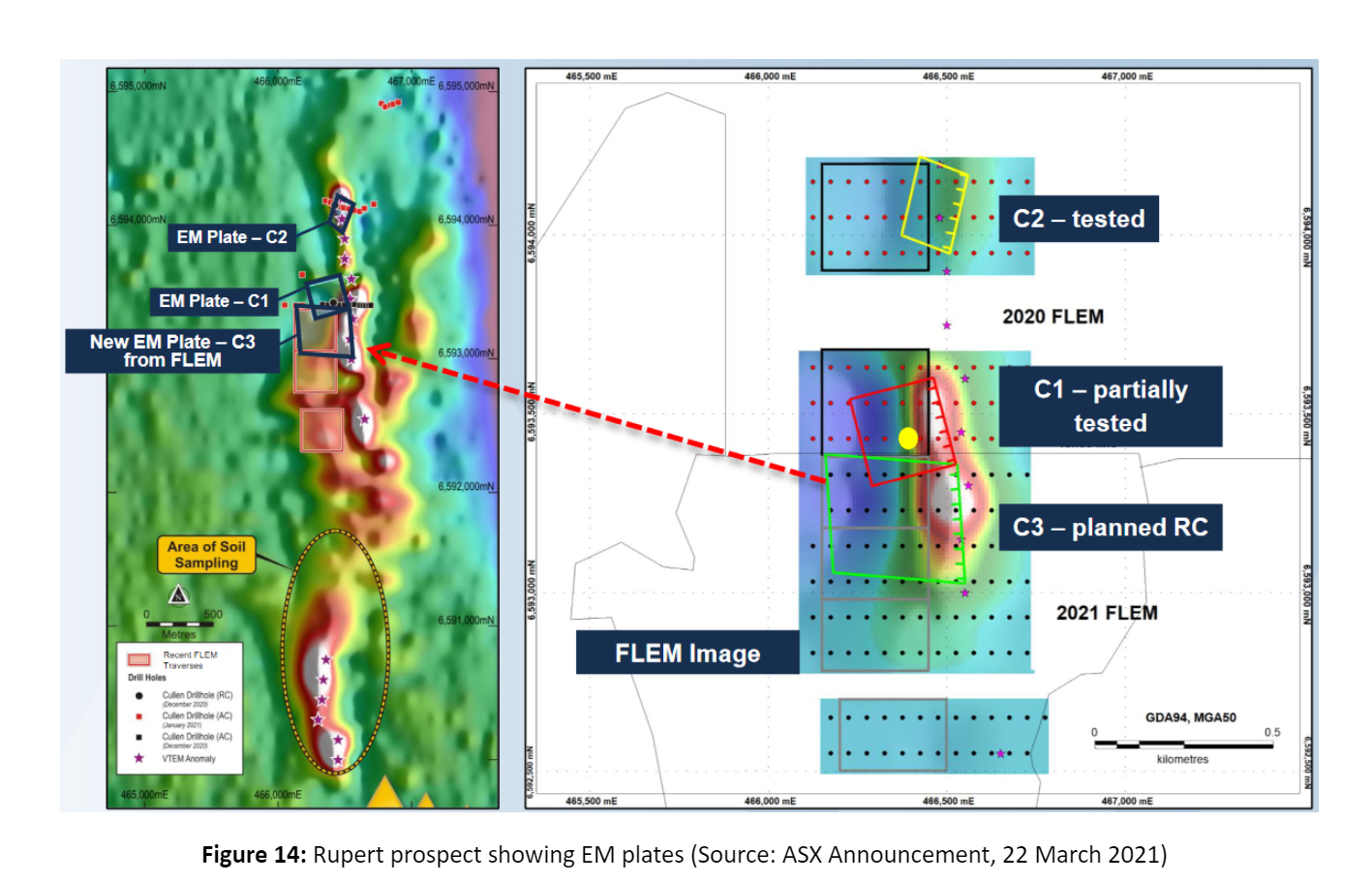

Cullen Resources (ASX:CUL) closed at 3.7c (figure 12) after investor interests was piqued by the mention in its March quarterly of the identification of a strong electromagnetic (EM) conductor with an apparent strike length of around 240m at the Rupert copper-zinc-silver-gold prospect (Wongan Hills project, figure 13).

The company also identified mafic-ultramafic stratigraphy prospective for nickel-copper-platinum group elements mineralisation at the Jackaby prospect, where a ground survey is planned, subject to negotiating landowner access.

It’s very early days here with some smoke from soil, laterite sampling and drilling providing good pathfinder results for VMS (volcanogenic massive sulphide) deposits, and the EM plate does look encouraging (figure 14).

At a market capitalisation around $13m and a recently completed placement at 2c ($1.48m) this is one to watch.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.