GTI gears up for drilling of its Utah uranium and vanadium project

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Special Report: GTI Resources is preparing to kick off drilling to test the high-grade potential of its Jeffrey uranium and vanadium project in Utah.

A field program carried out in November 2018 identified high-grade in-situ mineralisation from within the workings on the Jeffrey Claim including a sample that returned 1.39 per cent uranium and 2.46 per cent vanadium.

More recently, underground channel sampling returned assays that included 0.12 per cent uranium and 3.89 per cent vanadium from a sample collected from historic mine workings.

GTI Resources (ASX:GTR) has identified over 20 open historical drill holes within the Jeffrey project and will conduct a downhole geophysical logging program in them to refine drill targets before starting its permitted exploration program.

This is timely given that US president Donald Trump’s 2021 budget now includes expenditure of $US150m ($230.7m) per annum for 10 years to create a strategic uranium reserve.

The program includes a purchasing requirement of 3.75 million pounds of annual domestic uranium production based on a weighted average price of $US40 per pound.

Additionally, the US Government has flagged that it will expand this initiative to revive and strengthen the uranium mining sector.

GTI says the move to support domestic uranium producers is “game changing” for both itself and the broader US uranium industry.

Uranium spot prices have climbed significantly since the beginning of 2020, rising from $US24.85 per pound to the current $US32.15 per pound due to ongoing supply constraints and underlying long term demand expansion.

Notable COVID-19 related supply disruptions during and subsequent to the March quarter include Kazatomprom (Kazakhstan operations), Cameco (Cigar Lake mine), CNNC (Rössing mine) and Swakop Uranium (Husab mine).

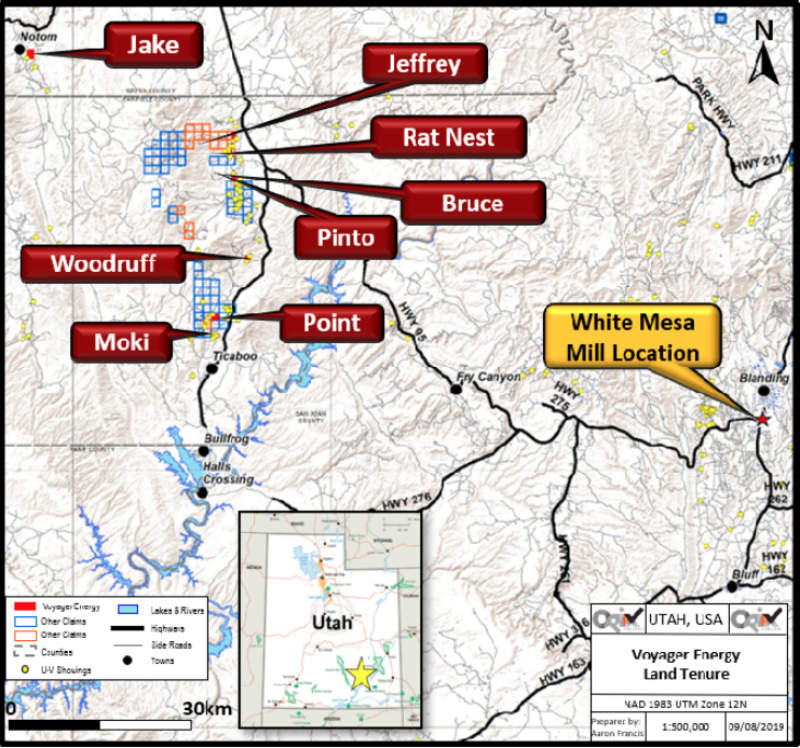

Jeffrey is one of eight projects that the company picked up from its acquisition of Voyager Energy in September 2019.

These projects are located in the Henry Mountains mining district — a region which has already produced 92 million pounds of uranium and 482 million pounds of vanadium.

As a result, the region benefits from well-established infrastructure and a mature mining industry that provides low cost experienced personnel and equipment.

This includes Energy Fuels’ White Mesa mill, the only fully licensed and operational conventional uranium/vanadium mill in the US, which is within trucking distance of the properties.

NOW READ: Guy on Rocks: Uranium makes a surprise move, but gold is still very much the favourite

This story was developed in collaboration with GTI Resources, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.