Groundbreakers: Punters hear beating drums of war, pile into gold stocks

Pic: Getty

Gold is back.

The prospect of war in Europe is back as Risk #1 for financial markets. Gold, a safe haven in times of uncertainty, hit the rockets as risk assets took a tumble.

The Aussie market has kicked off the session in the red as expected, with the #ASX200 down 64pts or 0.9% to 7232. Financials, healthcare, tech & miners (with exception of gold miners) are lower.

— CommSec (@CommSec) February 17, 2022

“Gold soared again to crack $US1900 as of this morning, despite a higher US Dollar and higher real yields, off the back of a perception that financial sanctions on Russia will drive institutions there, including its central bank along with a few disgruntled oligarchs (it must be assumed) to dump dollars and park money in an alternative store of value,” IG market analyst Kyle Rodda says.

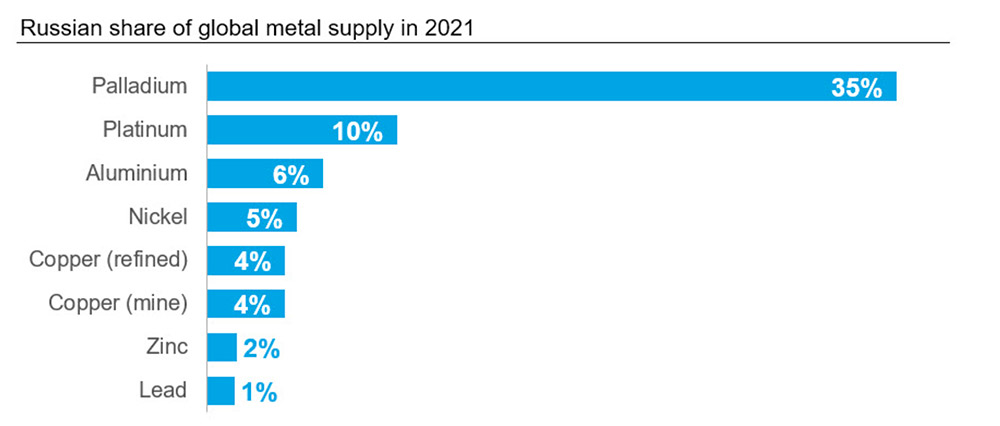

Also making outsized gains overnight were palladium (up 3.7% to $US2,367/oz) and platinum (up 2.5% to 4US1,092/oz).

Why?

Russia is the world biggest producer of PGEs alongside South Africa.

It is also a significant fertiliser producer.

If it attacks neighbouring Ukraine, economic sanctions by the Western world against Russia are a near certainty.

What form these would take is still up for debate, but they would probs significantly increase relevant commodity prices in the short term and disrupt trade flows.

“The palladium price in particular could rally very strongly,” CRU researcher Eoin Dinsmore told Stockhead.

“Sentiment towards palladium has been very bearish since mid 2021 and investors are net short palladium. Even at the depths of the pandemic in early 2020 they were still holding a small net long palladium position.

“For gold, its safe haven status will really come to the fore if we see military escalation and disruptive sanctions.”

Our long-suffering goldies are responding positively. Its green across the board, led by Newcrest (ASX:NCM) +3.2%, Northern Star (ASX:NST) +3.5%, and AngloGold Ashanti (ASX:AGG) +2.9%.

NCM, NST, AGG share price charts

DACIAN GOLD (ASX:DCN)

Gold being at an 8-month high is especially great news for previously-embattled-but-still-kicking WA producer DCN.

The poster child for missed guidance actually REAFFIRMED FY2022 production guidance of 100,000-110,000oz this week as production ramps up for remainder of FY2022.

However, the company was forced to revise its all-in sustaining costs upwards to between $A1,750-$1,850/oz due to “challenging labour conditions and cost environment”.

That’s higher than the industry average.

Still, at current prices – about $A2,650/oz — DCN still will be making cash hand over fist, which will help service its debt pile and set it up for a strong March quarter.

The $230m market cap stock had cash and gold on hand at 31 December 2021 of $30.2m, with total debt of $16.0m.

TIETTO MINERALS (ASX:TIE)

The $457m market cap West African mine developer remains on track for first gold pour in Q4 this year, it said today, with construction progressing as planned.

At 62c and a market cap of $457m TIE is a long way from where it once was.

TIE was trading at just 6c a share in early 2019 before a string of high grade, shallow gold hits saw the explorer increase its gold bounty by 146% to 1.7Moz in the space of a couple months.

After two years of sustained drilling success ‘Abujar’ now contains 3.4Moz.

The fully funded development has potential to be one of the largest gold mines in Côte d’Ivoire, producing +260,000oz in its first year and 1.2Moz in the first six years.

Abujar also has an eye-watering post-tax NPV of US$722 million and IRR of 95%.

READ: Tossing up ASX-listed African gold stocks? Here’s the ultimate, only guide you’ll ever need

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.