Ground Breakers: Miners raise the roof as US debt ceiling deal drives market higher

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

The USA appears to have staved off concerns about a standoff on the debt ceiling, ending fears on an impending default by the US Government.

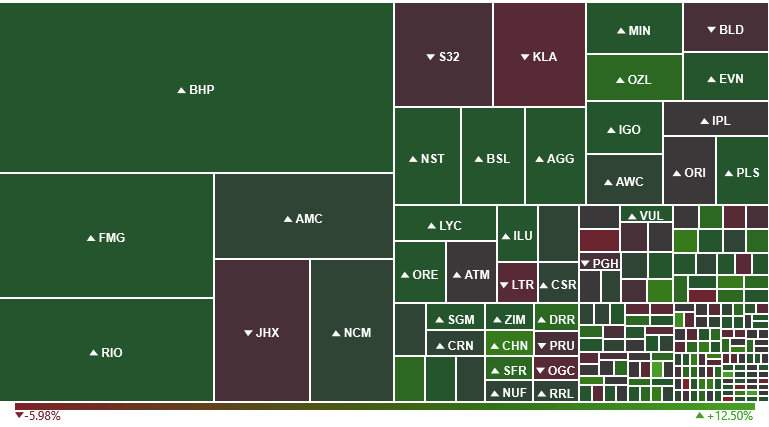

It has meant happy times in capital markets, with mining stocks leading the ASX 200 in a merry dance into a field of green in early trade.

The big boys have been among the top performers.

Rio Tinto (ASX:RIO) was up by 3.09%, or $2.98, to test the $100 per share mark for the first time in a week.

BHP (ASX:BHP), Mineral Resources (ASX:MIN) and Fortescue Metals Group (ASX:FMG) were also in broadly positive territory as the Materials sector climbed by around 1.75% in the morning.

While Australian coal prices continued to contract from record highs, base metals were up overnight, led by copper, with Sandfire Resources (ASX:SFR) and OZ Minerals (ASX:OZL) both among the top ASX large and mid cap stocks today.

Chinese markets will emerge from the cave today following the end of their National Day celebrations, with the iron ore price holding steady at US$117.02/t yesterday, according to Fastmarkets MB.

BIG BOY HIGHLIGHTS

Westgold Resources (ASX:WGX) lawyers up as it hits the accelerator on Gascoyne bid

Westgold Resources has tapped lawyers HopgoodGanim and advisors Argonaut PCF to beef up its bid to takeover Gascoyne Resources (ASX:GCY).

Since launching the bid last week Westgold, which wants Gascoyne to can a previous merger proposal with explorer Firefly Resources (ASX:FFR), the Peter Cook chaired gold miner says it’s had “no constructive engagement” from Gascoyne’s board.

However it claims to have had ‘significant incoming and positive engagement from Gascoyne shareholders’.

Westgold plans to lodge its official Bidder’s Statement with ASIC next week.

“It has been more than a week since Westgold announced its intention to make a bid on terms that are far superior to Gascoyne’s proposed merger with Firefly. Bemusingly, the Gascoyne Board has provided no guidance to Gascoyne’s shareholders nor to Westgold regarding the Board’s intentions on either the Firefly Scheme or the Westgold Offer,” Westgold executive director Wayne Bramwell said.

“The silence from the Gascoyne Board in relation to our Offer is in stark contrast with the volume of calls and emails we are receiving from Gascoyne shareholders wanting our Offer to be considered by their Board. Westgold knows the Gascoyne Board is cognisant of its fiduciary duty to its shareholders and would expect the Board to dutifully and proactively act to ensure their loyal shareholders have the opportunity to evaluate and respond to our value accretive proposition.”

Gascoyne is yet to comment on the new statement, having advised shareholders last week to take no action on the takeover proposal that would hand Westgold its Dalgaranga gold project and give the Murchison gold miner a line of sight to a 500,000ozpa production profile.

Westgold and Gascoyne share prices today:

Energy Resources of Australia (ASX:ERA) Ranger clean up plans blowout

Energy Resources of Australia shares have been rising apace since Sprott got into the uranium market and drove a short-lived mania in the uranium spot price.

Prices rose from around US$32.50/lb to nine year highs of more than US$50/lb before settling back down to around the US$40/lb level.

That could come again, with deficits forecast over the long term, but just when ERA shareholders could actually benefit from that is unclear.

The Rio Tinto backed uranium miner shuttered its Ranger mine in the Northern Territory progressively, pledging to invest in a major rehabilitation job.

It still has the option at some point to head underground via the Ranger Deeps development, but that seems a way off if it happens.

Nevertheless, $1.3 billion capped ERA’s shares are up almost 120% over the past year.

It copped a big hit this morning though, falling more than 5% after revealing there would be material schedule and cost overruns from the rehabilitation program. A feasibility study in February 2019 declared ERA would need an $830 million rehab provision to carry out the works.

Energy Resources of Australia share price today:

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.