Ground Breakers: Copper lovers, it’s about to get choppy

Pic: Getty

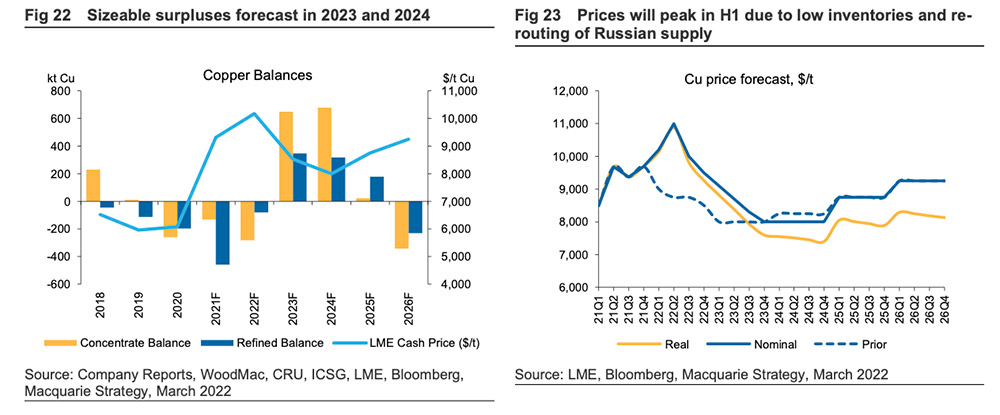

It’s turbulent times ahead for copper, which could peak at $US11,000/t this year before new supply moderates prices in 2023-2024, says Macquarie in a new note.

Macquarie expects mine supply to increase by 4.9% this year and 8.6% in 2023, driven by significant production increases at large mines and new start-ups.

Supply growth in 2024 will soften to 3.2%, before declining from 2025 as depletions and closures outweigh new mine supply.

Longer term deficits will start to bite again from about 2026, says Macquarie.

“We are forecasting global mine supply will peak in 2024 at 24.9Mt before declining due to depletion,” it says.

“By 2030, we estimate a theoretical supply gap of 4.6Mt will have developed.

“There is sufficient copper in the pipeline to meet the forecast demand, but only if sufficient new projects are approved and, given the typical construction timeframes, this will need to happen in the next few years.”

Emphasis ours.

“We reviewed the copper project pipeline in detail in our recent note where we highlighted that there is sufficient copper in the pipeline to meet demand this decade, albeit of varying quality, but project approvals are being delayed as miners are increasingly finding themselves in the crosshairs of communities, environmentalists and governments,” Macquarie says.

“Longer term, the largest growth in supply could come from Chile, which is primarily from brownfield projects and weighted towards the end of this decade.”

But one disruptive event could hit copper supply where it hurts

While Russia’s invasion of Ukraine has sparked a notable step up in volatility across the metals complex (looking at you, nickel), copper prices have been comparatively steady so far, Macquarie says.

“This may persist, but copper’s low inventory backdrop (visible stocks at 0.65 weeks demand cover) leaves little buffer in the event of any supply disruption,” it says.

This is an improvement. Copper inventories on the LME, Shanghai and Comex exchanges fell to around 200,000t last month – that’s just 3 days of global consumption.

What sort of disruptive events are we talking about? In the near term, it’s all about the war. Whilst sanctions have not yet been imposed on commodities, the impact of the Ukraine-Russia situation on copper supply remains highly uncertain.

Russia produces around 1Mtpa of refined copper, accounting for 4% of the global market. Around 75% of Russian metal is exported, primarily to China and Europe (48% and 50% respectively in 2021).

Then you have miners striking in Peru (world’s #2 producer) and the proposed nationalisation of the mining industry in Chile (world’s #1 producer, with 28% of global supply).

Longer term market watchers will be looking at Chile and Peru’s increasingly nationalistic tax policies for signs it could restrict investment in new mines and expansions.

NOW WATCH: Copper: Increasing demand, exploration and two emerging producers

ASX miners gaining in early trade

The S&P/ASX 200 Resources [XJR] index – the benchmark for ASX resources companies — was a standout performer in early trade Friday as the wider bourse sank into the red.

An XJR gain of ~1% was driven by the big miners BHP (ASX:BHP), Rio (ASX:RIO) and FMG (ASX:FMG).

XJR is down 2.71% over the past week, but up 7.33% year-to-date.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.