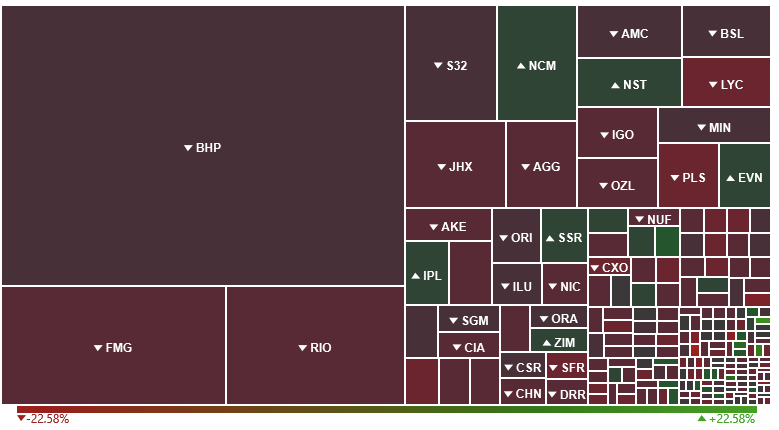

Ground Breakers: Conflict tanks big miners even as metals prices continue to rise

Pic: Getty

Commodities went on a literal warpath in February, with prices soaring on news of the Russian invasion of Ukraine.

But as it has worn on risk has weighed on big mining stocks.

Iron ore prices climbed 5.5% to head back above US$150/t after big movements in futures markets yesterday, on expectations of strong Chinese infrastructure spending later this year.

Iron ore up US$8.00 or 5.5% to US$153.00 a tonne.

— CommSec (@CommSec) March 3, 2022

“Iron ore futures rallied to a six-month high, boosted by growing expectations of stronger Chinese demand,” ANZ’s David Plank said.

“China has reiterated its commitment to more infrastructure spending this year. Positive sentiment was boosted by the nation’s manufacturing PMI showing an improvement in February.”

But iron ore stocks were all in the red despite continued upwards movement in futures today, with Singapore prices around the US$160/t mark.

Gold was up around US$15/oz this morning and tracking towards on the uncertainty, but failed to get a major risk bump with Fed Reserve chair Jerome Powell still recommending a 25 basis point rate cut despite the ongoing situation in Ukraine.

Really taking the mining sector lower today were uranium stocks, as Russian forces moved on the town of Energodar.

Ukrainian officials including its foreign minister Dmytro Kuleba reported shelling had taken place at the nearby Zaporizhzhia nuclear power plant, with reports an administrative building at what is Europe’s largest nuclear plant was on fire.

The International Atomic Energy Agency said it was aware of reports.

#Ukraine: IAEA is aware of reports of shelling at #Zaporizhzhia Nuclear Power Plant (NPP), in contact with Ukrainian authorities about situation.

— IAEA – International Atomic Energy Agency (@iaeaorg) March 4, 2022

Mid caps Boss Energy (ASX:BOE) and Paladin (ASX:PDN) were two of many uranium stocks to slide with $2.3b capped Paladin losing an astonishing 25% of its value.

Uranium prices collapsed in 2011 in the wake of a wide scale shutdown following a meltdown at the Fukushima nuclear facility in Japan during the Tohoku earthquake, an incident the market was only recently recovering from.

Newcrest up as Greatland Gold goes rogue on Havieron

Newcrest Mining (ASX:NCM) jumped almost 2% this morning after its junior partner at the Havieron gold and copper project appeared to go rogue and post its own resource upgrade at the NCM operated JV.

Havieron is one of the best gold discoveries in WA in recent years, and the next phase of the company’s long running Telfer hub in WA’ Pilbara.

Newcrest’s London-listed partner Greatland Gold, the original owner of the tenements where Havieron was discovered has engaged in some apparent freelancing, posting a major resource upgrade to its London shareholders overnight.

According to Greatland its review of 10 months of “consistently impressive drilling results since the February 2021 cut off” for the last resource upgrade had underpinned a 53% increase in gold resources to 5.5Moz of gold and 218,000t of copper and 63% increase in indicated mineral resources to 3.1Moz.

Greatland says probable ore reserves at Havieron have also been lifted substantially from 1.7Moz gold equivalent to 2.4Moz of gold and 109,000t of copper or 2.9Moz gold equivalent.

That sent Greatland’s share price up almost 6%, a nice bump given it’s almost 36% lower over the past 12 months.

Greatland CEO Simon Day described it as an “independent verified analysis”.

“This Mineral Resource and Ore Reserve update represents a considerable increase on that which was defined in the Stage 1 PFS,” he said.

“The update has unearthed further aspects of the Havieron system and validates that Havieron is a world class deposit with significant growth potential.”

“Through an independently verified analysis, the total Mineral Resource at Havieron has increased to 6.5M oz of gold equivalent, an increase of almost 50% in 10 months of drilling.”

Only Newcrest came out this morning with this gem.

“Newcrest has not reviewed or verified the analysis conducted by Greatland Gold,” the ASX gold giant said in a statement.

“Newcrest intends to issue an updated Group Mineral Resources and Ore Reserves statement as at 30 June 2022 with its Full Year Financial Results, which will include a revised Mineral Resource estimate for Havieron.

“The Havieron Feasibility Study will be informed by the revised Mineral Resource estimate reported in Newcrest’s 30 June 2022 Mineral Resource and Ore Reserve statement and remains on track to be completed in the December 2022 quarter.”

Curious.

Newcrest Mining share price today:

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.