Ground Breakers: Coking coal is now 62% down on its all time high as steel demand falls

The coal market is confusing right now. Pic: Williams + Hirakawa/The Image Bank via Getty Images

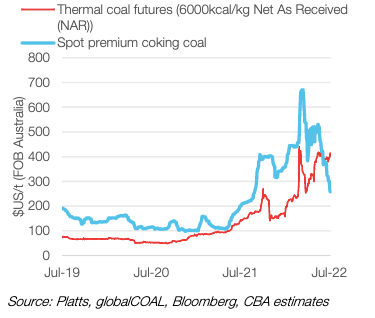

- Coal market continues to confound conventional logic as thermal coal premium over met coal rises above US$150/t

- Newcastle energy coal futures surged as flooding in the Hunter Valley added to global supply woes

- BHP poised to defend Samarco court action in the UK

A couple years ago BHP (ASX:BHP) announced a shift resulting from investor pressure to turn its back on fossil fuels and focus on future facing commodities like nickel, copper and potash.

That came with a black and white division between its interest in two key commodities. Met coal used for steelmaking was good, it had a future.

Thermal coal and lower quality met coal, to be sold or with the potential to be sold for not very green energy, was off the roster.

Its bet on met coal as part of its core strategy was looking very good early this year, as recovering demand for steel and Russia’s war with Ukraine sent prices to a record US$671/t, a US$334/t premium to also heady thermal coal prices.

But that situation has reversed stunningly, possibly leaving BHP and Anglo American to rue the low price they accepted for their stakes in the Cerrejon mine in Colombia from JV partner Glencore last year.

Coking coal could fall further: Dhar

It should be said, this pretty much never happens.

Newcastle thermal coal futures are now trading at US$413.75/t, a US$156/t premium according to CommBank metals guru Vivek Dhar.

And it seems that gap could get even wider.

Bans on Russian coal from the EU don’t officially come into place until August 10, but already buyers in nations allied with the Ukrainian cause have been substituting cargoes for coal from non-Russian sources.

While Russia controls around 10% of the coking coal trade, it has a larger 16% share of the thermal coal market.

Gas prices are also super high, meaning coal is more economic for energy buyers even at current levels.

Coking coal meanwhile is suffering from falling steel demand both in the largest market in China and outside it, where Aussie met coal is being sold.

“It’s worth noting that traded coking coal markets were already tight before the Ukraine war due to i) a recovery in steel production outside China, ii) COVID 19 disruptions to Mongolian coking coal supply and iii) disruptions to Chinese coking coal output,” Dhar said.

“A number of these factors have been mitigated or even nullified.

“Steel production outside China has contracted every month from March to May as steel prices drop in different regions around the world. China’s coal output has increased 10%/yr from January to May.”

Price support could come from a lack of supply. Australian exports, which make up around 53% of the seaborne market, are down 6.5% through May. But global economic fears could weaken demand.

“The big question for coking coal markets is where prices land. We think a coking coal price above historic levels like ~$US200/t (FOB Australia) makes sense,” Dhar said.

“That’s because we believe a supply gap in coking coal markets is likely from weaker net demand for Russian coking coal exports and insufficient supply relief from elsewhere.

“With global growth fears intensifying though, it’s possible that coking coal prices breach this level, especially as global steel prices continue to fall.”

Why thermal coal is still running hot

They don’t call it a global energy crisis for nothing, and it is no secret that thermal coal production is struggling around the world right now.

Recent floods in New South Wales have not helped.

“Traded supply has faced significant challenges too. Indonesia’s exports (42% of traded supply) has declined 43%/yr in the first four months of 2022, while Australian exports (19% of traded supply) has slipped 9%/yr from January to May this year,” Dhar said.

“Wet weather from February to March had adversely impacted Australia’s thermal coal production. And those disruptions are likely to re‑emerge with recent flooding in the Hunter Valley region in New South Wales.”

The most recent run in coal prices, which saw Yancoal (ASX:YAL), Whitehaven (ASX:WHC) and New Hope Corp (ASX:NHC) shares charge this morning, came after the Australian Rail Track Corporation closed its railway line last week to the Port of Newcastle due to the rainfall.

BHP’s Samarco issues rear their head again, towel up market

BHP shares fell more than 2% this morning after a judgment in the UK Court of Appeal that will allow victims of the Samarco dam failure in 2015 — at a mine owned by BHP and Vale — to pursue a group claim for US$6 billion in compensation.

BHP says it is considering whether to seek permission to appeal the judgment to the UK Supreme Court.

“BHP Brasil remains committed to continue supporting the local remediation efforts in Brazil through the Renova Foundation. Those efforts have already provided BRL9.8bn (~£1.5bn) in compensation and direct financial aid in relation to the dam failure to over 376,000 people,” BHP said in a statement.

“BHP will continue to defend the UK group action, which BHP believes is unnecessary because it duplicates matters already covered by the existing and ongoing work of the Renova Foundation and legal proceedings in Brazil.”

BHP was not the only mining major looking a bit pale this morning, with all the big iron ore players down as excitement about China’s mooted economic stimulus subsided.

Gold miners offered little respite, falling across the board as prices remain around nine month lows at US$1742/oz.

Northern Star (ASX:NST), Evolution (ASX:EVN) and Newcrest (ASX:NCM) dropped 3.86%, 5.51% and 3.44% respectively.

The materials sector tumbled 2.08% in morning trade.

Ground Breakers share price today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.