Laughing all the way to the Development Bank: China mulls another monstrous stimmy plan

Picture: Getty Images

In potentially perky news for fans of insane infrastructure spending, it looks like China has at last run out of patience with its gently, gently approach to a COVID-cracked and property-punctured 2022 economy.

The possibility lifted commodity markets on Friday; metals too, as copper jumped 4%.

So, gentlemen, start your pneumapresses. Because the word is that Beijing is unleashing a familiar beast in an unfamiliar way.

The very good Bloomberg reporter Li Yanping says local level government will soon be able to go ahead and raise and then spend $220 billion – 1.5 trillion yuan – in special bonds over the next six months. Li said she spoke with some of the officials involved in the talks who asked not to be named because they’re only allowed to leak anonymously.

And while the info remains entirely unverified by me, Ms Li has a track record of decent access – and frankly a Bloomberg subscription is really expensive – so if cost is a measurement, I’m pretty sure it’s gold.

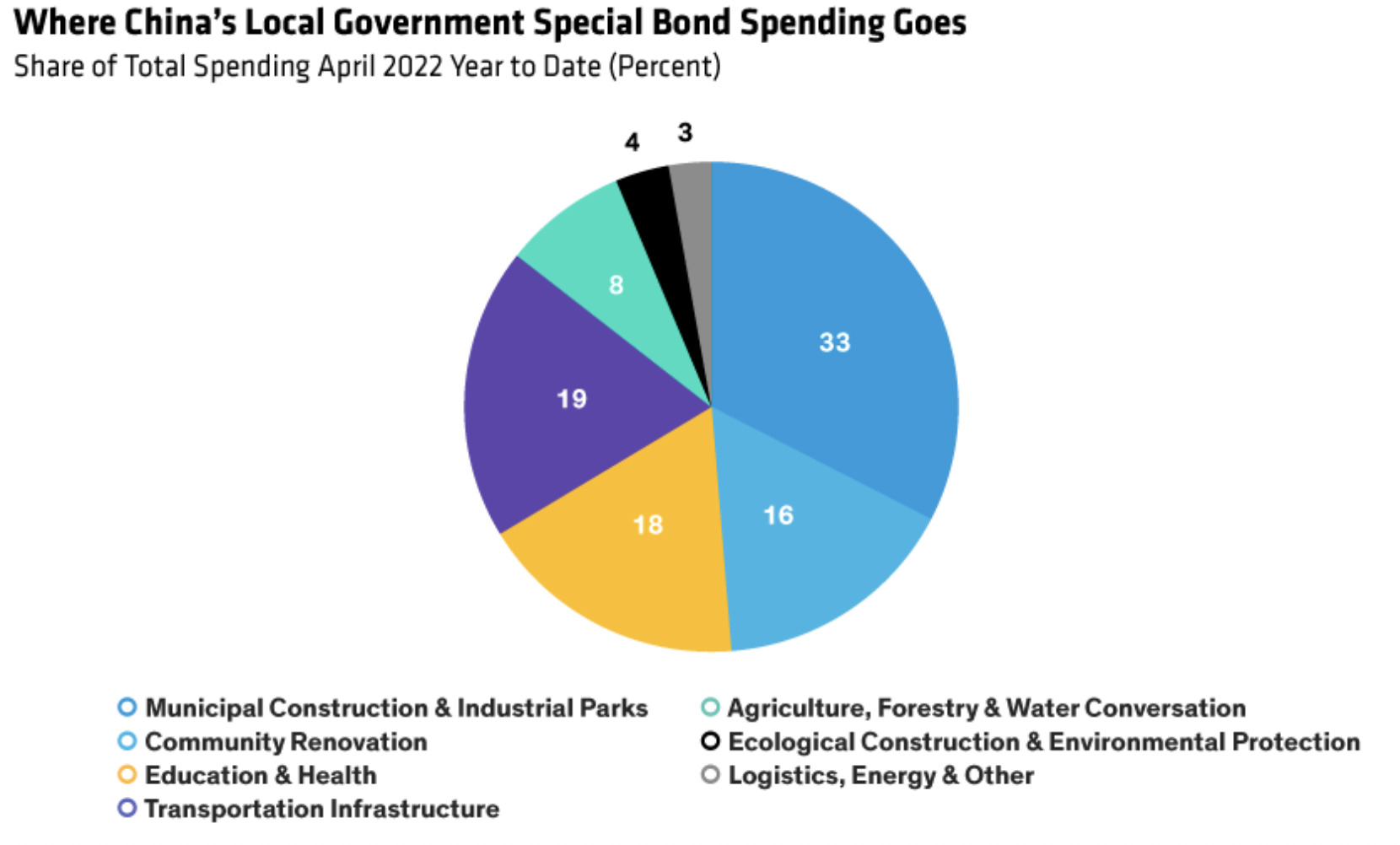

The program would both green-light and fast-track a monumental rise in debt issuance by below Provincial level governments, with the vast bulk of it earmarked for infrastructure investment to support the hamstrung Chinese economy, but cannibalising the cache which was to be used in 2023.

Li says she’s been told the 1.5 trillion yuan in bond sales would be brought forward from next year’s quota of local debt issuance, the US $220 billion fiscal stimulus program a pretty clear sign Beijing has run out of ideas for a second half of 2022 already brimming with political, social and economic significance.

The news comes as Beijing’s city government says it will boost spending by offering residents the old wine and dine vouchers as local governments all over China try to shore up crestfallen consumers and get people out and spending after the trauma of COVID-lockdowns.

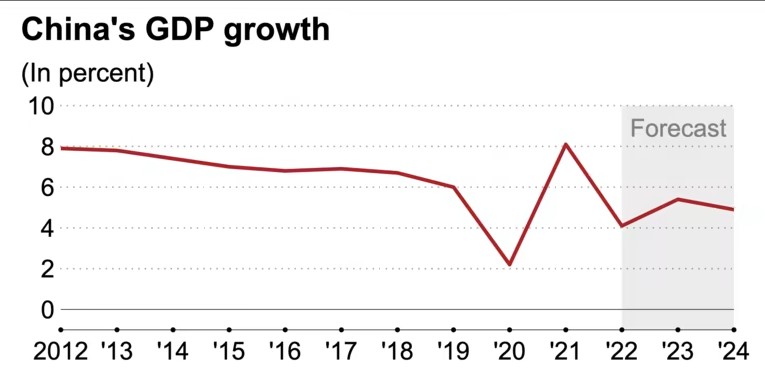

It seems highly unlikely this step will get the full year GDP growth rate to the 5.5% target, and if Li is on the money, it’s another flag of just how tense the real economic/social situation likely is over there in lockdown, sit-down and shut-up land.

Just get out and build

The vast and intricate network of under-sighted local officials who’ve been at the very heart of China’s ongoing real estate crisis look like being the go-to guys again – but are they best placed to revive consumer demand in an economy whacked by an up-down, lock-out zero-COVID-19 policy.

Local government sold a record 1.95 trillion yuan – US$289 billion – of these bonds in June, that’s an almost 150% increase, according to measurements provided by Great Wall Securities.

That topped the previous COVID-inspired record of 1.3 trillion yuan back in April 2020, when Beijing once again reached for the tried and true playbook of driving up growth through public investment, expressed most volubly and effectively through mad infrastructure builds.

President Xi Jinping’s hopes of hitting the promised GDP growth target of circa 5.5% for this year is looking more and more like a moonshot – COVID-cases doubled in just one day this week in Shanghai.

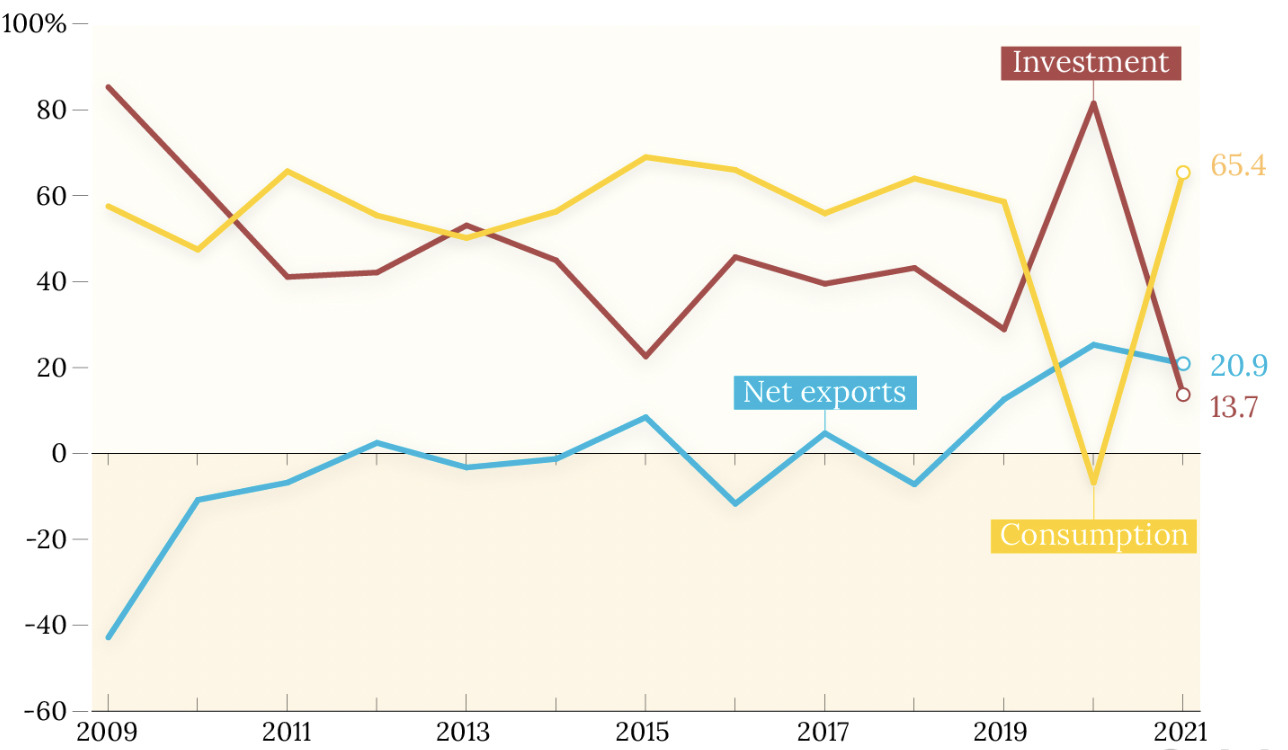

That whole zero-COVID policy which mandates lockdowns, mass screening and quarantine, is a dire weight on the back of an economy which was supposed to be driven by domestic consumption.

Yet as the engine splutters and the burden grows, China has apparently gone big, and gone back to basics.

Mean while, the China Development Bank (CDB), China’s historically big daddy of policy lending by assets, will fund the majority of the 300 billion yuan (US$45 billion) infrastructure stimulus, according to officials chatting with officials at the now government run Caixin.

The CDB and the Agricultural Development Bank of China (ADBC), the No #2 policy lender, will share the raise (210 billion yuan and 90 billion yuan respectively), in this coming half Caixin said.

The State Council headed by Premier Li Keqiang confirmed the 300 billion yuan fundraising last week, saying it’d serve for capital to drive new major infrastructure projects or as bridge financing for projects which will be now be supercharged by the 1.5 trillion local governments’ special-purpose bonds which Bloomberg says are on the cards in an unprecedented acceleration of infrastructure funding.

Infrastructure spend is starting to be the pony with one trick which the ruling Communist Party rolls out to trigger an economic turbo-charge.

We saw it best post-COVID or even better during the GFC when Beijing went on its utterly fabulous 5 or so trillion yuan investment spree – which not only stimulated the hell out of China’s post-Olympic economy – but bodily dragged the commodity-exporting Australian economy out of the mire.

Yes Kevin. T’weren’t the Pink Bats.

For this, the party has its three uncomplicated policy banks — the CDB, the ADBC and the Export/Import Bank of China — which finance the often astonishing projects which are largely unprofitable roads to nowhere, but have been crucial to social stability and economic movement, driving the big jumps in infrastructure, energy and the like.

The People’s Bank of China (PBoC) – the central bankers of the world’s second largest economy – say the targeted infrastructure spend will be for the full array of infrastructure projects. That’s transportation, energy, water conservancy, technology and logistics.

Such quick-fix traditional stimmy is likely to limit the PBoC’s room to relax monetary policy if confirmed. Everyone else including us have been busy moving in the opposite direction to contain runaway inflation.

China’s policymakers have been struggling with different stresses, while the country’s beleaguered economy, weakened by stifled domestic consumption and battered exports, has failed to deliver the domestically driven response to shifting global allegiences.

It now appears that with the economic walls closing in just as Xi Jinping is going for the never-before-considered-record-three-term-and-beyond presidency, Beijing has enlisted those go-to banks and mini-governments in the olde “all out” infrastructure investment wallop which has worked before and hopefully steampunk some decent growth in the downhill half of 2022.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.