Ground Breakers: Bloomberg says we’ll be starving for 6Mt of copper by 2032, but a supply glut now could make things tricky

Pic: CHBD/E+ via Getty Images

- Bloomberg Intelligence says 6Mt of copper capacity is needed to fill global demand by 2032

- But approval blowouts and a supply glut that will push the market into a hefty surplus could hurt investment through critical years in the middle of this decade

- WA1 up as terrific year winds down for boom niobium stock

Decarbonisation and blown out timeframes to develop new projects mean an additional 6 million tonnes of copper capacity could be needed by 2032 to fill demand for the key industrial metal, Bloomberg Intelligence says.

Don’t hold your breath for a quick turnaround bull run though.

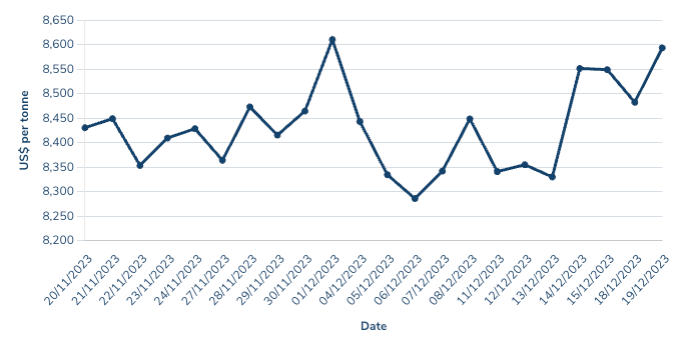

Trading around US$8600/t currently, a 4-4.5% lift in mined supply next year could keep prices depressed for longer, with Bloomberg also projecting a surplus of 300,000-500,000t a year from 2024-2026.

“Demand for electric vehicles and renewables could remain decisive drivers over the next two decades, offsetting the negative pull from China’s maturing economy and sustaining consumption at or slightly above long-term trends,” Bloomberg says.

“Yet in the near term, copper could fall below $8,000 a ton, with marginal cost support kicking in at $7,400.”

That spells out a challenge for copper believers, which include mining giants looking to hitch their horse to future facing commodities like BHP (ASX:BHP).

Other analysts like those at Goldman Sachs see marginal cost support for new projects at over US$9000/t. Prices may need to rise as high as US$13,000/t for everything required for the energy transition — EVs, renewables, poles and wires — to be built.

Bloomberg says copper supply growth could fade due to more extreme regulatory challenges later this decade.

“Miners promised a big output increase in 2H, with over 800,000 tons of additional supply,” its analysts say.

“Mined supply could have a bumper 2024, up 4-4.5%, but the benefit of greenfield and brownfield projects, many initiated over a decade ago, may start to dissipate from 2027, based on our bottom-up analysis.

“We calculate an additional 6 million metric tons of capacity could be needed by 2032.”

It comes with copper bounding back in the direction of US$9000/t thanks to some major supply cuts, notably the cancellation of an extension to First Quantum’s Cobre Panama mine in the Latin American nation. The mine accounts for around 1.5% of global copper output, while Anglo American last week also dramatically reduced its 2024 copper production forecast from over 1Mt to 730,000-790,000t.

Meanwhile Bloomberg Intelligence separately says gold looks like a “well-rested bull market, ripe to break above US$2000 an ounce resistance”.

“Deteriorating global economic growth, central-bank buying and the potential for a US recession may set the metal on a path toward US$3000, particularly if the US stock market declines.”

Don’t get all frisky too soon though gold bulls, Bloomberg’s senior macro strategist Mike McGlone has doled out similar suggestions before and these US$3000/oz predictions come around pretty often these days. Maybe one day they will be true though.

According to LBMA PM prices, bullion was fetching US$2024/oz overnight, prices Aussie miners should be making pretty tidy profits at.

READ: ASX gold miners smash world’s biggest producers on costs, share price gains

WA1 makes more moves as Xmas approaches

It’s one of the year’s top performing exploration stocks.

And WA1 (ASX:WA1) had at least one more trick up its sleeve as the car pulls into the driveway for the last time in 2023.

Reconnaissance drilling at the P2 prospect, a satellite to the much-touted Luni niobium discovery, a find on the WA-NT border that threatens to break open a virtual monopoly in the critical mineral’s supply chain, hit 18m at 0.6% niobium oxide at P2 from 55m and 114m at 0.5% Nb2O5 from 52m in separate holes.

Those hits are considerably thicker than results in last year’s discovery hole at P2, some 30km west of the Luni deposit.

It should give hopes the region in general has more niobium endowment to go around as well.

“This year’s reconnaissance drilling program was designed to better inform our understanding of the geophysical anomalies at P2. Shallow mineralisation has now been confirmed over a broad area and future drilling will be focussed on the highest-grade zone identified in the east,” WA1 MD Paul Savich said.

“The Luni carbonatite enhances the importance of regional discoveries such as P2 which provide optionality and add strategic value to the West Arunta Project.”

A maiden mineral resource is set for Luni in Q2 of 2024. The stock is up over 470% this year, including a near 5% rise today, with a market cap of ~$390 million.

The materials sector had a bullish morning, rising 0.58%, with battery metals and gold stocks leading the charge.

Ground Breakers share prices today

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.