Ground Breakers: BHP’s eagerness to get OZ deal over the line shines light on impending copper, nickel boom

Pic: Via Getty

- BHP back at the table with a $28.5/sh takeover offer and this time OZ Minerals is keen

- Represents a ~$1.1 billion increase to the initial offer

- Meanwhile, Sandfire is raising $200m to grow its own copper business

After its initial $25/sh bid for copper-nickel mid-tier Oz Minerals (ASX:OZL) was rebuffed for not being exciting enough, BHP (ASX:BHP) played it cool with ‘it’s fine, you’d be nice to have but we don’t need you’.

That wasn’t exactly true. BHP are now back at the table with a far shinier, $28.5/sh offer and, this time, OZ is keen.

OZ chairman, Rebecca McGrath says the revised proposal from BHP followed a period of “board-level engagement” which secured a circa $1.1 billion increase to the initial offer.

The share price briefly touched new offer levels in January this year. Before that, the last time OZ hit $28.5 was mid-2008.

Long suffering shareholders rejoice.

The revised offer represents:

- an enterprise value for OZ Minerals of $9.6bn

- a 59.8% premium to OZ Minerals’ 30-day volume weighted average price of A$17.67 per share (as at 5 August 2022); and

- a 13% increase compared to the initial proposal of $25 per share.

BHP will now conduct four weeks of exclusive due diligence, which will kick off next Monday.

If all goes well the miners will ink a binding scheme implementation agreement, after which the OZ board will unanimously recommend the deal to shareholders in the absence of a superior proposal.

BHP says this is their best and final offer.

OZL, BHP share price charts

BHP is gearing up for battery led nickel, copper boom

Veteran industry watcher Barry Fitzgerald says BHP’s eagerness to reengage after the first failed bid shows its intent “on increasing its exposure to the two future-facing metals is deeper than many observers suspect”.

“OZ’s assets are just part of a bigger picture in which BHP sees demand for the metals taking off in a couple of years’ time,” Barry writes.

“The prices of both metals are weaker than they were earlier in the year on short-term economic concerns and China’s COVID lockdowns.

“But both are critical to the multi-decade clean energy transition proceeding as planned.”

Copper prices have fallen in the order of 20% in 2022, hammered down by a heady cocktail of Chinese Covid restrictions, energy struggles, rate rises and global recession fears.

At a ~US$8,300/t, the price of the red metal is a far cry from 2021 highs, when a spike in industrial activity and excitement about its role in the transition to renewable energy sent prices beyond US$10,500/t to record highs twice, in both May and October.

Still, low prices are just a bump in the road, experts say. On BHP’s own reckoning, demand for copper could double over the next 30 years compared with the last 30.

For nickel it could be four-fold, Barry says.

“There are serious doubts that the required supply response will take place, making dreams of eventual net zero by 2050 just that, a dream,” he says.

“The fix of course is sharply higher copper and nickel prices to encourage more investment.

“BHP doesn’t disclose its price expectations, but it has talked openly about a take-off in copper come 2025.”

Goldman Sachs have said prices above US$13,000/t would be needed to incentivise the 8Mt of additional annual copper production needed by 2030 to cater for demand from renewables, power infrastructure and EVs — around eight times that of the world’s biggest copper mine Escondida.

NOW READ: As EVs boom the junior nickel market has cashed-up private equity firms circling

Meanwhile, Sandfire is raising $200m to grow its own copper business

Fellow copper mid-tier Sandfire (ASX:SFR) was once targeted by OZ in a mid-2010 raid on the register, according to energetic former boss Karl Simich.

“There was a group of people assembled to deliver a shareholding into OZ Minerals, unbeknownst to me,” he says.

“OZ then appeared on the register in early July having been delivered a 19 per cent shareholding at a cost of about ~$100m.

“10 mins after the trade I get a call from [former] OZ boss Terry Burgess who says ‘we’ve just bought some shares in your company, Karl.’

“I expected to have a takeover bid lodged on us within four minutes.”

READ: This is how copper play Sandfire went from 4c to over $8 in 18 crazy months

That didn’t happen, and now 12 years later hyper-growth focused SFR looks like the last man standing.

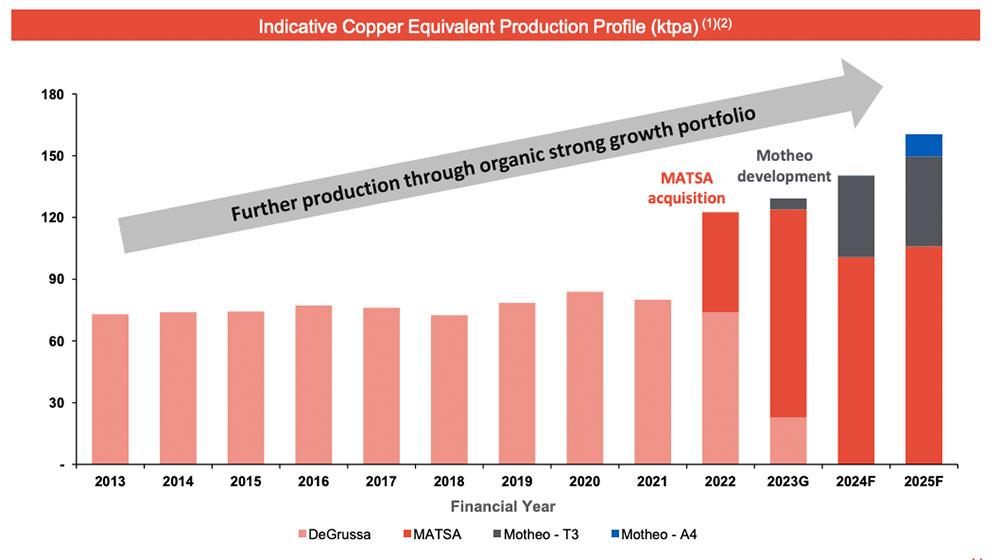

The fully underwritten $200m raise announced today will be used partially for the ramp up at the Motheo copper mine in Botswana, scheduled to begin production in the June FY 2023 Quarter.

It will also be used to repay debt, and on growth initiatives at the MATSA copper and base metals complex in Spain, which it bought for $2.6b earlier this year to replace an almost depleted DeGrussa mine in WA.

At $4.30/sh, it represents a reasonable 10.2% discount to the last closing price.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.