Ground Breakers: BHP lobs US$100m into a nickel orebody so deep it’s measured in Eiffel Towers

Pic: Getty

Chastened by a loss to Andrew Forrest in its pursuit of Canadian nickel explorer Noront Resources, BHP (ASX:BHP) has wasted no time finding its next investment.

It will invest US$100 million in three tranches in Kabanga Nickel’s Kabanga project, which will eventually convert into a 15% equity stake in the project.

The mine is owned by private UK company Kabanga, led by executive chairman Keith Liddell, the founding chairman of Australian nickel company Panoramic Resources (ASX:PAN) when it launched as Sally Malay in 2000 and the inventor of the Kell Process, a processing method for extracting PGEs from concentrates.

BHP will make an initial tranche payment of US$40 million for convertible securities in Kabanga with another US$50m payment to follow.

Once the securities are converted into equity BHP would hold 15% of the mine, with 69% held by Kabanga and the balance by the Tanzanian Government.

Another US$10m will be invested into Lifezone’s “low carbon hydrometallurgical processing technology”.

News the world’s biggest miner is investing in Kabanga is good news also for neighbour Adavale Resources (ASX:ADD).

The junior, which owns exploration licences immediately next to Kabanga, where it has identified mineralised nickel and copper bearing sulphide veins, was up almost 14% this morning on the open as investors gave it the BHP bump.

The world’s largest nickel sulphide development project

Previously owned by Glencore and Barrick and abandoned when the nickel price took a dive, Kabanga’s revival appears to have come at the right time.

Nickel prices are hovering just under a very economic US$21,000/t, with major deficits forecast to emerge over the course of the next decade as demand for the stainless steel ingredient is increasingly provided by the EV and battery market.

Only some nickel can currently be sold into that market without absorbing huge costs. High grade sulphides like those at Kabanga are the cheapest and most efficient to convert into battery chemicals.

BHP already mines and processes these into nickel sulphates for NCM lithium ion batteries at its Nickel West business in WA, and having sold out of its oil and gas and coal assets in the past year, has made investing in battery metals nickel and copper one of its long term priorities.

By any measure Kabanga is a monster. It contains 58Mt of resources at an average nickel grade of 2.62%, up to an even higher equivalent of 3.14% when copper and cobalt credits are included.

That makes around 1.86Mt of nickel metal, more than three times the total of nickel sulphides in Chalice Mining’s Gonneville discovery, the largest nickel sulphide find globally in two decades.

With a DFS due this year, Kabanga anticipates entering production in 2025, turning out around 65,000t of nickel metal equivalent (40kt nickel, 6kt copper and 3kt cobalt) for 30-plus years.

That’s a project of significant scale, around 1.5 times the size and three times the longevity of IGO’s Nova nickel-copper mine. The BHP investment values Kabanga at US$658 million all up.

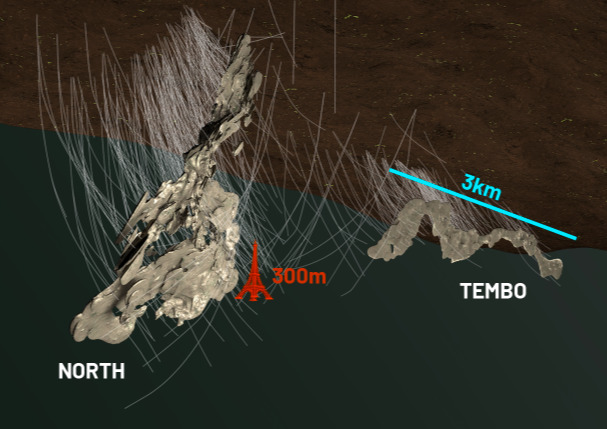

The orebody at Kabanga North is so deep already at 1.2km that the company uses Eiffel Towers at its chosen unit of measurement.

Kabanga CEO Chris Showalter said BHP’s investment highlighted the world class nature of the deposit and “its importance in helping meet the crucial decarbonisation challenge facing the world today”.

“BHP is the ideal partner for Kabanga Nickel, bringing significant advantages and expertise that will enable us to move ahead with the project,” he said.

“BHP’s investment reflects the project’s strong ESG credentials and its role in improving environmental performance throughout the nickel value chain.”

The news came the same day Tesla announced a deal to purchase 75,000t of future nickel production over six years from a JV between TSX-listed Talon Metals and Rio Tinto (ASX:RIO) in Minnesota, the EV giant’s first deal to secure a US-based supply of the metal.

Kabanga deal share prices today:

Rio Tinto starts electric rail journey

Rio will become the second iron ore major to roll out battery electric locomotives at its Pilbara mines, after Fortescue Metals Group (ASX:FMG) announced a similar initiative last week.

The move was foreshadowed by iron ore boss Simon Trott in a speech last month and comes after the mining powerhouse announced last year it would invest US$7.5 billion this decade in decarbonisation efforts at its mine sites and smelters.

Rio has agreed to buy four 7MWh FLXdrive battery-electric locomotives from Wabtec Corporation in the USA, where they will be manufactured in 2023 before heading to site for trials in 2024.

The company estimates it would reduce its diesel emissions by 30% annually if it is able to switch its entire Pilbara rail network to battery electric.

The trains will use a system known as regenerative braking, meaning after being initially recharged at charging stations at the mine and port, the train’s own energy will be used to recharge the batteries during transit.

Rio’s managing director of port, rail and core services Richard Cohen said it was an important early step.

“Our partnership with Wabtec is an investment in innovation and an acknowledgement of the need to increase the pace of our decarbonisation efforts,” he said.

“Battery-electric locomotives offer significant potential for emissions reduction in the near term as we seek to reduce our Scope 1 & 2 carbon emissions in the Pilbara by 50 per cent by 2030.”

Rio Tinto share price today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.