Green technology uses for silver in solar and EVs add to metal’s elevated demand

Silver has a bright future with its use growing in futuristic green technologies. Image: Getty

- Demand is rising for silver in solar power systems, EVs and autonomous vehicles

- ‘New demand centres [for silver] come up with advancements in technology’ – The Silver Institute

- ASX Silver Stocks Guide: Everything you need to know

Silver’s use in a range of green technologies such as solar power generation and EVs plus its medical applications is creating huge new waves of demand for the white metal on top of rising levels of bullion and investment interest.

“We are no longer using silver in photography but new demand centres come up with advancements in technology,” said Michael DiRienzo, executive director of the Silver Institute, in an online presentation on Silver’s Role in Green Technologies.

The Washington DC-based institute is celebrating its 50th anniversary this year, and its membership includes silver miners, refiners, bullion suppliers, silver product manufacturers, transporters and wholesalers of investment products for silver.

The organisation produces regular reports and publications including its annual World Silver Survey, the 2021 version of which is published in April.

Silver’s use in solar systems to surge in 2020s

A major industrial use of silver is in photovoltaic cells for solar panels and the cost of generating electricity from solar has fallen over the past decade to compete with fossil fuels.

“This sector is projected to remain an important and consistent source of industrial demand for silver over the next 10 years while underscoring silver’s role as a green metal,” DiRienzo said.

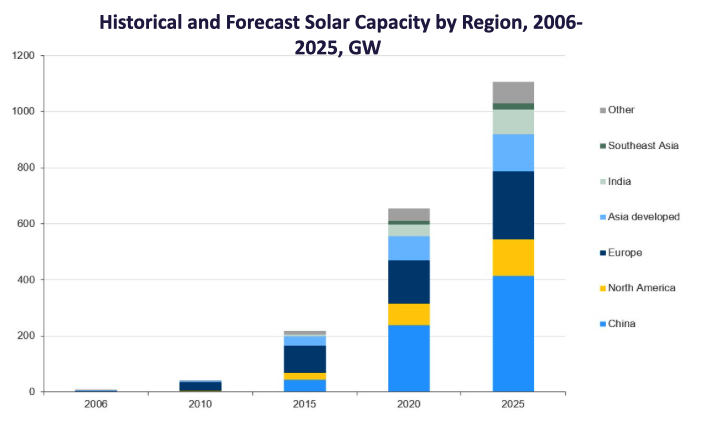

Solar power generation is expected to double by 2025 to about 1,100 gigawatts from just over 600GW currently. Just a decade ago this sector had barely any demand for silver.

The Silver Institute is seeing solar power installations proliferate around the world as a result of government action to reduce fossil fuel reliance and favourable tax policies for solar.

California’s state government has insisted that all new homes are built to include solar electricity systems.

Most of the growth in solar power generation over the next five years will be led by China, followed by Europe and North America, India and southeast Asian countries, DiRienzo said.

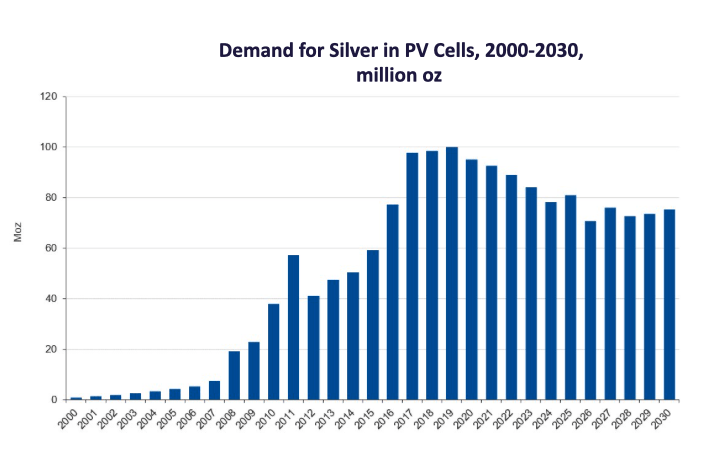

“Demand for silver in the solar sector is expected to remain at elevated levels over the 2020s,” said DiRienzo.

The solar sector is forecast to consume 888 million ounces of silver over the 2020s, which is equivalent to about 81 million ounces of silver per year, according to metals consultancy CRU which was commissioned to write a report on the sector by the Silver Institute.

Another metals consultancy group, Metals Focus, has a higher usage forecast for silver usage in the solar sector of 105 million ounces for 2021, which adds up to 1 billion ounces over 2020 to 2030.

Autonomous and EVs use more silver than conventional cars

“Automakers are increasingly relying on silver to enable the vast technological advances that are being incorporated into modern vehicles,” said DiRienzo.

Silver is contained in many automotive functions such as battery and engine management systems, electrical and electronic components, lighting, sensors, and power steering.

Its widespread use in motor vehicles is because of its superior electrical properties, and oxide resistance and durability under harsh operating environments.

Modern day petrol or diesel-driven vehicles use an average of 15 to 28 grams of silver, a figure that has been rising over recent years.

Electric vehicles each consume between 25 to 50 grams of silver, and hybrid vehicles use an average of 18 to 34 grams of silver, said DiRienzo.

Additional amounts of silver are needed for charging stations for EVs and ancillary equipment and EV batteries.

“The move to autonomous vehicles does lead to a dramatic escalation in vehicle complexity requiring even more silver consumption,” he said.

The changing nature of the motor vehicle fleet towards electrification is driven by a need to reduce carbon emissions from fossil fuel usage.

Fifteen countries have announced timelines to phase out sales of diesel and petrol-driven vehicles in favour of EVs which accounted for 8 per cent of world production last year.

“By 2025 global battery electric vehicles could account for around nine per cent of global light vehicle production,” he said, up from around three per cent in 2020.

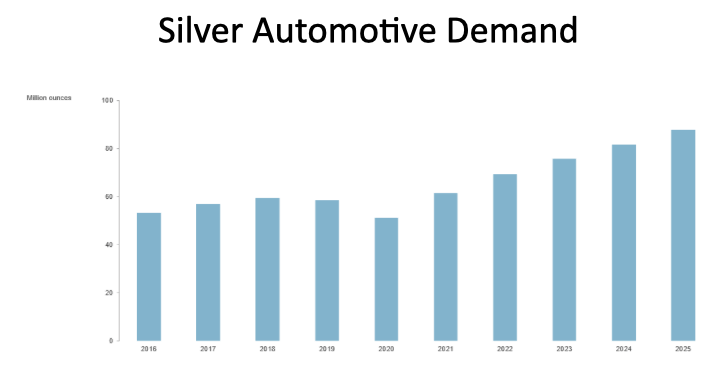

Silver demand in the automotive sector will rebound strongly in 2021 to 60 million ounces and is set to increase by 50 per cent in the next five years.

“We are predicting that 90 million ounces of silver will be absorbed annually in the automotive sector by 2025,” said DiRienzo.

Healthcare and investment applications for silver also rising

Silver also has widespread applications in the medical field as an anti-bacterial agent that keeps items clean and fresh and prevents bacterial infections.

There are silver coatings on medical instruments and on operating tables and in surgical gowns and clothing, and it is also present in wearable personal personal equipment.

The metal’s application in face masks to guard against COVID-19 and in testing equipment to detect the novel Coronavirus has also created new demand for silver-based products.

“It [healthcare] is a small end amount use for silver at anywhere between 10 million and 12 million ounces per year and that is because the silver use is in small, nano form. But we do anticipate this use is going to continue to grow,” said DiRienzo, commenting on silver’s use in healthcare.

The worldwide pandemic has affected production levels for silver in various countries which is likely to be reflected in the Silver Institute’s upcoming 2021 World Silver Survey report.

“We anticipate there will be drop in mine production for 2020 which is basically due to COVID-19 and the suspension of operations in key mining countries like Mexico and Peru,” said DiRienzo, although he did not provide any additional data.

Supply of silver metal is forecast at 978 million ounces in 2020 to demand at 963 million ounces in 2020, according to the Silver Institute in a report last year.

Exchange-traded products (ETPs) for silver grew by 331 million ounces last year to 1.04 billion ounces, and since then global ETP holdings for silver have continued to escalate.

“By February 3rd 2021 another 137 million ounces of silver has gone into ETPs, which is an important dynamic for silver. People that buy silver ETPs tend to hold on to these and add to their portfolio, and that is a very good story for silver,” said DiRienzo.

The Silver Institute’s presentation is available at Virtual Investor Conferences.com.

Silver is produced often as a by-product of copper or zinc by large mining companies like BHP (ASX:BHP) and South32 (ASX:S32) but there are also many specialised ASX silver miners.

They include Adriatic Metals (ASX:ADT), BBX Minerals (ASX:BBX), Investigator Resources (ASX:IVR), Mithril Resources (ASX:MTH), Manuka Resources (ASX:MKR) and Silver Mines (ASX:SVL).

Full details of the ASX silver mining sector is contained within Stockhead’s ASX Silver Stocks Guide.

ASX share prices for Adriatic Metals (ASX:ADT), BBX Minerals (ASX:BBX), Investigator Resources (ASX:IVR), Mithril Resources (ASX:MTH), Manuka Resources (ASX:MKR), Silver Mines (ASX:SVL)

At Stockhead, we tell it like it is. While Manuka Resources is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.