Gold’s advance slows as Fed fails to deliver more stimulus

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

- Gold crawls higher in Friday trade to $US1,950 per ounce ($2,662/oz)

- US central bank will likely keep interest rates at basement levels through to 2023

- “It became clear that the bazooka wasn’t making an appearance.”

Low interest rates are usually bullish for gold which earns a nil return unless lent out to investors, but gold is facing stiff resistance on its upward climb.

Fed’s monetary policy toolbox looking bare

“While the Fed has promised rock-bottom rates for longer than three years, the across market reaction with lower stocks and a stronger dollar, have raised some concerns that the Fed’s toolbox has started to look empty with the element of surprise no longer there,” Saxo bank head commodity strategist, Ole Hansen, told Kitco news.

ANZ bank senior commodity strategist Daniel Hynes said in a note: “Some of the lustre for gold has dulled in recent days as forecasters revise up economic growth numbers.”

The OECD has revised its forecast fall in global economic growth to minus 4.5 per cent this year, down from minus 6 per cent in its June forecast.

Kitco’s precious metals division head, Peter Hug, said he saw spot gold prices trading sideways for the time being, without another burst of retail buying.

Silver has been rangebound for the past several weeks, trading around $US27/oz ($37/oz).

Carawine receives exploration funds from FMG for gold project

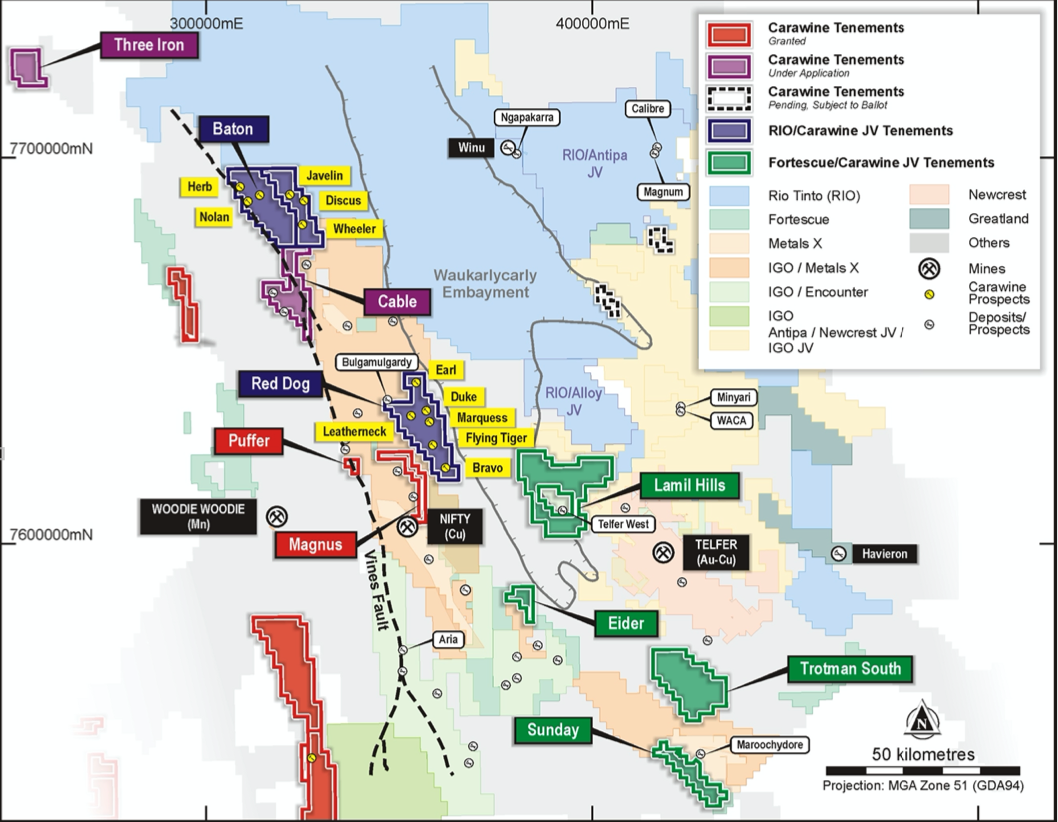

Gold explorer Carawine Resources (ASX:CWX) has added its Eider tenement to its Coolbro joint venture with Fortescue Metals Group (ASX:FMG) in WA’s Paterson gold province, a hotspot for gold exploration.

“Fortescue has agreed to complete an airborne geophysical survey and drilling program before they can earn an interest in the tenements, thereby providing a commitment to exploring the tenement along with our other Coolbro joint venture tenements,” managing director, David Boyd, said.

Fortescue Metals has the right to earn a 51 per cent interest in the expanded Coolbro joint venture tenements located 35km southwest of Newcrest’s Telfer gold mine, by spending $1.6m on exploration over three years.

Other recent discoveries in the Paterson region include Rio Tinto’s Winu copper-gold deposit with a maiden inferred resource of 503 million tonnes at 0.45 per cent copper.

FMG can earn interests in Paterson gold tenements through its Coolbro jv with Carawine Resources

New Lachlan Fold gold company emerges from Magmatic Resources

Magmatic Resources’ (ASX:MAG) subsidiary Australian Gold and Copper (AGC) is to separately list on the ASX after acquiring two central Lachlan Fold gold projects, Cargelligo and Gundagai, from New South Resources, a private company.

Australian Gold and Copper will also acquire Magmatic’s Lachlan Fold Belt gold project Moorfield, allowing Magmatic to focus on its East Lachlan Fold gold and copper prospects in NSW.

“We have always described Magmatic as a junior explorer with a ‘major’s’ portfolio, and this transaction will further unlock shareholder value, giving shareholders exposure to both Magmatic and AGC shares and further upside of two new gold projects,” executive chairman, David Richardson, said.

NS Resources will receive a 40 per cent interest in AGC before it is floated on the ASX in an IPO, and Magmatic will retain the remaining 60 per cent stake in the company.

AGC’s portfolio will offer multiple drill-ready exploration targets of a Fosterville-style gold and Cobar-style gold polymetallic mineralisation in the central Lachlan Fold belt, said Magmatic.

ASX share prices for Carawine, FMG and Magmatic Resources

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.