Gold climbs steep resistance, Cyprium completes Nanadie Well deal

Pic: John W Banagan / Stone via Getty Images

Spot gold edged slightly higher to $US1,955 ($2,687) per ounce Tuesday but is climbing a wall of resistance while silver’s prospects could be determined by government stimulus measures.

“Gold has well-denoted support between $US1,900 and $US1,920 an ounce, with trendline resistance at $US1,970,” Jeffrey Halley, senior market analyst at trading platform OANDA said in note.

Bloomberg Intelligence said it expects gold to do better than silver for the rest of the year.

“The done-deal nature of continued central bank easing is a solid foundation for gold, but less so for silver and copper prices,” said Bloomberg commodity strategist, Mike McGlone, according to Kitco.

Silver and other industrial metals are dependent on more fiscal stimulus and a global economic recovery, but at the same time are vulnerable to a stock market correction, he said.

Silver was up marginally to $US27.10/oz ($37.30/oz).

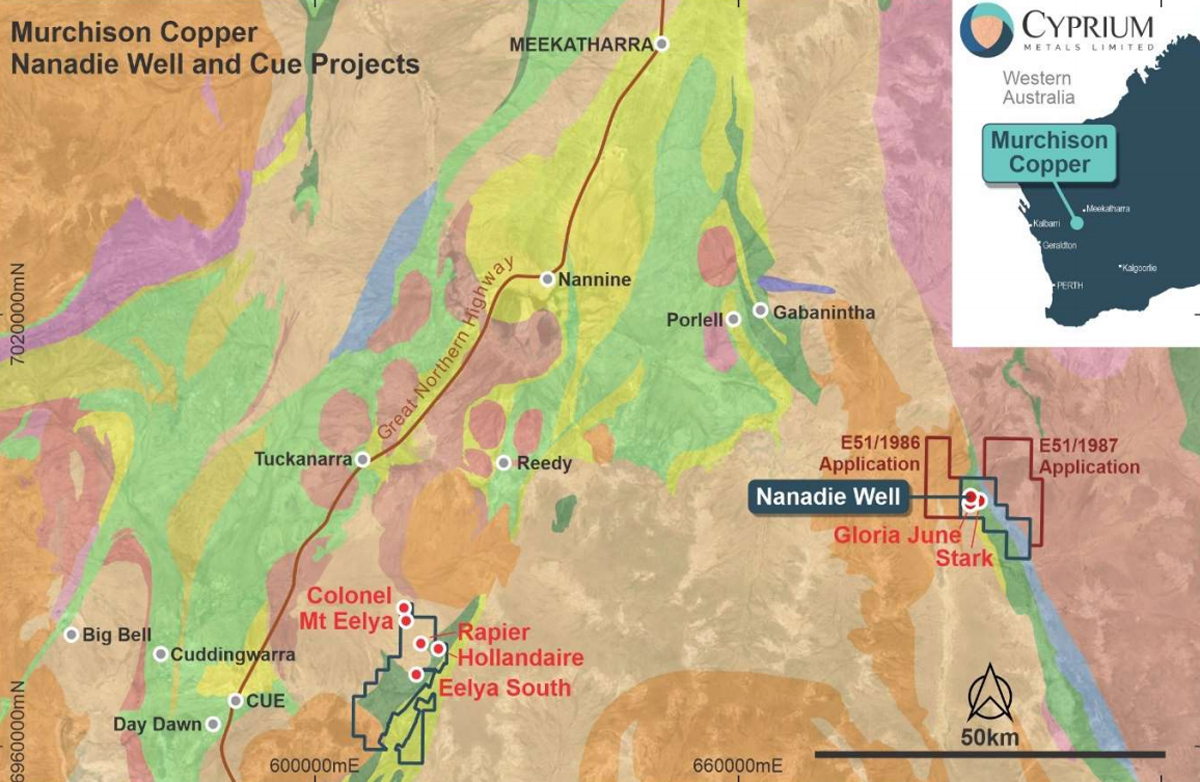

Cyprium seals the deal for Nanadie Well project

The Nanadie Well copper-gold project in WA has changed hands with Cyprium Metals (ASX:CYM) acquiring 100 per cent of Horizon Minerals’ (ASX:HRZ) interest in the asset for $1.5m.

Horizon will receive a mix of cash and Cyprium shares for Nanadie Well which has a Jorc-compliant resource of 151,000 tonnes of contained copper and 74,000 ounces of contained gold.

“The Nanadie Well copper deposit is located only 75km to the east-northeast of our Hollandaire copper deposits and is an exciting addition that increases our regional mineral resource base which will be included in the ongoing Cue copper project scoping study,” executive director Barry Cahill said.

Nanadie Well’s copper mineral resource has multiple shallow and broad intersections which are open along strike and at depth, and several drill ready targets have already been identified, he said.

Cyprium has a mining lease for the project and has also applied for two exploration tenements adjacent to Nanadie Well to expand its presence in the area.

The Nanadie Well project will be included in the company’s Cue copper project mine scoping study.

The Hollandaire copper mineralisation in Cyprium’s Cue 80 per cent-owned copper project has a Jorc-compliant mineral resource of 38,700 tonnes of contained copper.

Falcon deposit delivers up more gold for De Grey

Meanwhile, De Grey Mining (ASX:DEG) has revealed more hits for gold from drilling at its Falcon deposit within its Hemi gold discovery in the Pilbara region of WA, including 92m at 1.3 grams per tonne gold from 167m.

“Falcon is an exceptional drilling target and drilling is advancing as a priority,” technical director, Andy Beckwith said. “The scale of Falcon demonstrates its potential to significantly add to the overall gold endowment at Hemi.”

The Falcon intrusion has been found to extend a further 640m to the south for an overall strike length of 2.4km that remains open to the south, and drilling also confirms broad gold mineralisation to a depth of 250m, said the company.

To the north of De Grey’s Mallina gold project which includes Hemi, Caeneus Minerals (ASX:CAD) has carried out some exploration activity at its Roberts Hill, Mt Berghaus and Yule River tenements. Its share price reacted to the news.

Caeneus has undertaken an aeromagnetic survey over Roberts Hill and Mt Berghaus and will focus on identifying special intrusive rock types within specific shear orientations.

The company said it expects to start drilling at Roberts Hill before the year-end.

“It is with great excitement that we can now fast-track activities at our Roberts Hill project which immediately abuts the De Grey Mining tenements containing their exciting Hemi and Shaggy deposits,” chief executive, Rob Mosig said.

ASX share prices for CAD, CYM, DEG and HRZ

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.