Gold within a whisker of $US1,900/oz as America goes to the polls

US president Donald Trump gets into the groove at a campaign rally. Image: Getty

- Delayed or uncertain US election outcome could play into gold prices

- ‘Gold has unwound its oversold position of late last week’

- ASX Gold stocks guide: Everything you need to know

Gold’s price moved closer to $US1,900 per ounce in Tuesday trade as the US presidential election cast a long shadow over the market and its near-term direction.

In early trade, gold touched $US1,895/oz ($2,685/oz), nearly matching its August 2011 high, but off from its all-time high of $US2,070/oz in early August, according to Kitco data.

“Gold has unwound its oversold position of late last week and is moving up to test dual resistance at $US1,900 [per ounce] from the 10-day and 20-day moving averages,” Rhona O’Connell, head of market analysis at StoneX Group told Kitco.

“As uncertainty fades going forward, we expect that investment demand will continue to grow in the months ahead, lifting gold prices as real [interest] rates resume their downward trajectory,” according to TD Securities.

Delayed US election outcome could affect gold prices

Market analysts said a delayed result in the US presidential election could be bullish for gold prices, but will add to their volatility.

“The possibility of post-election turmoil and a contested outcome represents a significant risk in our view, and one that could prove quite gold-positive in the most extreme scenarios,” Royal Bank of Canada analysts were reported as saying by Bloomberg.

Uncertainty over the outcome of the US presidential election could also affect gold’s price, not least because of possible delays to a $US2 trillion government stimulus for the ailing US economy that is before the US Congress.

“The key swing state polls are still too close to call and it is very uncertain who will win the election,” said Commonwealth Bank of Australia analysts in a report.

“The added risk of an indeterminate result on the day, for votes to be disputed and or for the election result to be contested suggests that currency volatility can remain high well beyond election day.”

Election uncertainty is leading to a stronger US dollar, as investment pours into the world’s reserve currency as a short-term measure.

Thursday’s meeting of the US Federal Reserve is expected to add to US dollar volatility.

“No monetary policy changes is expected but the risk is the Federal Open Market Committee points to an increase in the pace of bond purchases because of the lack of more aggressive US fiscal stimulus,” said CommBank analysts.

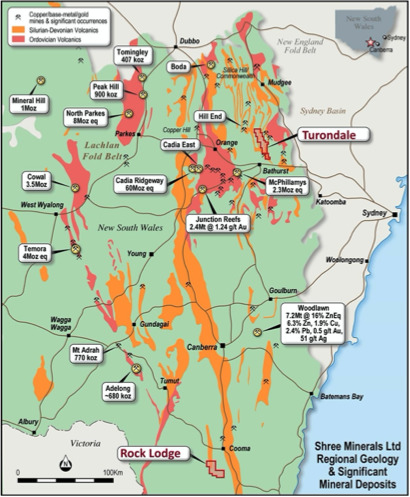

Shree Minerals expands Lachlan Fold project area

Shares in Shree Minerals (ASX:SHH) took off Tuesday, rising 18 per cent, on its application for a new exploration licence that would add to its existing Turondale gold project.

The proposed licence covers 75sqkm of the historic Rock Lodge gold workings near Cooma in the NSW Lachlan Fold Belt for which rock sampling returned values of 11 grams per tonne for gold.

“The Rock Lodge prospect has proven prospectivity with significant drill intersections of gold mineralisation reported previously that remain open along strike and at depth,” executive director, Sanjay Loyalka, said.

Victory gains on Coogee project buy-out

Victory Mines (ASX:VIC) saw an uplift in its share price after it bought out Ramelius Resources (ASX:RMS) from its Coogee gold project near Kambalda in WA for $1m of its shares.

“The acquisition of the remaining 90 per cent of the Coogee gold project represents a significant step for the company,” executive director, Matthew Blake, said.

Coogee has a mineral resource of 96,000 tonnes at 3.4 grams per tonne for 10,600 oz of gold and Victory Mines is to drill a promising gold-copper target on the tenement.

Renascor plans extensive drilling at Gawler Craton gold project

Renascor Resources (ASX:RNU) said it has restarted a program of geophysical surveying, gold exploration soil sampling and drilling for its Carnding gold project in South Australia.

The geophysical work is to guide 2,000m of exploration drilling for the project in the Gawler Craton where shallow drilling intersected high-grade gold at its Soyuz prospect.

Maiden drilling for Miramar’s WA project

Miramar Resources (ASX:M2R) announced a maiden drilling program is underway over a 12km strike at its Gidji joint venture 15km north of Kalgoorlie and comprising three tenements.

The company purchased an 80 per cent interest in Gidji as part of its recent IPO, and the company said the Bangemall region has a similar mineralisation to Chalice Gold Mines’ (ASX:CHN) Julimar deposit.

Initial drilling will focus on testing potential extensions to the 314,000 oz Runway gold deposit in the project’s southern tenement.

ASX share prices for Miramar Resources (ASX:M2R), Renascor Resources (ASX:RNU), Shree Minerals (ASX:SHH), Victory Mines (ASX:VIC)

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.