Gold poised for breakout as US presidential election enters final 24 hours

Gold is waiting on the US Presidential seal of approval. Picture: Getty Images

- Gold and silver steady before Americans go to the polls

- ‘Increases in risk-off sentiment tend to buoy the US dollar, which weakens gold and silver’

- Red 5 awards engineering contract for KoH project,

Gold was trading sideways at $US1,876 per ounce ($2,677/oz) Monday ahead of the final day of campaigning in the US election with Americans going to the polls on Tuesday.

Traders are expecting increased volatility in gold prices this week until a clear result emerges in the closely-fought contest between President Donald Trump and former Vice-President Joe Biden.

“When the election result, and the composition of the Senate, is known then the path ahead for gold will be clearer and less fraught,” said DailyFX strategist Nick Cawley in a report.

The US dollar index was stronger at 94.10 as investors piled into the safe haven while they wait for the outcome of the US election.

“Increases in risk-off sentiment tend to buoy the US dollar, which weakens gold and silver,” James Steel, chief precious metals analyst at HSBC Securities, told Bloomberg.

Silver was a touch lower at $US23.45 per ounce ($33.50/oz) in Monday’s Asia trading session.

Stimulus boost waiting in the wings

Once the election is out of the way, traders will focus on the US Federal Reserve’s November 5 meeting, and the progress of a stalled $US2 trillion economic stimulus package through the US Congress.

Federal Reserve chairman Jerome Powell stated that without the $US2 trillion spending the US economy could “decelerate at a faster-than-expected pace in the further quarter”.

Red 5 gets going on King of the Hills project

An engineering, procurement and construction contract for Red 5’s (ASX:RED) King of the Hills has been awarded to engineering firm MACA (ASX:MLD).

The project is 80km south of Red 5’s Darlot gold mine in WA’s Eastern goldfields region, and has a resource estimate for 90 million tonnes at 1.4 grams per tonne for 4 million ounces.

An ore crusher and processing mill are being delivered to the project site in June 2021, and production is planned to start in the June quarter of 2022.

NSW gold project similar to Victorian goldfields: Manhattan

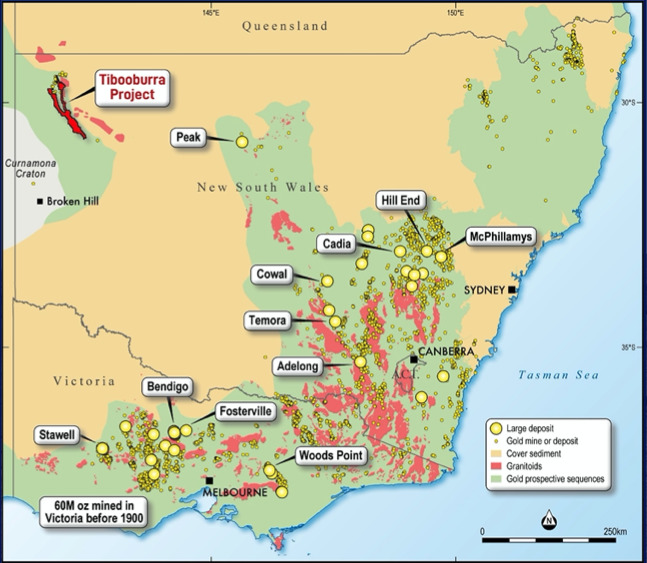

Manhattan Corp (ASX:MHC) announced its Tibooburra gold project in NSW has a strike length of 220km of gold-anomalous features and similar features to Victorian goldfields.

Recent drilling at its New Bendigo prospect in the project includes 30m at 4g/t from 11m. The company said in a presentation that the Tibooburra project has ‘multi-million ounce orogenic gold discovery potential’.

Musgrave shares jump on high recovery rates for Starlight lode

Shares in Musgrave Minerals (ASX:MGV) gained in early trade Monday as it unveiled 98-99 per cent recovery rates on samples from its Starlight lode at its Break of Day prospect.

“The very high total gold recovery and high gravity-only component recovery ensures that conventional processing options can be applied in any development scenario and also means the mineralisation is suitable for treatment through several of the nearby processing facilities currently in operation,” managing director Rob Waugh said.

An resource update for the Break of Day prospect within the company’s Cue gold project is due later in November.

ASX share prices for Manhattan Corp (ASX:MHC), Musgrave Minerals (ASX:MGV), and Red 5 (ASX:RED)

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.