Gold: Saracen to shell out $1.1bn for Super Pit stake, Tietto raises $17m to accelerate 2.2moz Abujar

Pic: Tyler Stableford / Stone via Getty Images

The morning’s biggest news comes from ambitious mid-tier miner Saracen (ASX:SAR), which will pay Barrick a lazy $1.1 billion for 50 per cent of Kalgoorlie’s iconic Super Pit.

The mammoth Super Pit, which produced 490,000oz in FY2019, has about 7.3moz in reserves for a ~12-year mine life.

For those who don’t know, it looks like this:

Saracen will raise $796 million, with the balance of the purchase price funded from a new $450 million senior secured term loan.

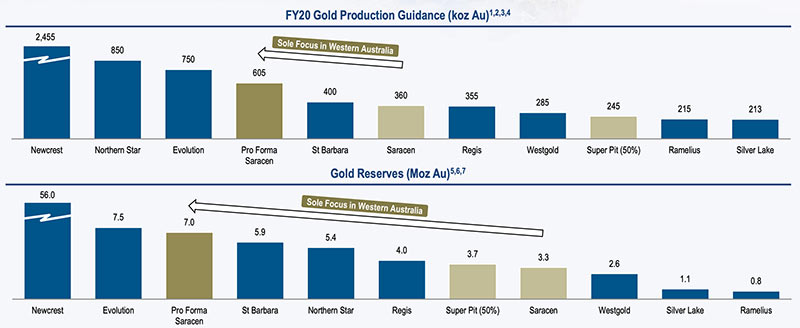

The deal will establish the $2.8 billion miner — up about 38 per cent over the past 12 months prior to today’s announcement — as the #4 biggest Australian producer with annual production of +600,000oz.

And it looks like money is also flowing into the small cap end of the market, with Tietto Minerals (ASX:TIE) raising $17m to accelerate resource growth at the flagship 2.2moz Abujar project in Cote D’Ivoire, West Africa.

Tietto – which is up an astounding 320 per cent in the past 12 months – has already snagged binding commitments for the placement from existing shareholders and leading global institutional investors.

Tietto managing director Dr Caigen Wang said 2019 has been a year of phenomenal success.

“The recent upgrade of our resources to 2.2Moz, and a large number of high grade and shallow gold intersections being reported over the past few months, [suggest] excellent potential for a future high-margin mining operation,” he says.

“Our full focus is on adding high grade ounces to the resource as rapidly as possible and we have ordered a 4th diamond rig to add to our existing fleet of company-owned rigs.”

READ MORE about Tietto:

Tietto ‘ticking all the boxes’ ahead of big resource boost at 1.7moz Abujar project

Who made the gains? Here are October’s top 50 small cap miners and explorers

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.