Gold: Rex amasses 936,000oz resource at Hog Ranch in just 6 months

Pic: John W Banagan / Stone via Getty Images

In August 2019, explorer Rex (ASX:RXM) bought the historic Hog Ranch project in ‘well-endowed’ Nevada (their words, not ours).

Hog Ranch produced 200,000oz in the late 80s/ early 90s when gold was selling for ~$US350/oz.

Immediately after the acquisition, Rex delivered a maiden resource of 830,000oz (using historic drill results) within an open pit optimised for heap leach processing (which is cheap), based on a gold price of $US1300/oz.

Current prices hover around the $US1570/oz ($2320) mark.

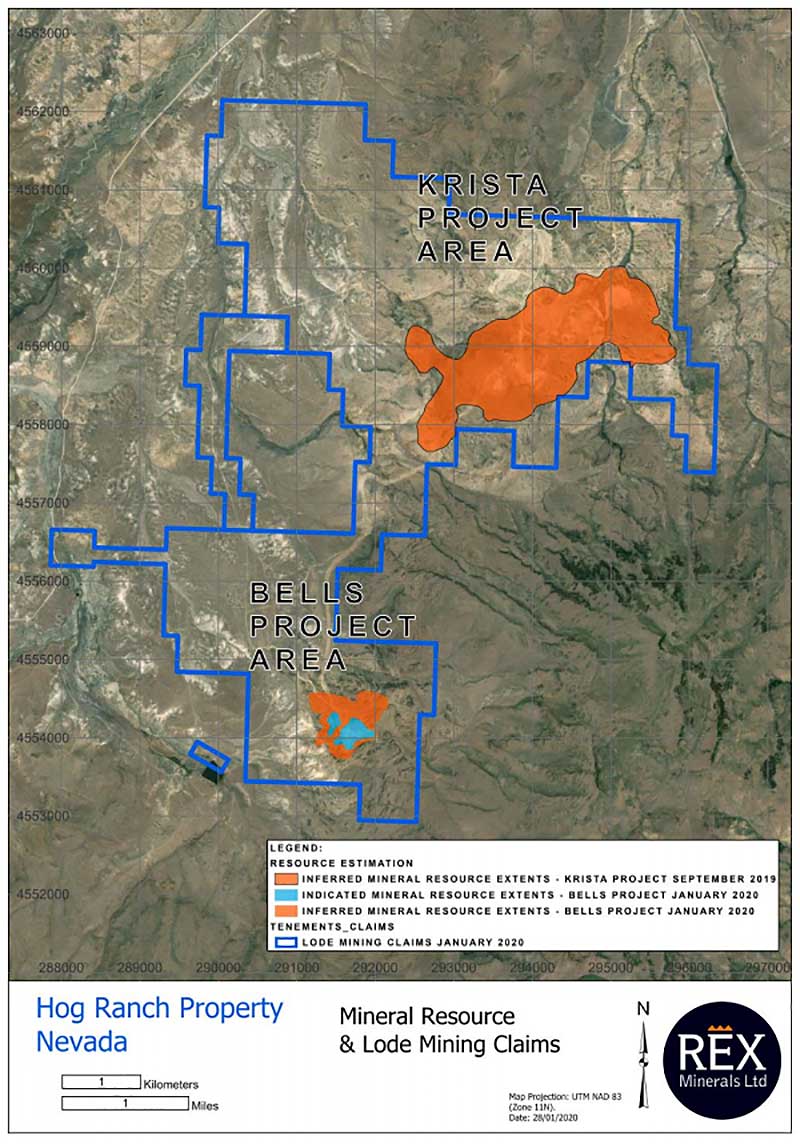

One drilling program later and that resource is now 936,000oz, comprising 521,000oz at Krista and 415,000oz at Bells.

Mineralisation at the Bells project — the focus of the latest drilling barrage – starts at surface, with over 90 per cent of the 415,000oz less than 75m deep.

“The Bells project area was an obvious place to start our initial exploration and economic studies. It was well defined, and offered a smaller scale, project start-up opportunity for Rex, at potentially lower capital than the larger northern Krista Project,” Rex managing director Richard Laufmann says.

“We are now well advanced with a scoping study for Bells and are simultaneously upgrading the mineral resource at the larger Krista Project of Hog Ranch.

“We expect to publish the results of these programs this quarter.”

The stock — which is down about 16 per cent over the past year — nudged ~7 per cent higher in morning trade.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.