Gold: Rex scores ‘free’ 830,000oz resource as part of Hog Ranch acquisition

Pic: John W Banagan / Stone via Getty Images

Explorer Rex Minerals (ASX:RXM) is the proud owner of a fresh 830,000oz gold resource — without having drilled a single hole.

In August, Rex agreed to pay up to $2.7m (depending on development milestones) for the historic Hog Ranch project in the gold-rich US state of Nevada.

The project came with extensive historic exploration work, including a +2575 hole drilling database.

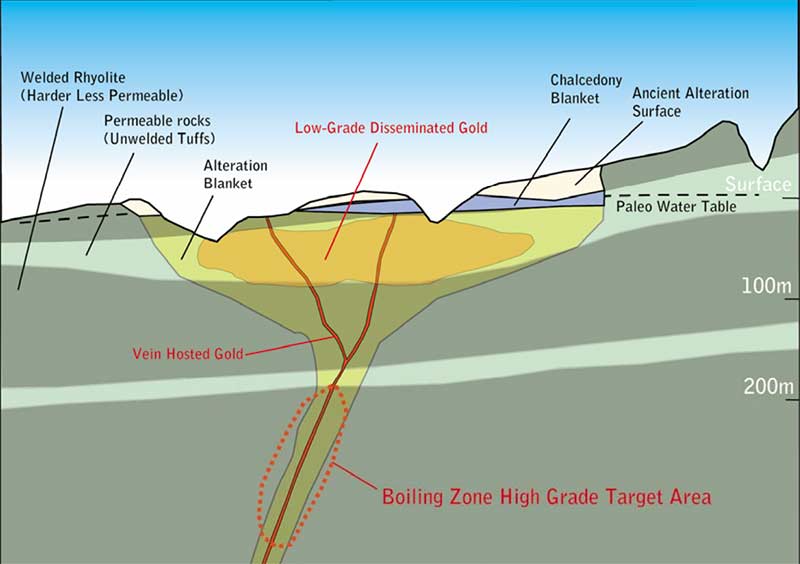

This 1980s drilling highlighted a large ‘blanket’ of low-grade gold mineralisation which was uneconomic at a time when the gold price was about $US350 ($520) an ounce.

With prices now breaching the $US1500/oz mark, that’s changed.

This drilling has allowed Rex to develop an inferred resource of 44 million tonnes grading 0.6 grams per tonne (g/t) for 830,000oz.

“The current database of 2678 drill holes, which is included within the mineral resource estimate, has a total combined length of over 200,000m,” Rex managing director Richard Laufmann says.

“At replacement, this drill data base alone would cost over $30m.”

Sounds like a pretty good deal to us.

But Rex also believes there could be high-grade vein-hosted gold deposits underneath this shallow low-grade mineralisation:

These deeper targets remain untested.

In other ASX gold news:

Breaker Resources (ASX:BRB) boosts Bombora gold resource by 30 per cent, says the very shallow 803,000oz deposit will become a “significant” open pit mine. Breaker completed the shallow resource in preparation for an open pit pre-feasibility study for Bombora at the Lake Roe project in WA. This study on a “high margin” 2.5km-long open pit operation is on track for completion in October.

Nova Minerals (ASX:NVA) discovers high-grade shallow gold at the Estelle project in Alaska for a potential “starter pit” scenario. Assays of up to 27.6g/t gold were returned from the Oxide Korbel prospect, one of 15 known gold occurrences at Estelle. “We have only scratched the surface in the Oxide Korbel deposit area to date,” Nova’s Avi Kimelman says. “The gold mineralisation is open in all dimensions and additional diamond drilling is planned to establish the outer limits and depth extent of the deposit.”

Junior gold producer Blackham Resources (ASX:BLK) would be loving these sky-high Australian gold prices more than most. A year or so ago these guys were marginal. Now, a +$2200/oz gold price means September quarter production of ~19,500oz, at all-in sustaining costs of $1550-$1750/oz (which is high), will still lead to “strong operational cashflow”.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.