Gold records biggest daily plunge since Covid – are miners still a buy?

You'd still fight this squirrel for his solid gold acorn, you bastard. Don't say you wouldn't. Pic: Getty Images

- Gold fell around 6% on Tuesday night, ending weeks of unstoppable gains

- A rush of retail money into Western ETFS left gold, silver and platinum vulnerable to a sell-off

- But brokers and fund managers remain bullish on gold stocks, saying fundamentals are solid

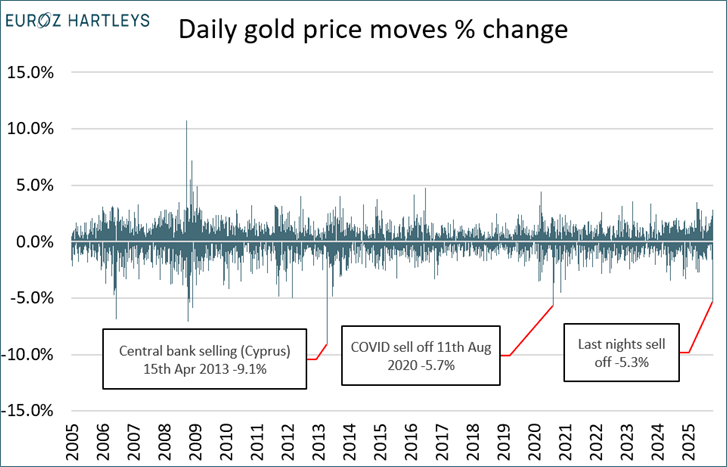

After weeks of shallow exuberance, gold, silver and platinum have faceplanted, gravity pulling them off their wheels with the biggest single day fall, for bullion at least, since the Covid pandemic in 2o20 and at one point intraday since 2013’s bear market.

Gold fell as much as 6% overnight on Tuesday, with silver and platinum copping bigger proportional hits as a dovish tone on China from Donald Trump surprised investors, who had built big positions on the back of safe haven demand as the world went to hell.

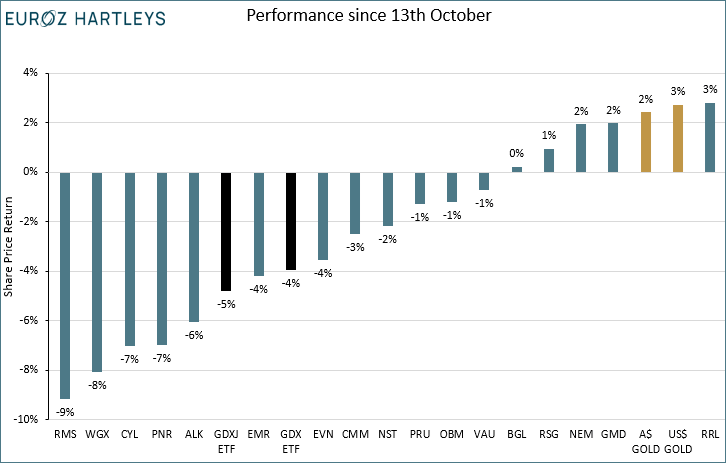

ASX stocks were smashed. The All Ords Gold sub-index dropped 8.5% on Wednesday, with bellwethers Northern Star Resources (ASX:NST), Evolution Mining (ASX:EVN) and Newmont Corporation (ASX:NEM) down 8.8%, 10.3% and 9.6% respectively.

The VanEck Gold Miners ETF in America (the GDX) was down 9.4%, with the junior GDXJ off a stiffer 10.4%.

There are other factors at play. A silver squeeze in the London market has eased as shipments arrive from other markets, and in the US market, where the latest leg up in demand has been driven by ETF and physical gold investors, financial positions appear to have been unwound.

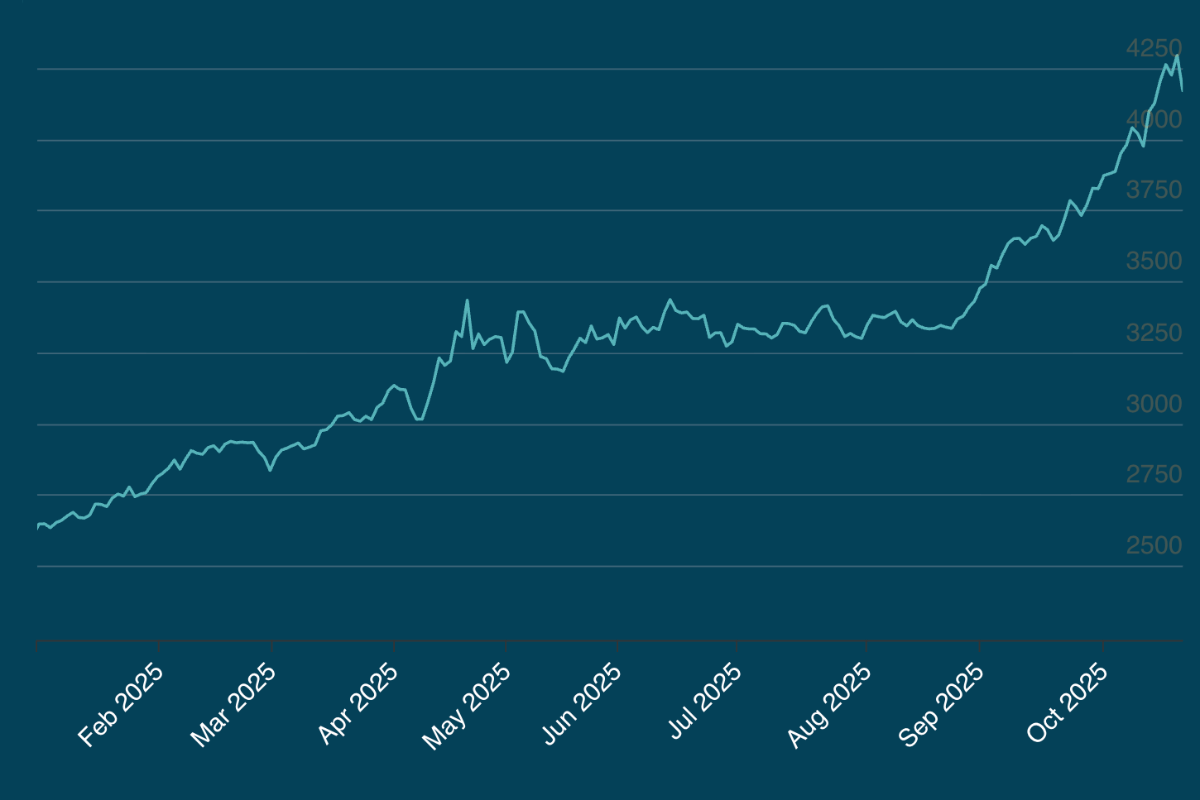

“Since the start of September, (gold) has gained 26% as investors piled into the sector amid rising expectations of outsized interest rate cuts by the Fed. This has been supported by mounting geopolitical, economic and financial uncertainties,” ANZ’s Daniel Hynes said in a Wednesday note.

“With the US government shutdown, the market has been without the weekly CFTC report which shows speculative positions by investors. We assume such positioning had built to substantial levels and ultimately triggered the selloff.”

Gold fell again early in North American trade on Wednesday, though not as violently.

But the long-term drivers remain in play. ANZ last week upped its year-end forecast to US$4400/oz, and its mid-2026 expectation to US$4600/oz.

“Despite this pullback, we still see long-term drivers in place and providing support to prices,” Hynes said.

Chasing the price up

With gold prices running so hard in recent weeks, building to their best annual performance since the 1979 bull run, brokers have been rushing to update models.

Only this week Canaccord Genuity’s gold expert Tim McCormack upped the firm’s long-term gold price forecast by 13.7% to US$4745/oz and silver by 19% to US$56.9/oz.

He said valuations remain undemanding for miners with price to NAV ratios of 0.73x across Canaccord’s coverage universe against a historical average of 0.84x.

“We continue to encourage positioning in the sector, and remain bullish on the gold thematic, underpinned by anticipated interest-rate cuts, rising US debt, persistent geopolitical risk, and sustained central-bank buying,” he said in Tuesday morning’s note.

Other analysts remain optimistic on the upside in gold stocks, despite the sell-off.

While gold traded 3% higher between last Monday and yesterday, ASX gold producers have been clipped as far as 9%.

Euroz Hartleys analyst Michael Scantlebury says physical gold had become a ‘crowded trade’.

The most recent leg up in the gold price had been driven by ETF buying, fuelled by a pool of retail money – flighty capital compared to the central bank purchases that powered the start of the gold boom.

“It’s purely momentum trading. So they’re there in the trade whilst it’s working and gold price is going up and quite typically they’ll have stop losses in those trades,” Scantlebury said.

“So when the trade loses momentum and it starts to reverse, it instantly hits these stop losses and triggers a kind of a negative feedback loop as it gets sold off.

“I’ve got no evidence to prove that but I wouldn’t be surprised to see that that was the case last night.”

Those itchy triggers and the short-term noise from Donald Trump does little to change the fundamental support for gold, Scantlebury thinks.

“It’s the unsustainability of the US federal budget. It’s inflation coming back in as a concern. It’s the move away from the US dollar. It’s central banks around the world not trusting the US dollar and the weaponisation of it,” he said.

“I think they’re the true long-term fundamental drivers of the gold price. If they (Trump and Xi) come up with a trade deal, it could easily be another hit to the gold price but I think over years to decades, the trade in gold is very, very solid.”

Even after the price drop, Scantlebury thinks ASX gold stocks screen as cheap, with equities hit harder than the underlying commodity price.

“When you run gold stocks models at spot gold, they screen extremely cheaply in terms of cash flow multiples and DCFs … we get spot net asset values higher than share prices,” he said.

Looking for growth

Scantlebury isn’t alone in his thoughts.

Argonaut executive director and head of research Hayden Bairstow, having recently tipped a peak of US$4500/oz in 2027, said a pullback was ‘inevitable’. But the short-term pain may not alter the outlook.

“The underlying drivers of gold haven’t changed, right? There’s rising government debt, both in the US, but in most other countries in the world,” he said.

“There’s not many Western countries running positive balance sheets and positive balance of payments.

“Effectively, money printing is ongoing and that’s really what’s driving it all in my view.”

Bairstow remains positive on ASX gold stocks with production growth on the horizon.

“I was at LME Week all of last week, so most of these stocks are just back to where they were when I left,” he said.

“No one seems to care when it’s going up 5-7% every day, but the minute it goes down 2% it gets headlines.

“I still think the more liquid growth stories in Australia are what we favour, so … Genesis, Capricorn, Greatland, Catalyst are the names we like the most.”

Interest rates in focus

Despite the violence of Tuesday’s move, ARI Funds Management investment manager Stephen Gorenstein says little news in the last three days has changed the lay of the land.

“Our view is pretty simple. One, gold’s had an incredibly good run of late as have the equities. So seeing a bit of retracement of that is not concerning,” he said.

“And two, the key drivers for gold for us continue to be interest rates in cutting mode in the US and central bank buying and I don’t see either of those things changing.

“Should interest rate cuts get delayed it doesn’t change that they’re going down, it just delays it.”

The next meeting of the US Fed will be on October 28 and 29 next week, following a 25bps cut handed down in September that fuelled an uptick in precious metals prices.

A lull in the tide that floated all boats makes gold equities more of a “stock picker’s market” when it comes to explorers, Gorenstein said.

His conviction picks are Ramelius Resources (ASX:RMS) and Vault Minerals (ASX:VAU) among producers and West African explorers Desoto Resources (ASX:DES) and Many Peaks Minerals (ASX:MPK) for earlier-stage plays.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.