Gold price battles US dollar volatility as Congress debates $US2tn stimulus

Pic: Schroptschop / E+ via Getty Images

Gold prices have started to advance again and traded higher Thursday at $US1,890 per ounce ($2,636/oz), while silver was steady at $US23.35/oz ($32.57/oz).

Volatility in the US dollar over the past weeks has led to back and forth movements in gold prices, which have traded between $US1,860 to $US1,970/oz since September 1.

“Expect volatility to continue through elections as Brexit, global economic worries and US-China tensions increase, while pandemic numbers could delay recovery,” RBC Wealth Management managing director, George Gero, told Kitco News.

While all eyes were on the televised debate between presidential candidates Joe Biden and Donald Trump, Congress was wrangling over the detail of its proposed $US2.2 trillion economic stimulus which could impact gold prices.

“The package needs to be passed by the Republican-controlled Senate and signed by the President – unlikely in the current environment,” Commonwealth Bank of Australia analysts said in a report.

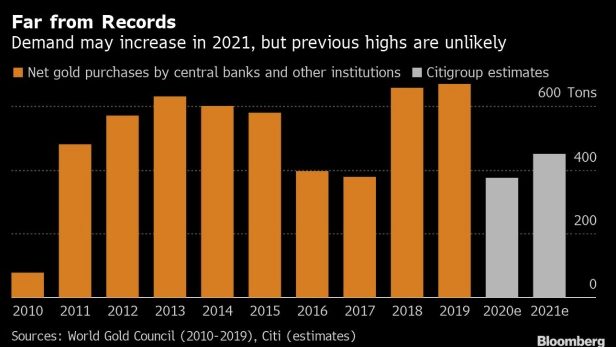

Central banks forecast to ramp up gold buying

Meanwhile, central banks are expected to add to their stockpiles of gold in their vaults this and next year, but at a slower rate than in previous years.

Citibank is forecasting central banks will buy 450 tonnes of gold in 2021, up from 375 tonnes this year, while HSBC Securities sees central bank gold buying at 400 tonnes next year, according to Bloomberg.

“Net central bank purchases have slowed down but are still positive, so there is no risk that central banks become a source of downward pressure on prices like they were in the 90s,” Nataxis senior commodities analyst, Bernard Dahdah, told Bloomberg.

Gold stockpiles in central bank vaults are set to increase this year and next say analysts

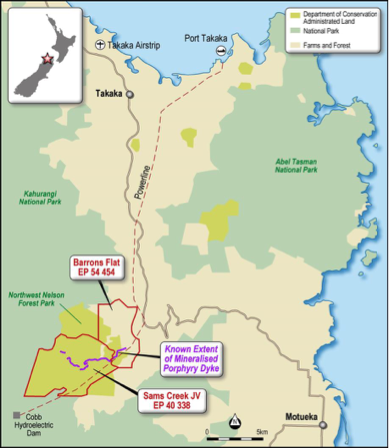

Gold explorer Auris makes NZ acquisition

Auris Minerals (ASX:AUR) has acquired a 1Moz gold project, Sams Creek, in New Zealand’s highly prospective Reefton goldfield, in a deal worth $8.2m and paid in Auris shares.

Sams Creek’s former owner Sandfire Resources (ASX:SFR) becomes a 19.9 per cent shareholder in Auris after the deal, and is funding a $600,000 drilling program and scoping study for the asset.

New Zealand’s Reefton gold region has attracted investors, including the Eric Sprott-backed Advent Gold and Clive Palmer’s Mineralogy. The areas also hosts OceanaGold’s Macreas and Waihi gold mines.

AusQuest starts drilling at Paterson project

AusQuest (ASX:AQD) will start drilling 200m drill holes at several ‘compelling’ gold and copper targets at its Gunanya project in WA’s Paterson goldfield in early October.

“These are compelling targets based on analogies that we have been able to draw with new discoveries in the Paterson region from both a gold and copper perspective,” managing director, Graeme Drew, said.

The explorer has a partnership agreement with South 32 (ASX:S32) for the Gunanya project.

Cyprium Metals (ASX:CYM) has made progress at its recently acquired Nanadie Well project, 75 km east-northeast of its Hollandaire deposits in its Murchison copper-gold project.

Preliminary results of geological data show the presence of supergene mineralisation, which complements its Hollandaire sulphide orebody, and is easily leachable.

“There is significant potential for shallow supergene copper-gold mineralisation above the sulphide mineralisation at Nanadie Well,” executive director, Barry Cahill, said.

ASX share prices for Auris Minerals, AusQuest and Cyprium Metals

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.