Gold: Pioneer gets free ride from Northern Star at Acra

“At the moment, if a junior has a project with scale there are majors looking to joint venture,” Encounter Resources’ (ASX:ENR) Will Robinson said last month.

After neglecting greenfields exploration for years, major miners need more gold – and they’re turning to the juniors for help.

- Scroll down for more ASX gold news >>>

There’s been a marked increase in the number of JV deals between major miners and small cap explorers, as the majors look to restock their production pipelines.

Today, explorer Pioneer Resources (ASX:PIO) told investors that $6 billion market cap gold miner Northern Star (ASX:NST) is going to keep picking up the tab at the Acra gold project JV near Kalgoorlie in WA.

Since October 2016, Northern Star has sole funded $3 million in exploration at Acra (NST 75 per cent, PIO 25 per cent), where a 20km-long gold target was identified.

Now it wants to keep the ball rolling. If exploration is successful, Northern Star wants to incorporate Acra into its Kalgoorlie production hub.

Pioneer will be free-carried (it won’t need to spend a thing) right up to government approval of a mining proposal. After that, Pioneer could elect to shell out cash to retain its stake or sell out.

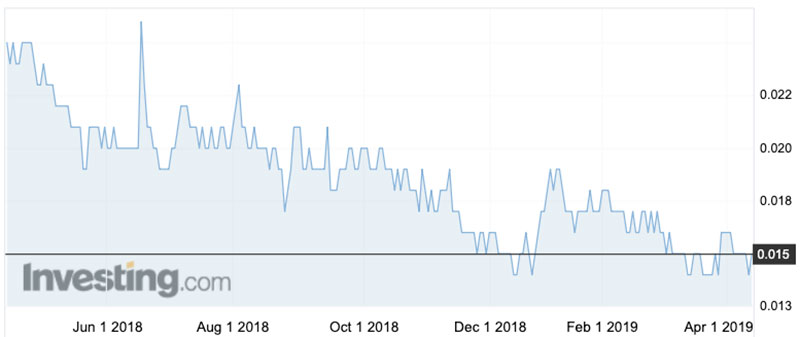

The Pioneer share price was up over 7 per cent in morning trade.

Until Northern Star decided to joint venture in 2016 the project had only really been considered for nickel sulphides, Pioneer managing director David Crook says.

“But there was this 20km long gold in soil anomaly running through the project,” he told Stockhead.

“So we did some work ourselves and got some quite interesting results, and that attracted Northern Star.”

The project was looking so big that it could have swamped the small cap explorer at a time when capital raisings have been pretty tight, Mr Crook says.

And the deal meant that Pioneer could go on and successfully explore “more digestible things”, like its caesium deposits.

“To me, this is the kind of transaction that junior companies should be doing more of — getting a big company involved where they can,” Mr Crook says.

“I think quality projects attract quality partners.”

Searching for the source

Northern Star is currently looking to identify the gold system that explains the 20km-long soil anomaly.

You can go out there and find gold nuggets, almost at will,” Mr Crook says.

“But a company like Northern Star is prepared to step back and say ‘let look at the whole system’ instead of just plugging into the easy targets.”

In other ASX gold news today:

Rox Resources (ASX:RXL) and Venus Metals (ASX:VMC) are partnering on another project; right next to its recently announced Youanmi gold mine acquisition in Western Australia.

The JV is buying the Currans prospect, which is smack-bang in the middle of these Venus-Rox tenements.

Drilling will kick off at Currans in about four weeks.

50,000 oz a year producer Pantoro (ASX:PNR) has hit a few speed bumps at its Halls Creek Project, which includes the Nicolsons and Wagtail mines.

But things could be looking up; Pantoro says it is making decent money after its cost-cutting drive, producing 11,280 oz of gold at an all-in sustaining cost (AISC) of $1217 for the March quarter.

The company made $1.9 million in free cashflow after major capital project and exploration costs — which it says is a good result given the ongoing development works at Wagtail north underground and Wagtail South open pit.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.