Gold Mountain sets out to share Mt Wipi spoils

Pic: Tyler Stableford / Stone via Getty Images

When Gold Mountain made the decision to undertake a capital raising of up to $5.1 million recently, it did so with its shareholder interests firmly in mind.

Gold Mountain (ASX:GMN) decided to go down the path of raising the funds by way of a 1-for-3 renounceable rights issue, priced at just 2c – a significant 49% discount on its 90-day volume weighted average price of 3.9c.

With every three new shares, shareholders will receive a free attaching option with an exercise price of 4c and a term of 18 months, with the ability to apply for additional shares and options.

The rights have also started trading on the ASX with a Code of GMNR, this enables non-shareholders to purchase rights and then participate in the raise at 2c.

As the company works towards maiden drilling at the exciting and highly prospective Mt Wipi prospect within the Wabag project in Papua New Guinea, executive director Tim Cameron told Stockhead it had taken the move to reward those who had stood by the company.

“We’ve now advanced this project to a state where, in my opinion, it’s never been before,” he said.

“We’ve run a planned and staged approach to our onsite exploration, undertaking a process through which we carry out stream sediment sampling, rock chip sampling, soil sampling, trench sampling, airborne geophysics reviews – all designed to identify the locations to drill with the highest perspectivity”.

“That’s the most economic way to run exploration because we give the Company the highest chance of hitting a discovery, and we’re now ready to drill at Mt Wipi.

“We couldn’t be more excited about starting the diamond drill program there.”

By bringing in funds with a rights issue – underwritten by Mahe Capital to the tune of $2.05 million including $643,003 worth of director commitments – the company is able to give back to those who have supported it.

On completion, GMN expects to be debt free, with around $1 million worth of loans and creditors to be repaid, and will be funded to tackle its next chapter at Mt Wipi.

“I’m a big believer in rewarding those people who have helped the company get to where it needs to be,” Cameron said.

“We feel we’re close to a discovery, so I personally believe giving our shareholders an opportunity to further paricipate in the story is the best thing we can do.”

Potential aplenty at Mt Wipi

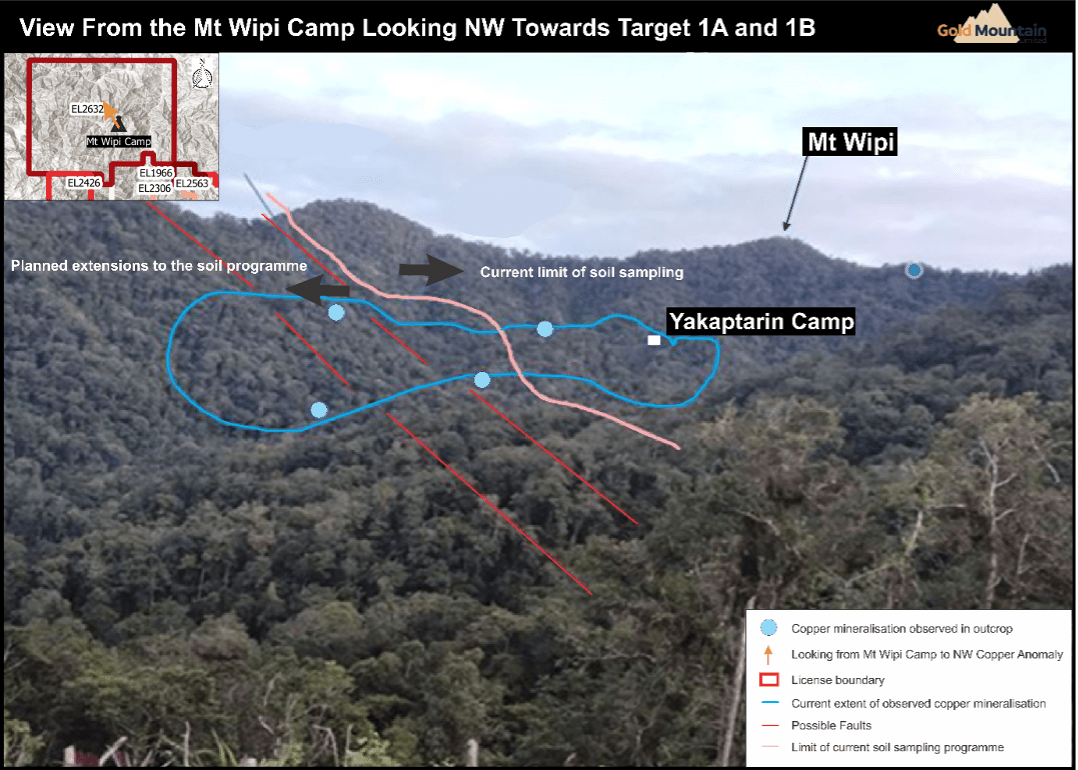

In addition to becoming debt free, the cash raised will also be used to begin a 6000-8000m targeted drilling campaign, along with a detailed airborne geological survey spaced 100m by 100m which will provide a better understanding of structural geology in the area.

A compilation and review of extensive geological data collected at the highly prospective Monoyal and Sak Creek target areas will also be carried out, with a specific focus on Lombokai Creek, while a regional exploration works program will be continued.

The planned drilling will test three key targets identified at Mt Wipi, where rock chip samples have returned results containing up to 9.64% copper, 1.96 grams per tonne gold and 100g/t silver in a greenfield area not subject to modern exploration since Gold Mountain was granted the exploration licence in August 2020.

Gold Mountain has uncovered strong coherent coincident copper, molybdenum and gold in soil anomalies at the three main Mt Wipi targets, which are located in the Papuan Mobile Belt which also hosts monster copper-gold mines including Porgera, Grasberg and OK Tedi.

Molybdenum is considered an important secondary mineral in many porphyry deposits – the kinds which can produce projects of the ilk of those above.

“This fundraising will allow us to start drilling at Mt Wipi immediately,” Cameron said.

“That’s extremely exciting for anyone, whether they’re a current or future shareholder or a stakeholder, that’s part of GMN.”

It is planned that rights trading will end on August 2, and the capital raise will close on August 9.

This article was developed in collaboration with Gold Mountain, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.