Gold: MetalsTech forced to go cyanide-free at its 1.1moz Sturec project

Pic: Schroptschop / E+ via Getty Images

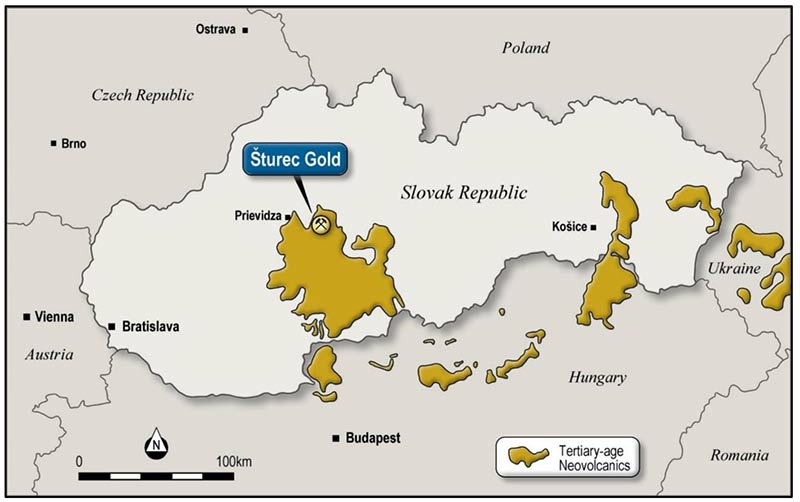

Explorer MetalsTech (ASX:MTC) will partner with a company to test cyanide-free gold recovery tech at the historic Sturec project in Slovakia.

The former battery metals microcap recorded the biggest one-day gain for an ASX stock in 2019 after announcing that it had signed an option agreement to acquire the 1.1-million-ounce gold project.

There’s a problem though – a widely used cyanide-based gold recovery process has been banned in Slovakia since 2014.

A gold cyanidation ban also exists in places like Germany, the Czech Republic, Hungary, Costa Rica, as well as the US states of Montana and Wisconsin.

And yet cyanide leaching — toxic and environmentally unfriendly for obvious reasons — remains the industry standard because it is a proven, cheap method which delivers maximum gold recovery from low-grade and some refractory (ultra-fine gold particles) ores.

This ban is understood to have discouraged the previous owners of Sturec from developing the project further, MetalsTech says.

But there have been significant improvements in the use of cost-competitive non-cyanide processing tech over the past few years, MetalsTech says.

In 2014, major miner Barrick Gold successfully implemented a thiosulphate processing tech at the 350,000oz Goldstrike mine in Nevada.

MetalsTech says the thiosulphate process developed by partner Clean Earth Technologies is an attractive, safe alternative to cyanide.

“Sturec hosts a significant gold endowment, however unlocking its potential value rests on our ability to demonstrate that we can operate in a safe and environmentally respectful manner,” chairman Russell Moran says.

“Through our partnership with Clean Earth Technologies we intend to investigate how their proprietary cyanide-free processing technology can assist us in developing a sustainable mining operation within the legislative framework of Slovakia.”

READ: Who made the gains? Here are November’s top 50 small cap miners and explorers

In other ASX gold news today:

Chinese company Jin Resources has finally bailed on the $4m purchase of Ausmex Mining’s (ASX:AMG) non-core Gilded Rose gold project, blaming “ongoing issues” in Hong Kong.

Last month, Ausmex granted a second deal extension after “the Principal of Jin, along with members of his family, fell ill around mid-January and have been quarantined and isolated after one of their infants showed symptoms of the coronavirus”.

Jin Resources will forfeit the $200,000 non-refundable option fee, and Ausmex is now working with other potential buyers.

READ: Ausmex wants to be making $$ from mining in 2020

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.