Gold is at ALL TIME HIGHS but bullion and equities have never been so disconnected. Experts think the gap will close

Pic: Wragg/E+ via Getty Images

- At US$2180/oz, gold prices hit a new all time high on Monday, but equities have been slow to catch up

- Experts explain why gold mining stocks have trailed record gold prices, and why that presents opportunities for investors

- Argonaut PCF deputy vice chairman Liam Twigger tells us why unsung $260m capped hero Magnetic Resources could be the best undeveloped gold story on the ASX after De Grey Mining

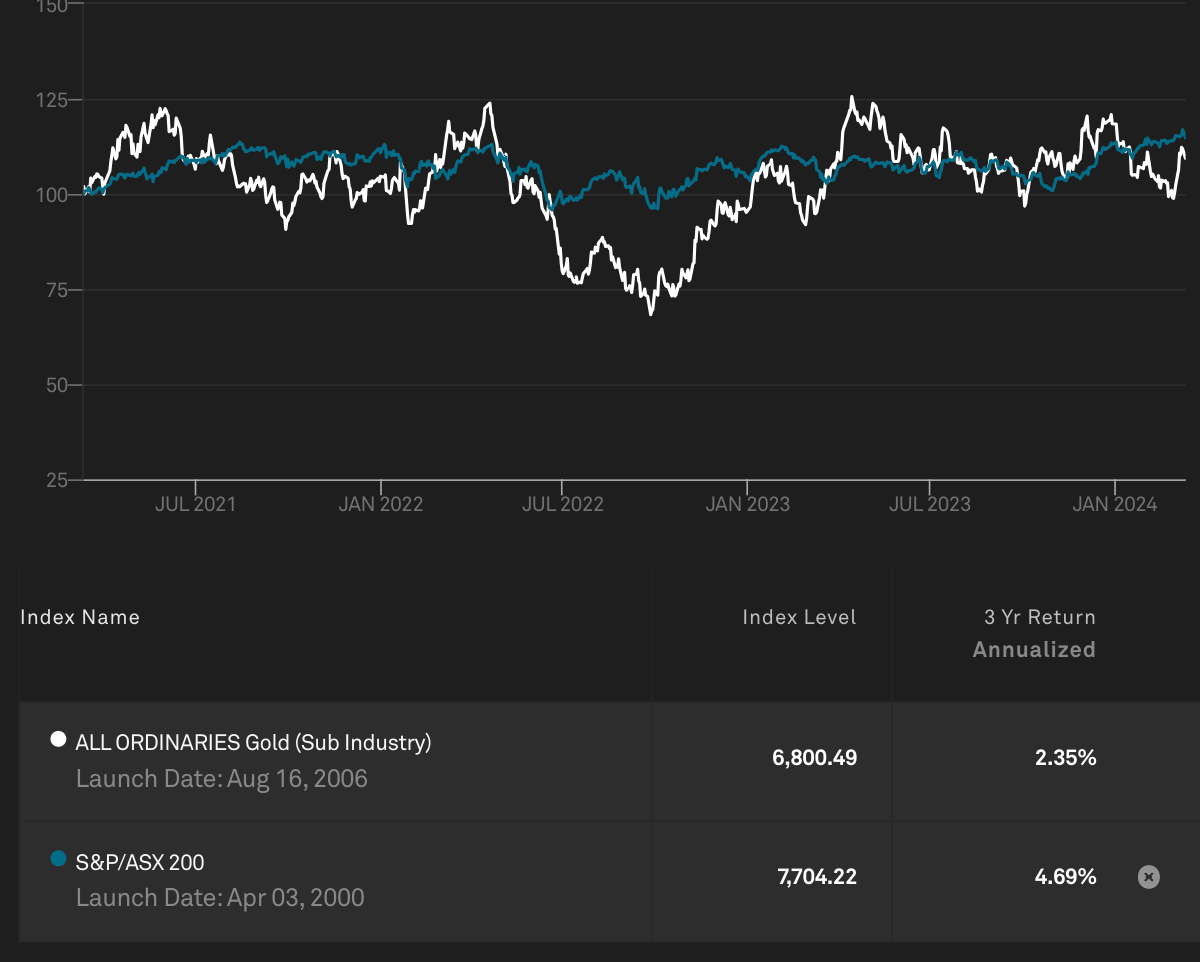

In July 2020 as gold prices approached a then record of US$2075/oz in the wake of the Covid-19 pandemic, Aussie gold stocks surged to new heights, with the ASX All Ords gold sub-index hitting an ATH of 9528 points.

Fast forward to March 2024 and gold prices have eclipsed those now antiquated records, yet the sub-index is trading at just 6955 points.

With gold at US$2180/oz, bullion is some 5% above previous historic highs, yet miners have tumbled more than 25% over the same period.

It could create an enormous arbitrage for gold bulls who stick to their guns, experts say.

“Any bounce on news is an opportunity to sell. There’s a massive discrepancy and it’s an inconsistency,” Argonaut PCF vice chairman Liam Twigger told Stockhead.

“Normally you’d see them rise. Historically, junior explorers and developers might trade at $60 an ounce and as you make more progress, you get up to $200 an ounce.

“But these guys are under $20 an ounce and there’s a huge amount of leverage.

“The opportunity is on a massive scale and I’m sure we’ll see more corporate M&A taking advantage of that, especially those that are close to infrastructure.”

In decades trading gold mines as a corporate advisor, Twigger has never the gulf between gold prices and equities “so wide”. That will give rise to more takeovers and mergers as bigger companies look to use scrip to boost scale and engulf undercapitalised juniors.

“There are so many very cheap juniors that will be merged and we’re seeing that up with Horizon Minerals (ASX:HRZ) and Greenstone Resources (ASX:GSR) coming together and I think there’ll be a lot more of that.”

Bitcoin, ESG eating gold’s lunch

There are a number of reasons experts have fingered for the discrepancy.

Twigger says the failure of gold mine start-ups by the likes of Calidus Resources (ASX:CAI), Pantoro (ASX:PNR) and Gascoyne Resources, the latter rebadged as the now highly successful explorer Spartan Resources (ASX:SPR), have led to nerves from investors in development stories and juniors.

Lowell Resources Fund (ASX:LRT) chief investment officer John Forwood said the perception gold miners generate ‘pointless’ greenhouse gas emissions without producing a product linked to decarbonisation — unlike lithium and nickel miners — hurt them as an investment proposition in recent years.

Competition from more glamourous tech stocks in the US market and Bitcoin was also a factor.

Forwood also pointed out that the forces driving investor interest in physical gold and miners were distinct, bifurcating the market.

Gold prices have lifted largely in response to the conflicts in Ukraine and Gaza, and hopes US interest rates will come off and reduce incentives for investors to hold cash.

But demand has been driven heavily by central banks, the sort of investors who don’t own mining stocks. Gold ETFs are still seeing outflows, reducing the capital that normally reticulates into miners and explorers.

“It’s not unusual for the gold price to jump and gold equities not to follow but the disparity or the spread is historically large,” Forwood said.

Forwood says with margin pressures and post-Covid inflation pulling back there may be more confidence from investors to dive into exploration and development stage gold stocks “because their capex is not going to get blown out of the water as soon as they press the button on FID”.

But he also sees a rise in M&A as a distinct possibility.

“Gold miners are obviously making lots of money and stashing away cash and some of that will be used to implement M&A to bolster their resources and reserves and that’ll help the junior end of the gold sector,” Forwood said.

Gold could go higher still

It’s worth noting that the largest tailwind for gold prices, a potential cycle of rate cuts many market watchers expect to start this year, is yet to even blow.

According to the CME Fedwatch Tool, upwards of 70% of the market expects at least one 25 point rate cut by June, with almost 13% of punters backing rate cuts on both May 1 and June 12.

Commonwealth Bank mining doyen Vivek Dhar called the 6% rise in gold futures since late February a surprise, suggesting safe haven and Chinese physical demand could be hidden factors adding to lower bond yields and a weaker US dollar.

The rise in gold prices has also come despite projections on the pace and impact of rate cuts from the US Fed slowing since January.

Markets priced in a Fed funds rate cut for 2024 from 5.25-5.5% to 3.65% on January 12. That has moderated since to 4.43%, a near halving of the anticipated rate slash.

But Commbank is more bullish on the reversal of the US Fed’s monetary policy.

“If the conflict in the Middle East continues with little change, we expect gold prices to retrace lower to ~$US2,100/oz in the near term as safe haven demand eases,” Dhar said.

“However, any retracement lower will have to consider the release of US inflation data for February tonight. The result will drive FOMC rate cut expectations.

“Our view that the FOMC will deliver 150bps of cuts by the end of this year suggests that US inflation will need to trend lower than expected in coming months.

“That should ultimately support gold prices through 2024 via a weaker US dollar. We think gold futures could finish the year at $US2,200/oz to $US2,300/oz based on our FOMC and US dollar outlook.”

If prices run that high, ASX gold miners may be too valuable for punters too ignore.

The best unloved gold development stories on the ASX

Some gold stocks have caught the eye in recent days.

$1.9 billion capped Bellevue Gold (ASX:BGL) surged more than 10% yesterday after a production update that suggested it was on track to generate free cash in the June half.

It’s up 35% in the past year. $2.4 billion De Grey Mining (ASX:DEG) is in pretty much any major institution’s portfolio nowadays with a decision to mine its 500,000ozpa-plus Hemi development around the corner.

But Twigger says Argonaut has a new choice as the best gold development story on the ASX outside De Grey, and it’s a pick that may not be on the front of your mind.

“Probably the number one this was a call from one of our analysts, Patrick Streater,” he said.

“He said that the next best undeveloped gold project in Australia after Hemi is Magnetic Resources (ASX:MAU). (MD) George (Sakalidis) has got a discovery there.

“It’s probably big, it’s got grade, it’s open cut and it’s close to infrastructure. They could go standalone, but they’re also well positioned to nearby plants that seemed like they are underutilised and they present a fabulous opportunity.”

Up almost 42% over the past year, Magnetic released a pre-feasibility study last week on its Lady Julie project near Laverton, suggesting the project could produce 87,000ozpa over a nine-year mine life at an IRR of 108% at current spot prices with all in sustaining costs of $1445/oz and development capex of just $93.4m.

Twigger also likes Ora Gold (ASX:OAU), which boasts 240,000oz at its Crown Prince deposit at an impressive grade of 4.1g/t.

The Alex Passmore led miner is focused on its Garden Gully project near Meekatharra, surrounded by acquisitive gold miners like Westgold Resources (ASX:WGX), Catalyst Metals (ASX:CYL) and Ramelius Resources (ASX:RMS), as well as junior developer Meeka Metals (ASX:MEK).

$7 million capped Carnavale Resources (ASX:CAV) is another Twigger has taken a liking to.

It’s hit high grade gold at its McTavish East project near the historic WA Goldfields ghost town of Kookynie.

While many junior companies would lack the scale to become developers in their own right, Twigger noted companies like Ramelius — which made millions trucking ore from the high grade Vivian mine near Leinster 340km to its Mt Magnet mill — showed satellite developments could transform the economics of small, high grade gold deposits.

“The truck and haul model makes a lot of sense and if you can dodge the capital bullet, there’s lots of money to be made and I think there are juniors there that represent outstanding value, and they’ll get picked off,” Twigger said.

“Within six months we’ll see it move.

“And there’s nothing like the guys at the top end of town (doing M&A) — Silver Lake coming in with Red 5, and Ramelius if they get up with Karora — it’s a great endorsement and it will give the market confidence.”

Forwood also has a couple of key picks in the advanced explorer space.

He likes Astral Resources (ASX:AAR), which could benefit from some competitive tension if Ramelius buys Karora, owner of the nearby Higginsville and Lakewood plants and Beta Hunt gold mine.

Astral already looms as a logical target for Gold Fields, which is likely to need more feed in the future for its St Ives gold mine, located near Astral’s 1.25Moz Mandilla gold project.

“There is at least one obvious buyer in Gold Fields at St Ives up the road. Astral are sitting on over a million ounces with a nice high grade kicker at their Kamperman project, which they’re drilling at the moment and getting some nice high grade hits,” Forwood said.

“They’re in the PFS stage. And it may require them completing their studies before they get a bid from a major but that’s what we expect to happen there.”

Forwood also like Saturn Metals (ASX:STN), which has a large, low grade resource at its Apollo Hill project near Leonora in WA.

At 0.6g/t it’s unusual for the WA gold sector, but Forwood thinks it can be processed via heap leach technology, akin to Kinross’ 9Moz Fort Knox mine in Alaska.

Twigger and Forwood gold picks

At Stockhead, we tell it like it is. While Magnetic Resources was a Stockhead advertiser at the time of writing, it did not sponsor this article.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.